Breaking Down The 2024 Bitcoin Halving: Implications & Predictions For Bitcoin Miners

Authored by ‘El Sultan Bitcoin’ via Bitcoin Magazine,

The Bitcoin halving event, a pivotal occurrence, is scheduled for April, 19 2024. This quadrennial event will reduce the block subsidy for Bitcoin miners from 6.25 BTC to 3.125 BTC, thereby halving the reward that miners receive for their efforts.

Such events have historically led to profound shifts in the mining landscape, potentially influencing various economic and operational facets of Bitcoin mining.

ECONOMIC OUTLOOK AND MARKET PREDICTIONS

After the halving, the immediate impact is a considerable decrease in miner revenue due to the reduced block subsidy. This could lead to a decline in the hashrate as less efficient miners may turn unprofitable and exit the network. Luxor’s Hashrate Index Research Team projects about 3-7% of Bitcoin’s hashrate could go offline if Bitcoin’s price maintains its current level. However, if prices fall, up to 16% of the hashrate could become economically unviable, depending on the trajectory of Bitcoin prices and transaction fees post-halving.

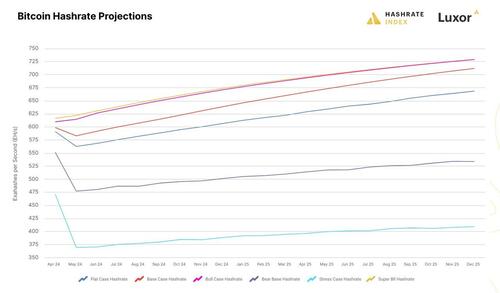

The hashrate, a critical security measure for Bitcoin, might adjust along with difficulty levels to align with the new economic realities. Luxor’s analysis suggests different scenarios where the network’s hashrate could end up ranging from 639 EH/s to 674 EH/s by year’s end, reflecting adjustments to the new earning potential post-halving.

ASIC PRICING AND BREAKEVEN POINTS

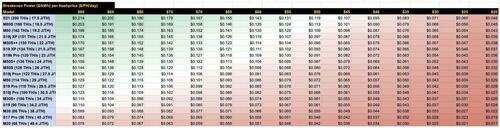

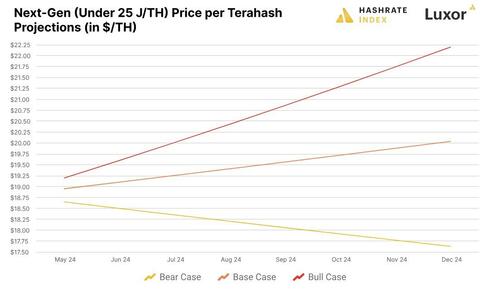

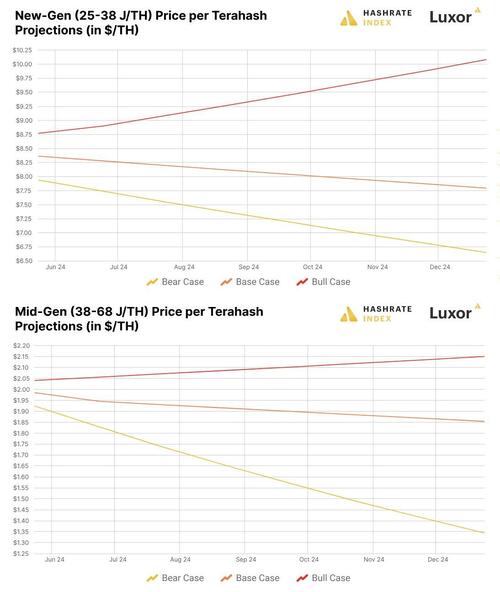

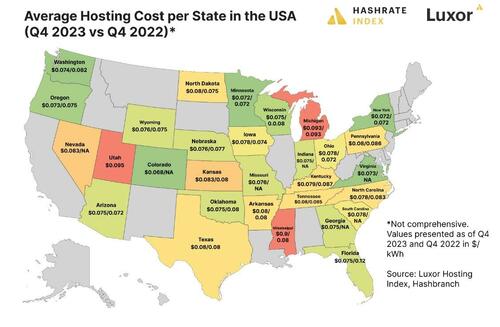

Post-halving, the profitability of different ASIC models will become crucial as the mining reward drops. Lower rewards mean that only the most efficient machines will be able to operate profitably if the price of Bitcoin does not see a significant increase. For instance, according to Luxor’s projections, next-generation ASICs like the S19 XP and M30S++ might have breakeven power costs ranging from $0.07/kWh to $0.15/kWh, depending on post-Halving hashprice.

This shift in profitability will likely lead to a repricing of ASIC machines. Historical data suggests that ASIC prices are highly correlated with hashprice; therefore, the anticipated reduction in hashprice will prompt a downward adjustment in ASIC values. This will particularly impact older and less efficient models, potentially accelerating their phase-out from the market.

THE ROLE OF CUSTOM ASIC FIRMWARE POST-HALVING

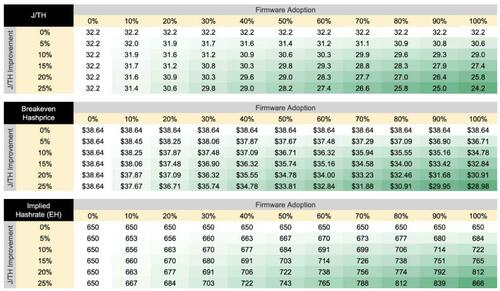

To combat reduced profitability, miners are increasingly turning to custom ASIC firmware to improve the efficiency of their hardware. Firmware like LuxOS and BraiinsOS can enhance the performance of machines by optimizing their power usage and hashrate output, thus lowering the breakeven point for electricity costs. For example, underclocking an S19 with custom firmware could extend its operational viability by reducing its power draw, thereby maintaining profitability even at lower hashprices.

Public miners, in particular, are adopting custom firmware to boost the efficiency of their fleets. Companies like CleanSpark and Marathon have reported using custom solutions to enhance their operational efficiencies. This trend is expected to grow as more miners seek to maximize their output and minimize costs in the face of decreasing block rewards.

2024 BITCOIN HALVING AND BEYOND

The 2024 Bitcoin Halving is set to reshape the mining landscape significantly, just as previous halvings have. While the exact outcomes are uncertain, the event will undoubtedly present both challenges and opportunities. Miners who plan strategically, taking into account both economic forecasts and operational efficiencies, will be better positioned to navigate the post-halving environment.

For those in the Bitcoin mining industry, staying informed and adaptable will be key to leveraging the halving event as an opportunity rather than a setback. With the right preparations, particularly in ASIC management and firmware optimization, miners can continue to thrive even under tightened economic conditions.

Tyler Durden

Thu, 04/18/2024 – 14:25

via ZeroHedge News https://ift.tt/xt6IC7F Tyler Durden