Stock futures are pointing to a flat open on the last trading session of the week, month, and quarter, following a late-session spike that took the S&P 500 to yet another record as the much anticipated quarter-end pension dump (as big as $32BN according to Goldman failed to materialize, but may very well show up today). As of 7:45am ET, both Nasdaq and S&P futures were down 0.1% after Fed Governor Christopher Waller poured cold water on the path to lower interest rates, saying there’s no rush to cut rates given recent “disappointing” inflation figures.

The broadest equity index is set for a gain of 10% for the first three months of the year, with the Nasdaq 100 just short of a 9% rise. Europe’s Stoxx 600 benchmark also notched up another record as Arnaud Cayla, deputy CEO at Cholet Dupont Asset Management, said: “Investors have no reason to sell”, and sure enough, a look at either the weekly S&P candle chart which is up 19 of the past 22 weeks…

… and the monthly, up five straight months.

In premarket trading, RH shares jumed 7.8%, reversing a 10% plunge, after the furniture retailer reported fourth-quarter results. While the company missed on adjusted earnings per share for the period, its guidance update, which showed expectations of accelerating demand throughout fiscal year 2024, led to a positive reaction among analysts. Here are the other notable premarket movers:

- Akebia Therapeutics shares jump 20% after the biopharmaceutical company said the FDA approved vadadustat, an anemia medicine already available in other countries as Vafseo.

- Estee Lauder shares gain 2.0% as Bank of America upgrades the personal care products maker to buy from neutral, saying that the company’s earnings have now bottomed.

- MillerKnoll shares slide 17% after the office furniture maker issued guidance for fourth-quarter adjusted earnings per share that missed estimates. Additionally, the company reported third-quarter sales that did not meet consensus expectations.

- Snowflake shares are up 3.1% after Chief Executive Officer Sridhar Ramaswamy reported the purchase of about $5 million in shares late Wednesday.

- Sprinklr shares rise 9.5% after the application software company gave a full-year forecast that is stronger than expected. It also reported fourth-quarter results.

10Y treasury yields rose 4 basis points to 4.22% and the Bloomberg Dollar Spot Index rises 0.2% to its highest since mid-February after the Fed’s hawkish governor Christopher Waller said the Fed still needs to see lower inflation before easing monetary policy in a speech titled, “There’s Still No Rush.” As a result, Brown Brothers strategists Win Thin and Elias Haddad wrote in a note that “market easing expectations for the Fed still need to adjust.”

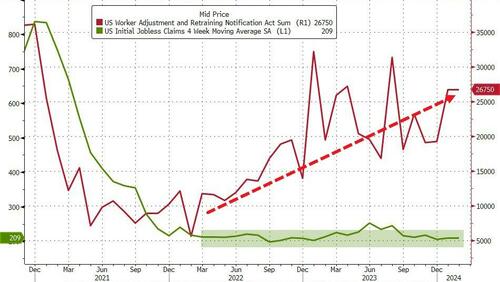

Waller pointed to a strong US economy and robust hiring as further reasons the Fed has room to wait to gain confidence that inflation is on a sustained path toward the 2% target. “In my view, it is appropriate to reduce the overall number of rate cuts or push them further into the future in response to the recent data,” he said in prepared remarks Wednesday before the Economic Club of New York.

Stock markets are on cusp of closing out blockbuster gains for the quarter. MSCI’s global equity index has soared 8% in the past three months, supported by rallies in the US, Japan and the frenzy for artificial intelligence. Data on US economic growth and jobless claims are scheduled later today. The Fed’s preferred inflation gauge — the core personal consumption expenditures price index — is due on Friday, when markets will be closed.

European stocks rise to another record high and are on track for the best quarterly performance in a year. The Stoxx 600 climbed 0.3% marking a four-day winning streak, led by gains in travel, consumer product and retail shares. The rally in European stocks has broadened out this month beyond the biggest names on the benchmark such as ASML Holding NV and Novo Nordisk A/S, unlike the US where the gains remain concentrated in big tech stocks.

Earlier in the session, Asia stocks steadied as gains in China countered declines in Japan, with the regional benchmark on course for its biggest first-quarter gain in five years. The MSCI Asia Pacific Index dropped as much as 0.6% before paring most of the loss. TSMC and Toyota were among the biggest drags on the gauge, while Chinese internet stocks including Tencent rose and Taiwan’s Hon Hai Precision climbed to a record on AI expectations. Many markets will be closed for holidays on Friday.

- Hang Seng and Shanghai Comp. were underpinned by tech strength and after another firm PBoC liquidity operation, while China’s 3rd highest-ranked official Zhao Leji stated at the Boao Forum that China’s economy will provide a strong driving force for a world recovery and that China will reduce the ‘negative list’ for foreign investors.

- Nikkei 225 was pressured after the JPY bounced back from 33-year lows amid intervention risks.

- ASX 200 rose to a fresh record high with the broad-based gains in the index led by strength in the mining industry.

In FX, the Bloomberg Dollar Spot Index rises 0.2% to its highest since mid-February after Federal Reserve Governor Christopher Waller said there is no rush to lower interest rates. Meanwhile, the euro fell to a five-week low and traded below $1.08 as the dollar strengthened.

In rates, treasury futures traded off lows into early US session, although cash yields remain cheaper by up to 6bp across front-end of the curve after comments from Fed’s Waller after Wednesday’s close, who said that data warrants fewer cuts or a later start to monetary-policy easing. Treasury yields are cheaper by 6bp to 1bp across the curve in a bear flattening move, with front-end led losses flattening 2s10s, 5s30s spreads by 2.5bp and 3bp on the day; 10-year yields around 4.215%, cheaper by 2.5bp vs. Wednesday close with bunds and gilts marginally outperforming in the sector. Additional hawkish comments seen from BOE’s Haskel in early London session, who said rate cuts are a long way off, according to a Financial Times report. US session focus includes GDP, jobless claims data in a shortened trading day, with SIFMA recommending a 2pm New York cash close.

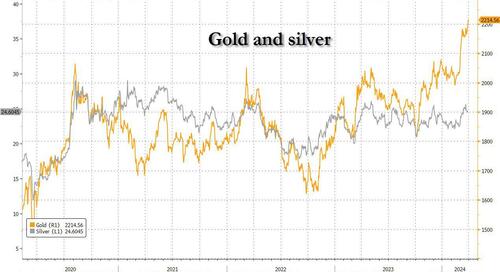

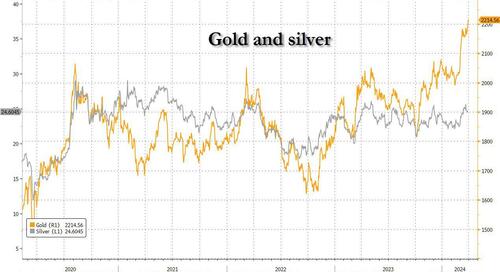

In commodities, oil prices advance, with WTI rising 0.9% to trade near $82.10. Spot gold rises another 0.7% to trade at a fresh all-time high above $2,200.

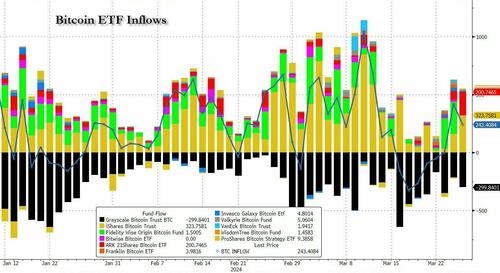

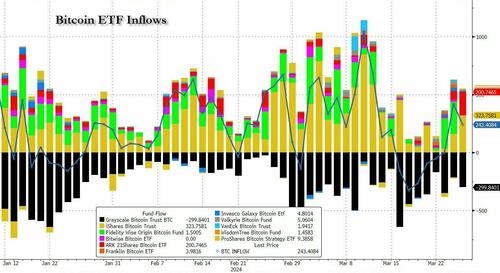

Bitcoin reversed Wednesday’s losses driven by another round of futures manipulation, and jumps 2% to around $70,500 after the latest bitcoin ETF data showed continued inflows.

The US economic data slate includes 4Q final GDP, initial jobless claims (8:30am), March MNI Chicago PMI (9:45am), February pending home sales, March University of Michigan sentiment (10am) and Kansas City Fed manufacturing activity (11am). Fed speaker slate empty for the session; Daly (11:15am) and Powell (11:30am) are scheduled to speak Friday

Market Snapshot

- S&P 500 futures little changed at 5,305.00

- STOXX Europe 600 up 0.1% to 512.47

- MXAP down 0.4% to 176.24

- MXAPJ up 0.3% to 535.76

- Nikkei down 1.5% to 40,168.07

- Topix down 1.7% to 2,750.81

- Hang Seng Index up 0.9% to 16,541.42

- Shanghai Composite up 0.6% to 3,010.66

- Sensex up 1.3% to 73,961.36

- Australia S&P/ASX 200 up 1.0% to 7,896.86

- Kospi down 0.3% to 2,745.82

- German 10Y yield little changed at 2.31%

- Euro down 0.3% to $1.0792

- Brent Futures up 0.5% to $86.54/bbl

- Gold spot down 0.0% to $2,194.58

- US Dollar Index up 0.24% to 104.59

Top Overnight News from Bloomberg

- Fed’s Waller (voter, hawk) said still no rush to cut rates in the current economy and the Fed may need to maintain the current rate target for longer than expected, while he needs to see more inflation progress before supporting a rate cut and needs at least a couple of months of data to be sure inflation is heading to 2%. Waller said he still expects the Fed to cut rates later this year but added the economy’s strength gives the Fed space to take stock of the data and data suggests fewer rate cuts possible this year.

- S&P affirmed the US at AA+; Outlook Stable, while it stated the US outlook remains stable indicating its expectation of continued economic resiliency, as well as proactive and effective monetary policy execution. S&P said the stable outlook reflects the US’s institutional checks & balances, and free flow of info contributing to stability and predictability in economic policies but added that ratings are constrained by fiscal weaknesses such as high net general government debt and deficits.

- Several board members at the BOJ called for a gradual path towards policy normalization when the central bank last week raised interest rates for the first time since 2007. “The bank would need to emphasize its cautious stance in the case of terminating the negative interest rate policy, as Japan’s economy is not in a state where rapid policy interest rate hikes are necessary,” said one board member, according to a summary of opinions at its March meeting released on Thursday. FT

- The BOE is probing how UK businesses would be hit by the reversal of a long-running private equity boom, officials said, as they escalated warnings about leverage, transparency and valuations. FT

- German retail sales fell more than expected in February, showing consumers remained cautious and a first-quarter rebound was increasingly unlikely in Europe’s largest economy. Spending on goods by German consumers fell for the fourth consecutive month, dropping 1.9% from the previous month and 2.7% from a year earlier, according to data from the federal statistics agency. Economists polled by Reuters had expected a monthly rebound of 0.3%. FT

- Christopher Waller said there’s no rush to lower US interest rates, adding that recent eco data warrants delaying or reducing the number of cuts this year. Price trends are “disappointing” and he wants to see “at least a couple months of better inflation data” before easing. BBG

- Thames Water shareholders refused to provide the first £500 million needed for a turnaround plan to tackle chronic leaks and sewage spills around London. Parent company Kemble said it will be unable to refinance or repay a £190 million loan maturing on April 30 without an extension. BBG

- Blockbuster deals more than doubled in the first quarter of this year, signaling a nascent recovery in the mergers and acquisitions market following a lengthy drought. The number of takeovers worth at least $10bn jumped in the first three months of 2024 compared with the same period last year, driven by large US deals in the energy, tech and financial sectors, according to data from the London Stock Exchange Group. Eleven such transactions, with a total value of $215bn, were struck during the quarter, up from five takeovers worth a combined $100bn in the first three months of 2023. FT

- Blackstone’s Steve Schwarzman said the private credit industry will expand further even as critics warn of a bubble. “Our default rate on these types of loans is three-tenths of 1%,” he said. The firm is also planning more retail-investment products in Japan. BBG

- Insurance payouts for the Baltimore bridge collapse may be among the largest ever in marine insurance, Lloyd’s of London CEO John Neal said. “It’s a multi-billion dollar loss.” BBG

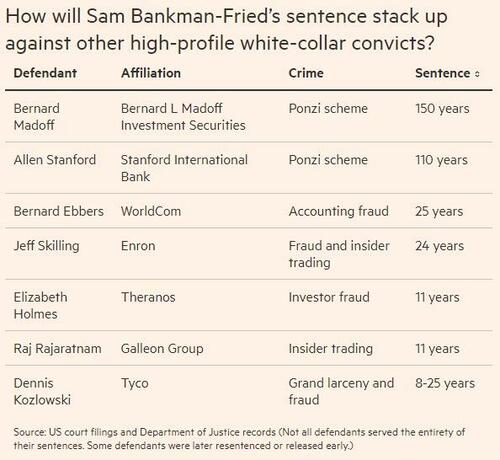

- Sam Bankman-Fried faces a 40-to-50 year prison term in his fraud case sentencing due today. The FTX co-founder’s lawyers are asking for leniency, arguing that the crypto business was solid and the company expects to repay $8 billion in missing customer funds. BBG

- Home Depot (HD) has entered into a definitive agreement to acquire SRS Distribution for a total enterprise value (including net debt) of approximately USD 18.25bln

A more detailed look at global markets courtesy of Newsquawk

APAC stocks partially sustained the momentum from the late ramp-up on Wall St heading into quarter-end. ASX 200 rose to a fresh record high with the broad-based gains in the index led by strength in the mining industry. Nikkei 225 was pressured after the JPY bounced back from 33-year lows amid intervention risks. Hang Seng and Shanghai Comp. were underpinned by tech strength and after another firm PBoC liquidity operation, while China’s 3rd highest-ranked official Zhao Leji stated at the Boao Forum that China’s economy will provide a strong driving force for a world recovery and that China will reduce the ‘negative list’ for foreign investors.

Top Asian news

- China’s top legislator Zhao Leji said at the Boao Forum that Asian countries should inject a strong impetus for world economic growth and that China’s economy will provide a strong driving force for world recovery. Zhao also stated that they oppose trade protection and decoupling, while he added that China is willing to collaborate with other countries on tech innovation and will reduce the ‘negative list’ for foreign investors.

- China’s Commerce Minister discussed with Dutch counterpart lithography machines and strengthening semiconductor industry cooperation, while the Commerce Minister stated that China hopes the Netherlands will uphold the spirit of the contract, support companies in fulfilling their contractual obligations, and ensure the normal conduct of lithography machine trade.

- BoJ Summary of Opinions from the March 18th-19th meeting stated that a member said YCC, negative rate and other massive stimulus tools have accomplished their roles and that the BoJ must guide monetary policy using short-term rate as main policy means in accordance with economic, price and financial developments. Furthermore, a member said shifting to ‘normal’ monetary easing is possible without causing short-term shocks and may have a positive impact on the economy in the medium- and long-term perspective, while a member warned that changing policy now could delay achievement of the BoJ’s price target.

- Citi raises China 2024 GDP growth forecast to 5% (vs 4.6% reported in Jan).

- China’s Commerce Ministry is lifting anti-dumping and anti-subsidy tariffs on Australian wine as of 29th March

Mixed sentiment across Europe, Stoxx600 (+0.2%), with a modest upward bias following a mostly-firmer APAC handover; the FTSE 100 (+0.5%) benefits from the weaker Pound. European sectors hold a strong positive tilt; Travel & Leisure propped up by Evolution (+1.8%), whilst Construction & Materials is found at the foot of the pile. US Equity Futures (ES -0.1%, NQ -0.2%, RTY -0.2%) are subdued following yesterday’s late rally and ahead of the long weekend. A busy docket ahead will dictate price action today.

Top European news

FX

- DXY picked up strength in early European trade as participants digested hawkish remarks from the influential Waller at the Fed. DXY now at levels not seen since mid-Feb. Currently eyeing the YTD peak at 104.97. PCE tomorrow looms large.

- EUR has been dragged lower by USD strength; EUR/USD below the double-bottom at 1.0802 and the 1.08 level with a session trough at 1.0775. Next large is the 20th Feb low at 1.0761.

- GBP is outmuscled by the dollar with Cable tripping below the 1.26 level in quiet newsflow, where it eventually found support at its 200 DMA at 1.2588; since, it reclaimed 1.26, where it currently resides. Haskel remarks are hawkish but not necessarily a consensus view on the MPC.

- JPY is one of the better relative performers vs. the USD but ultimately softer. Fresh Yen-specific drivers light ahead of CPI later. Currently contained within yesterday’s 151.02-97 range.

- Antipodeans lag against the majors as the uptick in the USD saw AUD/USD trip below last week’s low at 0.6503 and the 0.65 mark, with softer Australian Retail Sales also a factor.

- PBoC set USD/CNY mid-point at 7.0948 vs exp. 7.2259 (prev. 7.0946).

Fixed Income

- USTs are pressured and dragging fixed benchmarks lower after Fed’s Waller stuck to his hawkish bias and made clear that there is no need to rush towards rate cuts.

- Bunds ticked higher on the region’s retail numbers, though proved fleeting, with Bunds now probing 133.00 to the downside conforming to the post-Waller pressure seen in Treasuries.

- Gilt price action is in-fitting with peers; specifics light after an interview from BoE’s Haskel who underscored his hawkish credentials and made clear that while he is no longer voting for further tightening he is in no rush to vote for easing. Gilts currently at 99.57 and will find support at 99.41, 27 & 16 from the last three sessions.

Commodities

- A positive day thus far for the oil complex despite the strengthening Dollar and quiet newsflow, though has been edging off best levels in recent trade. Brent reside within 86.30-60/bbl parameters.

- Precious metals vary with spot silver feeling the pressure from the firming Dollar, whilst spot gold is more resilient, potentially supported via geopols/recent BTC strength. XAU briefly printed a fresh weekly high at USD 2,200.75/oz before pulling back under USD 2,200.

- Mixed trade across base metals with copper futures relatively flat; 3M LME copper trades on either side of the unchanged mark and towards the bottom of a USD 8,830.50-8,930.50/t.

- Russia’s Kuibyshev mid-sized oil refinery is at a complete halt following a drone attack on March 23, via Reuters citing sources.

Geopolitics

- US military said it destroyed four long-range drones launched by Iranian-backed Houthis in Yemen, according to Reuters.

US Event Calendar

- 08:30: March Initial Jobless Claims, est. 212,000, prior 210,000

- March Continuing Claims, est. 1.82m, prior 1.81m

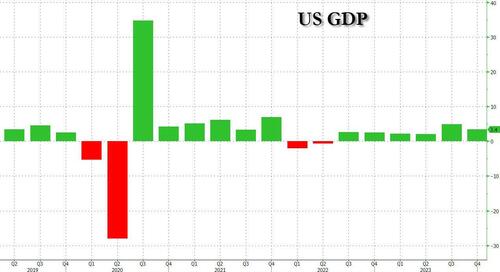

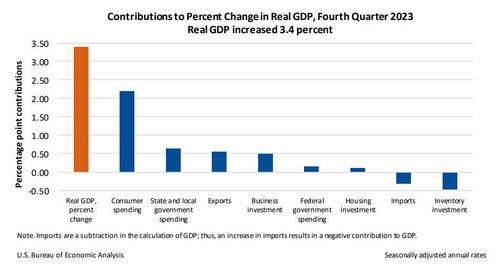

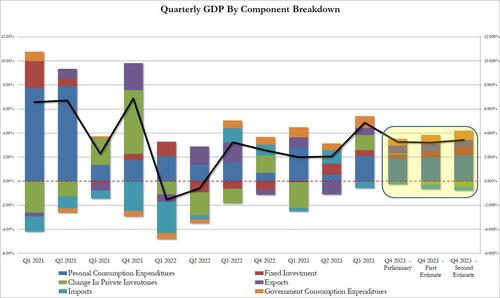

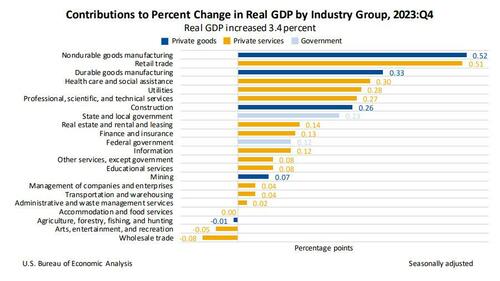

- 08:30: 4Q GDP Annualized QoQ, est. 3.2%, prior 3.2%

- 4Q Personal Consumption, est. 3.0%, prior 3.0%

- 4Q Core PCE Price Index QoQ, est. 2.1%, prior 2.1%

- 4Q GDP Price Index, est. 1.6%, prior 1.6%

- 09:45: March MNI Chicago PMI, est. 46.0, prior 44.0

- 10:00: Feb. Pending Home Sales YoY, prior -6.8%

- 10:00: March U. of Mich. Sentiment, est. 76.5, prior 76.5

- March U. of Mich. Current Conditions, est. 79.6, prior 79.4

- March U. of Mich. Expectations, est. 74.7, prior 74.6

- March U. of Mich. 1 Yr Inflation, est. 3.1%, prior 3.0%

- March U. of Mich. 5-10 Yr Inflation, est. 2.9%, prior 2.9%

- 10:00: Feb. Pending Home Sales (MoM), est. 1.5%, prior -4.9%

- 11:00: March Kansas City Fed Manf. Activity, est. -4, prior -4

DB’s Jim Reid concludes the overnight wrap

Welcome to the last business day of Q1 for a sizeable chunk of the global financial market. I’m going on holiday for a couple of weeks tomorrow so see you on the other side. Henry and Peter will be keeping the EMR in safe hands while I’m away. Tonight I’ll be doing the usual negotiating dance with my wife as to what time we start off on our 14-hour drive to the ski slopes tomorrow. I am an early person and worry about falling asleep at the wheel on the last leg of the journey where I always drive, so I’d be quite happy leaving at 5am. My wife is a night person and doesn’t want to get up too early so she’s happier leaving at around 9am. So the bid-offer is always 5-9. Before you trade I should say we have never left before 845am so that tells you all you need to know about my powers of persuasion.

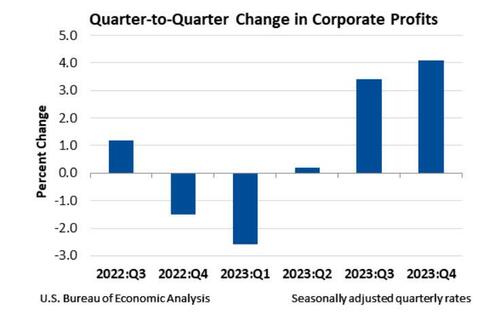

As we approach the end of Q1, it’s fair to say that is has been a very good quarter for risk and less so for government bonds. In equities some highlights include (price only) the Nikkei (+20%), the DAX (+10.3%), the S&P 500 (+10.04%) and the Magnificent-7 (+17.79%) on the upside, but with the Hang Seng (-2.16%) the standout on the downside. Elsewhere 10yr USTs and Bunds are +32bps and +27bps respectively and we’ve moved from pricing in 158bps of Fed cuts by YE to c.75bps. US HY credit is -22bps tighter and WTI oil is +13.54%. All with a few hours of trading left in the quarter.

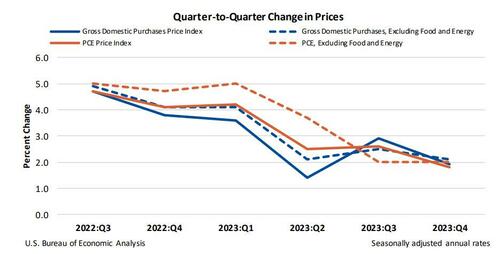

As trading floors resemble ghost towns tomorrow, we’ll see the US core PCE print. DB expects +0.27% vs. 0.42% last month. In Powell’s press conference, he remarked that the month-over-month print for core PCE could be “well below 30bps” at the end of the month. Taking him at his word does offer downside risk to our economists’ forecast. They believe upward revisions to the January healthcare services prices could square these two numbers. We’ll also see French and Italian inflation tomorrow so a busy day for a holiday!

As we await these events, yesterday was another day where technical factors related to quarter-end appeared to dominate, with a late rally leading to strong close for the S&P 500 (+0.86%) and with it to a fresh all-time high. Treasuries saw a steadier rally, with 10yr yields down -4.2bps across the day. Overnight though we’ve heard notably hawkish comments from Fed Governor Waller. He suggested that “it is appropriate to reduce the overall number of rate cuts or push them further into the future in response to the recent data”, specifically referring to the recent inflation data as “disappointing”. So expressing clearly more concern about the upside in January/February inflation than we heard from Powell last week.

After this markets have dialled back expectations of Fed cuts by -4.6bps to 74.9bps at year end adding to a 1bps decline yesterday. 2yr and 10yr yields are +3.9bp and +1.4bps higher in Asian trading. US futures haven’t responded though and are flat. On a similar note the BoE Haskel has just been quoted in the FT, as we go to print, that “wage growth remains too high” and that interest rates cuts are a “long way off”. He is a known hawk and until last week’s meeting was voting for BoE hikes.

Equity market moves had become very subdued as we moved past last week’s major central bank meetings, but some volatility has returned in the past couple of sessions. In a near mirror image of Tuesday’s close, the S&P 500 rallied more than half a percent within the final hour of trading to narrowly exceed the record level it posted last Thursday and bring the YTD gain to above 10%. The VIX index of implied equity volatility fell to a 2-month low, down -0.46 points to 12.78. Earlier in the day, European equities also saw a positive if less eventful session, with Stoxx 600 (+0.13%), Dax (+0.50%) and CAC (+0.25%) all closing at record highs.

In a sign of potential sector reweighting playing out, rate-sensitive and domestically-oriented stocks led the gains, with utilities (+2.75%) and industrials (+1.60%) outperforming within the S&P 500. This also led the Dow Jones (+1.22%) and Russell 2000 (+2.13%) to outperform, with the latter seeing its strongest day since mid-February. By contrast, tech mega caps lagged behind, with the Magnificent 7 up a marginal +0.03%. Reweighting effects may have even played out within the Magnificent Seven, with Nvidia seeing another major decline (-2.50% after -2.57% on Tuesday), while Apple (+2.12%) and Tesla (+1.22%) outperformed, having lagged YTD.

The Treasury rally yesterday was helped along by a solid 7yr auction, as $43bn of bonds were issued 0.8bps below the pre-sale yield with the indirect bidder share its highest since October. But quarter-end positioning effects may have also contributed to the bond rally – in a note earlier this week, our US rates strategists highlighted how the strong equity rally seen in Q1 pointed to potential significant quarter-end rebalancing into long-dated Treasuries. Consistent with this, long-dated Treasuries outperformed yesterday, with 30yr yields down -4.7bps. It’s a shortened session today in US bonds so expect activity to mostly grind to a halt in the European afternoon.

On the ECB side, yesterday we heard from Cipollone (one of the more dovish voices), who said that “if incoming data confirm the scenario foreseen in the March projections, we should stand ready to swiftly dial back our restrictive monetary policy stance”. The more hawkish Kazaks said he didn’t “have any objection at the moment” to market pricing of a June rate cut, while noting that “we need to be very cautious”. This backdrop saw slight dovish repricing of near-term ECB expectations, with a 25bp June cut fully priced by yesterday’s close (vs. 94% the day before), the first time this has been the case since March 8. Bonds posted a solid rally in Europe, with 10yr bund yields down -5.8bps, while OATs (-4.5bps) and BTPs (-3.7bps) saw slightly smaller moves.

In other central bank news, Sweden’s Riksbank became the latest G10 central bank to signal it’s approaching the start of rate cuts. While keeping rates on hold, it indicated that it saw “a 50% probability of a 25bps cut [at the next meeting] in May”. In large part, this was catching up to market pricing, which further inched up expectations of a May cut from 63% to 67% following the decision.

Elsewhere in Europe, we had the first taste of March inflation data, as Spanish inflation came in a touch below expectations at 3.2% (vs. 3.3% expected) on the EU-harmonized measure. We will get prints for France and Italy tomorrow, followed by Germany and the euro area aggregate next Tuesday. For more, see our European economists’ preview here. The March inflation prints are the most important remaining data points ahead of the next ECB meeting in just two weeks’ time. Similarly to the US, the euro area has seen upside surprises in domestic inflation at the start of the 2024, after a sizeable slowing in the second half of 2023. Whether this upside persists may prove crucial to whether the central banks deliver the starts of their easing cycles that they’ve increasingly signaled for Q2.

In other European data, surveys showed a continued gradual improvement in momentum in March. The European Commission’s economic sentiment picked from 95.4 to 96.3 (va. 96.2 expected), while France’s consumer confidence index rose to 91 (vs. 90 expected), its joint highest since February 2022.

Asian equity markets are seeing divergent trends this morning. The Nikkei (-1.63%) is the biggest underperformer across the region mostly on Japanese stocks going ex-dividend but perhaps a little on rising expectations of possible intervention in the FX market. Elsewhere, the KOSPI (-0.12%) is also lower while the Chinese stocks are outperforming with the Hang Seng (+1.63%), the CSI (+1.12%) and the Shanghai Composite (+1.09%) all comfortably higher. Meanwhile, the S&P/ASX 200 (+0.98%) is extending its gains for a second straight session, hitting an intraday record high of 7,901.20.

To the day ahead now, data releases include jobless claims, final March University of Michigan consumer survey, March MNI Chicago PMI, Kansas City Fed manufacturing activity, and February pending home sales in the US. In Europe we’ll have March unemployment claims and February retail sales for Germany, February money supply for the euro area and Q4 current account balance for the UK. Among central bank speakers, we have ECB’s Villleroy and Panetta.

And while the EMR and most markets are off on their Easter break, Friday will see the important February March PCE inflation print in the US, as well as March flash inflation prints in France and Italy. And we are also due to hear from Fed’s Powell and Daly.