Yen Dumped, Yield-Curve Pumped, Bonds & Bitcoin Slump

Quiet macro day with Durable Goods Orders looking like a beat – but only because of sizable downward revisions – as orders and shipments are actually down on a YoY basis.

Source: Bloomberg

But stocks were messy with an opening bid immediately squelched and post-EU-close ramp faded into the US close. Small Caps were the day’s laggard as Nasdaq outperformed while The Dow and S&P desperately tried to get green…

Nasdaq and The Dow got back above their 100DMAs while Small Caps cannot hold above theirs…

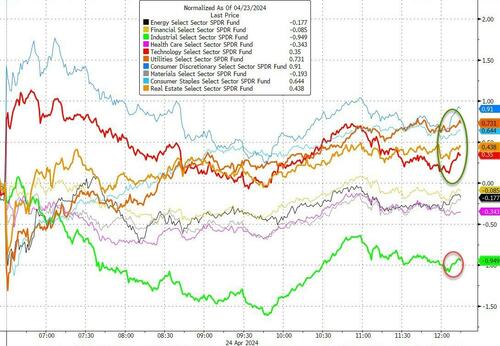

Goldman’s Chris Hussey pointed out that, despite an uptick in rates today (yields on 10-year Treasuries are up 6bp to 4.66%), yield sensitive sectors like Tech, Utilities, and Real Estate are outperforming.

On the flip side, Industrials are lagging on the back of particularly weak earnings in Transports.

Source: Bloomberg

And stepping even further back, 9 of the 10 worst-performing stocks in the S&P 500 today reported results after the close yesterday, or before the open this morning — highlighting how earnings are driving stocks amidst a macro vacuum (at least for today).

Volumes were muted today once again, according to Goldman’s trading desk, as they noted once again that hedge funds were slightly better to buy (buying Indust., Info Tech, Disc.), Long-Onlys slight for sale (selling Mats, Disc.,).

TSLA had a big day – its best since Jan 2022 – after earnings last night (that reaffirmed its strategy wasn’t too crazy)…

The basket of MAG7 stocks ended unchanged after a strong open thanks to TSLA’s gains as traders await META’s earnings after the bell…

Source: Bloomberg

Treasury yields were higher across the board today (with the long-end underperforming) as the following two-day chart shows, the 10Y & 30Y yields are back above pre-PMI levels from yesterday while 2Y is at the lows from yesterday…

Source: Bloomberg

The yield curve (2s30s) steepened dramatically once again, now up 14bps in two days, back to one-month highs (still inverted)…

Source: Bloomberg

The dollar ended modestly higher on the day, pulling back during the US session from overnight gains…

Source: Bloomberg

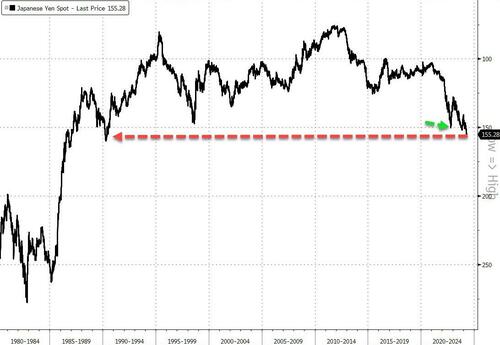

Yen was slammed (again) as traders continue to call The BoJ’s interventionist bluff…

Source: Bloomberg

…as JPY is now well below the last intervention threshold (back at its lowest in 34 years)…

Source: Bloomberg

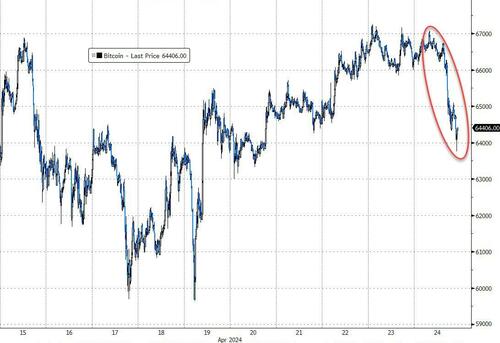

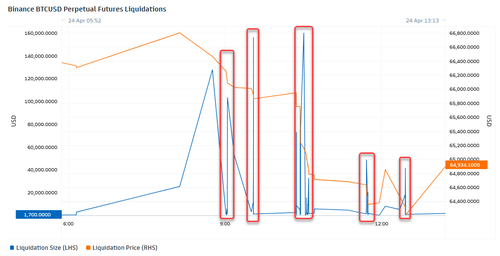

Bitcoin took another kicking today, tumbling back to a $63,000 handle…

Source: Bloomberg

…once again driven by extreme selling pressure from the perpetual futures market…

Amid all the excitement today, gold ended unchanged and traded in a narrow range…

Source: Bloomberg

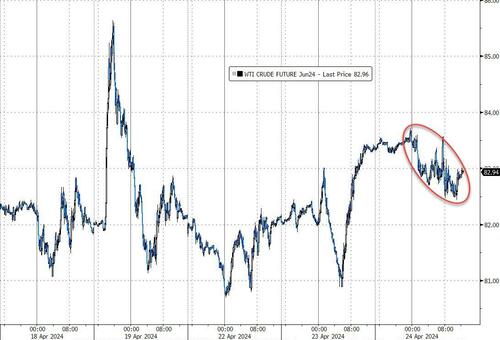

Crude prices slipped back from yesterday’s surge despite a big crude draw…

Source: Bloomberg

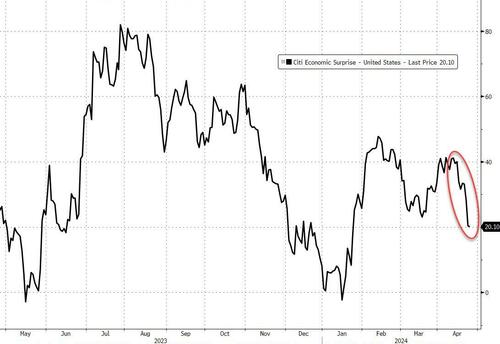

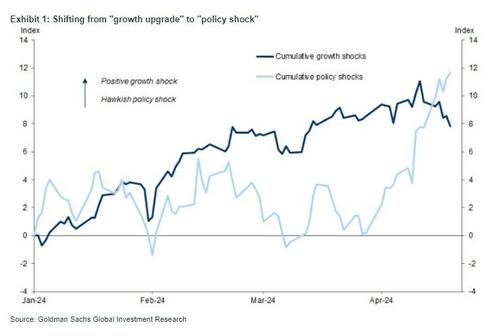

Finally, Goldman’s Dominic Wilson and Kamkshya Trivedi highlight how geopolitical tensions and stickier than expected US inflation prints have transitioned markets to trading more of a ‘policy shock’ than a ‘growth upgrade’…

…a development that is making directional trades trickie.

Tyler Durden

Wed, 04/24/2024 – 16:00

via ZeroHedge News https://ift.tt/novAmTZ Tyler Durden