Hard Money Heat Check

Submitted by QTR’s Fringe Finance

There are few things I like more about NBA basketball than when a player gets so hot that it seems as though they can’t miss a shot, no matter where they are shooting from. The legendary video game NBA Jam captured this beautifully, for those that remember.

A “heat check” is when a hot player takes what would normally be a shot that’s borderline absurd because they are feeling so good and confident in their ability that they feel like they can “push it” a little. The difficult shot is supposed to be the determining factor as to whether or not the player is still “hot”.

The point is that I’m having the same kind of “heat check” feeling about precious metals and hard money this week — let me explain why.

First off, the movement in gold has been absolutely outstanding — even Goldman Sachs raised their forecast to $2700/oz. this week. But still, the action in the precious metal has really only gotten limited coverage in the news media so far.

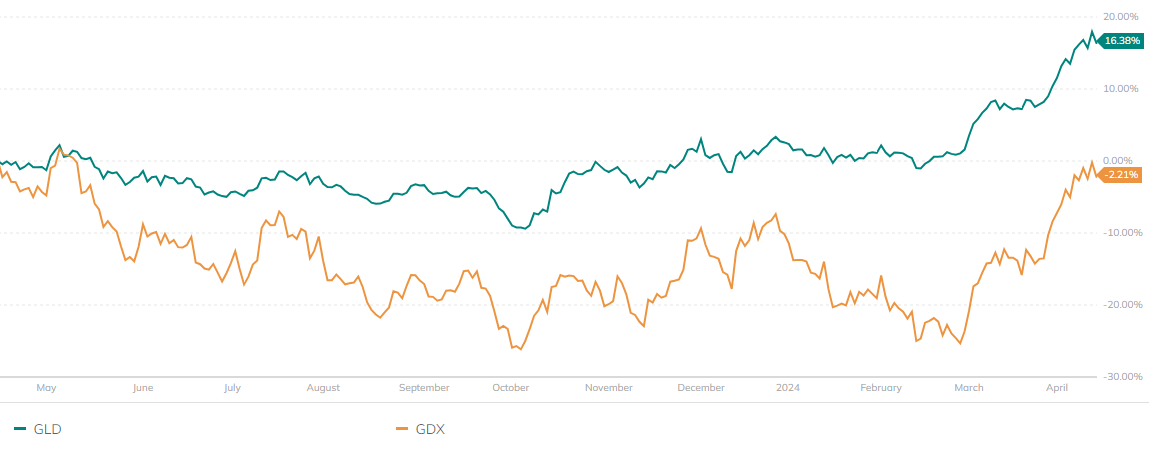

And if it isn’t obvious by now, gold miner stocks are still extremely unloved. As I mentioned in my portfolio review of my 24 stocks I like for this year days ago, sentiment around miners remains horrific. Gold and the GLD is continually piercing through all-time highs, and miners and GDX are nowhere near all-time highs, let alone 52-week highs.

As the divergence between the gold spot price and miners continues to widen, it feels as though it is getting more and more blindingly obvious that miners remain one of the best places for value in the entire market.

Miners continue to be my top conviction pick, and I still think there is tons of runway. While gold spot prices have gotten a few mentions in financial media, the precious metal miners have gotten very few, if any. The sell signal I’ll be looking for will be the days when the GDX performance has been so good that CNBC can do nothing but talk about miners. This is obviously a very, very, very long way off.

The purpose of this article—the reason why it is a “heat check” for gold and sound money assets—is because even though I’ve never been more bullish on gold, it’s important to understand that if the broader market crashes, gold will sell off with everything else. If the broader market starts to sell off for any reason—political conflict, overvaluation, election results—everything that isn’t bolted down is going to be sold as people scramble for liquidity in a 5.5% interest rate environment. Gold, silver, bitcoin, and all commodities will likely be part and parcel with such a sell-off.

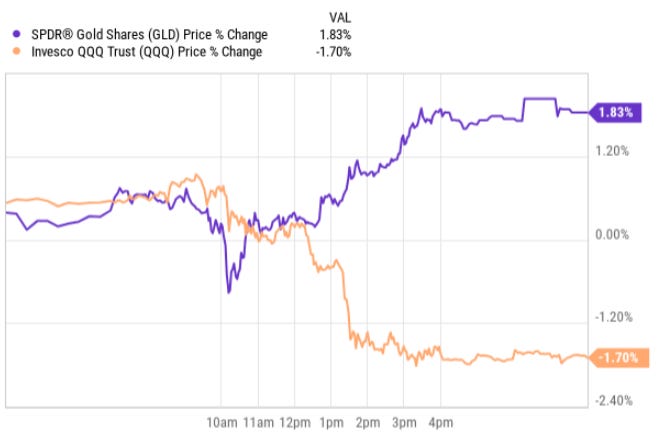

For example, on Monday when the market puked midday, it took gold with it. This is the same type of selling that would occur during a crash. The encouraging thing is that it didn’t take but an hour or two for investors to realize that the sell-off was nonsensical, as the reason for the crash—escalating tensions in the Middle East—was actually bullish for gold. So, you can see the GLD diverge from the Nasdaq (QQQ) and finish the day positive despite falling with the indices midday.

This move is a microcosm of what I expect to happen when the broader market crashes at some point in the relatively near future as a result of high interest rates and a stretched consumer during an economic contraction: a crash with markets, followed by a recovery as the market remains decimated.

It’s not even that the crash that will occur in metals will matter, seeing as how $2000 is likely now going to act as significant support for gold, and that’s a price that is still 10 or 20% higher than most miners have modeled for the next couple of years. It’s more about just keeping our heads screwed on straight right now, as there appears to be a lot of developments worthy of mixed feelings.

🔥 50% OFF ALL SUBSCRIPTIONS: Subscribe and get 50% off and no price hikes for as long as you wish to be a subscriber.

As a gold investor, I said at the beginning of the year that I liked it not only because it was a commodity but also because it was a fiscal dominance/inflation hedge and a geopolitical hedge. All of the situations I raised at the beginning of the year now seem to be playing out at the same time, which frankly makes me feel a little conflicted. I don’t want the US to be in an inflation crisis, nor do I want World War III to break out. However, as I said at the beginning of the year, it just seemed that these would be the most likely situations investors would be responding to this year, unfortunately. That said, it really doesn’t make crowing about how right we have been about gold for the last decade enjoyable.

I’m cautiously optimistic about the way things are going, but just remember that it’s called volatility because it can shock the market with unexpected outcomes. I personally plan to have cash on the sidelines and plenty of breathing room to be able to navigate whatever choppy waters may be ahead, even as gold rips.

Also on Monday, I sacrificed a couple of brain cells to let Charles Payne onto my TV since he was hosting Natalie Brunell and Peter Schiff debate bitcoin versus gold.

I’ve been pretty clear that my bitcoin allocation is far less than that of my gold position. I still think the precious metals are top dog when it comes to money. And even I get sick of listening to Peter Schiff crow about gold every time bitcoin is up and gold is down, but he did make some very good points during his appearance.

He noted that relative to one another—if you want to compare them both as types of assets—that bitcoin priced in gold has still not hit new all-time highs:

“Well, you know, gold’s probably going to close at a new record high today. It’s only a few dollars off now, above $2370. Gold is rising because the dollar, the Euro, and the Yen—fiat currencies—are losing value. Inflation is real, it’s here to stay, it’s not going anywhere near the Fed’s 2% target. We’re headed in the wrong direction. We’ll probably be in double digits by next year, and eventually, the first digit isn’t going to be a one.

Central banks are out in front of this; they’re the main buyers. You know, a lot of Americans have been foolishly selling their gold to buy these Bitcoin ETFs. There’s nothing elegant about losing your money in Bitcoin. Bitcoin is not going up; in fact, Bitcoin peaked two and a half years ago at about 37 oz. of gold. As we speak now, it’s worth less than 27 oz. That’s a 27% decline in 2 and a half years. This is a bear market.”

On the other hand, Peter was using price to make his case:

“There’s nothing sound about Bitcoin. It’s losing the race right now. Take a look at your screen. Gold is up $25, $26, and Bitcoin is getting clobbered.”

Using price to make your case is something that when bitcoiners do it, Schiff is quick to remind them that “price is what you pay and value is what you get”. Personally, the price action for me is not an indicator of the fundamentals. On the contrary, the fundamentals are a driver of the price action. Companies don’t perform better because their price goes up, for the most part. Usually, companies performed better and then their price goes up.

Natalie also made some points that I didn’t particularly agree with, specifically when she claimed that bitcoiners don’t feel the need to attack gold:

“Oh, I know Peter, and you know what? Bitcoiners don’t feel the need to constantly attack gold because we’re not threatened by gold.”

This (bitcoiners attacking gold) is so prominent it was going to be the topic of an entire article for me this week, but I’m writing this article instead.

Natalie is dead wrong. Bitcoiners absolutely cannot stop infringing on otherwise happy gold and silver investors by constantly telling them they don’t own enough bitcoin or that their allocation is too small. I see it every day that I tweet about gold — people respond to me and ask me why I waste my time with it, people are constantly telling me that I need more bitcoin or and bitcoiners are generally not staying out of the business of people who choose to own gold, either by itself or alongside bitcoin.

This is extremely toxic behavior. In my decade of working with short sellers and dealing with scams, a pump like this — where people go out of their way to unprovokedly tell you that you need to own something — always seems to be a common denominator. It just isn’t a good look for bitcoin and it’s why I wrote the article “Let Bitcoin Cook”. In it, I made the argument that the community would be better served by simply shutting the f*** up and letting the asset do the talking.

For example, I’m a gold investor, but I don’t tell people that are bitcoin-only that they need to own gold. Instead, I just mind my own business. Bitcoiners seem incapable of this. Natalie also gets it wrong when she says that gold “didn’t work” — yet it is the main reserve asset of many Central Banks, which is a dream scenario for bitcoiners (becoming a Central Bank reserve asset). During the interview, Natalie claims:

“I think the American dream has really been hijacked. We tried gold; it didn’t work. It was papered over. That system has failed the American people, and Bitcoin does provide hope for us, the working class. We want to be able to work for something that has to be measured by a free market so that we can see real value emerge, as opposed to being captured by politics and bureaucracy, which ultimately is a system that benefits the few at the expense of everyone else…”

All this did was remind me of Celsius’s Alex Minsky—now with his company bankrupt and dealing with criminal liability for running a crypto scheme—who said nearly the same nonsensical argument about gold, claiming in a debate with Peter Schiff that gold had “zero value”.

Bitcoin and gold have different properties—each with their own positives and negatives—but anybody telling you that gold has zero value or has failed is either catastrophically misinformed or simply not arguing in good faith, in my opinion.

And so, we forge forward another day, where owning whatever sound money assets we want to own—gold, silver, commodities, housing, etc.—still remains the obvious choice. Tensions in the Middle East are still simmering, and the United States still has the urgency of fiscal dominance. By virtue of those two things alone, pretty much anything that has a fixed supply is going to wind up going up in price, in my opinion. If I had to deliver general advice in one saying it would be “take it easy…but take it”.

What I mean by that is embrace the fact that from an investment perspective, things appear to be moving as we planned, but don’t get cocky or arrogant, and to remember that in a broader market sell-off, nearly everything can drop in value. However, as the only tool in the Fed’s toolbox remains printing money—which I believe they will do no matter how bad inflation is if the market crashes—any such crash in sound money would likely be short.

For today, the world hasn’t ended and the US is not experiencing hyperinflation. Treasury auctions haven’t failed and the market is still living to fight for one more day. So, onward and upward — take it easy, but take it.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. I didn’t double check any numbers or figures in this piece and am generally lazy with my research. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. Contributor posts and curated content are posted either with the author’s permission or under a Creative Commons license. This is not a recommendation or solicitation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. Sometimes I just lose money by misplacing it. I’m generally irresponsible. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. Do your research elsewhere. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it numerous times because it’s that important that you know.

Tyler Durden

Fri, 04/19/2024 – 07:20

via ZeroHedge News https://ift.tt/YtAMxD3 Tyler Durden