Submitted by QTR’s Fringe Finance

Every week, usually once or twice, I sit down to put onto paper my thoughts about the market. And every week, my disgust not only for the rigged system that encompasses our equity markets, but also for the sound of my own whining, grows exponentially.

When I sit down to perfunctorily prattle on about how nothing makes sense and how I constantly see things the polar opposite of 99% of everybody else in the world of finance every week, I usually wonder two things.

First, I wonder whether or not today will finally be the day that I capitulate, get bullish on the stock market, and start bowing religiously to a statue of Stephanie Kelton.

“I should know, I’ve followed a few!” – Arthur

After all, the incessant price moves higher in Bitcoin are part of what triggered me to eventually reassess my thought process on the cryptocurrency. And even though I got bullish for reasons other than price, why couldn’t the same happen with equities?

Second, I try to conceptualize exactly how fast the universe can, and will, make a total ass out of me by crashing markets 50% in 15 minutes in the days, hours, minutes, or probably even seconds after I’d have such a shift in sentiment.

Which is why, like the Black Knight in Monty Python and the Holy Grail, I will continue to forge forward, exasperated, regardless of the inconvenient fact that I have no arms or legs left. But don’t let anybody ever tell you that my spirit was easy to break.

“The Black Knight always triumphs!”

I had my most recent bout of vomiting in my own mouth just thinking about how wrong I’ve been on macro analysis late on Wednesday, when, as if part of some ant-burning-under-a-magnifying-glass-type-cosmic-conspiracy to torture my psyche, the Fed’s Chris Waller came out and assured the public that he was in no rush to cut interest rates. Here’s a look at some of the headlines that came out of Waller’s speech in New York:

-

“There is no rush to cut the policy rate,” Waller said in a speech in New York.

-

The recent data “tells me that it is prudent to hold this rate at its current restrictive stance perhaps for longer than previously thought to help keep inflation on a sustainable trajectory toward 2%.”

-

Waller still expects to cut rates this year but isn’t ready to take that step without further evidence that inflation continues to drop.

-

Waller said analyzing three- and six-month measures of the Consumer Price Index, excluding volatile food and energy prices, tells him that progress on inflation has slowed and may have stalled.

-

“The risk of waiting a little longer to cut rates is significantly lower than acting too soon,” said Waller. “Cutting the policy rate too soon and risking a sustained rebound in inflation is something I want to avoid.”

-

Waller said that he is considering reducing the overall number of rate cuts this year or pushing them further into the future in response to the recent data if things don’t improve. But he also said he isn’t rushing to take that step yet.

While I’m not sure how the market will receive this blindingly, exhaustively obvious negative news, my guess is by the time you read this at 4:45am EST on Thursday morning, futures will be raging higher and every index will be up in the pre-market session. After all, nothing says “bull case” like the Fed not being able to meet objectives in bringing down inflation and then a Fed governor telling the market not to expect the very same rate cut bonanza it has rallied more than 10% expecting this year alone, despite already being pornographically overvalued.

Not unlike how when Donald Trump said, “I could stand in the middle of Fifth Avenue and shoot somebody and I wouldn’t lose any voters,” I’m not sure there’s anything the Fed could do right now to stop the market’s pre-ordained ascent. As I said in last week’s totally non-award-winning analysis, I have no f*cking idea where the liquidity is coming from, no clue what the market is thinking, and pretty much don’t understand anything at all.

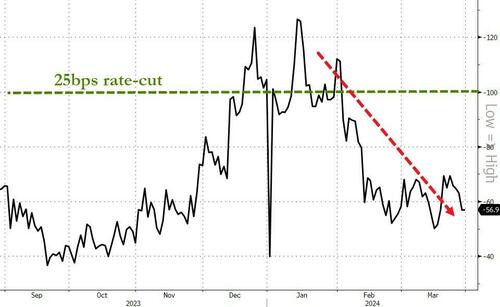

“Eat sh*t, Waller” — S&P 500 (probably) | Chart via Zero Hedge

I know what you’re thinking: “Why then, Chris, do you run a financial newsletter?”

That’s a great question. I wish I had a great answer for you other than it’s better than therapy for me and I get paid instead of having to pay someone else. But hey, 99% of “newsletter writers” don’t have any clue what they’re talking about — at least I admit it.

Look, it’s either me or lessons from Whitney Tilson’s fishing trip and ruminations about his colonoscopy. Choose wisely.

I’m breaking Whitney’s balls, of course. He’s a good dude and was one of the first people to be nice to me on Wall St. a decade ago.

Anyway, continuing the sick satire playing out on Wednesday, S&P came out after the bell on Wednesday and affirmed the United States’ credit rating and said things look stable, casually noting that debt to GDP and interest to revenue are out of f*cking control (my words, not S&P’s) before summing things up with a “stable” outlook despite the fact. Among other brain farts, including praising monetary policy execution, S&P concluded:

-

A diversified and resilient economy with solid growth, extensive monetary policy flexibility, and benefits associated with the unique status as the issuer of the world’s leading reserve currency underpin the U.S. sovereign rating.

-

A high debt burden, with net general government debt approaching 100% of GDP and interest to revenue over 10%, and difficulties garnering bipartisan cooperation to strengthen U.S. fiscal dynamics are credit weaknesses.

-

We affirmed our ‘AA+/A-1+’ sovereign credit ratings on the U.S.

-

The outlook remains stable, indicating our expectation of continued economic resiliency; proactive, effective monetary policy execution; and our view that government officials will continue to resolve near-term fiscal deadlines, such as addressing the debt ceiling, in a timely manner.

S&P said: “We could lower the rating over the next two to three years if unexpected negative political developments weigh on the strength of American institutions and the effectiveness of long-term policymaking, or jeopardize the dollar’s status as the world’s leading reserve currency.”

They continued: “The ratings could also come under pressure if already-high deficits were to rise, owing to political inability to contain rising spending or to manage revenue implications of future changes in the tax code.”

Is it me, or are both of these situations literally occurring already right now?

As if people in the world of economics pride themselves on analytical non sequiturs, S&P’s rating and reasoning for their rating stand at stark odds with reality.

But then again, who really knows what reality is anymore? Me? You? This certifiably insane old bird?

“I regret saying it was transitory.”

As many people know, Fitch downgraded the United States last year (my exceptional analysis here). They had it right. Whether we have the reserve currency or not, there are extraordinary, unprecedented risks facing the United States economy and the US dollar. Both S&P and Chris Waller came out and said today that the reserve currency status of the dollar gives the United States enormous flexibility.

But just because we have enormous flexibility doesn’t mean that we can bend and not eventually break. Does policy flexibility mean that we can literally do whatever we want and nothing matters at all? Have we replaced the natural laws of economics and rewritten the basics of mathematics and macroeconomics? We think we have, but we haven’t.

If you think of the basic immutable laws of macroeconomics and mathematics as a bathroom shower, every layer of bullsh*t, monetary policy, money printing, foreign war mongering slush fund, overspending, misuse, hubris, rewriting of the rules, and Stephanie Kelton book is like adding one of those Bath Fitter (TM) renovations to your shower. You’re not replacing the disgusting, mold-ridden, toxic equipment, you’re just covering it up with another layer of shiny-looking fiberglass.

Left: The “old school” laws of economics. Right: The trillion dollar coin idea.

The question then becomes: how many of these layers can we pile on top of one another before the room becomes so f*cking small that we can’t fit in the shower anymore?

And, then what? We just walk around stinking to high heaven?

I mean, for f*ck’s sake, we’ve got lifelong spend-ocrat Steve Liesman of all people breaking down on CNBC yesterday, openly worrying about how the United States is going to service its debt obligations and calling bullsh*t on the Inflation Reduction Act. Putting aside the insane irony that Steve Liesman has sat at Fed press conferences for the last decade and massaged the feet of whoever the Fed chair was at the time instead of asking them serious questions about accountability, when Liesman starts to worry, isn’t it time to take notice?

For the last decade, I have watched dozens of Fed press conferences (feels like trillions) where Liesman has done nothing but make excuses for central bankers and throw them softball questions, in between the time he takes to congratulate them on the great job they’re doing. Very few people on his network, with the exception of possibly Guy Adami and Rick Santelli (combined total airtime each day: 32 seconds), have raised any questions about the Fed’s trajectory. Most days on CNBC look like this:

Guests who are critical of the Federal Reserve, like Peter Schiff, have been blackballed from the network entirely. And now, all of a sudden, it’s time to panic? What’s next? Will Paul Krugman or Jeremy Siegel be taking to CNBC to all of a sudden “remember” the lessons of Milton Friedman and Thomas Sowell?

Waller’s remarks Wednesday wrap up what will be the remainder of any Fed commentary on this short week. The entire market has placed an “all-in” wager on rate cuts this year, and Waller has reiterated his position as “we need to wait and see what happens.” And while he said circumstances would need to be extenuating for it to occur, he even brought up the idea of hikes. Considering the market is a forward-looking indicator and it has already pulled in probably six months to a year of expectations of rates being lower (and Trump tax cuts again, and AI growth, and more money printing, and colonizing Mars, and Tesla robotaxis that double as laundry folding humanoid droids), rates staying the same for longer – or a hike – would be devastating.

And so, we sit and wait for the next bullsh*t CPI print to try and determine whether or not the government has figured out a new way to disguise the fact that prices have consistently been up at least 10% almost every year at any point in the past, especially these last three years.

Both Waller and S&P Global are leaning, one way or another, on the US dollar’s reserve currency status as the foundation and basis for their “everything isn’t totally screwed and backwards” outlook.

These conclusions by Waller and S&P are the latest in a long line of trillions of analyses and judgments that have relied on the US dollar remaining reserve currency for the time period of “forever times infinity” to be correct.

I think of each one of these analyses, which arrived daily by the hundreds across Wall Street, as sheets of paper being placed on the back of a donkey that is trying to scale Mount Everest. A couple of sheets of paper, the donkey doesn’t notice. When you have enough for a ream of paper, the donkey starts to notice a little weight. Approaching a century into the US dollar’s dominance, the donkey is carrying on its back a stack of papers that would puncture the ozone layer at this point.

It may not be Wednesday’s two additional sheets that cripple the donkey on its continued journey up the hill, but at some point, the weight is going to become unbearable. And watching it all play out, for me, already has.

—

If you enjoyed this QTR post, please take a moment to subscribe to my content here.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. I didn’t double check any numbers or figures in this piece and am generally lazy with my research. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. Contributor posts and curated content are posted either with the author’s permission or under a Creative Commons license. This is not a recommendation or solicitation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. Sometimes I just lose money by misplacing it. I’m generally irresponsible. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. Do your research elsewhere. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get sh*t wrong a lot. I mention it numerous times because it’s that important that you know.