US Futures Tumble After Facebook Implodes; GDP Data On Deck

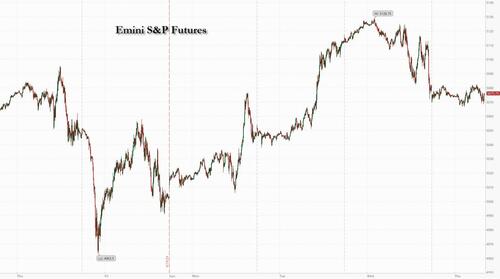

The three-day rebound from last week’s rout ended with a thud after the close yesterday when Meta imploded, plunging as much as 17% and losing $200 billion in market cap, after the company revealed disappointing revenue guidance coupled with higher capex projections. The report sent US futures lower, and as of 7:50am, S&P futures are down 0.6% with Nasdaq futures sliding 1% (Meta accountied for more than half of the decline) dragged by Mag7 names (META -12.6%, AMZN -2.2%, MSFT -1.5%, GOOGL -2.8% but Semis are broadly stronger, buoyed by META’s capex spend (at least $70bn over next 2 years). Bond yields are flattish with the 10Y trading at 4.65% and the curve slightly steeper as the USD is moving lower but not for the yen which continues its historic implosion as the hopeless BOJ sits in shock and watches its currency collapse (there is a BOJ meeting tonight where we expect nothing from the headless chickens). Commodites are rising today with strength in Energy and Metals. In macro, we get Q1 GDP numbers today with an update on March inventories and the normal jobless claims, but tomorrow’s s PCE is the more impactful number. After the close we get earnings from GOOG/MSFT which take on heightened importance given META’s price reaction.

In premarket trading, Meta tumbled as much as 15% after it projected second-quarter sales below analyst expectations and increased spending estimates for the year (JPM tech trader Jack Atherton says he would buy the dip with META). Alphabet Inc., which reports earnings later along with Microsoft Corp., also dropped. IBM shares are also down over 8% following weak demand for the company’s consulting unit. Here are the most notable US premarket movers:

- Arista Networks (ANET US) shares rise 2.7% as analysts note that the cloud-networking company could benefit from Meta’s increased spending plans.

- Ford (F US) shares gain 3.0% after the automaker reported first-quarter adjusted earnings per share that came ahead of consensus estimates. Citi said the results were an “encouraging outcome.”

- International Business Machines (IBM US) shares slip as much as 9.0% after the company reported results that showed weak demand for the company’s consulting unit. It also confirmed the acquisition of software firm HashiCorp Inc.

- Meta Platforms (META US) shares slump 13% after the Facebook parent gave a revenue forecast that was seen as weak and increased its spending estimates for the year amid an ongoing push into AI.

- Social media and online advertising companies trade lower following disappointing results from Facebook parent Meta. Snap (SNAP US) -5.1%, Pinterest (PINS US) -4.5%, Alphabet (GOOGL US) -2.9%, Trade Desk (TTD US) -3.3%

- ServiceNow (NOW US) shares fall 4.9% after the software company gave a full-year subscription revenue forecast that was slightly weaker than expected. Analysts are broadly positive on the report.

- Silicon Laboratories (SLAB US) shares rise 2.3% as Needham & Co. upgrades rating to buy from hold. The broker says the semiconductor device company “is well positioned for the semiconductor cyclical recovery.”

Hopes for tech megacaps have been red hot after the frenzy around artificial intelligence powered Wall Street’s record-breaking rally. But gains at the start of the week are flagging, suggesting wagers on an AI-driven profit boost may be overdone. US data due Thursday could turn the focus back to the timing of Federal Reserve policy easing.

“I think we are just hitting a little bit of a reality check,” Sonja Laud, chief investment officer at Legal & General Investment Management, said on Bloomberg Television. “This doesn’t take away the excitement around the potential going forward, but it’s probably valuation coming back to a more realistic pathway.”

Beyond corporate results, traders are also bracing for US economic growth figures after scaling back expectations for Fed interest-rate cuts for weeks. Economists predict GDP cooled to around 2.5% in the first quarter from 3.4%, with the figures still potentially suggesting persistent inflationary pressures.

“Any downside surprises could see markets bringing expected Fed interest rate cuts earlier — after having been pushed out to much later this year,” economists at Rand Merchant Bank in Johannesburg said. “However, upside surprises could see continued market volatility as the market tries to ascertain the risk that a hotter-than-expected economy poses to anticipated interest-rate cuts.”

Meanwhile, Secretary of State Antony Blinken said the world’s largest economies must “lay out our differences,” as he began two days of talks in China, with the threat of US sanctions targeting Beijing over its support of Russia’s war in Ukraine looming over his visit.

Europe’s Stoxx 600 Index edged lower with food beverage and industrial goods sectors leading declines, while mining and personal care drug shares are the biggest outperformers as traders processed a deluge of corporate updates on the busiest day of the earnings season. Anglo American Plc soared 14% after rival BHP Group made an all-share takeover proposal valuing it at £31.1 billion ($38.8 billion) in a deal that would create the world’s largest copper miner. Here are the biggest movers Thursday:

- Anglo American soars as much as 14%, hitting the highest level since July, after the miner received an all-share takeover approach worth $39 billion from global industry leader BHP

- AstraZeneca jump as much as 6.5%, the most since November 2020, after the drugmaker reported better-than-expected results for the first quarter

- Unilever gains as much as 5.3%, the most in over a month, after the consumer goods giant delivered a strong sales beat in the first quarter and showed volumes are improving

- Barclays rises as much as 5.2% to the highest since Feb. 2022, after investment banking revenue for the first quarter met the average analyst estimate

- Sanofi advances as much as 4.5%, the most since March 2023, after the French drugmaker reported first-quarter results that beat expectations, helped by new drug products Beyfortus and Altuviiio

- Adyen slumps as much as 15% after the Dutch payment firm’s 1Q report showed a decline in take rates, offsetting stronger-than-expected growth in processing volumes

- Pernod Ricard shares drop as much as 3.1% after the spirits maker reported fiscal 3Q results. Organic sales missed estimates as US buyers work through high inventories and the Chinese market remains slow

- Telia shares fall as much as 9.6% after reporting free cash flow well below estimates, with the Swedish telecom operator blaming higher interest costs and different timing of pension refund this year, among others

- Kesko slides as much as 6.5%, the most since June, after the Finnish home goods and improvement retailer reports weaker-than-expected earnings and cuts 2024 guidance, with its construction arm dragging on growth

- Neste declines as much as 11% to their lowest since 2020 after Finnish refiner reports adjusted 1Q Ebitda for the first quarter that missed estimates, driven by a weaker renewable diesel market, RBC says

In FX, the Bloomberg Dollar Spot Index falls 0.1% while the pound is among the best performing G-10 currencies, rising 0.4% versus the greenback. The yen extended losses after weakening beyond 155 per dollar for the first time in more than three decades on Wednesday, heightening the chances of intervention ahead of Bank of Japan’s policy decision Friday. The Japanese currency weakened to 155.74 per dollar on Thursday, a new 34-year low. The BOJ is forecast to keep its interest rate settings unchanged, while the yen’s plunge makes it more likely the bank will tone down its stance on keeping policy easy. Governor Kazuo Ueda’s press conference “is expected to take a hawkish tone, and even if depreciation in the yen doesn’t accelerate, the government is likely to intervene at the same time and swing the yen stronger by about 5 yen,” said Eiji Dohke, a strategist at SBI Securities. The first intervention would probably be for trillions of yen, followed by smaller long-term purchases, he said.

In rates, treasuries were little changed after yields rose in the previous session. US 10-year yields around 4.64% are near flat on the day with bunds and gilts outperforming by 1.5bp and 2.5bp in the sector. Core European rates outperform Treasuries, with little reaction in Spanish short-end bonds to Prime Minister Pedro Sanchez’s threat to resign, made after European markets closed on Wednesday. The week’s treasury coupon auction cycle concludes with $44b 7-year note sale at 1pm New York time, following solid results for both 2- and 5-year sales earlier this week; WI 7-year yield at ~4.652% is roughly 47bp cheaper than last month’s, which stopped 0.8bp through in a strong result.

In commodities, oil prices are little changed, with WTI trading near $82.80 a barrel. Spot gold rises 0.4% to around $2,325/oz.

Bitcoin was flat in choppy trade and briefly approached the $64,000 level before fading back.

Looking at the calendar, US data releases include the initial Q1 GDP reading from the US, along with the weekly initial jobless claims, pending home sales for March, and the Kansas City Fed’s manufacturing index for April. Meanwhile from central banks, we’ll hear from ECB President Lagarde, the ECB’s Schnabel, Vujcic, Nagel and Panetta. And we’ll also get the ECB’s latest Economic Bulletin. Finally, today’s earnings releases include Microsoft, Alphabet, Caterpillar and Intel.

Corporate Highlights:

- Caterpillar Inc. reported first-quarter results that showed machinery sales dipping from a year earlier and warned its second-quarter figures are also expected to be lower.

- Lazard Inc. posted its best first-quarter revenue on record as the investment bank jostles for position among boutiques to take advantage of the rebound in mergers and acquisitions.

- Southwest Airlines Co. is slowing growth, ending service at four airports and offering voluntary leaves to address “significant challenges” in 2024 and 2025 created after Boeing Co. again reduced the number of aircraft the carrier will receive this year.

- Barclays Plc posted first-quarter revenue that topped analyst estimates after its stock traders collected a surprise windfall from tumultuous global markets.

- Deutsche Bank AG relied on its traders and investment bankers to make up for a slowdown in income from lending, as Chief Executive Officer Christian Sewing seeks to deliver on an ambitious revenue goal.

- BNP Paribas SA’s fixed-income traders trailed all of the large Wall Street banks in the first quarter, taking the shine off a strong performance in other parts of the investment bank.

- Unilever Plc sales jumped more than expected in the first quarter as Chief Executive Officer Hein Schumacher pushes ahead with his turnaround plan.

- Nestle SA sales growth sputtered in the first quarter as the maker of Nespresso coffee was hit by cooler demand in North America and supply constraints at its vitamins unit.

- STMicroelectronics NV reported weaker sales than analysts expected, exacerbated by a slowdown in chip demand from the automotive sector.

Earnings

- Meta Platforms Inc (META) Q1 2024 (USD): EPS 4.71 (exp. 4.32), Revenue 36.46bln (exp. 36.16bln), Q2 24 revenue view 36.5-39bln (exp. 38.38bln), FY24 capex view 35-40bln (exp. 34.73bln), also expects capex to increase in FY25 (exp. 37.73bln). Shares are down -12.9% pre-market.

- International Business Machines Corp (IBM) Q1 2024 (USD): Adj. EPS 1.68 (exp. 1.60), Revenue 14.46bln (exp. 14.55bln). Shares are down 8.5% pre-market

- Ford Motor Co (F) Q1 2024 (USD): Adj. EPS 0.49 (exp. 0.42), Revenue 42.8bln (exp. 40.1bln). Shares are up 3.2% pre-market

- Barclays (BARC LN) Q1 (GBP): Investment Bank Revenue 3.33bln (exp. 3.35bln). FICC Revenue 1.4bln (exp. 1.52bln); affirms FY24 NII guidance. CEO said seeing an uptick in deals flow and equity markets

- AstraZeneca (AZN LN) Q1 (USD): Core EPS 2.06 (exp. 1.89). Revenue 12.7bln (exp. 11.9bln); Confirms a 7% increase in the annual dividend announced at AGM.

- Unilever (ULVR LN) Q1 (GBP) Revenue 15bln (exp. 14.7bln). Underlying Sales +4.4% (exp. +3.6%). Co. is increasingly confident in its ability to deliver sustained volume growth and positive mix; affirms FY24 underlying sales growth.

- Nestle (NESN SW) Q1 (CHF): Organic Revenue +1.4% (Exp. 2.9%); Revenue 22.1bln (prev. 23.5bln Y/Y). CEO said “We had expected a slow start and see a strong rebound in Q2 with reliable delivery for the remainder of the year.”

- STMicroelectronics (STM FP) Q1 (USD): Revenue 3.47bln (exp. 3.63bln). Guides Q2 Revenue 3.2bln (exp. 3.8bln) and gross margin 40% (exp. 42.4%). Cuts FY24 Revenue guidance amid slower than expected Auto chip demand, now between 14-15bln (exp. 16.2bln). (Newswires)

Market Snapshot

- S&P 500 futures down 0.6% to 5,079.25

- STOXX Europe 600 down 0.1% to 504.95

- MXAP down 1.0% to 171.56

- MXAPJ down 0.4% to 531.90

- Nikkei down 2.2% to 37,628.48

- Topix down 1.7% to 2,663.53

- Hang Seng Index up 0.5% to 17,284.54

- Shanghai Composite up 0.3% to 3,052.90

- Sensex up 0.6% to 74,269.03

- Australia S&P/ASX 200 little changed at 7,683.00

- Kospi down 1.8% to 2,628.62

- German 10Y yield little changed at 2.58%

- Euro up 0.3% to $1.0726

- Brent Futures up 0.4% to $88.40/bbl

- Gold spot up 0.4% to $2,326.48

- US Dollar Index down 0.25% to 105.60

Top Overnight News

- The South Korean economy grew at the fastest pace in more than two years in the first quarter beating all estimates with a pick-up in domestic consumption and robust exports, but the market questioned if the recovery was sustainable. GDP for the January-March quarter was 1.3% higher than the preceding three months on a seasonally adjusted basis, the sharpest expansion since the fourth quarter of 2021. RTRS

- French President Emmanuel Macron, who was instrumental in making Ursula von der Leyen the European Commission president five years ago, is now in talks with fellow EU leaders to find a different candidate — such as Mario Draghi — to fill the top job. BBG

- BHP has proposed a £31bn takeover of Anglo American that would bring together two global mining companies and rank as one of the industry’s largest transactions in years. FT

- Ukraine is set to increase long-range attacks inside Russia as an influx of western military aid aims to help Kyiv shape the war “in much stronger ways”, the head of the UK military has said. FT

- Israel will no longer pursue an all-out assault on Rafah but instead proceed gradually and in a more targeted fashion so as to limit civilian casualties. WSJ

- Pivotal GDP data looks set to confirm an ongoing economic boom last quarter, adding to pressure on the Fed to keep rates steady. GDP probably rose at a 2.5% annualized rate, with consumer spending seen advancing 3%. That would mean the fastest growth on a four-quarter basis in two years. BBG

- White-collar hiring is stalling out across much of the US. Hiring in professional services, finance and tech is running at one-third the rate of the overall labor market. Wage growth for high-paid workers has also cooled. BBG

- Micron is poised to receive $6.1 billion in grants and as much as $7.5 billion in loans from the US government, to build new American factories. BBG

- Mark Zuckerberg rekindled investor fears that he would not control costs at Meta after vowing to increase spending and turn the social media group into “the leading AI company in the world”, sending its shares tumbling more than 12 per cent in pre-market trading on Thursday. FT

- Boeing DoJ aims to determine by late May if Boeing breached an agreement shielding it from criminal prosecution over 2018 and 2019 fatal crashes, Reuters reports. Families of victims urged prosecution in five-hour meetings on Wednesday. Separately, Boeing said it was disappointed at not advancing in the US Air Force’s Collaborative Combat Aircraft programme, but remains committed to delivering next-gen autonomous combat aircraft, including MQ-25 Stingray, MQ-28 Ghost Bat, and undisclosed proprietary programmes.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued after the uninspiring handover from the US where futures were pressured after-hours following Meta’s underwhelming guidance, while the region also digested several earnings releases and markets in both Australia and New Zealand markets were closed for ANZAC Day. Nikkei 225 underperforms and retreated beneath the 38,000 level amid tech weakness and with earnings releases influencing price action, while the BoJ also kick-started its 2-day policy meeting. KOSPI was dragged lower amid losses in tech heavyweights despite stronger-than-expected GDP data and a blockbuster earnings report from SK Hynix. Hang Seng and Shanghai Comp. were positive with the Hong Kong benchmark underpinned amid resilience in the property industry, while the mainland eked slight gains after Premier Li noted China seeks to enhance development momentum and with US Secretary of State Blinken calling for the US and China to manage differences responsibly during a trip to China.

Top Asian News

- China is to speed up the local government special bond offer and is expected to accelerate special bond issuance in Q2 and Q3, according to PBoC-backed Financial News.

- China’s mission to the EU said if the European side suspects the existence of so-called subsidies, it is entirely possible to verify and resolve the situation through communication with the firm or a government department, after Chinese security equipment company Nuctech’s Dutch and Polish offices were raided by EU competition regulators.

- US Secretary of State Blinken called for the US and China to manage differences responsibly, according to AFP.

- Japanese Chief Cabinet Secretary Hayashi said won’t comment on forex levels or intervention but reiterated it is important for currencies to move in a stable manner reflecting fundamentals and rapid FX moves are undesirable, while he added they are closely watching FX moves and will be ready to take full response.

- Japanese Finance Minister Suzuki said closely watching FX markets and will handle it appropriately.

- South Korea’s market watchdog is preparing a new monitoring system to detect illegal stock short selling with the new mechanism to be implemented in a speedy manner, according to Reuters.

- CNOOC (883 HK) Q1 (CNY): Net 39.7bln (+24% Y/Y). Oil & Gas sales revenue CNY 89.98bln. Total net production -9.9% Y/Y

European bourses, Stoxx600 (-0.1%) initially opened mixed, though sentiment quickly soured and indices now hold a negative bias. European sectors hold a negative tilt; Basic Resources is the clear outperformer, with Anglo American (+11.5%) taking the lion’s share of the gains on BHP takeover reports; positive price action in the metals complex is also helping. Food Beverage & Tobacco is found at the foot of the pile, following post-earning losses in Nestle (-3.9%) and Pernod Ricard (-2.9%). US Equity Futures (ES -0.5%, NQ -0.9%, RTY +0.5%) are mixed, with clear underperformance in the tech-heavy NQ, dragged down by Meta (-13%) post-earnings, with IBM (-8%) also fuelling the downside.

Top European News

- ECB’s Schnabel said may face bumpy last mile of disinflation; wage growth seems to be easing in line with projections.

- ECB’s Muller said not comfortable starting with back-to-back cuts, via Bloomberg.

- BHP (BHP AT) confirmed that on the 16th April, it made an offer to Anglo America (AAL LN) regarding a potential combination; valuing Anglo American’s share capital at GBP 31.1bln (vs GBP 25.75bln market cap on Wednesday’s close)

FX

- Dollar is losing ground vs. peers (ex-JPY) with no obvious driver. DXY dipped under yesterday’s 105.59 trough but it remains to be seen how much the dollar is sold ahead of upcoming tier 1 US data.

- EUR is benefiting from the broad softness in USD with EUR/USD eclipsing yesterday’s 1.0714 peak and eyeing the 12th April high at 1.0729.

- GBP is enjoying a session of gains vs. the USD and to a lesser extent the EUR. Cable is back on a 1.25 handle for the first time since April 12th; 1.2558 was the high that day, which roughly coincides with the 200DMA at 1.2557.

- JPY is the only of the majors losing ground to the USD as USD/JPY’s ascent above 155.50 overnight is sustained. Intervention speculation remains. However, comments from an LDP lawmaker yesterday that 160 could be the line of the sand has given USD/JPY bulls confidence to chase prices higher.

- Antipodeans are at the top of the leaderboard for the majors vs. the USD. AUD/USD breached its 200DMA at 0.6526 alongside strength in copper and iron prices.

Fixed Income

- USTs are in consolidation mode below the 108 mark as traders brace for today and tomorrow’s tier 1 US data. For today’s quarterly PCE data, ING notes that a 0.4% MoM reading tomorrow could see Fed easing expectations cut back to just 25bp. Currently USTs remain contained within yesterday’s 107.20-108.02.

- Steady trade for Bunds with macro drivers on the light side, and unreactive to typical hawkish-leaning commentary from ECB’s Muller; Bunds are contained within yesterday’s range with greater attention to the downside with the 10yr just circa 20 ticks above the recent contract low.

- Gilts are marginally firmer in quiet UK trade. However, the modest gains need to be taken in the context of recent selling pressure post-Pill. 96.18 is the high for today but is a far cry from Wednesday’s 96.67 peak.

Commodities

- Choppy sideways trade for the crude complex; initial gains in the morning have now faded, with oil prices now lower on the session; Brent June in a USD 87.80-88.49/bbl parameter.

- Firm bias across precious metals amid a weaker Dollar and as geopolitical risks remain. Price action is more contained ahead of US GDP and PCE. XAU found support at USD overnight support at 2,305/oz before rising to a USD 2,328.88/oz intraday peak.

- Base metals are mostly firmer with clear outperformance in copper prices this morning and gains in iron overnight, with desks citing robust Chinese demand prospects. Elsewhere, mining giant BHP made a takeover offer for peer Anglo American.

Geopolitics

- Russian Foreign Ministry said the appearance of NATO nuclear facilities in Poland makes it a military target for Russia, according to Al Arabiya.

- Belarusian President Lukashenko said probability of incidents on the Belarusian-Ukrainian border is quite high; around 120k Ukrainian servicemen deployed near the border; Belarus has moved several battalions of fully operational readiness to the border.

US Event Calendar

- 08:30: 1Q GDP Annualized QoQ, est. 2.5%, prior 3.4%

- 1Q Personal Consumption, est. 3.0%, prior 3.3%

- 1Q GDP Price Index, est. 3.0%, prior 1.6%

- 1Q Core PCE Price Index QoQ, est. 3.4%, prior 2.0%

- 08:30: April Initial Jobless Claims, est. 215,000, prior 212,000

- April Continuing Claims, est. 1.81m, prior 1.81m

- 08:30: March Wholesale Inventories MoM, est. 0.3%, prior 0.5%

- March Retail Inventories MoM, est. 0.5%, prior 0.5%, revised 0.6%

- 08:30: March Advance Goods Trade Balance, est. -$91b, prior -$91.8b, revised -$90.3b

- 10:00: March Pending Home Sales (MoM), est. 0.4%, prior 1.6%

- March Pending Home Sales YoY, est. -3.0%, prior -2.2%

- 11:00: April Kansas City Fed Manf. Activity, est. -5, prior -7

DB’s Jim Reid concludes the overnight wrap

Markets have had a challenging 24 hours, and futures on the S&P 500 are down -0.66% overnight after Meta reported a disappointing outlook after the market close. Ahead of that, risk assets had already experienced a mediocre session yesterday, with equities flat in the US but down in Europe, as a bond selloff and geopolitical tensions weighed on sentiment. The losses for bonds didn’t have a single catalyst, but they gathered pace throughout the day, and in Europe it left 10yr yields at their highest levels of 2024 so far. To be honest, there were few assets that did particularly well, with the dollar index (+0.17%) the notable exception. Today will see more tech results come out as well, with Microsoft and Alphabet reporting after the US close.

Kicking off with Meta, its shares fell -15% in after-hours trading yesterday, as even though its Q1 results slightly exceeded revenue and earnings estimates, revenue guidance for Q2 came towards the lower end of analysts’ expectations. The company also raised its cost expectations for 2024, seeing capex spending totalling $35-40bn (vs. $30-37bn earlier guidance). All this led to what was in many ways a mirror image of the reaction to Tesla’s results the day before, with Meta’s outlook disappointing relative to lofty expectations that had seen its shares rise +39.4% year-to-date. Adding to more negative tech sentiment overnight, IBM slumped -8.5% after-market after its own results.

Prior to this, the sizeable bond selloff was the bigger story yesterday. This was most prominent in Europe, leaving yields on 10yr bunds (+8.6bps) at 2.59%, which is their highest level since November. One factor behind that were comments from Bundesbank President Nagel, who cautioned that a rate cut in June “would not necessarily be followed by a series of rate cuts.” So that adds to the suggestions that an initial cut doesn’t have to be followed by lots of further cuts. On top of that, we then got the Ifo’s latest business climate indicator from Germany, which rose to 89.4 in April (vs. 88.8 expected). That was its highest level in 11 months, and the expectations component also hit a one-year high of 89.9 (vs. 88.9 expected). So several headlines leant in a hawkish direction, and that came on top of the positive European PMIs the previous day.

Against that backdrop, markets dialled back their expectations for ECB rate cuts, and the amount priced in by the December meeting came down -3.9bps on the day to 73bps. That meant sovereign bonds lost ground across the continent, and yields on 10yr gilts (+9.3bps), OATs (+9.2bps) and BTPs (+13.8bps) all reached their highest levels year-to-date. Meanwhile in the US, yields on 10yr Treasuries (+4.1bps) closed at 4.64%, just beneath last week’s high for the year, and the 30yr yield (+4.4bps) hit a post-November high of 4.77%.

Higher rates had led to a mixed day for equities prior to Meta’s results. The S&P 500 was flat on the day (+0.02%), with the Magnificent 7 (+0.66%), posting a third consecutive gain thanks to a significant boost from Tesla (+12.06%), which surged after its own results the previous day. But there were also pockets of weakness, especially for the more cyclical sectors, with industrials (-0.79%) seeing the biggest declines, whilst the small-cap Russell 2000 was down -0.36%. Over in Europe, equities saw moderate losses, as the STOXX 600 (-0.43%) erased its earlier gains to close lower.

Sentiment wasn’t helped yesterday by geopolitical developments, and Israel said they had struck around 40 Hezbollah targets in Lebanon. Currently, investors don’t appear as concerned as they were last week after Iran’s strikes, and Brent crude oil prices actually came down -0.45% to $88.02/bbl. However, there are still nerves about the prospect of a further escalation, and the Israeli shekel (-0.26% against the US Dollar) lost ground after the headlines came through. Otherwise, the VIX index of volatility ticked up again, with a +0.28pts rise to 15.97pts.

Overnight in Asia, equity markets are struggling for the most part, with the Nikkei (-2.00%) experiencing a significant decline. That comes as the Japanese Yen (-0.09%) has posted further losses, falling to its weakest level since 1990 against the US Dollar, at 155.49 per dollar. T he Bank of Japan will also be making their latest policy decision tomorrow. Meanwhile in South Korea, the KOSPI (-1.20%) has also lost ground, even though the Q1 GDP data was much stronger than expected, with quarter-on-quarter growth of +1.3% (vs. +0.6% expected). Nevertheless, other equity indices did post a stronger performance, including the Hang Seng (+0.55%), the CSI 300 (+0.24%) and the Shanghai Comp (+0.17%).

Looking forward, we’ll get the first estimate of US GDP for Q1 today, which follows some very strong growth over the previous couple of quarters. Those previous releases showed an annualised growth rate of 4.9% in Q3 and +3.4% in Q4, and for today, the consensus is expecting a deceleration to an annualised 2.5% pace. Otherwise yesterday, US durable goods orders were up +2.6% in March (vs. +2.5% expected), but the previous month’s growth was revised down six-tenths to +0.7%. And for core capital goods orders, they were up +0.2% as expected, but the previous month’s growth was also revised down three-tenths to +0.4%.

To the day ahead now, and US data releases include the initial Q1 GDP reading from the US, along with the weekly initial jobless claims, pending home sales for March, and the Kansas City Fed’s manufacturing index for April. Meanwhile from central banks, we’ll hear from ECB President Lagarde, the ECB’s Schnabel, Vujcic, Nagel and Panetta. And we’ll also get the ECB’s latest Economic Bulletin. Finally, today’s earnings releases include Microsoft, Alphabet, Caterpillar and Intel.

Tyler Durden

Thu, 04/25/2024 – 08:09

via ZeroHedge News https://ift.tt/rRkxgv6 Tyler Durden