Sound Money Vs. Fiat Currency: Trade And Credit Are The Wild Cards

Authored by Charles Hugh Smith via OfTwoMinds blog,

We need to start thinking outside the current system, which has no solutions.

Our convictions about money are quasi-religious: heretics are burned at the stake. I’m not sure which stake I’ll be tied to, because all the conventional choices–fiat currency, sound money (gold, Bitcoin) or debt-free currency (a.k.a. MMT)–are all fatally flawed.

To understand why, consider the wild cards in any monetary system: global trade and credit. Let’s start with credit, which as David Graeber explained in his book Debt: The First 5,000 Years, has been an integral component of monetary arrangements since the dawn of civilization.

Taxes must be paid and seed purchased for the next crop, and so credit in some form–notched sticks, bills of sale, purchase orders, loans–is the lifeblood of commerce and state revenues. Credit naturally divides into short-term commercial credit–credit extended until the goods or payment are delivered–and longer term credit secured by collateral.

In traditional economies in which gold and silver are money, credit was generally limited to commerce, as credit based on loaning surpluses of gold and silver was limited by the scarcity of those metals. But the demand for credit did not diminish; rather, it increased, which is why small banks (that often went bust) emerged in the 1820s in America to meet the demand from small enterprises for credit to expand.

In an economy in which gold is the only money, credit is limited to a percentage of gold held in reserves, as much of the reserves must be held to fund customer redemptions / withdrawals. This limits the availability of credit.

In a fractional reserve banking system such as ours, one ounce of gold held in reserve is sufficient collateral for a loan 10 times the value of the reserve: $2,300 in gold enables the issuance of $23,000 in new money, i.e. a loan of $23,000, as every loan is new money created by the act of issuance.

What happens to “gold-backed money” when credit expands the supply of money expands 10-fold? The gold reserves are now spread over a much larger sum of money. The actual value of the gold backing each unit of money declines to a fraction of its initial value.

In other words, if credit is allowed to create money, then the “gold-backed” valuation of each unit is massively diluted. If credit is limited to surplus gold/silver loaned at interest, the sum of credit is a tiny fraction of all money in circulation.

Ancient Rome offers an example of a system in which only gold-silver were money.

When the empire’s silver mines in Spain were depleted, the supply of new money dried up and scarcity forced authorities to shave the actual silver content of coinage, the older higher-value coinage was quickly hoarded and left circulation: this is Gresham’s law, that bad money drives good money out of circulation.

Rome also offers an example of trade’s impact on money.

Rome’s wealthy–who naturally ended up with most of the empire’s “sound money” wealth–spent freely on luxuries from foreign trade with Africa, India and distant China: silks, incense, gemstones, etc. This trade drained the empire of gold and silver, which was transferred overseas to buy the luxuries.

In other words, trade imbalances drain importers of their gold/silver.

President Nixon didn’t end the convertibility of the US dollar to gold on a whim; due to rising US trade deficits, America’s gold would have been drained to zero in a few years. That’s what happens to “sound money” when trade deficits cannot be controlled: those running the trade deficits run out of gold-silver and cease importing goods.

Nixon’s hand was forced by the requirements of a global reserve currency, the US dollar. What is often overlooked in discussions of money is the necessity for reserve currencies to be “exported” to the global economy at scale so there’s enough units floating around to fund commerce and credit.

If there is insufficient currency available in the global system, the currency cannot function as a reserve currency due to its scarcity. As the global economy increased in size, the sums of US dollars required also increased, requiring permanent trade deficits as the means to “export” the currency into the global financial system.

Many feel that getting rid of the USD’s reserve status would be a plus, but those mercantilist nations exporting to the US would disagree, as once trade dries up their gravy train ends. Also unsaid is the reality that many nations must import food and energy, and their trade deficits are thus unavoidable.

A global economy with severely limited credit and trade will be a very different economy than the one we have now, undoubtedly better in terms of reduced consumption but this may not be entirely welcome or usher in an era of stability. The ideal system would be one that enables a transition to a new global economy that doesn’t impoverish the bottom 90%.

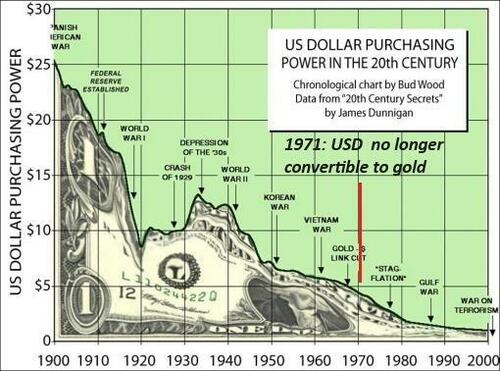

Interestingly, convertibility to gold didn’t restrain the ravages of inflation. Look at the chart of the USD’s purchasing power since 1900 and note the value dropped from $25 to $5 during the period that the USD was convertible to gold.

The influx of New World gold and silver via Spain in the 1500s and 1600s also deflated the value of precious metals in Europe.

The larger point is the purchasing power and price of everything is set by global markets: the relative value of precious metals, currencies, commodities, labor, risk, credit–all are set by global markets. Any nation-state which presumes to anchor a price that suits its policy makers only creates a black market for whatever they are attempting to control.

Fiat currencies arose to escape the limitations of “sound money” generated by credit and trade. The problems of fiat currencies are well-known: the temptation to create more currency is irresistible. If currency is simply printed, per Modern Monetary Theory (MMT), a.k.a. debt-free currency, we end up with billion-dollar bills because the increase of currency above and beyond the increase in production of goods and services reduces the value of each unit of currency.

Borrowing money into existence by selling Treasury bonds serves to limit the collapse of currencies, but it imposes interest payments (mostly paid to the wealthy who own 90% of the nation’s financial wealth) which drain the economy of vitality, leading to stagflation / decline.

We need to start thinking outside the current system, which has no solutions: debt-free money leads to billion-dollar bills, “sound money” (gold or bitcoin, it doesn’t matter) ends up in the hands of the wealthy and borrowing money into existence leads to stagnation as soaring interest sucks the economy dry.

I have explored money in two books:

Money and Work Unchained and A Radically Beneficial World, which proposes a system that creates new money at the bottom of the wealth-power pyramid rather than at the top. Yes, I understand this is wildly impractical in the current zeitgeist, but all conventional monetary systems run aground on their intrinsic limits / flaws, we’ll have to start somewhere other than the status quo.

* * *

Tyler Durden

Fri, 04/12/2024 – 07:20

via ZeroHedge News https://ift.tt/0TcyoNQ Tyler Durden