Inflation-Risk Latecomers Pile Into Silver

Authored by Simon White, Bloomberg macro strategist,

As gold makes new highs, speculators’ net longs in silver are jumping higher.

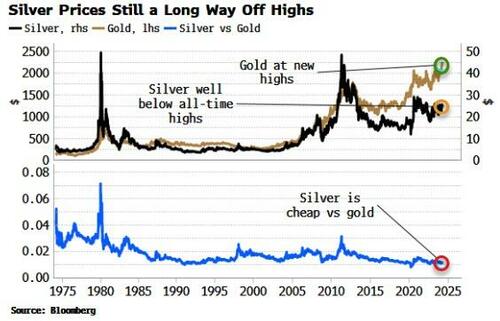

Inflation and global growth risks – as well as demand from China – are helping to drive gold to new all-time highs. For those late to the trade, silver is serving as the next best thing.

Silver remains well off the highs it reached in 1980 (the Hunt brothers’ infamous corner) and in 2011, and it is very cheap in comparison to gold.

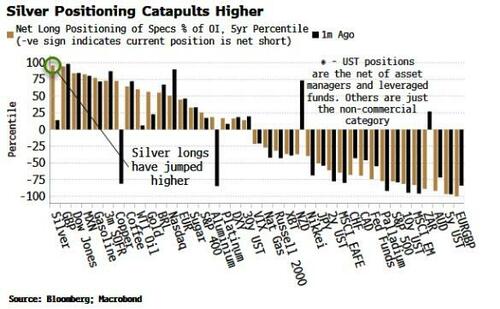

That probably explains the surge higher in speculator net longs in silver, according to the Commitment of Traders data.

Silver positioning, from being nearly flat a month ago, is now near five-year highs, and longer on a percentile basis than any other major bond, equity or commodity future.

Silver is notoriously volatile, and if speculators are correct in their view, the gains could be rapid and large.

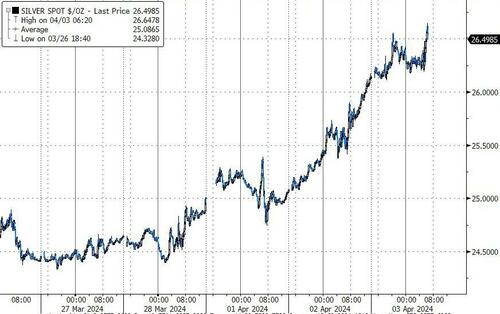

It’s up today over 9% in the last few days, topping its recent high of ~$26.

Tyler Durden

Wed, 04/03/2024 – 10:50

via ZeroHedge News https://ift.tt/L7QPJEh Tyler Durden