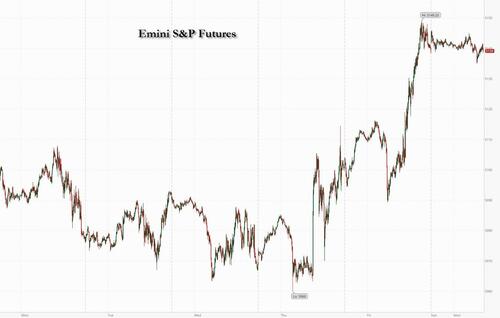

S&P Futures Flat As MegaTech Bubble Gets Bigger Around The Globe

US equity futures were flat after closing Friday at a new record high above 5,100 for the first time ever, and gaining for 16 of the past 18 weeks, while European shares extended gains to new all time highs after six weeks of gains, as investors waited for reassurances that central banks are on track to cut interest rates in the coming months. US equity futures traded in a narrow range with S&P futures trading down 0.1% while Nasdaq futures were modestly in the green. NVDA is +1.3% pre-mkt but the rest of Mag7 are flat or down; Apple was down more than 1% after it was hit Monday with a €1.8 billion ($2 billion) penalty from the European Union over an investigation into allegations it shut out music-streaming rivals. SMCI soared 16% after it was added to the S&P 500 index in the latest quarterly weighting change. Treasuries slipped, while commodities are mixed with ags higher and Energy lower; WTI falls below $80 even though OPEC+ extended production cuts through mid-year. Bitcoin topped $65,000, leading traders to bet the cryptocurrency will surpass the record price of almost $69,000, hit during the pandemic. With no US macro data today and only one Fedspeaker, we may see a low volume day as investors await the next batch of data, ISM-Srvcs (tmrw), JOLTS (Weds), Productivity (Thurs), and NFP (Fri). Earnings this week have AVGO and several Consumer/Retailer names which may help clarify the picture on the Consumer.

In US premarket trading, chipmakers continued their ascent, with Western Digital Corp., Micron Technology Inc. and Nvidia Corp. rising more than 1%. Tesla Inc dropped 1.7% on a drop in Chinese auto sales. Cryptocurrency-linked stocks also rallied after Bitcoin breached the $65,000 mark, extending gains to a second consecutive session. Here are some other notable premarket movers:

- Super Micro Computer soared 16% and Deckers Outdoor also rallied aboug 6% after the pair were added to the S&P 500 index in the latest quarterly weighting change.

- Dutch Bros rise 2.8% after the drive-through coffee chain was upgraded to overweight from neutral at Piper Sandler, which says it’s the right time to become more constructive on the stock.

- Lyft shares gain 5.2% after RBC Capital Markets speculates about a partnership between the ride-hailing service and food delivery firm DoorDash (DASH US), with the broker upgrading both to outperform.

- Toast shares gain 1.3% in premarket trading after the restaurant software company was initiated with an outperform recommendation at Evercore ISI, which also set a Street-high price target for the stock.

- Macy’s rose 16% after Arkhouse Management Co. and Brigade Capital Management boosted their offer for the department store operator by 14% after the company rebuffed a previous proposal.

The S&P 500 has now gained for 16 of the last 18 weeks, a run not seen since 1971, Deutsche Bank analysts pointed out. That rally was fanned further last week by US data that reinforced bets the Federal Reserve would be able to cut rates later this year. The earnings season, meanwhile, showed companies averaging 8% earnings growth.

“Better economic outlook, bullish investor sentiment and some better earnings have supported the equity markets,” Jefferies strategist Mohit Kumar wrote in a note. “Whether it’s the economic outlook or the central bank ‘put’ being back on the table, investors are very positive on risky assets.” While markets have broadly pushed Fed policy-easing expectations to July, from the previously anticipated May, Kumar still expects 75-100 basis points worth of rate cuts this year, according to Bloomberg.

Some hints could come this week from Fed Chair Jerome Powell’s congressional testimony, while the European Central Bank will hold a policy meeting on Thursday. A raft of economic data is also due, including US monthly payrolls figures on Friday.

Europe’s Stoxx 600 reversed earlier losses to trade up 0.3% to a new all time high with technology, health care and banks outperforming. Delivery Hero SE rose after announcing the launch of a financing transaction to amend and extend its financing facilities. Here are the biggest movers Monday:

- Delivery Hero rises as much as 6.9% after the German online food ordering services firm amended and extended its existing debt facilities, something Bernstein calls “overwhelmingly positive”

- Diasorin advances as much as 5.4% after the Italian biotechology firm said it’s Liaison Plex diagnostics platform received US FDA clearance, a very clear positive, analysts says

- Evonik rises as much as 4.5% after announcing job cuts and other measures that will reduce costs by €400 million annually by the end of 2026, with analysts positive on cost cuts

- Aryzta gains as much as 6.1%, the most since Jan. 19, after the Swiss industrial baker presented results that Stifel called “compelling” and fresh guidance which boosts confidence

- DS Smith shares rise as much as 2.1% to a one-year high, after Bloomberg reported late Friday that Mondi has increased its preliminary takeover offer for the rival packaging company

- BT Group advances as much as 2.7% as Berenberg upgrades the telecom operator to buy, saying the investment case should become much clearer and concerns seem overdone

- Henkel shares decline as much as 4.5% after the consumer-chemical producer posted in-line 4Q results. RBC flags company outlook for low-single-digit negative impact from M&A in 2024

- Comet tumbles as much as 7.9%, the most in more than four months, after the Swiss supplier of radio frequency tools to the semiconductor industry posted an outlook below expectations

- SoftwareOne falls as much as 3.3% after the firm’s founding shareholders move to dissolve the group acting in concert between them and Bain Capital and terminate an underlying agreement

Earlier in the session, Asian stocks gained, lifted by the tech sector, as traders prepared for a slew of central bank events and China’s key political meeting this week. The MSCI Asia Pacific Index rose 0.6%, with chipmakers TSMC and Samsung Electronics among the biggest boosts: the world’s top chipmaker, Taiwan Semiconductor Manufacturing Co., rose to its highest-ever level. Bets that the Federal Reserve will be able to cut rates as soon as June and Dell’s better-than-expected results provided support for tech shares. Taiwan’s Taiex jumped 2%, Korea’s Kospi rose more than 1% and Japan’s Nikkei 225 climbed above the key 40,000 level for the first time ever. The tech gains came on the heels of “the whole AI push again, especially in Taiwan,” said Xin-Yao Ng, an investment director at abrdn. “The AI thematic is very strong at the moment when themes like EV and renewables are facing issues.”

Chinese equities were steady ahead of the National People’s Congress, an annual gathering of the nation’s top officials that may offer trading cues from policy priorities and signals about fiscal stimulus. While recent “national team” buying has put a near-term floor on the market, some investors say more consistent policies and structural reforms are needed for fund flows to meaningfully return.

- Hang Seng and Shanghai Comp. were choppy with an early lacklustre mood after the PBoC’s liquidity drain, while China begins its Two Sessions meeting with the focus on the NPC tomorrow including Premier Li’s first government work report and the official GDP target.

- ASX 200 lacked conviction amid varied data releases and despite initially printing a fresh record high.

- Nikkei 225 resumed its uptrend and climbed above the 40,000 level for the first time.

- KOSPI outperformed as it played catch up on its return from a 3-day weekend.

In FX, the US dollar declined for a second day, in a quiet session with no US economic data due. The Bloomberg Dollar Spot Index is down 0.1% with muted moves across the G-10 currencies. The pound is the best performer, rising 0.2% versus the greenback ahead of the UK budget announcement on Wednesday. Sterling and euro outperformed developed-nation peers while most other currencies were down.

- USD/JPY rises 0.2% to 150.38, up for a second day

- GBP/USD also gains a second day to 1.2682, up almost 0.5% in two sessions

- EUR/USD climbs 0.2% to 1.0853

- USD/CHF rises 0.1% to 0.8843; the pair fell as much as 0.3% to session low 0.8806 after Switzerland’s Feb CPI rose quicker than estimated

In rates, treasuries fall, with US 10-year yields rising 2bps to 4.20%, underperforming core European rates. Treasury yields were cheaper by 2bp to 3bp across the curve with spreads broadly within 1bp of Friday’s close; 10-year yields trade around 4.21% with bunds and gilts outperforming by 3bp and 2bp in the sector. 2s10s and 5s30s spreads, little changed on the day, remain inside Friday’s sharp steepening ranges.Monday’s US session is expected to include at least 10 corporate bond offerings, while economic data slate is empty. Key labor-market indicators later this week include February jobs report Friday. The US IG dollar issuance slate empty so far, though syndicate desks are calling for roughly $30b of new IG sales this week and $130b in March

In commodities, oil prices are flat, with WTI trading near $79.90 after OPEC+ extended its oil supply cutbacks to the middle of the year. Spot gold is little changed.

Bitcoin continued to climb higher and rose more than 3% above 65,000, now just $4K away from a new all time high; price action which has lifted Crypto stocks such as Coinbase and Riot. Chinese state media warned against cryptocurrency trading as domestic interest surges amid the bitcoin rally, according to SCMP.

Looking at today’s calendar, the US economic data slate is empty for the session; ahead this week are S&P Global US services PMI, factory orders, ISM services, ADP employment, JOLTS and jobs report. Fed speakers scheduled include Harker at 11am; Barr, Powell, Daly, Kashkari, Mester and Williams are scheduled to appear later this week

Market Snapshot

- S&P 500 futures little changed at 5,142.25

- STOXX Europe 600 little changed at 498.06

- MXAP up 0.4% to 174.83

- MXAPJ up 0.7% to 531.07

- Nikkei up 0.5% to 40,109.23

- Topix down 0.1% to 2,706.28

- Hang Seng Index little changed at 16,595.97

- Shanghai Composite up 0.4% to 3,039.31

- Sensex up 0.2% to 73,938.36

- Australia S&P/ASX 200 down 0.1% to 7,735.79

- Kospi up 1.2% to 2,674.27

- German 10Y yield little changed at 2.40%

- Euro up 0.1% to $1.0848

- Brent Futures little changed at $83.61/bbl

- Gold spot up 0.0% to $2,083.89

- U.S. Dollar Index little changed at 103.84

Top Overnight News

- In the early 2000s, the U.S. and the global economy experienced a “China shock,” a boom in imports of cheap Chinese-made goods that helped keep inflation low but at the cost of local manufacturing jobs. A sequel might be in the making as Beijing doubles down on exports to revive the country’s growth. Propped up by cheap, state-directed loans, Chinese companies are glutting foreign markets with products they can’t sell at home. Some economists see this China shock pushing inflation down even more than the first. China’s economy is now slowing, whereas, in the previous era, it was booming. As a result, the disinflationary effect of cheap Chinese-manufactured goods won’t be offset by Chinese demand for iron ore, coal and other commodities. WSJ

- Beijing is expected to resist growing market pressure for much stronger stimulus to spur China’s economic recovery at its flagship annual political event this week, analysts have said, as President Xi Jinping focuses on turning the country into an advanced manufacturing superpower. FT

- Japan is considering calling an end to deflation in the wake of rising prices, Kyodo news reported, a move that would turn a new page for the world’s fourth-largest economy after decades of economic stagnation scarred a generation of workers and investors. RTRS

- Israel has “basically signed on” to a six-week ceasefire that would be used to facilitate a second round of swaps of Israeli hostages for Palestinian prisoners, a senior US administration official said. FT

- OPEC+ extended its oil supply cutbacks to the middle of the year in a bid to avert a global surplus and shore up prices. The curbs — which on paper total roughly 2 million barrels a day — will remain in place until the end of June, according to delegates who asked not to be identified because the information isn’t public. Group leader Saudi Arabia accounts for half of the pledged reduction. BBG

- US real estate inflation is much cooler/tamer than the official gov’t data would suggest as rents ease amid a jump in supply and a downtick in demand (economists insist it’s only a matter of time before the CPI/PCE start to reflect reality). WaPo

- SMCI (Supermicro) and DECK (Deckers) will replace WHR (Whirlpool) and ZION (Zions Bancorp) in the S&P 500 prior to the open of trading on Mon March 18. WSJ

- Arkhouse and Brigade increase their bid for Macy’s from $21/shr. to $24/shr. and identify additional information about their financing for the deal. RTRS

- President Biden is struggling to overcome doubts about his leadership inside his own party and broad dissatisfaction over the nation’s direction, leaving him trailing behind Donald J. Trump just as their general-election contest is about to begin, a new poll by The New York Times and Siena College has found. With eight months left until the November election, Mr. Biden’s 43 percent support lags behind Mr. Trump’s 48 percent in the national survey of registered voters. NYT

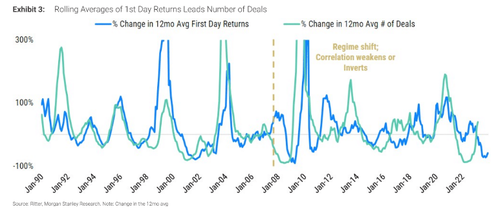

- The recent rally has driven the share of market cap in stocks with extremely high valuations to levels similar to those reached during the euphoria of 2021. But the prevalence of extreme valuations today looks far less widespread than in 2021 after adjusting for market concentration. In contrast with 2021, the cost of capital (WACC) is much higher today and investors are focused on margins rather than “growth at any cost.” These headwinds from a higher WACC have also weighed on small-caps. Quality is expensive and will tactically underperform when confidence in the inflation outlook improves. However, a higher WACC means valuations of small and unprofitable growth stocks are unlikely to return to their 2021 highs. GIR

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid a tentative mood ahead of an event-packed week. ASX 200 lacked conviction amid varied data releases and despite initially printing a fresh record high. Nikkei 225 resumed its uptrend and climbed above the 40,000 level for the first time. KOSPI outperformed as it played catch up on its return from a 3-day weekend. Hang Seng and Shanghai Comp. were choppy with an early lacklustre mood after the PBoC’s liquidity drain, while China begins its Two Sessions meeting with the focus on the NPC tomorrow including Premier Li’s first government work report and the official GDP target.

Top Asian News

- China NPC spokesperson said the 2024 annual parliamentary meeting will close on March 11th and they will make new laws to deepen economic reform including financial institutional reform to promote private companies, while the spokesperson said Premier Li will not give a press conference at the close of the NPC this year and will not hold a press conference in following years, according to Reuters. It was separately reported that Beijing is expected to resist market pressure for a much stronger stimulus to spur China’s economic recovery at the annual political event this week, according to FT.

- ZOZO (3092 JT), Disco Corp (6146 JT), and Socionext (6526 JT) are to join the Nikkei 225, from April 1

- China’s NDRC is to raise retail gasoline and diesel prices by CNY 125/ton and CNY 120/ton respectively from March 5th.

- Chinese insurers reportedly warn of debt risks at property giant Vanke (2202 HK/ 2 CH), via Bloomberg

European bourses, Stoxx600 (+0.1%) began the session on a mixed footing and currently trade on either side of the unchanged mark in what has been a catalyst-thin morning. Sectors are mostly lower; Tech takes the top spot, seemingly benefitting from broad-base optimism within the sector. Basic Resources is hampered by the softer risk tone in Chinese trade overnight. US Equity Futures (ES -0.1%, NQ +0.1%, RTY +0.2%) are firmer, though trading with little direction ahead of a quiet docket on Monday. The RTY outperforms, lifted by gains in SMCI (+12.2%) and in tandem with strength in Bitcoin. Attention this week will be on appearances from Fed Chair Powell, the ECB and the US NFP report on Friday.

Top European News

- UK Chancellor Hunt said he hoped to be able to lower taxes further in his annual budget on Wednesday but noted it would be “deeply unconservative” for him to do so in a way that required higher borrowing and his budget will be prudent and responsible, according to Reuters. Furthermore, Hunt said during an interview with the BBC that he wants to move towards lower taxes but will only do so in a responsible way and that the most unconservative thing he could do would be to cut taxes by increasing borrowing.

- UK Chancellor Hunt is putting together plans for up to GBP 9bln worth of tax increases and spending cuts in order to fund a 2p reduction in national insurance, according to The Times.

- UK Chancellor Hunt is reportedly expected to set out plans for private companies to trade shares on exchanges, according to FT.

- UK PM Sunak’s close allies reportedly worry that his chances of winning the next UK election have been made even more difficult as one of his Cabinet ministers, Business Secretary Badenock is said to be positioning to succeed him as Conservative Party leader, according to Bloomberg.

- EU’s Dombrovskis said it is positive that the e-commerce moratorium has been extended, while he noted there were disappointments related to agriculture and fisheries talks.

- S&P upgraded Portugal from BBB+ to A-; Outlook Positive amid ongoing steep external and government deleveraging.

FX

- Contained trade for DXY on a 103 handle, holding above Friday’s trough of 103.65 and the 200DMA at 103.79. Catalyst-light session thus far with greater attention on the week’s upcoming risk events.

- The EUR briefly eclipsed Friday’s high at 1.0856 before pulling back a touch. For now, is contained between between its 50DMA at 1.0867 and 200DMA at 1.0828.

- A slightly softer start to the week for JPY as USD/JPY maintains a footing on a 150 handle. Attention for the pair remains to the upside with Friday’s high at 150.72 and the YTD peak at 150.88. A decisively more hawkish BoJ is required to change fortunes for the pair.

- The Swiss Franc is the marginal outperformer across the majors in the wake of firmer-than-expected inflation metrics. EUR/CHF remains above its 200DMA at 0.9560. ING continues to target a move towards 0.96 for EUR/CHF by spring.

- PBoC set USD/CNY mid-point at 7.1020 vs exp. 7.1906 (prev. 7.1059).

Fixed Income

- USTs are the relative underperformers, and have been gradually fading from the 111-01 session peak which left USTs just one tick shy of Friday’s best, a pullback which has been gradual and without any real driver but one that is relatively modest when compared to Friday’s action overall.

- Bunds are in a tight 132.53-132.89 bound which keeps it near Friday’s best of 132.87 but markedly shy of last week’s 133.61 peak. There was no reaction to EZ Sentix as attention turns to ECB’s Holzmann later today (ECB is in the quiet period) and the ECB Policy Announcement on Thursday.

- Gilts are slightly weaker than EGBs but with an equally narrow 30 tick range, the high point resides at 98.33 shy of Friday’s 98.43 best and another 10 ticks from that week’s contract peak.

Commodities

- Sideways trade across crude futures with little impetus from the weekend OPEC+ output cut extension through Q2 (as expected), with the move seemingly limiting near-term downside. Geopolitics also remain in focus with Gaza truce talks underway; “Egyptian media reports ‘significant progress’ in talks between the mediators and Hamas on a ceasefire in Gaza”, according to Walla News’ Elster.

- A flat-to-subdued morning for precious metals with the Dollar index also caged in a tight range as participants await this week’s myriad of risk events in the absence of unscheduled macro drivers; Spot gold found intraday resistance at Friday’s high (2,088.19/oz) before waning.

- Mixed trade across base metals with copper firmer intraday despite the recently reported increases in Chinese inventories; 3M LME copper briefly fell under USD 8,500/t before reclaiming the level and currently prints a USD 8,481.50-8,570/t intraday range.

- OPEC+ members agreed to extend voluntary cuts to Q2 whereby Saudi Arabia is to extend its voluntary oil cut of 1mln bpd for Q2 with its output to be around 9mln bpd through June and Russia is to cut oil output and exports by an additional 471k bpd, while the UAE is to voluntary cut oil output by 163k bpd and Iraq will voluntary cut output by 220k bpd. Furthermore, Kazakhstan is to extend voluntary oil output cuts of 82k bpd through to Q2 2024 and Kuwait is to cut oil output by 135k bpd for June.

- Russian Deputy PM Novak said Russia will implement an additional voluntary oil and export output cut of 471k bpd for Q2 in which it will cut output by 350k bpd in April with exports cut by 121k bpd, while it will cut output by 400k bpd in May with exports cut by 71k bpd and will cut 471k bpd in June which will all be from output, according to Reuters and The Moscow Times.

- GCC ministerial meeting communiqué stated that the entire Durra gas field and its natural resources are jointly and only owned by Saudi Arabia and Kuwait.

- Iran’s Oil Minister said Iran aims to reach 1.3bln cubic metres per day of gas output in 5 years.

- HSBC says Qatar expansion is likely to prolong Global LNG glut until 2030; cuts Europe TTF forecasts by 14% on average to USD 9.25/9.5/MBTU in 2024/2025E

- EQT (EQT) is to curtail approximately 1bcf per day of gross production beginning late Feb amid low nat gas prices from warm winter weather and elevated storage inventories Q1 curtailments expected to total 30-40bcf of net production.

Geopolitics: Middle East

- Israeli military spokesman said the IDF concluded the initial review of civilian deaths at the Gaza aid convoy in which it was concluded that the IDF did not carry out a strike towards the aid convoy and the majority of Palestinians that died were the result of a stampede, while forces fired warning shots and responded towards several individuals that approached forces posing an ‘immediate threat’.

- Hamas delegation arrived in Cairo on Sunday for ceasefire talks, while it was also reported that a Palestinian official familiar with Gaza truce talks said they were not there yet when asked whether a deal was imminent. Furthermore, Egyptian security sources had previously stated that parties agreed on the duration of a truce, as well as hostage and prisoner releases although the completion of a deal still requires an agreement on the withdrawal of Israeli forces from northern Gaza and a return of residents.

- US VP Harris said what we are seeing every day in Gaza is devastating and too many innocent Palestinians have been killed and Gazans are suffering from a humanitarian catastrophe. Harris added that Israel’s government must do more to increase the flow of aid, “no excuses”, as well as work to restore basic services and restore order in Gaza. Furthermore, she said there must be an immediate ceasefire and the threat posed by Hamas must be eliminated, while she added there is a deal on the table and Hamas needs to agree to that deal, according to Reuters.

- US VP Harris is to meet with Israeli war cabinet member Gantz on Monday and US Secretary of State Blinken is also to meet with Gantz in Washington on Tuesday.

- US official said on Saturday that the outlines of a Gaza peace deal are in place and it depends on Hamas agreeing to release hostages, according to Reuters.

- Houthi transport ministry said hostile actions by British and US naval vessels against Yemen caused a malfunction in submarine cables in the Red Sea.

- Hezbollah claimed it detonated a large IED and fired artillery at an Israeli force that attempted to infiltrate Lebanon, according to a source via social media platform X.

- “Tangible progress on the second day of Cairo negotiations on the truce in Gaza”, according to Egyptian media cited by Sky News Arabia.

- “Egyptian media reports ‘significant progress’ in talks between the mediators and Hamas on a ceasefire in Gaza”, according to Walla News’ Elster.

OTHER

- Road traffic near Crimea’s port of Feodosia was temporarily restricted following reports of an explosion.

- China’s Embassy in the Philippines commented on remarks from the Philippines Ambassador to the US in which it stated the China-related remarks disregard basic facts, ‘wantonly hype up’ the South China Sea issue and maliciously smear China which they strongly condemn, according to Reuters.

US Event Calendar

- Nothing scheduled

Central Bank Speakers

- 11:00: Fed’s Harker Remarks on Economic Impact of Higher Education

DB’s Jim Reid concludes the overnight wrap

We’re currently on a run that you may not see again in your lifetimes. The S&P 500 last week completed a run of 16 positive weeks out of the last 18 for first time since 1971. If this carries on for another week it’ll be 17 out of 19 for the first time since 1964. A remarkable and relentless period of performance.

If the run survives this week it will have navigated a number of big events ending with US payrolls on Friday. Before that we have the US services ISM, China’s Caixin services PMI, the start of China’s National People’s Congress, alongside Super Tuesday in the US presidential race tomorrow. Wednesday sees the latest JOLTS data, the BoC meeting, the UK budget and Powell’s first congressional testimony of the week. Thursday has the latest ECB meeting. Biden’s state of the union address, and Powell’s second testimony. Friday has a fair bit of European data alongside payrolls, including German PPI and Industrial Production.

Let’s briefly review a few of these highlights now starting with payrolls. Our economists and consensus expect +200k against +353k last month with private payrolls at +175k (consensus +160k) versus +317k last month. Winter storms in February bring a lot of uncertainty to the reading as does the fact that January saw a low response rate versus long-term averages so revisions could be sizeable.

Before that we’ll hear from many Fed speakers (see the week ahead calendar at the end for them all) including Chair Powell’s testimonies to the House Financial Services Committee and the Senate Banking Committee on Wednesday and Thursday, respectively. He will likely stick to the January FOMC script but the market always seem to get something new out of these appearances which include a lot of congressional Q&A. He may receive plenty of questions about the balance sheet and DB’s Matt Luzzetti co-authored an important academic paper on Friday, discussed on releases by both Governor Waller and Dallas Fed President Logan, called “Quantitative Tightening Around the Globe: What Have We Learned?”.

The most interesting thing around the ECB meeting will be the updated staff forecasts where downgrades might not be as severe as they could have been a couple of months ago including to inflation where the flash print lasts week was ahead of consensus. So there is now unlikely to be any great urgency to cut and our economists have now pushed back their first cut to June from April. See their preview note here where they detail this and everything else you’d want to know about the meeting.

In politics, tomorrow sees ‘Super Tuesday’, when 16 states and territories will be holding primary elections. It perhaps lacks a bit of razzmatazz this year as a Trump vs. Biden rematch looks the overwhelmingly most likely outcome outside of an event removed from the results of the primaries. Perhaps the most interesting thing to learn is whether pollsters are accurately gauging Mr Trump’s actual support levels as a guide to more national trends/predictions for November.

Moving on to Asia, in Japan, there will be several appearances by BoJ speakers including Governor Ueda tomorrow. In China, the main event will be the National People’s Congress starting tomorrow. Our economists have an overview here and point to several key announcements to watch, including the 2024 growth target, the fiscal stance for 2024 and property sector policy.

Staying with Asia, markets have started the week mostly on the positive side led by the KOSPI (+1.30%) after being closed on Friday. The Nikkei (+0.58%) is currently trading above 40,000 for the first time in history. Elsewhere, the CSI (+0.15%) and the Shanghai Composite (+0.22%) are edging higher ahead of the important political meeting this week. The Hang Seng (-0.06%) and the S&P/ASX 200 (-0.14%) are slightly weaker alongside S&P 500 (-0.11%) futures. 2yr (+1.45bps) and 10yr UST (+1.36 bps) yields are slightly higher, trading at 4.55% and 4.19%, respectively.

Brent futures (+0.16%) are slightly higher at $83.68/bbl after OPEC+ members agreed over the weekend to extend voluntary crude supply cuts of 2.2 million barrels per day (mbpd) until the end of second quarter to support the “stability and balance of oil markets”. This was as expected.

Recapping last week now, and markets were given fresh impetus after the US PCE inflation report was in line with expectations, after some fears had built up of an even stronger print. The S&P 500 gained +0.95% last week (and +0.80% on Friday), meaning the index has now recorded positive weekly gains for 16 out of the last 18 weeks, the first time since 1971. Talking of milestones, the Russell 2000 reached its highest level since April 2022, jumping +2.96% on the week (and +1.05% on Friday), so the rally was fairly broad. But it was tech stocks that led Friday’s sizeable rally, with the Magnificent 7 up +1.27% (+1.74% over the week). A strong earnings beat by Dell Technologies (+31.62% Friday) lifted semiconductor stocks (+4.29%) and saw Nvidia (+4.00%) move above $2trn market cap for the first time.

European equities enjoyed a more modest performance last week, with the STOXX 600 near flat (+0.07%) despite a +0.60% rise on Friday. But the German DAX was a standout, as the index shot up to a new all-time after rising +1.81% (and +0.32% on Friday).

Friday’s equity strength came despite the downside surprise in the US February manufacturing ISM (at 47.8 vs 49.5 expected). That said, it may have helped markets by increasing expectations of rate cuts, with the amount of Fed cuts expected by December rising +9.4bps last week to 92bps (+6.6bps on Friday). This supported a rally in sovereign bonds with yields on 2yr Treasuries slipping -16.0bps (and -8.8bps on Friday). 10yr Treasury yields fell by -6.7bps (and -6.9bps on Friday).

Meanwhile in Europe, flash inflation for February came in hotter-than-expected. Headline HICP slowed to 2.6% year-on-year (just above the 2.5% expected), while core saw a larger upside surprise at 3.1% (vs 2.9% expected). Against this backdrop, investors pared back expectations of ECB rate cuts, with the rate priced in for June rising +5.2bps to 23.2bps (+0.2bps on Friday). This marks the first week since October that less than 25bps of cuts have been priced by June. 10yr bund yields rose +5.1bps (+0.2bps on Friday).

In commodities, WTI crude rose to its highest level since October after gaining +2.19% on Friday to $79.97/bbl (+4.55% week-on-week), ahead of OPEC+’s production decision early this month. Last but not least, Friday was a remarkable day for alternative stores of value as gold (+1.89% to $2,083/oz) closed at an all-time high, whilst Bitcoin (+1.89% to $61,921) closed at a two-year high.

Tyler Durden

Mon, 03/04/2024 – 08:18

via ZeroHedge News https://ift.tt/Edo7zrh Tyler Durden