Market Now More Hawkish Than The Fed As June Rate-Cut Odds Fade

The official narrative is breaking bad.

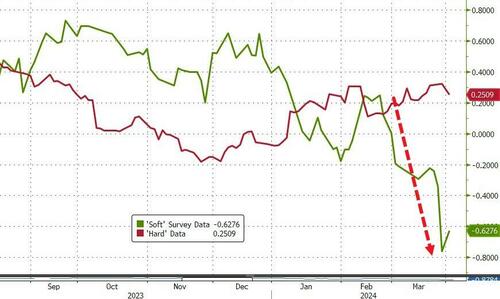

‘Soft’ survey data is literally collapsing as ‘hard’ data improves gradually…

Source: Bloomberg

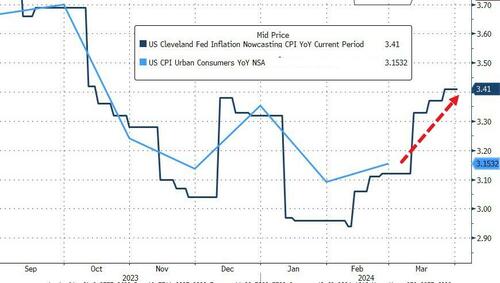

…and more worryingly, inflation signals are flashing red once again…

Source: Bloomberg

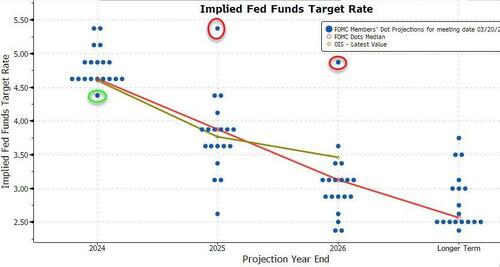

Having started the year massively more dovish than The Fed’s ‘Dot Plot’ (almost 7 cuts vs The Fed’s 3 cuts), recent resurgence in inflation signals and continued strong growth signals offer The Fed a smaller and smaller ‘narrative window’ to start (and continue) a rate-cutting cycle. The market is now once again pricing in less rate-cuts than The Fed’s latest plot for this year and is notably less dovish through 2026…

Source: Bloomberg

“I thought it would be hard for the market to challenge the Fed on the hawkish side, but apparently it is willing to do so, in the face of some evidence,” said Benoit Gerard, a rates strategist at Natixis in Paris.

As the market is now pricing in just 65bps of rate-cuts in 2024 (remember in January it was pricing in almost 170bps of cuts)…

Source: Bloomberg

The shift is also casting doubt on bets that the first rate cut will land in June. The probability of a quarter-point reduction in June briefly dropped below 50% on Monday.

Source: Bloomberg

“While June is not off the table, market conviction for a first Fed cut by then is fading,” ING strategists including Benjamin Schroeder wrote in a note.

“In the coming weeks we can expect some Fed speakers to remain vocal about June cuts, but in the end the data will be the deciding factor.”

As WSJ’s ‘Fed whisperer’ Nick Timiraos noted on X, “The sell-side bank and Fed forecaster consensus is now aligned in expecting the first rate cut in June, with the previous outliers recently junking their recession calls.“

“The uniformity here oversells the degree of conviction around a June cut. These have moved a lot in 2024.”

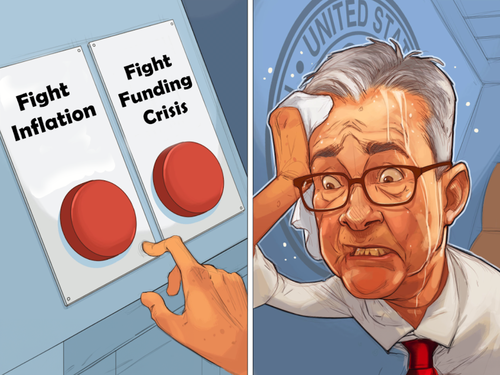

But, The Fed may have another problem.

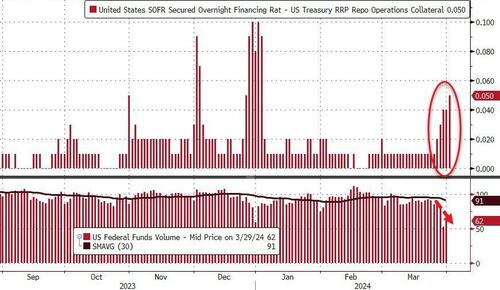

Something is afoot in the funding markets as the SOFR spread has now been rising for 5 straight days (it should have reverted post-quarter-end) and Fed Fund volumes have slumped…

Source: Bloomberg

And finally, of course, for now, stocks don’t care about the massively hawkish shift in market expectations for Fed action…

Source: Bloomberg

How long (and wide) than this divergence hold?

Tyler Durden

Tue, 04/02/2024 – 11:00

via ZeroHedge News https://ift.tt/Ix2pHmv Tyler Durden