Subpar Record 5Y Auction Tails, Pushes Yields To Session Highs

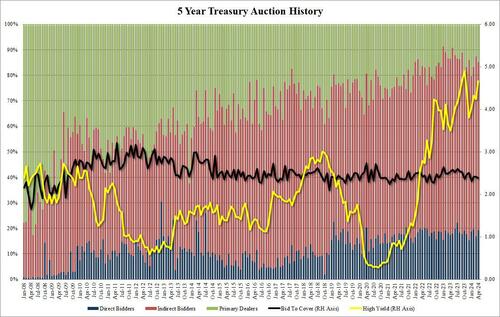

One day after the US sold a record amount of 2 Year paper in a very strong auction, the Treasury has followed that up with a record amount of 5 year paper, this time in a less than impressive sale.

The $70BN in 5Y paper was up $3BN from $67BN last month and was the highest amount on record offered for the tenor. But don’t worry there will be plenty more record auctions in the future: after all, the US has now crossed into the Minsky Moment and it is now issuing debt just to pay the interest on its existing debt.

The auction priced at a thigh yield of 4.659%, up sharply from 4.235% last month and the highest since October’s cycle high of 4.899%. Unlike yesterday’s 2Y auction which stopped through, today’s sale modestly tailed the When Issued 4.655% by 0.4bps.

The Bid to Cover was also weaker than last month, dropping from 2.41 to 2.39, and just below the 2.411 six-auction average.

The internals were also subpar, with Indirects sliding to 65.7% from 70.5% last month, if almost on top of the recent average of 65.4%. And with Directs taking down 19.2%, above the 17.9% recent average, Dealers we left holding 15.0%, just below the recent average of 16.7%.

Overall, this was a mediocre and forgettable auction, and one which accelerated the move higher in bond yields which are now at 4.654%, just shy of session highs.

Tyler Durden

Wed, 04/24/2024 – 13:21

via ZeroHedge News https://ift.tt/fzLH0Nt Tyler Durden