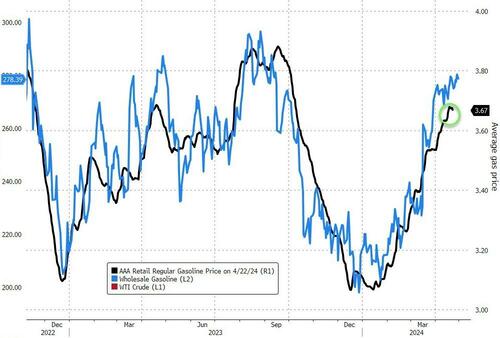

WTI Jumps After Bigger-Than-Expected Crude Inventory Build, Gasoline Demand (Reportedly) Slumps

Oil prices are drifting lower this morning, despite API reporting a surprise crude inventory draw last night, as hopes that geopolitical tensions are easing (hope is not a strategy) combined with a reduced expectation of economy-juicing rate-cuts are weighing on crude prices.

Supporting the upside, the US Senate, meanwhile, passed tougher measures against Iran in response to its attack on Israel earlier this month, with President Joe Biden saying he’ll sign the legislation into law. But the market is clearly calling Biden’s bluff on this threat as he faces soaring pump prices domestically which will do nothing to help his “but I fixed inflation” narrative into the election…

Source: Bloomberg

However, for now, all eyes are on the official inventory and supply data for any signs of overall tightness, and refined products demand as the summer driving season is fast approaching.

API

-

Crude -3.23mm (+500k exp)

-

Cushing -898k

-

Gasoline -595k (-1.5mm exp)

-

Distillates +724k (-1.0mm exp)

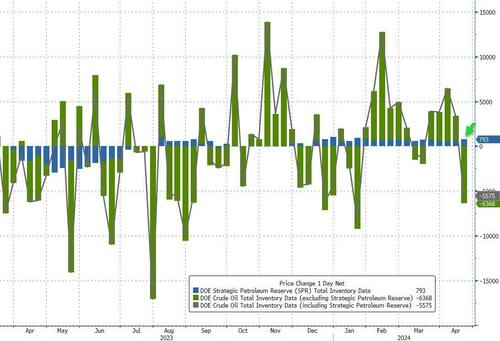

DOE

-

Crude -6.4mm (+500k exp)

-

Cushing -659k

-

Gasoline -634k (-1.5mm exp)

-

Distillates +1.6mm (-1.0mm exp)

Confirming API’s report, the official data showed crude inventories plunging last week by the most since January. On the product side, it was mixed with gasoline drawing down by distillates building…

Source: Bloomberg

There was a 909k b/d drop in the adjustment factor versus last week, the biggest decline since February, coinciding with the big increase in crude exports. At 257k b/d this week’s balancing measure was pretty small by its own highly volatile standards.

Source: Bloomberg

The Biden admin added 793k barrels to the SPR last week – the largest addition since January… and probably the last!

Source: Bloomberg

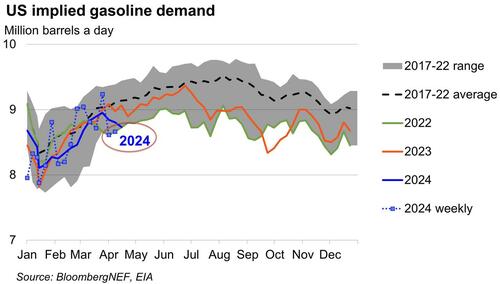

Implied gasoline demand fell yet again, nearly slipping back below 2022 seasonal levels for the first time since early March.

The figure typically sees decent growth at this point in the year, yet a post-Spring Break slump appears to have become the norm since 2020.

In comparison to pre-pandemic demand, the figure is at its lowest since 2014.

Source: Bloomberg

US crude production was flat at 13.1mm b/d (near record highs) and we note a very modest rise in rig count trends starting…

Source: Bloomberg

WTI was trading around $83.00 ahead of the API data and jumped back into the green for the day after the crude draw…

The conflict in the Middle East has “undoubtedly exacerbated tensions in an already volatile region,” Stephen Innes, managing partner at SPI Asset Management, told MarketWatch.

“While the recent attacks have been downplayed, the potential for further escalation cannot be entirely dismissed.”

However, “there’s a lesson to be gleaned from this situation, particularly in how swiftly demand responded to higher oil and gasoline prices, as evidenced by the increase in U.S. oil stockpiles,” he said.

Finally, timespreads are signaling tighter conditions, with the gap between Brent’s two nearest contracts widening to $1.05 a barrel in backwardation, a bullish pattern in which the nearer contract trades at a premium to the next in sequence. That compares with 69 cents a week ago.

Tyler Durden

Wed, 04/24/2024 – 10:38

via ZeroHedge News https://ift.tt/WdJs1L2 Tyler Durden