Authored by Nick Giambruno via InternationalMan.com,

Given the characteristics of gold and Bitcoin, which is best suited for sending value through time and space?

Below, I’ll analyze the ten most decisive monetary attributes and see whether gold or Bitcoin has an advantage.

Monetary Attribute #1: Scarcity

The World Gold Council estimates there are 6.8 billion ounces of mined gold globally, and annual production averages around 118 million ounces.

That much is what is known. However, we don’t know how much gold will be discovered and mined in the future.

For example, how many mined ounces of gold will be available on June 1, 2031?

We can probably make a pretty accurate projection, but nobody can know.

What will the Bitcoin supply be on June 1, 2031?

It will be around 20,589,121 Bitcoins.

With Bitcoin, the current and future supply is finite and known to all.

There will never be more than 21 million Bitcoins, and there is nothing anyone can do to change that.

Today, the Bitcoin supply is about 19.6 million, meaning the vast majority—over 93%—of the total Bitcoin supply has already been created.

The remaining 1.4 million BTC will come onto the market at a preset, ever-decreasing rate until the last Bitcoin is created 116 years from now, in 2140.

In other words, Bitcoin’s supply will only grow about 7% in the next 116 years.

The supply of Bitcoin won’t grow much at all from here.

By 2030, over 98% of all Bitcoins will have already been created.

Bitcoin_apex, a German Bitcoin advocate, describes Bitcoin’s scarcity like this:

8 billion people, 21 million Bitcoin.

That is proportionally as if:

80,000 people had to share $210.

8,000 people spread out on a bus with 21 seats.

800 people would share 2.1kg of bread.

80 people sharing 0.21 liters of water.

8 people would have to live in an apartment with 0.021 square meters.

Here’s another way to think of it.

Owning 1 BTC is like owning 324 ounces of the global gold supply; each would give you ownership over about 0.00000476% of the overall supply.

Owning 1.236 BTC is like owning a 400-ounce Good Delivery gold bullion bar; each would give you ownership over about 0.0000059% of the overall supply.

Here’s the bottom line.

Gold is scarce, but only Bitcoin is absolutely scarce.

Verdict: Bitcoin Wins

Monetary Attribute #2: Hardness

In my view, hardness is the most important monetary attribute.

Hardness does not mean something that is necessarily tangible or physically hard, like metal. Instead, it means “hard to produce.” By contrast, “easy money” is easy to produce.

The best way to think of hardness is “resistance to debasement,” which helps make it a good store of value—an essential function of money.

All other monetary characteristics are meaningless if the money is easy for someone to produce.

What is desirable in a good money is something that someone else cannot make easily.

For example, imagine the price of copper going 5x or 10x.

You can be sure that would spur increased production, eventually expanding the copper supply. Of course, the same is true of any other commodity.

That’s why there is a famous saying in mining: “The cure for high prices is high prices.”

The dynamic of higher prices incentivizing more production and ultimately more supply, bringing prices down, exists with every physical commodity. However, gold is the most resistant to this process.

That supply response is why most commodity prices tend to revert around the cost of production over time.

This dynamic is even more profound with money.

When an asset obtains monetary properties, the natural reaction is for people to make more of it—a lot more of it.

This is known as the easy money trap.

Historically, gold was always the hardest asset, the one most resistant to the easy money trap… until Bitcoin.

Bitcoin is the first—and only—monetary asset with a supply entirely unaffected by increased demand.

That is an astonishing and game-changing characteristic.

That means the only way Bitcoin can respond to an increase in demand is for the price to go up. Unlike gold and every other commodity, increasing the supply in response to increased demand is not an option.

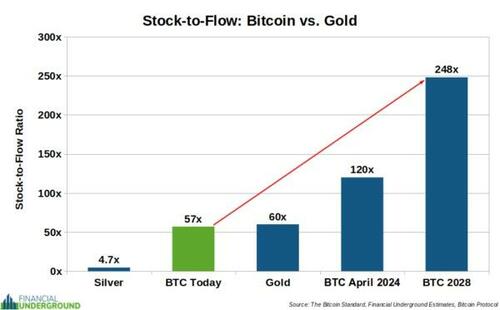

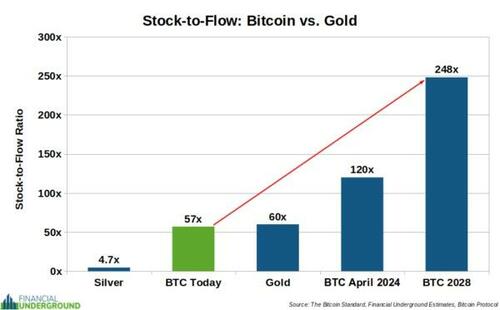

The stock-to-flow (S2F) ratio measures an asset’s hardness.

S2F Ratio = Stock / Flow

The “stock” part refers to the amount of something available, like current stockpiles. It’s the supply already mined. It’s available right away.

The “flow” part refers to the new supply added from production and other sources each year.

A high S2F ratio means that annual supply growth is small relative to the existing supply, which indicates a hard asset resistant to debasement.

A low S2F ratio indicates the opposite. This means that new annual production can easily influence the overall supply and prices, which is not desirable for something that functions as a store of value.

Before I move on, it’s important to clarify that hardness is not the same as scarcity. They are related concepts but not the same thing.

For example, platinum and palladium are scarcer than gold but not hard assets. Current production is high relative to existing stockpiles.

Unlike gold, stockpiles of platinum and palladium have not built up over thousands of years. It’s the primary reason why new supply can easily rock the market.

Because of their low S2F ratios, platinum (0.4x) and palladium (1.1x) are not suitable as money. Their low S2F ratios indicate they are primarily industrial metals, corresponding to how people use them today. Almost nobody uses platinum and palladium as money.

Gold has an S2F ratio of 60x. That means it would take about 60 years of the current production rate to equal the existing gold supply.

Today, Bitcoin’s S2F ratio is about 57x, slightly below gold’s.

According to its fixed protocol, we know precisely how Bitcoin’s supply will grow in the future.

A key feature is that the new supply gets cut in half every four years, which causes Bitcoin’s hardness to double every four years. This process is known as the “halving.”

The next time Bitcoin’s supply growth will be cut in half will be in April 2024.

But this coming halving will be very different…

That’s because Bitcoin’s hardness will be almost twice that of gold’s when that happens.

That’s how Bitcoin will soon become the hardest money the world has ever known. And it will keep getting harder as its S2F ratio approaches infinity.

For thousands of years, gold has always been mankind’s hardest money. That is all set to change in a few weeks, and most people have no idea.

Verdict: Bitcoin Wins

Monetary Attribute #3: Liquidity

Having a large global pool of buyers and sellers—liquidity—is critically important for any serious money.

With a market cap of around $14.6 trillion, gold has a large pool of global liquidity.

At around $1.3 trillion, Bitcoin has a much smaller pool of global liquidity.

However, it is growing quickly.

If the Bitcoin price goes up 10x—which it has done many times in its history, and I expect it will do again soon—Bitcoin’s pool of global liquidity will be within spitting distance of gold’s.

If Bitcoin’s market cap and pool of liquidity continue to grow faster than gold’s, it will erode gold’s advantage. But for now, gold wins.

Verdict: Gold Wins

Monetary Attribute #4: Portability

If you send $1 billion worth of physical gold from New York to Beijing, complicated and expensive logistics are required.

$1 billion of gold weighs about 14,300 kilograms (or about 31,500 pounds). Transporting that much gold would likely involve multiple cargo flights and then armored trucks moving it from the destination airport to the destination vault.

It would also require insurance, navigating regulations, paying import or export taxes, clearing customs, and thorough verification of the gold’s purity, among other things.

It would also take considerable time; It wouldn’t happen overnight.

Transporting smaller amounts of gold is also problematic. For example, going through airport security with gold coins and bars will likely generate unwanted attention.

These are some of the issues with gold’s portability.

Physical gold is vulnerable to seizure in part because of the problems with transporting it.

Bitcoin, on the other hand, is the most portable asset in the world.

It is a digital bearer asset that can achieve final international settlement in 10 minutes for pennies.

You can send $1 billion worth of Bitcoin from New York to Beijing for less than $10 in fees. It will arrive in around 10 minutes.

The transaction has no credit risk and no counterparty risk. You don’t need to get anyone’s permission or need to use—or trust—any third party whatsoever. And there’s nothing anybody can do to block, freeze, reverse, or censor the transaction.

The recipient can instantly verify the Bitcoin’s authenticity at no cost.

Going through airports and crossing borders with Bitcoin is also much more practical than other forms of wealth.

If you hold Bitcoin on your phone, laptop, or flash drive, it can be accessible to border agents if they search you and you reveal your password. However, those things are much less conspicuous than physical gold.

Further, many popular Bitcoin wallets use a 12-word phrase to recover your funds. If you can memorize the 12-word phrase, you can potentially store billions of dollars worth of value just in your head with nothing else.

When it comes to portability, Bitcoin isn’t just slightly better. It’s an upgrade orders of magnitude better than gold.

It’s an even more profound upgrade than when mankind moved from using horse carriages for travel to using Boeing 747 airliners. It’s more like going from horse carriages to futuristic teleportation machines that can instantly beam you from one location to another.

Verdict: Bitcoin Wins

Monetary Attribute #5: Verifiability

Do you really know that the gold you own is authentic?

It could look something like this on the inside.

Chances are the gold you own is indeed authentic… but you can never know for sure unless you test it yourself with specialized equipment. Otherwise, you’ll have to trust a third-party auditor and appraiser.

If you want 100% certainty, you’ll probably need to melt the gold down and recast it.

No matter how you do it, verifying gold’s authenticity is infrequent, slow, people-intensive, costly, and potentially unreliable. It also doesn’t scale.

With Bitcoin, counterfeiting is practically impossible. Simple mathematics can instantly verify a Bitcoin transaction’s authenticity at no cost.

If you doubt it, try to send some fake Bitcoin and see what happens.

I don’t see any reason to believe Bitcoin’s resistance to counterfeiting would be eroded.

Further, imagine if the average person could instantly audit and verify the entire global gold supply’s authenticity—without relying on any third party. That’s what anyone can do with Bitcoin.

In short, Bitcoin users have a level of certainty that has never previously existed for any other monetary asset.

Verdict: Bitcoin Wins

Monetary Attribute #6: Fungibility and Privacy

Anyone can go to a website with details of the public Bitcoin blockchain to analyze and view the entire transaction history.

The information on Bitcoin’s blockchain doesn’t explicitly show your name, address, and other personal information. However, suppose it became known that a particular Bitcoin address was associated with you. In that case, outsiders could track your balance and every transaction you make.

Particular Bitcoins could also become “tainted” through transactions that governments don’t like. For example, suppose you received a Bitcoin with a transaction history linking it to someone in North Korea, Iran, or another sanctioned entity. It might cause complications.

All of this raises a fundamental question.

How do you obtain privacy on Bitcoin’s public blockchain?

It’s a good question that confuses many people.

The answer involves hiding in crowds.

Obtaining privacy on Bitcoin has been likened to the scene in the movie V for Vendetta in which thousands of masked people marched in the street. They were all engaged in a public act, but their identities were concealed because they all wore the same mask, allowing them to hide in a crowd.

Privacy in Bitcoin works similarly.

Several excellent privacy tools are available to anyone right now on Bitcoin, and they are getting better every day.

For example, you can find a typical JoinMarket transaction, a special Bitcoin transaction optimized for privacy, at the link below.

Can you tell who the sender and receiver are?

https://mempool.space/tx/a56d23da7df68eb49d3665452bf7085c07a79be62f29f19e588240f02eb94c76

On the other hand, physical gold doesn’t retain a transaction history for anyone to view at any time. Further, you can always melt down a gold bar or coin and recast it to destroy any previous associations.

I expect developments in the next few years to significantly increase Bitcoin’s fungibility and privacy for all users.

In the meantime, gold has an advantage.

Verdict: Gold Wins

Monetary Attribute #7: Durability

Gold is indestructible. It doesn’t decay or corrode. That’s why most of the gold people produced even thousands of years ago is still around today.

With Bitcoin, all aspects are genuinely decentralized and robust.

Even if the US and Russia engaged in an all-out nuclear war, destroying most of the Northern Hemisphere, Bitcoin wouldn’t miss a beat in the Southern Hemisphere.

Barring an inescapable, global return to the Stone Age that lasts into eternity, Bitcoin is durable… but not as durable as physical gold.

Verdict: Gold Wins

Monetary Attribute #8: Divisibility

Physical gold is generally inconvenient and impractical to use for small transactions.

A one-gram bar—around the size of a pushpin—is about the smallest practical size. As of writing, one gram of gold is worth about $65. Transactions worth anything less than that will be problematic.

Each of the 21 million Bitcoins can be divided into 100,000,000 units called satoshis (or sats). Each sat is worth 0.00000001 of one Bitcoin.

As of writing, it takes about 1,500 sats to make a dollar, which means a penny is worth 15 sats, and each sat is worth 1/15 of a penny.

In short, Bitcoin’s extreme divisibility allows for transactions of any size—from fractions of a penny to billions.

Verdict: Bitcoin Wins

Monetary Attribute #9: Scalability

If gold or Bitcoin becomes the world’s dominant money, how can it be scaled to billions of people?

That’s a key question.

With gold, settling all transactions in physical payments—especially small ones—is not practical.

Trusted third parties, like mints, vaults, banks, transportation companies, and others, are necessary for gold to function as a practical medium of exchange at scale. These entities must follow all laws and regulations, or governments will quickly shut them down.

In short, trusted third parties are centralized vulnerabilities. Governments can capture and coerce them.

This is exactly how governments used the gold standard to bootstrap the fiat currency system into existence.

First, people used physical gold as money. Then, to scale, they necessarily turned to third parties, like banks, that stored gold and issued gold IOUs to facilitate trade. Governments captured those third parties and gradually removed the gold backing from the IOUs until they were nothing more than confetti. In short, that is how the fiat currency system was born.

Here’s the bottom line.

Gold’s biggest flaw as money is that for it to function at scale, it requires IOUs and third parties beholden to governments.

With Bitcoin, anyone can send and receive value—from fractions of a penny to billions—worldwide without relying on any third party and achieve final international settlement within minutes, 24/7/365.

However, the base layer of the Bitcoin network can only process about 576,000 transactions a day.

Every day, there are over 2,000,000,000 consumer transactions around the world. That means Bitcoin can only process about 0.029% of them. That’s why recording every Starbucks or McDonald’s transaction on the Bitcoin blockchain was never possible.

It was also never desirable.

If Bitcoin needed to record every consumer transaction on its blockchain—or even a fraction of them—it would require an industrial-scale operation with expensive data centers. The average computer would no longer be able to run the Bitcoin software.

In this scenario, Bitcoin might as well be another PayPal, Visa, or another centralized financial service where you need to ask for permission to do anything.

Remember, Bitcoin’s entire value proposition depends on it being neutral, censorship-resistant, accessible to everyone, and controlled by nobody.

To have these properties, it’s essential that the average person can run the Bitcoin software. That’s why Bitcoin has a hard limit on the transactions it can handle each day. It needs to be this way so that the average computer—and soon the average smartphone—can easily handle running Bitcoin. That makes Bitcoin genuinely decentralized and incorruptible, giving it unique monetary properties.

It’s crucial to emphasize that Bitcoin, without decentralization, would be worthless.

Scaling Bitcoin by compromising its decentralization would defeat its entire purpose.

Does that mean Bitcoin will never be able to scale and achieve widespread adoption?

Absolutely not.

Numerous scaling solutions for Bitcoin will inevitably emerge. However, the Lightning Network is the most dominant one.

The Lightning Network is an open, peer-to-peer network built on top of Bitcoin.

Anyone can use the Lightning Network, and nobody can be prevented from using it.

On the Lightning Network, people can perform an unlimited number of transactions without needing to add them to the Bitcoin blockchain. Delegating custody of funds to a third party is unnecessary—you can always remain in control.

The Lightning Network can eventually allow Bitcoin to scale up and handle every consumer transaction in the world.

Verdict: Bitcoin Wins

Monetary Attribute #10: Recognition

While gold is an established money, Bitcoin is an emerging one.

Gold has over 5,000 years of history as money. You can take gold to any country in the world, and most will instantly recognize it.

Bitcoin doesn’t have this established history and recognition. It’s only been around since 2009.

It took gold centuries to achieve monetization. Bitcoin has a good chance of undergoing monetization in a much shorter period—and it’s already well on its way.

In the meantime, gold has the advantage.

Verdict: Gold Wins

* * *

Historically, Bitcoin’s biggest moves to the upside happen very quickly… and the next big move could happen imminently. That’s why I’ve just released an urgent PDF report revealing three crucial Bitcoin techniques to ensure you avoid the most common—sometimes fatal—mistakes. Check it out as soon as possible because it could soon be too late to take action. Click here to get it now.