IMF Warns Biden’s Fiscal Profligacy Poses “Significant Risks” To Global Economy ‘In Great Election Year’

The IMF said the the quiet part out loud today (admittedly wrapped in 100s of pages of PhD-ese) in their benchmark Fiscal Monitor this morning: pointing out that America’s recent economic performance is partially the result of the country’s unsustainable borrowing, and that the US’ massive fiscal deficits have stoked inflation and pose “significant risks” for the global economy.

“The exceptional recent performance of the United States is certainly impressive and a major driver of global growth, but it reflects strong demand factors as well, including a fiscal stance that is out of line with long-term fiscal sustainability,” the IMF wrote in its latest World Economic Outlook. They added that: “Fiscal policy developments in major economies, notably in the United States, have implications for global financing conditions.”

The IMF said the US had exhibited “remarkably large fiscal slippages”, with the fiscal deficit hitting 8.8 per cent of GDP last year – more than double the 4.1 per cent deficit figure recorded for 2022, calculating that ‘Bidenomics’ (and its Inflation Reduction Act) had contributed 0.5 percentage points to core inflation (due to its fiscal profligacy).

Who could have seen that coming?

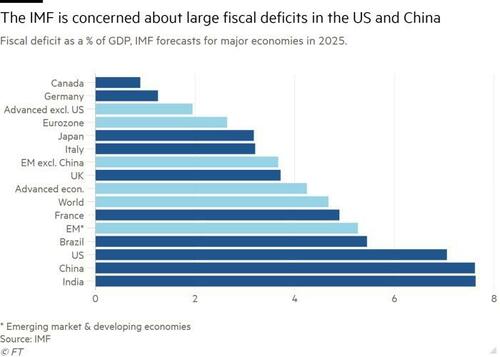

The fund further said in its Fiscal Monitor report that it expected the US to record a deficit of 7.1 per cent next year – more than three times the average for other advanced economies. It also raised concerns over Chinese government debt as Beijing copes with weak demand and a housing crisis.

The US and China were among four countries the fund named that “critically need to take policy action to address fundamental imbalances between spending and revenues.”

The others were the UK and Italy.

Rampant spending by the US and China in particular could “have profound effects for the global economy and pose significant risks for baseline fiscal projections in other economies,” the IMF said.

Furthermore, The IMF (rather too honestly) noted that things could get even worse as it’s a massive election year and politicans like to spend money they don’t have to buy votes (well, that’s our translation of their findings that deficits in election years tend to exceed forecasts by 0.4 percentage points of GDP, compared to non-election years).

“The risks of fiscal slippages are particularly acute given that 2024 is what is being called the ‘Great Election Year’: 88 economies or economic areas representing more than half of the world’s population and GDP have already held or will hold elections during the year,” says The IMF.

“Support for increased government spending has grown across the political spectrum over the past several decades, making this year especially challenging, as empirical evidence shows that fiscal policy tends to be looser, and slippages larger, during election years.”

Finally, we note that IMF chief economist Pierre-Olivier Gourinchas warned that the US’s fiscal position was “of particular concern”, suggesting it could complicate the Fed’s attempts to return inflation to its 2% goal.

“It raises short-term risks to the disinflation process, as well as longer-term fiscal and financial stability risks for the global economy,” he said.

“Something will have to give.”

“Something” indeed, Monsieur!

Tyler Durden

Wed, 04/17/2024 – 16:40

via ZeroHedge News https://ift.tt/YNesvVq Tyler Durden