AI Bubble Stumbles: First ASML, Now TSMC Downgrades 2024 Global Chip Outlook

According to a first-quarter update on Wednesday from Dutch chip giant ASML – the world’s sole producer of equipment needed to make the most advanced chips – chip makers aren’t rushing to prepare for the next leg in the AI boom.

This was confirmed on Friday when Taiwan Semiconductor Manufacturing Co. – the world’s largest contract chip maker – offered investors a very cautious outlook for the industry despite upbeat first-quarter earnings results.

TSMC reported better-than-expected first-quarter results led by increasing demand for advanced chips. TSMC’s quarterly net profit climbed 8.9%, breaking a three-quarter slide.

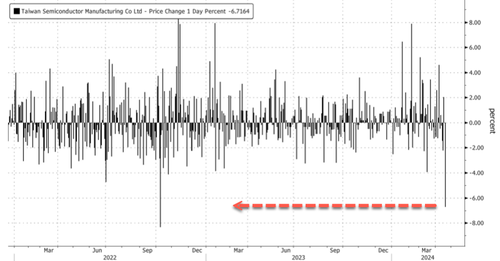

Aside from the earnings, TSMC’s downshift in this year’s industry outlook spooked the market, sending shares down as much as 7.2% in Taipei.

This was the largest intraday decline in about 18 months.

Excluding memory chips, TSMC’s industry outlook for the year is expected to be about 10%, compared to a growth forecast of “more than 10%” just three months ago.

“Macroeconomic and geopolitical uncertainty persists, potentially weighing on consumer sentiment and end-market demand,” Chief Executive Officer C. C. Wei told investors on an earnings call.

Some Wall Street weren’t surprised by TSMC’s gloomy outlook.

Deutsche Bank analyst Robert Sanders told clients in a note that self-driving company Mobileye Global warned not too long ago that a chip supply glut materialized in the auto industry.

As noted earlier, ASML’s 22% miss on first-quarter bookings is one sign that China’s frontloading of lithography machines has ended.

We explained here:

Followed by this week’s proof:

TSMC, AMSL, and Nvidia are likely long-term winners in the AI era. However, the new forecast suggests the AI bubble is waning and risks further deflating.

Plus, higher for longer interest rates by the Federal Reserve and reaccelerating inflation are bad news for tech valuations.

Tyler Durden

Fri, 04/19/2024 – 10:25

via ZeroHedge News https://ift.tt/9iSfu4s Tyler Durden