Blackstone Makes $10 Billion Bet On Multifamily Units As Real Rents Begin Re-Accelerating

Democrats are probably furious this morning after reading The Wall Street Journal’s headline announcing Blackstone’s $10 billion acquisition of Apartment Income REIT, taking the company private. This move signals the firm’s bullishness on the rental housing market, especially when rents are beginning to re-accelerate.

Blackstone agreed to purchase AIR Communities for $39.12 a share, representing a 25% premium to the company’s closing share price on Friday. The deal is being completed through the investment management company’s $30.4 billion global real-estate fund.

Blackstone favors rental housing as one of the hottest places in the commercial property market to invest. The acquisition of AIR will give the investment manager exposure to 76 rental housing communities in coastal markets, including Boston, Miami, and Los Angeles.

“The acquisition is Blackstone’s largest transaction in the multifamily market,” WSJ pointed out.

Earlier this year, Blackstone President Jonathan Gray said, “We can see the pillars of a real-estate recovery coming into place,” adding, “We are, of course, not waiting for the all-clear sign and believe the best investments are made during times of uncertainty.”

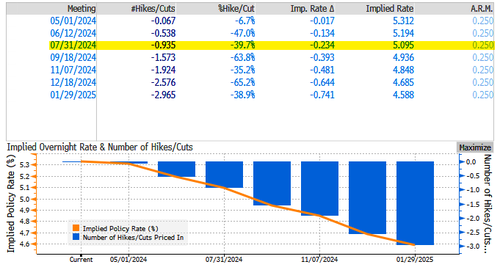

Blackstone has been aggressively increasing investments in CRE markets, a major bet the Federal Reserve’s interest rate hiking cycle has plateaued and cuts near.

Blackstone’s actual bet is based on the idea that rent inflation is reaccelerating.

In December, we noted that shelter CPI lags actual rents by about 18 months. So, by the time the Fed figures out the next surge in shelter costs – it will be too late.

The next paradox for the Fed: since Shelter/OER inflation lags by 18 months, housing inflation will decline well into 2025 even as actual rents are again starting to tick up.

By the time lagged CPI catches up with “today”, real rents will be rising double digits. pic.twitter.com/sHOWxN2OVQ

— zerohedge (@zerohedge) December 12, 2023

Fast forward to just days ago, we showed readers actual rents are beginning to rise.

this is what the Fed is betting on: OER will keep dropping for the next 18 months due to the huge lag to current rents, and since shelter is 36% of the CPI basket, inflation will soon appear low (even though real rents are rising again… so Fed is two cycles behind now) pic.twitter.com/x9zBi1dvCd

— zerohedge (@zerohedge) April 5, 2024

Meanwhile, Democrats have introduced bills in Congress that aim to restrict hedge funds from buying up homes, alleging these funds are responsible for driving up shelter costs.

According to a recent note by Realtor.com, the US housing market is short 7.2 million homes.

Demand for housing continues to increase as population growth outpaces the rate of new home growth. Also, the genius idea by radical progressives in the White House to flood the nation with ten million plus illegal aliens will continue to put upward pressure on shelter costs.

The latest data from Miller Samuel Inc. and brokerage Douglas Elliman Real Estate data shows the median rent in Manhattan is inching back up to record highs.

We guess inflation is not going away anytime soon – or at least before the elections in Novemeber.

Tyler Durden

Mon, 04/08/2024 – 13:00

via ZeroHedge News https://ift.tt/1B0DAMd Tyler Durden