Authored by James Rickards via DailyReckoning.com,

Gold is trading at $2,211 per ounce this afternoon. Since its interim low of $1,832 per ounce on Oct. 5, 2023, gold has posted a 21% gain. That’s in less than six months. Almost half of that gain occurred in the one-month period from Feb. 11 to March 11.

That overall gain is especially impressive considering gold had been stuck in a fairly narrow range of $1,650–2,050 for the past two years. That’s a range of about 10% above and below the midpoint of $1,850. Starting from the high end of that range, gold traversed the entire range to the upside and beyond in just one month.

Now, any reference to “gold prices” is an interesting one. If you treat gold as a commodity, then the price per ounce measured in dollars is one way to think about price.

On the other hand, if you think of gold as money (as I do) then the dollar price is not really a price — it’s a cross-rate similar to euro/dollar (about $1.08 today) or dollar/yen (about 152 today). When analysts say the “price” of gold is $2,211 per ounce, I think of that data as showing the gold/dollar cross-rate = $2,211.

That’s useful because there are two sides to a cross-rate. While most analysts say that gold has rallied from $2,000 to $2,211 per ounce, it is just as valid and perhaps more useful to say that the dollar has crashed from 1/2,000 per ounce to 1/2,211 per ounce.

In this analysis, gold is constant (by weight) and the dollar gets stronger or weaker relative to gold. All of the recent market action points to a weaker dollar.

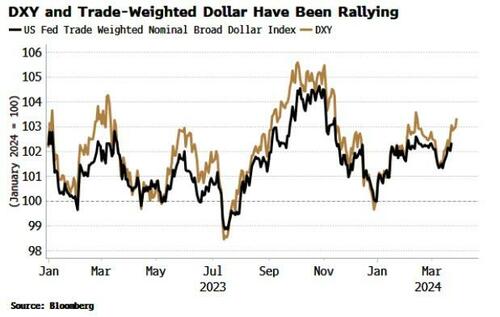

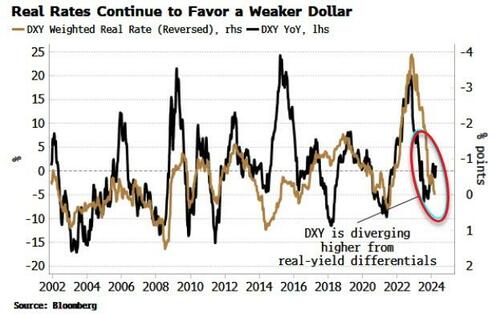

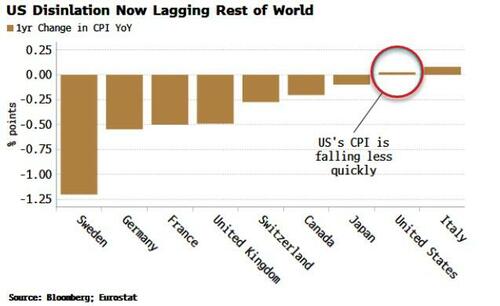

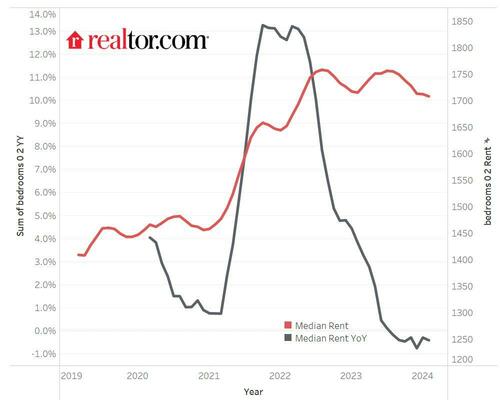

This mode of analysis also solves another market riddle. Given huge U.S. budget deficits, unprecedented levels of U.S. national debt, slow growth, rising unemployment and persistent inflation, how is it possible that the dollar has been so “strong” lately?

The answer is that it’s only been strong relative to the euro, yen, sterling and some other reserve currencies and as measured by certain dollar indexes (DXY, Bloomberg, etc.) composed of baskets of currencies (but not gold).

But that’s often because those other currencies are issued by countries with debt and growth problems even worse than the U.S.’ Those currencies dropping against the dollar have the look and feel of a good old-fashioned currency war.

It’s only when you use gold as your metric that the real weakness in the dollar becomes apparent, as it should. In effect, certain currencies are weakening against each other but all currencies are weakening against gold.

Returning to the “higher gold price” frame, there are a number of reasons for this trend.

The first factor is simple supply and demand. Mining output and recycled gold have been about flat for the past eight years running between 1,100 metric tonnes and 1,250 metric tonnes per year.

At the same time, central bank demand for gold has surged from less than 100 metric tonnes in 2010 to 1,100 metric tonnes in 2022, a 1,000% increase in 12 years. Central bank gold demand remained strong in 2023 with 800 metric tonnes acquired through Sept. 30, 2023. That puts central bank gold demand on track for a new record in 2023. There’s no sign of that demand slowing in 2024.

Constant output with surging demand by central banks does not by itself explain the recent surge in gold prices, but it is a contributor. Importantly, continued strong demand by central banks puts a floor under gold prices. This sets up what we describe as an asymmetric trade where downside is limited but upside is open-ended.

The second factor driving gold prices higher is the need for hedging. This is not the same as inflation hedging. It covers a larger list of risks including geopolitical risk, risks of escalation in the Ukraine and Gaza wars, Houthi efforts to close the Red Sea and Suez Canal, increasing risks of war with China and the intrinsic risk of a senile president of the United States.

As the list of risks grows longer and potentially more dangerous, the need for a hedging asset such as gold that does not rely on any nation-state for its value increases. I call gold the everything hedge.

Finally, gold prices are being driven higher by U.S. threats to steal $300 billion in U.S. Treasury securities from the Russian Federation. Those assets were legally purchased by the Central Bank of Russia as part of their reserve position.

The actual securities are held in custody in digital form at European banks, U.S. banks and the Brussels-based Euroclear clearinghouse. Only about $20 billion of those Treasury securities are held by U.S. banks; the majority are held by Euroclear. Those assets were frozen by the United States at the outbreak of the war in Ukraine.

Freezing assets means the Russians cannot collect interest or sell or transfer the assets or pledge them as collateral. Asset freezes are used frequently by the U.S. including in the cases of Iran, Syria, Cuba, North Korea, Venezuela and other nations. Often the assets are frozen for years but ultimately released to the owner as happened in the case of Iran after 2012.

Now the U.S. wants to go further and actually seize the assets, which may be viewed as outright theft under international law. The U.S. proposes to use the $300 billion to finance the war in Ukraine. European entities have expressed considerable uncertainty about this plan but the U.S. has maintained the pressure and wants to complete the theft before the June and July summits of G7 leaders and NATO members.

If the U.S. steals these assets, Russia will likely confiscate an equivalent amount of industrial and commercial assets located in Russia and owned by German, French, and Italian interests among others.

The bottom line is that if U.S. Treasury securities are not a safe investment, then securities of Germany, Italy, France, the U.K. and Japan are no better. The only reserve asset free of this kind of digital theft is gold. Nations are beginning to diversify into gold in order to insulate themselves from digital confiscation by the collective West.

Finally, there’s an interesting bit of math here, which I’ve explained in the past that shows each $100 per ounce increment in the price of gold is a smaller percentage gain because the denominator is larger.

That makes each $100 milestone ($2,400, $2,500, $2,600) easier to reach than the one before. People don’t really notice this; they just focus on the dollar amount of the gains. But this explains how price rallies gather crazy momentum.

All of these trends — flat output, rising central bank demand, hedging, protection against digital confiscation and simple momentum — will continue. Based on those trends, one would expect the gold price rally to continue as well.

The trend is gold’s friend.