“Hot, Hot, Hot”… And Then There Were None

By Peter Tchir of Academy Securities

And Then There Were None?

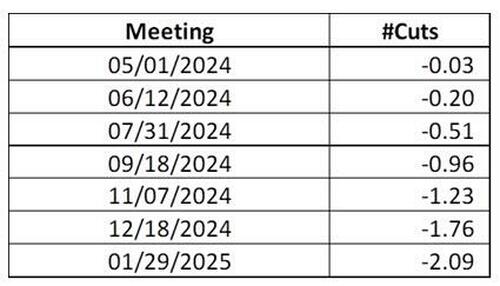

The moment CPI hit the tape, Buster Poindexter’s “Hot, hot, hot” popped into my head (not a song I want on replay, but I’m stuck with it). In any case, the market is repricing the potential number and timing of rate cuts. (using Bloomberg WIRP at approximately noon today)

We are now down to less than 2 cuts being priced into this year.

There is roughly a 50% chance the first cut is July or earlier, which leaves us with a 50% chance in September. I can only imagine the social media hell that would be unleashed by politicians trying to unseat incumbents if the Fed does the first cut in September. Yields dropping, stocks soaring would be great for incumbents. I have to believe, that the Fed, being apolitical, would like to avoid that fury if possible, but the data doesn’t seem to be cooperating.

I Thought it Was Over

We can only imagine the calls Powell is likely receiving today. Incumbents have been hoping to see inflation recede. High inflation has hurt the public opinion of elected officials. They want it manageable coming into the election. I’ve never been sure how the so-called Inflation Reduction Act did anything but increase inflation (spending). The “spend it and they will vote” mentality that seems pervasive in D.C. doesn’t help with inflation.

Geopolitical risk abounds (see yesterday’s Webinar Replay, with Generals (ret.) Marks and Robeson) and with the SPR reserve still near multi-decade lows, there are fewer tools to combat that.

As much as incumbents would like rate cuts (assuming they produce lower yields and higher stocks) they are desperate to avoid a rebound in inflation, and that card, seems to be back on the table (for those who thought it had been taken off the table).

Rethinking (or just thinking) about Recent Fedspeak

Of all the discussions, the one thing, at least on Fed speaker has mentioned directly, is the possibility that the neutral rate is higher than previously thought.

So far, markets have generally accepted that not only are we at peak Fed Funds (probably, but not certain) but that once the cuts start we would head toward a neutral rate reasonably quickly.

What has not been discussed as much, is what if the neutral rate and therefore terminal rate are higher than expected?

Bottom Line

We’ve gone from 6 to 2 cuts. Are we headed to none?

No cuts isn’t my base case, that seems too contrarian, even for a die-hard contrarian, but my gut is telling me it should be.

Inflation isn’t going away. If this Fed (many of whom were in the “transitory” camp) cuts and sees inflation rise, they will face great scrutiny. As much as we all understand the “long and variable” lag in monetary policy, and the “need” to get ahead of things, many will question what the heck they thought they were getting ahead of, when inflation was already turning higher?

I don’t like yields (though I’m hoping 10’s don’t break 4.6% too quickly, as resetting the range higher is getting increasingly difficult to get on board with).

As this realization sinks in, equities will struggle.

The corollary of “American Exceptionalism” might be “Higher for Much Longer!”

Tyler Durden

Wed, 04/10/2024 – 15:40

via ZeroHedge News https://ift.tt/HSRaj56 Tyler Durden