Authored by Michael Lebowitz via RealInvestmentAdvice.com,

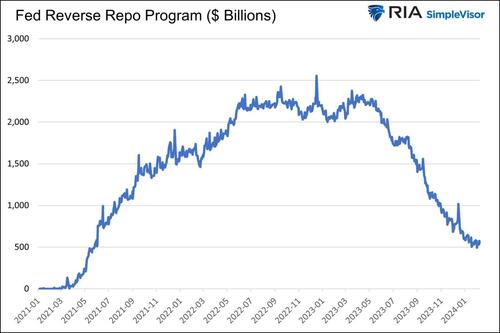

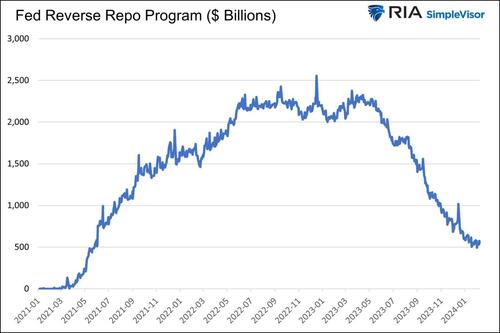

In 2019, the Fed cut interest rates and restarted QE despite a healthy economy. Today, inflation is higher than the Fed’s target, economic growth is above historical trends, and financial markets display complacency and exuberance. Yet, the Fed is talking about cutting rates and reducing QT. The only rationale for them in such an environment must be a concern with potential liquidity problems, as the declining balances in the Fed’s Reverse Repurchase Program (RRP) suggest.

Before discussing RRP and what it might foretell, it’s worth appreciating that a good understanding of the Fed’s policy tools is vital for investors.

Why The Fed Is So Important For Investors

Twenty to thirty years ago, very few investors needed to understand the Fed’s monetary plumbing. The Fed was undoubtedly important, but its actions were not nearly as closely followed or impactful as they are now. Investor success, whether in real estate, stocks, bonds, or almost any other financial asset, now hinges on understanding the Fed’s inner workings.

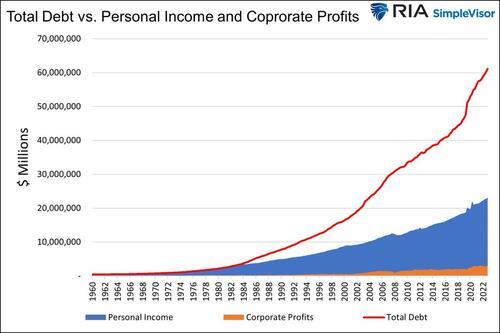

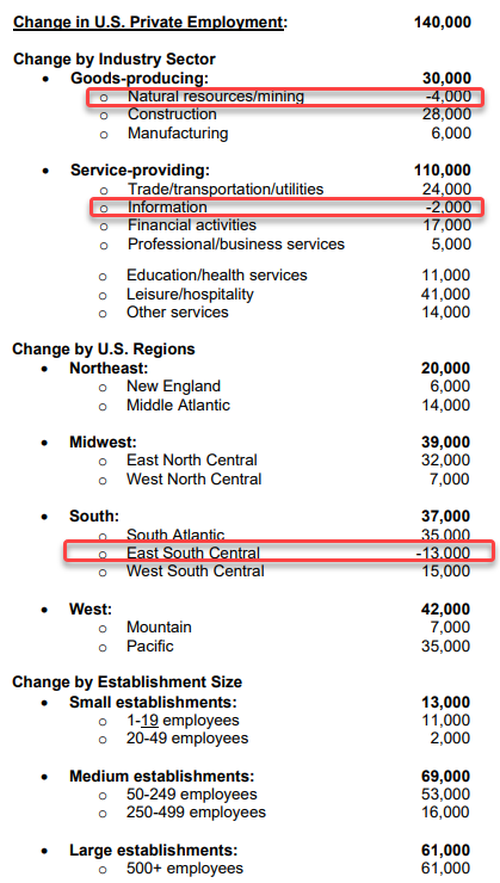

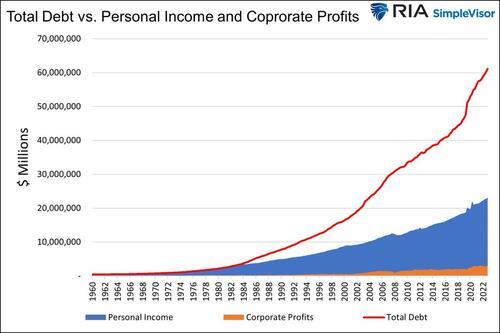

Total debt is growing much faster than the economy’s collective income. To facilitate such a divergence and try to avoid liquidity problems, the Fed has increasingly employed lower interest rates and balance sheet machinations (QE). Numerous bank and investor bailouts have also helped.

As the country becomes more leveraged, the Fed’s importance will increase.

What is the RRP?

A repurchase agreement, better known as a repo, is a loan collateralized by a security. The Fed’s RRP is a loan in which the Fed borrows money from primary dealers, banks, money market funds, and government-sponsored enterprises. The term of the loan is one day.

The program provides money market investors with a place to invest overnight funds.

What Does RRP Accomplish?

Think of RRP as money market supply offered to help balance the supply-demand curve for overnight funds.

During the pandemic, the Fed bought about $5 trillion of Treasury and mortgage bonds from Wall Street. As a result, a massive amount of liquidity was injected into the financial system. Since banks did not use all the liquidity to make loans or buy longer-term assets, financial institutions had excess liquidity that needed to be invested in the money markets. The result was downward pressure on short-term yields.

The Fed raised its Fed Funds overnight rate to help combat inflation. But, with the excess funds sloshing around the market, hitting their target rate would prove difficult. RRP allowed the Fed to meet its target.

The Current Status Of RRP

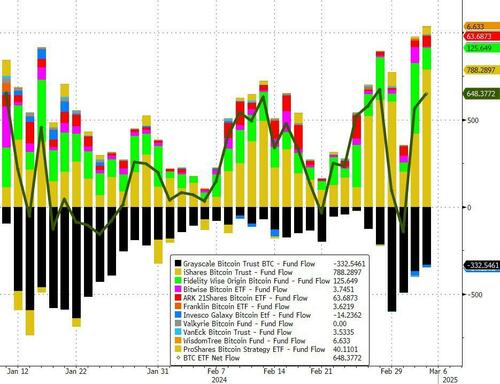

At its peak, the RRP facility reached $2.5 trillion. Since then, it has decreased steadily. Currently, it is half a trillion dollars and will likely fall to near zero in the coming months. Essentially, the market is absorbing excess liquidity. Over the last year, excess liquidity has been needed by the Treasury to fund its swiftly growing debt and to help the market absorb the bonds coming off the Fed’s balance sheet via QT.

Excess Liquidity Is Vanishing

It’s difficult to experience liquidity problems when liquidity is abundant. The extreme actions of the Fed in 2020 and 2021 made it much easier for the banking system, financial markets, and economy to handle much higher interest rates and $95 billion a month of QT.

However, excess liquidity is diminishing rapidly.

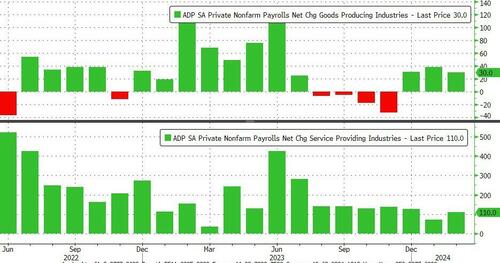

So, what type of problems occur when the excess liquidity is gone? For starters, banks will still have to use their reserves to help the Treasury issue debt and absorb the Fed’s balance sheet decline. Such actions will force liquidity to migrate from other parts of the financial system to the Fed and Treasury. Without RRP to draw funds from, banks will have to tighten lending standards for consumer and corporate loans. Further, they may likely pull back on margin debt offered to speculative investors.

The cost of higher interest rates and QT will likely be felt at this point.

Revisiting 2019

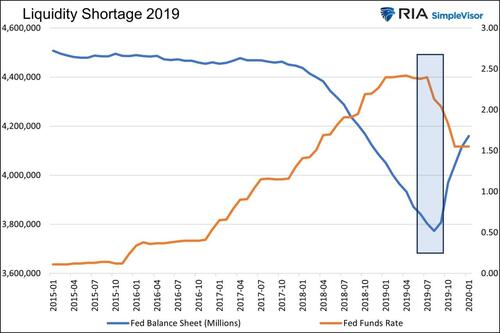

In 2019, Treasury-backed repo interest rates between banks and other investors were trading well above uncollateralized Fed Funds. Such a circumstance didn’t make sense.

As a hypothetical example, JP Morgan was lending Bank of America money overnight at 5.50% with no security (collateral) despite a hedge fund willing to borrow at 5.75% fully secured with Treasury bonds. Yes, Bank of America has a better credit rating and lower default risk, but the hedge fund is pledging risk-free collateral. While small, the odds of JP Morgan losing money in this example are greater for the Bank of America loan than the hedge fund repo trade.

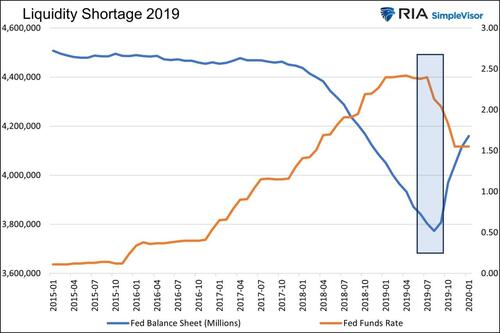

At the time, the Fed was raising rates and reducing their balance sheet for the prior year and a half. Liquidity was becoming a big problem. There was no RRP to draw liquidity from to offset QT. Simply, liquidity was lacking.

To combat the liquidity shortage, the Fed added liquidity by reducing the Fed Funds rate and re-engaging in QE. It’s important to remind you that they took these actions while the economy was in good shape and broader financial markets showed little to worry about.

The graph below highlights when the Fed quickly reversed course.

2019 is very relevant because similar problems may arise as the excess liquidity from the pandemic finally exits the system.

The Fed Is Prepping For Liquidity Problems

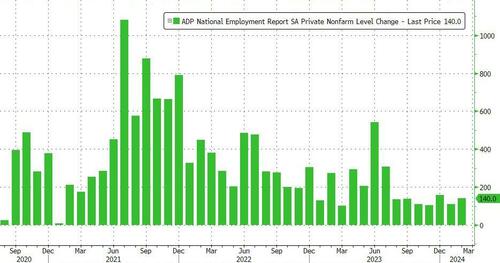

The Fed appears to be aware of potential liquidity shortfalls. Over the last month, they have started discussing reducing their monthly amounts of QT. A formal announcement could come as early as the March 20th FOMC meeting.

Such discussions and planning occur even though inflation is still above target, the economy is growing faster than the trend, and the stock market is near record highs. Under those circumstances, one would think the Fed would maintain its tight monetary policy.

The Fed is aware that large institutional investors have to sell assets to reduce leverage if there isn’t sufficient liquidity. Such collective actions could significantly weigh on financial asset prices and, ultimately, the economy.

To wit, consider a recent article by the New York Fed. In The Financial Stability Outlook, author Anna Kovner states the following:

Achieving a strong U.S. economy and stable prices is paramount, and remaining aware of the impact of policy choices on the financial system is a key ingredient to maintaining the ability to execute policy. To close with the snow metaphor I began with, if there is a blizzard in March, we will be prepared to dig out quickly, plow the streets, and get back to work.

March is not just a random date. March is when the RRP program is expected to fall to near zero!

Will The Fed Know When Liquidity Is No Longer “Ample”?

No magic number or calculation tells the Fed when excess liquidity is gone. Furthermore, they will only know when liquidity becomes insufficient after the money markets have reacted negatively.

Dallas Fed President Lorie Logan recently made that clear. Per a speech she gave on March 1, 2024:

The challenge today is knowing how far to go in normalizing the balance sheet. In 2019, the FOMC decided that it would operate in the long run with a version of the floor system where reserves are “ample.” The word “ample” suggests comfortably but efficiently meeting banks’ demand. As I’ve argued elsewhere, the Friedman rule provides a guide to the efficient supply of reserves in the ample-reserves regime. Banks’ opportunity cost of holding reserves should be approximately equal to the central bank’s cost of supplying reserves.

Further, she notes:

So, I don’t think we can identify the ample level in advance. We’ll need to feel our way to it by observing money market spreads and volatility.

Summary

Excessive amounts of debt support our economy and asset valuations. Therefore, the Fed has no choice but to keep the liquidity pumps flowing to support the leverage.

As in 2019, the Fed will likely take stimulative policy actions to provide liquidity despite an economic and inflation environment where policy should remain tight.

Keep a close eye on the excess liquidity gauge RRP and be aware of irregular activity in the money markets.