America’s Minsky Moment Approaches

Authored by Michael Wilkerson via The Epoch Times,

Named after American economist Hyman Minsky, the idea behind a Minsky moment is that a financial markets crisis (especially in credit markets) is caused by a sudden and systemic collapse in asset prices, usually after a sustained period of speculative investment, excessive borrowing, and widespread financial risk taking.

In other words, it’s the moment when the music stops playing, investors stop buying, and the Ponzi game ends abruptly. It’s a hard crash.

America may be on the brink of its Minsky moment.

This process, which moves from slowly, slowly, to suddenly and now, goes back decades.

The confrontation with reality that was required to put America’s economic house back in order after the global financial crisis of 2008–09 was deferred to a later date by politicians, central bankers, and government officials alike, presumably when they would no longer be around.

Instead of taking the painful but necessary steps of liquidation—i.e., allowing more over-levered and risk-heavy banks and financial firms to fail, and for the economy to take the short-term pain, then move on—the U.S. government and the Federal Reserve kicked the can down the road by massive money-supply expansion and unproductive government spending.

The same playbook from the financial crisis (i.e., money printing and fiscal excess) was used again in 2020 in response to the pandemic. As the monetary authorities had but one instrument in their toolbox—the blunt-force cudgel of money-supply growth—it was the go-to solution.

As the saying goes, when the only tool available is a hammer, every problem looks like a nail. In both instances—the financial crisis and COVID periods), the U.S. Congress went on a massive spending spree, not realizing (or, as political animals with short time horizons, not caring) that excess and repeated deficit spending, and the debt creation needed to fund it, would eventually spiral out of control and doom future generations.

While a more serious collapse of the bubble—a monetary Great Reset—was avoided in 2008–09, the underlying conditions were not resolved.

The monetary and fiscal actions taken at the time only postponed the crisis and, worse, further inflated a massive bubble that is destined to eventually burst.

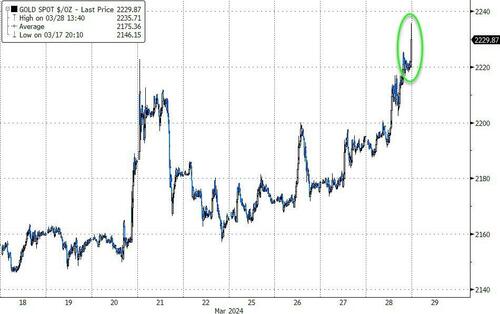

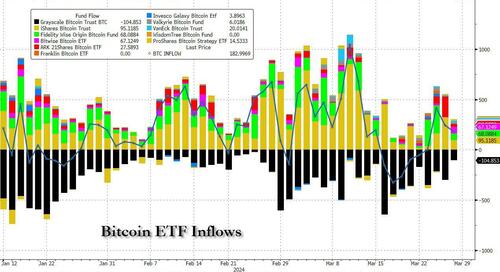

We are still living in this bubble, evidenced by all-time highs in equity and crypto markets, speculation in numerous asset classes from real estate to collectibles to memecoins, and “get what you can while you can” borrowing by governments, households, and corporates alike.

Given the increasing magnitude (in both nominal and real terms) of the debt problem, a financial crisis in 2024 or 2025 will have much worse consequences than anything that would have happened at the time of the financial crisis 15 years ago.

On the eve of the 2008 crisis, U.S. federal debt to GDP was around 64 percent, the same level as in 1995. This allowed some flexibility. As of the most recent quarter, the ratio of debt to GDP is now nearly double that, at 122 percent.

On this measure, the United States is now among the top 10 most indebted countries in the world, a peer group that includes economically hobbled nations such as Venezuela, Greece, Italy, and sclerotic Japan.

The level of U.S. national debt, quickly approaching $35 trillion in coming months, now requires more than $1.1 trillion in interest payments annually just to service it. And this number doesn’t include state and municipal debt or the unfunded liabilities and entitlements such as Medicare and Social Security that now comprise the substantial majority of the federal budget, limiting anyone’s ability to shrink the deficit through a reduction in discretionary spending.

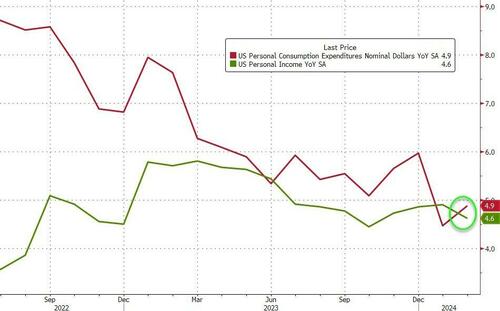

The deficit for 2024 is tracking at $1.7 trillion, adding to the existing cumulative U.S. deficit of $22 trillion since 2001. The deficit matters in part because high deficits relative to GDP are strongly correlated with persistent inflation.

Since 2020, the United States has run the highest levels of deficits (as a percent of GDP) since World War II. Those deficits produced high inflation, but they also reversed and became budget surpluses shortly after the war ended. This was made possible because of the productivity miracle that was mid-twentieth century America.

The United States of 2024 has no equivalent productivity boost waiting in the wings. Artificial intelligence is one bright spot, but other tech (crypto in particular), energy, and mining industries are each being chased off-shore through regulatory interference.

Manufacturing is attempting a comeback, but only represents 11 percent of GDP. Bureaucratic, tax, monetary (the U.S. dollar remains too high to be competitive), and other barriers persist. The continued growth (as a percent of GDP) of financial advisors, personal injury attorneys, and tax accountants needed to navigate the impossible IRS tax code hardly comprise the revolutionary army needed to make the American economy great again.

When the Minsky moment arrives, the U.S. government will have no ability to confront it save for a resumption of quantitative easing and other forms of money printing.

With the bond markets in turmoil, investors will be increasingly reluctant to buy more U.S. debt. Foreign buyers have already begun reducing their exposure, and now account for only 30 percent by value of U.S. Treasurys held, compared with 45 percent in 2013.

If this divestment trend suddenly accelerates, the United States will be forced to monetize its debt through Federal Reserve purchases of U.S. Treasurys. This will be highly inflationary, even as economic conditions are weakening and unemployment is rising.

The U.S. Department of the Treasury and the Federal Reserve have already committed to a “whatever it takes” approach to crisis management. When the Minsky moment arrives, and the bond markets are in meltdown, the “whatever it takes” will primarily be a firehose of liquidity (more money created out of thin air) to the banking system with an alphabet soup of program names.

As a result, the United States will be forced to accept significantly higher levels of inflation. The alternatives are just too severe. The U.S. government, as the issuer of the world’s reserve currency, cannot default. There is a practical limit on how high it can take the visible tax rate. Its only alternative is the hidden tax of ever-higher inflation.

To avoid this outcome, U.S. productivity would have to dramatically increase such that the ratio of debt to GDP falls back in line. This seems an impossibility. The higher the ratio of debt to GDP, the greater the anchor-like drag on the national economic ship.

Tyler Durden

Fri, 03/29/2024 – 09:00

via ZeroHedge News https://ift.tt/5wseAK6 Tyler Durden