‘All Bets Are Off’ – Market-Mayhem After Consumer Prices Crush Dovish-Dreams

Borrowing a phrase from one of our favorite movies “all bets are off” after this morning’s hot-hot-hot CPI print

The fourth hotter-than-expected core inflation report in a row got investors reevaluating expectations around the Fed’s first rate cut…

Source: Bloomberg

Goldman’s Diana Asatryan noted that their Research group pushed its first rate cut forecast to July from June, expecting two cuts this year.

The market is now pricing in just 38bps (1.5 rate-cuts) in 2024…

Source: Bloomberg

But do not worry, President Biden promised a rate-cut:

Fed Chair Jeo Boden https://t.co/dIkgCmyg5o pic.twitter.com/RRhJcX8s0m

— zerohedge (@zerohedge) April 10, 2024

And that all sparked a massive surge in TSY yields with the short-end/belly underperforming (2Y +22bps, 30Y +13bps)…

Source: Bloomberg

The 2Y Yield got within a tick of 5.00% today for the first time since mid-Nov…

Source: Bloomberg

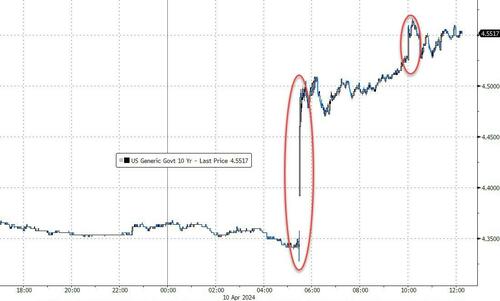

The 10Y Yield was double-buggered as a really ugly auction added another leg to the sell-off…

Source: Bloomberg

Today was the biggest yield jump for the 10Y since Sept 2022, 2Y’s biggest absolute jump since March 2023.

Source: Bloomberg

The 5Y TSY Yield broke higher than the 30Y yield today (inverted) for the first time since September…

Source: Bloomberg

Inflation expectations surged to a new cycle high (its highest since June 2022)…

Source: Bloomberg

Small Caps (as you’d expect, most sensitive to rates) were the day’s biggest laggards (-3.25%) with the rest of the majors down together around 1-1.5%…

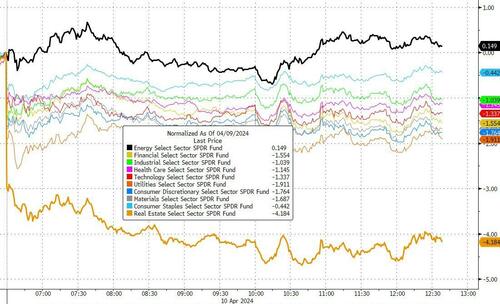

Real Estate stocks suffered the most today (smashed over 4% lower with homebuilders worst day since Oct) as only Energy stocks managed gains…

Source: Bloomberg

And as also makes sense – ‘most shorted’ stocks (heavily weighted to small caps) – was clubbed like a baby seal…

Source: Bloomberg

Small Caps (IWM) closed below their 50DMA for the first time since November…

Source: Bloomberg

Interestingly, the MAG7 basket of stocks was practically unchanged on the day as the early puke was bid back…

Source: Bloomberg

…with NVDA seemingly the new ‘safety’ trade as TSYs were dumped…

The dollar soared on the (less dovish and maybe hawkish) CPI print to its highest close since Nov 2023…

Source: Bloomberg

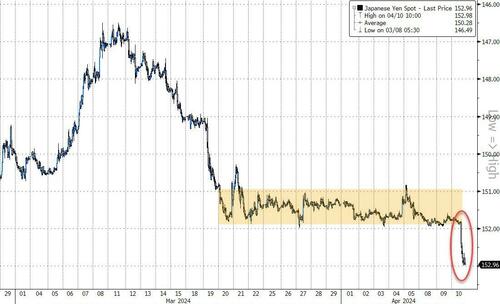

The Bank of Japan has a real problem now as USDJPY surged up to 153 – a fresh 34-year-low for the yen against the dollar and below the level at which the BoJ last intervened…

Source: Bloomberg

Gold prices fell on the day – amid dollar gains – but we do note that the initial puke in precious metals was quickly bid back up before fading later…

Source: Bloomberg

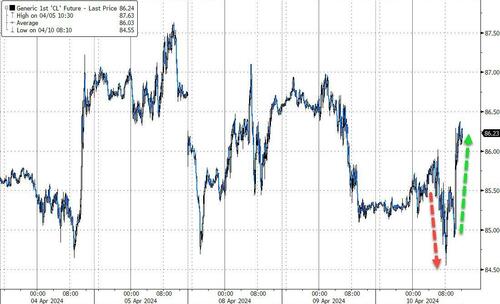

Oil prices bucked the trend today thanks to a spike in geopolitical tensions. The initial dump on CPI was worsened by a bigger than expected crude draw but then Iran-Israel missile headlines sent prices soaring back above $86 (WTI)…

Source: Bloomberg

And that won’t help gas prices…

Source: Bloomberg

Finally, this gaping wide crocodile’s mouth is getting ready to snap shut again…

Source: Bloomberg

When will rates matter again?

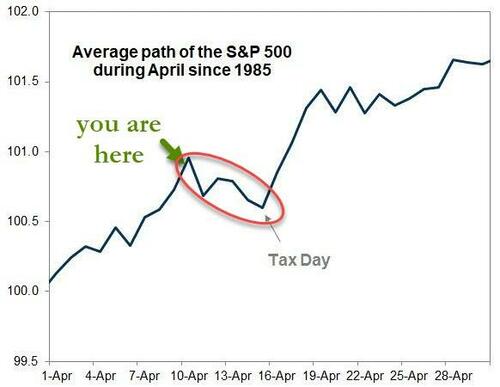

And don’t forget, its that time of the month/year again…

Will the tax on ‘gains’ from last year spook sellers more this year as rate-cuts are wiped off the table?

Tyler Durden

Wed, 04/10/2024 – 16:00

via ZeroHedge News https://ift.tt/kQqElVf Tyler Durden