As Egypt Implements Massive Devaluation Of Currency, Sending Pound Tumbling, Unrest & Instability On Horizon

The Egyptian pound crashed Wednesday as the government initiated a devaluation of more than 38%, while also hiking interest rates, in order to attract billions more in loans from the International Monetary Fund (IMF).

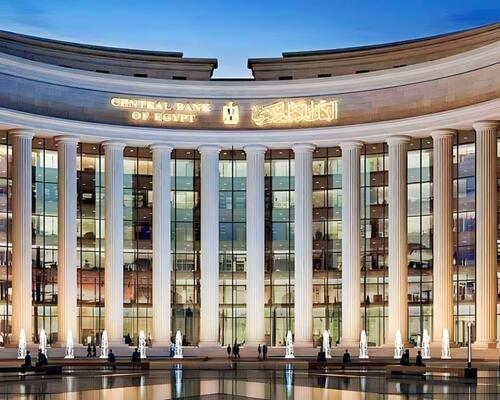

Already with one of the world’s highest levels of foreign debt, Egypt is trying to avoid potential default in the coming years, and has been propped up by loans and central bank deposits from Persian Gulf states and the IMF. Like other governments in the region, particularly Lebanon, Egypt has long had a severe shortage of foreign-currency reserves, resulting in the Central Bank of Egypt artificially propping up the pound’s value, leading to a robust black market exchange.

The central bank announced Wednesday, “The unification of the exchange rate is crucial, as it facilitates the elimination of foreign-exchange backlogs following the closure of the spread between the official and the parallel exchange-rate markets.” It will allow “the exchange rate to be determined by market forces.”

The statement said it further raised the overnight lending rate to 28.25% and its overnight deposit rate to 27.25%, and crucially that it would let the Egyptian pound trade freely on international markets, in a bid toward quashing inflation.

The central bank said of its drastic moves that they are “backed by the steadfast support of multilateral and bilateral partners” and that “sufficient funding has been secured to avail foreign exchange liquidity.”

Last month we previewed the $35 billion deal that will see the United Arab Emirates develop a sprawling portion of prime Mediterranean coast in Egypt’s northwest. It marks the largest foreign direct investment in an urban development project in the country’s modern history. This expected windfall of foreign exchange is badly needed as local businesses have been suffering and the cost of imported goods has soared.

Economic conditions have only steadily worsened by the increasing strain of over five months of war in neighboring Gaza, amid an ever-present risk that all of this together could fuel popular unrest and destabilization in northern Africa’s most populace country.

The Wall Street Journal noted, “The market reaction was swift, as Egypt’s pound lost more than half its value against the U.S. dollar, and was trading at around 48.0, compared with 30.9 at Tuesday’s close.”

So a big question will remain whether the inflation surge will lead to a spike in local instability at a very delicate geopolitical moment. The Sisi government and military deep state has long been propped up by Washington, in order to ensure the Camp David Accords and historic peace with Israel; however, the opposition and outlawed Muslim Brotherhood and its ultra-conservative Islam still holds sway over huge swathes of the population.

Another big deval for Egypt was inevitable and it finally came today. Here’s the thing. If Egypt now repegs $/EGP at 50 (blue), this is all for nothing. Inflation will push up the real exchange rate (black), as after every previous deval, and Egypt will need to deval yet again… pic.twitter.com/W58mCI5Kka

— Robin Brooks (@robin_j_brooks) March 6, 2024

Simmering anger on the Egyptian street over Israel’s military actions in Gaza, and soaring civilian death toll, could when combined with the inflationary surge unleashed by these major reform steps could boil over into anti-government unrest. Though talks are ongoing, Egypt’s bailout deal with the IMF is expected to exceed $10 billion. The aforementioned major UAE deal was a big catalyst in moving the IFM deal forward, coupled now with the planned currency devaluation.

Tyler Durden

Wed, 03/06/2024 – 12:45

via ZeroHedge News https://ift.tt/1cLGSFW Tyler Durden