WTI Extends Gains After API Reports Inventory Draws Across The Board

US crude futures pierced $85 for the first time since October, the latest milestone in a rally driven by OPEC+ production cuts, strong demand and heightened geopolitical risks.

As Bloomberg reports, oil has jumped this week as tensions rise in the Middle East, with Iran vowing revenge on Israel for an airstrike on its embassy in Syria that killed a top military commander.

After last week’s surprise crude build and big jump in stocks at the Cushing hub, traders were looking for a slowing build…

API

-

Crude -2.29mm

-

Cushing -751k

-

Gasoline -1.46mm

-

Distillates -2.55mm

Inventory draws across the board with Distillates and crude stocks falling most…

Source: Bloomberg

WTI was just above $85 ahead of the API data and extended gains after…

The market’s strength has also been reflected throughout the oil market curve.

“An escalation in tension in the Middle East has coincided with firmer oil fundamentals,” said Warren Patterson, head of commodities strategy for ING Groep NV.

“The market is tightening thanks to OPEC+ supply cuts, which is evident with the strength we have seen in timespreads.”

The US benchmark’s prompt spread has widened near $1 in backwardation, compared with as low as 54 cents three sessions ago. Meanwhile, the oil options market has flipped to a call skew, underscoring the magnitude of bullish sentiment for crude.

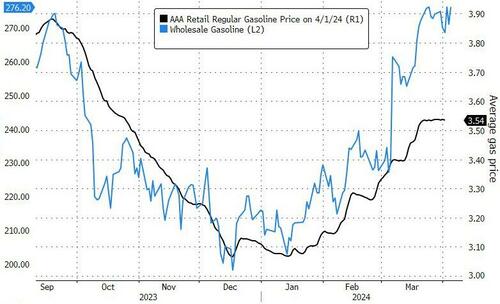

Meanwhile, pump prices remain near six-month highs as wholesale prices put increasing pressure to the upside…

Not good for Powell’s or Biden’s hopes.

Tyler Durden

Tue, 04/02/2024 – 16:40

via ZeroHedge News https://ift.tt/24LmIUD Tyler Durden