Key Events This Busy Week: Payrolls, Powell, China People’s Congress And Much More

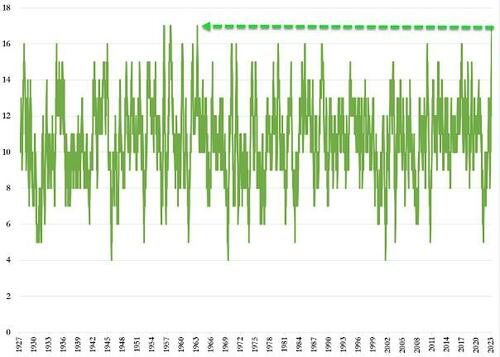

As DB’s Jim Reid writes this morning, we’re currently on a run that you may not see again in your lifetimes. He is referring to the fact that the S&P 500 just completed a historic run of 16 positive weeks out of the last 18 for first time since 1971. If this carries on for another week it’ll be 17 out of 19 for the first time since 1964, a “a remarkable and relentless period of performance”… and not even that can help Biden get elected. Oh well.

In any case, if the market run survives another week it will have navigated a number of big events ending with US payrolls on Friday. Before that we have the US services ISM, China’s Caixin services PMI, the start of China’s National People’s Congress, alongside Super Tuesday in the US presidential race tomorrow. Wednesday sees the latest JOLTS data, the BoC meeting, the UK budget and Powell’s first congressional testimony of the week. Thursday has the latest ECB meeting. Biden’s state of the union address, and Powell’s second testimony. Friday has a fair bit of European data alongside payrolls, including German PPI and Industrial Production.

Let’s briefly review a few of these highlights now starting with payrolls.

- DB economists and consensus expect +200k against +353k last month with private payrolls at +175k (consensus +160k) versus +317k last month. Winter storms in February bring a lot of uncertainty to the reading as does the fact that January saw a low response rate versus long-term averages so revisions could be sizeable.

- Before that we’ll hear from many Fed speakers (see the week ahead calendar at the end for them all) including Chair Powell’s testimonies to the House Financial Services Committee and the Senate Banking Committee on Wednesday and Thursday, respectively. He will likely stick to the January FOMC script but the market always seem to get something new out of these appearances which include a lot of congressional Q&A. He may receive plenty of questions about the balance sheet.

- The most interesting thing around the ECB meeting will be the updated staff forecasts where downgrades might not be as severe as they could have been a couple of months ago including to inflation where the flash print lasts week was ahead of consensus. So there is now unlikely to be any great urgency to cut and our economists have now pushed back their first cut to June from April. See their preview note here where they detail this and everything else you’d want to know about the meeting.

- In politics, tomorrow sees ‘Super Tuesday’, when 16 states and territories will be holding primary elections. It perhaps lacks a bit of razzmatazz this year as a Trump vs. Biden rematch looks the overwhelmingly most likely outcome outside of an event removed from the results of the primaries. Perhaps the most interesting thing to learn is whether pollsters are accurately gauging Mr Trump’s actual support levels as a guide to more national trends/predictions for November.

Moving on to Asia, in Japan, there will be several appearances by BoJ speakers including Governor Ueda tomorrow. In China, the main event will be the National People’s Congress starting tomorrow.

Here is a day-by-day calendar of events

Monday March 4

- Data: Japan February Tokyo CPI, France January budget balance

- Central banks: Fed’s Harker speaks, ECB’s Holzmann speaks

Tuesday March 5

- Data: US February ISM services index, January factory orders, China February Caixin services PMI, UK February official reserves changes, new car registrations, Italy February services PMI, France January industrial production, Eurozone January PPI, Canada February services PMI

- Central banks: BoJ’s Ueda speaks, Fed’s Barr speaks

- Earnings: Target, Crowdstrike, Bayer

- Other: Super Tuesday

Wednesday March 6

- Data: US January JOLTS report, wholesale trade sales, February ADP report, UK February construction PMI, Japan January labor cash earnings, Germany January trade balance, February construction PMI, Eurozone January retail sales, Canada Q4 labor productivity

- Central banks: Fed’s Powell testifies before the House Financial Services Committee, Daly and Kashkari speak, Beige Book, BoC decision

- Earnings: JD.com

- Other: UK Budget

Thursday March 7

- Data: US Q4 household change in net worth, January trade balance, consumer credit, initial jobless claims, China February trade balance, Japan January trade balance, current account balance, household spending, February bank lending, Germany January factory orders, Canada January international merchandise trade, building permits

- Central banks: ECB decision, Fed’s Powell testifies before the Senate Banking Committee, Mester speaks, BoJ’s Nakagawa speaks, BoE DMP survey

- Earnings: Marvell, Broadcom, Costco, Petroleo Brasiliero

- Other: State of the Union

Friday March 8

- Data: US February jobs report, Japan January leading index, coincident index, February Economy Watchers survey, Italy January PPI, Germany January PPI, industrial production, France January trade balance, current account balance, Canada February jobs report, Q4 capacity utilization rate

- Central banks: Fed’s Williams speaks, ECB’s Holzmann speaks

* * *

Focusing only on the US, Goldman writes that the key economic data releases this week are the ISM services report on Tuesday, the JOLTS job openings report on Wednesday, and the employment situation report on Friday. There are many speaking engagements from Fed officials this week, including Chair Powell’s testimony before Congress on Wednesday and Thursday.

Monday, March 4

- 11:00 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will deliver a presentation on the economic impact of higher education. Speech text, Q&A, and livestream are expected. On February 22, Harker said, “I believe that we may be in the position to see the [funds] rate decrease this year. But I would caution anyone from looking for it right now and right away. We have time to get this right, as we must…I think we’re close. Just give us a couple meetings.”

Tuesday, March 5

- 09:45 AM S&P Global US services PMI, February final (consensus 51.4, last 51.3)

- 10:00 AM Factory orders, January (GS -2.9%, consensus -2.9%, last +0.2%); Durable goods orders, January final (consensus -6.1%, last -6.1%); Durable goods orders ex-transportation, January final (last -0.3%); Core capital goods orders, January final (last +0.1%); Core capital goods shipments, January final (last +0.8%)

- 10:00 AM ISM services index, February (GS 52.6, consensus 53.0, last 53.4): We estimate that the ISM services index fell 0.8pt to 52.6 in February. Our non-manufacturing survey tracker pulled back 0.9pt to 52.2.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a panel discussion on modernization of the Community Reinvestment Act with FDIC Chair Martin Gruenberg and Acting Comptroller of the Currency Michael Hsu. Q&A and livestream are expected.

Wednesday, March 6

- 08:15 AM ADP employment change, February (GS +160k, consensus +150k, last +107k): We estimate a 160k rise in ADP payroll employment in February, reflecting a solid underlying pace of job growth and a boost from favorable seasonality.

- 10:00 AM JOLTS job openings, January (GS 8,700k, consensus 8,890k, last 9,026k): We estimate that JOLTS job openings fell by 0.3mn to 8.7mn in January, reflecting a pullback in online job postings.

- 10:00 AM Fed Chair Powell speaks: Federal Reserve Chair Jerome Powell will testify before the House Financial Services Committee. On February 5, Powell said, the “danger of moving too soon is that the job’s not quite done, and that the really good readings we’ve had for the last six months somehow turn out not to be a true indicator of where inflation’s heading.” The interviewer reported that Powell “suggested to us the likely time for the first interest rate cut would be the middle of the year, a few months before the election.” We expect 4 cuts to the Fed funds rate in 2024 starting in June and 4 cuts in 2025 for a terminal rate of 3.25-3.5%.

- 10:00 AM Wholesale inventories, January final (consensus -0.1%, last -0.1%)

- 12:00 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will deliver the keynote address at the 2024 National Interagency Community Reinvestment Conference. Speech text, moderated Q&A, and livestream are expected. On February 29, Daly said, “There is no imminent risk to the economy faltering. We are ready to make moves and adjust as the data demands us to do…It would be appropriate as inflation comes down to bring the nominal rate of interest down to make sure we’re not holding on even tighter. We want to avoid holding on all the way to 2%, putting policy very tight and then cause an unnecessary downturn.”

- 02:00 PM Beige Book, March FOMC meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the January FOMC meeting period noted that a majority of the 12 Districts reported little or no change in economic activity since the prior Beige Book period, while 3 reported modest growth and one reported a moderate decline. They noted that contacts from nearly all Districts reported decreases in manufacturing activity. Six Districts reported slight or modest price increases, and two reported moderate increases. We continue to look for anecdotes related to inflation pressures and economic activity in the Beige Book for the March FOMC meeting period.

- 04:15 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a moderated discussion at the Wall Street Journal’s CFO Network Summit. A moderated Q&A and livestream are expected. On February 7, Kashkari said, “We’re not looking for better inflation data, we’re just looking for additional inflation data that is also at around this 2% level. If we get to see a few more months of that data, I think that will give us a lot of confidence.”

Thursday, March 7

- 08:30 AM Trade balance, January (GS -$63.2bn, consensus -$63.5bn, last -$62.2bn)

- 08:30 AM Nonfarm productivity, Q4 final (GS +3.0%, consensus +3.1%, last +3.2%): Unit labor costs, Q4 final (GS +0.7%, consensus +0.7%, last +0.5%): We estimate a 0.2pp downward revision to nonfarm productivity growth to +3.0% (qoq ar) in the final Q4 reading. We expect a 0.2pp upward revision to unit labor costs—compensation per hour divided by output per hour—to +0.7%.

- 08:30 AM Initial jobless claims, week ended March 2 (GS 205k, consensus 218k, last 215k): Continuing jobless claims, week ended February 24 (GS 1,865k, consensus 1,870k, last 1,905k)

- 10:00 AM Fed Chair Powell speaks; Federal Reserve Chair Jerome Powell will testify before the Senate Banking Committee.

- 11:30 AM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will deliver a virtual speech on the economic outlook as part of the European Economics and Financial Centre’s Distinguished Speaker Series. Q&A and livestream are expected. On February 29, Mester said, “Right now that [three cuts to the fed funds rate this year] feels about right to me if the economy evolves as I anticipate it will.” She added that the January PCE inflation reading “doesn’t really change my view.”

Friday, March 8

- 07:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will participate in an event organized by the London School of Economics. Q&A and livestream are expected. On February 28, Williams said, “The economy is still strong, we expect to see positive growth and inflation to keep coming down. So something like three rate cuts is a reasonable starting point when you think about it… We still have a ways to go on the journey to sustained 2% inflation.” On February 29, Williams added, “I expect us to cut interest rates later this year.”

- 08:30 AM Nonfarm payroll employment, February (GS +215k, consensus +200k, last +353k); Private payroll employment, February (GS +175k, consensus +160k, last +317k); Average hourly earnings (mom), February (GS flat, consensus +0.2%, last +0.6%); Average hourly earnings (yoy), February (GS +4.2%, consensus +4.3%, last +4.5%); Unemployment rate, February (GS 3.7%, consensus 3.7%, last 3.7%); Labor force participation rate, February (GS 62.6%, consensus 62.6%, last 62.5%): We estimate nonfarm payrolls rose by 215k in February (mom sa), reflecting a 30-50k boost from a favorable swing in the weather. We believe fewer end-of-year layoffs drove the 353k jump in January payrolls, and with that tailwind now behind us, we assume a return towards a more normal pace of job gains. Big Data employment indicators also indicate solid or strong job growth, albeit well below that of January. We estimate that the unemployment rate was unchanged at 3.7%, reflecting a moderate rise in household employment offset by a 0.1pp rebound in the labor force participation rate to 62.6%. We estimate unchanged average hourly earnings (mom sa) that lower the year-on-year rate by three tenths to 4.2%, reflecting a 0.2pp drag on the monthly rate from the reversal of January’s weather-related distortions, as well as waning wage pressures and neutral calendar effects.

Source DB, Goldman, BofA

Tyler Durden

Mon, 03/04/2024 – 10:40

via ZeroHedge News https://ift.tt/fvRlYKZ Tyler Durden