Could US Treasuries Become The Trade Of The Decade?

Authored by Charles Hugh Smith via OfTwoMinds blog,

The expediencies and policy extremes have yet to be explored, much less exploited.

Napoleon is reputed to have said, “Do you know what amazes me more than anything else? The impotence of force to organize anything.” This is the lament of someone holding the reins of power: that this earthly power has limits.

Two things amaze me:

1. The public’s complacent confidence in the permanence of the global financial system. Put another way, what amazes me is the scarcity of awareness of the financial system’s fragility and vulnerability to collapse, a fragility that has increased as a result of policy extremes enacted to maintain a facade of security and confidence.

2. A general lack of appreciation for how few steps we’ve taken on the path of extreme central state/bank policies, a path that stretches over the horizon, beyond what we conceive as possible.

This complacency extends to proposed solutions to this systemic fragility. For example, many believe that all we need to do to fix the system is return to sound money such as the gold standard or a bitcoin-based system.

The possibility that there are no solutions doesn’t compute, as it goes against the zeitgeist of optimism: of course there’s a solution, preferably a technological solution that enables a trillion-dollar monopoly or cartel.

The widespread confidence in a predictably secure financial future is equally amazing. Sixty years of stability has generated a recency bias of immense strength: of course we can plan our retirement 20 years hence, for the future will naturally be a seamless extension of the recent past.

The more one knows about the global financial system, the greater one’s appreciation of systemic risk. The more one knows about the normalization of extreme policies enacted to stave off the collapse of the system in 2008-09, the greater one’s appreciation for the vulnerability of a system propped up by expediencies that are now permanent scaffolding for a system that is by design self-liquidating: all the “money”-printing, debt and leverage will dissolve because they will have no other choice but to dissolve.

To Napoleon’s point, there are limits on solving the problems created by “money”-printing, debt and leverage by printing more “money” and expanding debt and leverage.

Which brings us to the question: how will those in power put off the inevitable end-game as long as possible? Per Napoleon, their powers are earthly and limited. But this doesn’t mean they’re already exhausted. If the history of financial crises / depressions is any guide, authorities have barely started exploiting the grab-bag of expedient measures available to them.

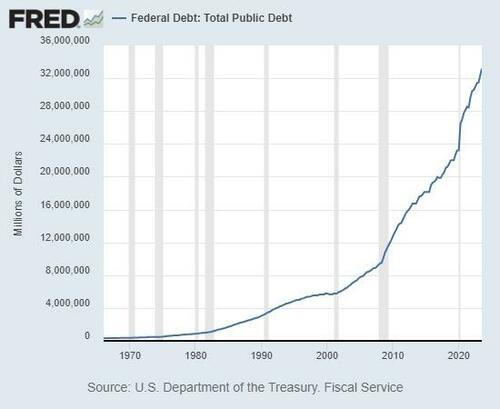

Which brings us to US Treasuries. The expedient game plan for the past 15 years was to inflate a global Everything Bubble via expanding “money”-printing, debt and leverage, on the implausible but oh-so appealing theories that 1) borrowing more from future earnings and resources was painless and 2) inflating the wealth of the already-wealthy would generate a pain-free “wealth effect” some of which would trickle down to the working stiffs who don’t own any of the assets being pushed into orbit.

We can summarize this “plan” thusly: save every asset class and every constituency. There was something for everyone in the grab-bag of expedient deficit-funded giveaways and bubble-economics.

Now that the hangover phase of the party looms, those in power won’t be able to save everything and everyone: a bunch of stuff is going to be tossed overboard. This triage–who keeps a seat in the lifeboat and who’s tossed overboard–is tricky. The bottom 60% have already been tossed overboard, and those between the top 10% and bottom 60% have been stripped of their life vests.

In other words, the bottom 90% are already either treading water or on the way to Davy Jones’ Debt-Serf Locker. Inflicting more pain on them raises the risk of social-political revolt, and so those in power will have a lamentably limited set of assets and constituencies to stripmine. Making it even trickier, this set of constituencies holds virtually all the nation’s wealth and political influence.

The first step in crisis is to save what must be saved to keep the ship afloat: the federal government’s ability to borrow more money and float that rising debt by selling Treasury bonds. This isn’t just a necessity for the domestic status quo, it’s also a necessity for the Imperial Project, which must have the capacity to “export” dollars in size globally to preserve the benefits of issuing a reserve currency.

The obvious way to save what must be saved is to reward owners of Treasuries and punish everyone else: make owning Treasuries safer and more lucrative than owning any other asset.

The conventional mind rebels at this: no way would the government punish all other asset classes. Alas, livestock being herded to the next pen might voice the same confidence based on recency bias: so far, we’ve been treated splendidly.

Yes, so far. But when push comes to shove, who’s positioned to overthrow the state and who’s a minion of the state? As various pundits have observed, quantity has its own quality. It’s far less risky to push 1 million wealthy overboard than to push 100 million already disenfranchised overboard.

The possibility of requiring a percentage of 401K and IRA retirement accounts be invested in Treasuries has been floating around for years. This is an excellent policy option, but it leaves the super-wealthy free to hoard non-Treasury assets. That will have to change, as the top 10% own 90% of all financial assets.

The new game will be to push a significant percentage of the $300 trillion in bubble-assets sloshing around the global economy into Treasuries. The grab-bag of policy options is capacious: everything from outright expropriation to wealth taxes to windfall taxes to restrictions on ownership are all available: mix and match, try a few or try them all.

The restlessly disgruntled disenfranchised will support wealth taxes and windfall taxes because they won’t be paying them. They’ll also support active efforts to track down and punish wealthy evaders of these taxes, and the eradication by any means necessary (ahem) of all the tax havens the Empire has left alone in coddling its financial elites.

Wealth taxes and windfall taxes are easy sells: why shouldn’t the wealthy pay more? At the same time, ease the taxes due on income flowing from Treasury bonds, and voila, the calculus of risk and return change: why own an asset that will be taxed at 80% when sold? Why own an asset whose income stream now carries a higher tax rate?

All of these policies rewarding Treasury owners and punishing every other asset class can be sold as serving the public good and protecting us from risk. Every one can start with a single twist of a screw that is then tightened at regular intervals.

Unbeknownst to the financial elite who has benefited so enormously from the past 15 years of bubble-economics, they’re not as indispensable as they believe. They can be tossed overboard and replaced with a new elite who understands the game has changed from inflating Everything Bubbles to funneling capital into Treasuries at scale.

Please understand it’s nothing personal. It’s just business. Those who feel their wealth and power are untouchable will discover the rules will change overnight, and keep changing, and going along to get along might be the best strategy: sell everything and buy Treasuries.

We might even find there’s a new category of dangerous terrorist: the financial terrorists who hoard wealth by evading the policies protecting our security and freedom. Rendition them to the ‘Stans, baby, they have it coming.

All earthly power is limited, but that doesn’t mean it’s as toothless as many presume. The expediencies and policy extremes have yet to be explored, much less exploited.

Save what must be saved to keep the ship afloat. Is there any doubt what qualifies? Tax breaks for the super-wealthy? The Everything Bubble? Um, guess again:

Quantity has its own quality:

* * *

Tyler Durden

Wed, 04/10/2024 – 15:00

via ZeroHedge News https://ift.tt/MubsQWO Tyler Durden