Intervention Or Not, Yen Bears Will Stay Confident

By Vassilis Karamanis, Bloomberg Markets Live reporter and FX strategist

Unless Japanese authorities show their hand with conviction when it comes to intervening in the spot market, the yen is bound to stay under pressure over the medium-term.

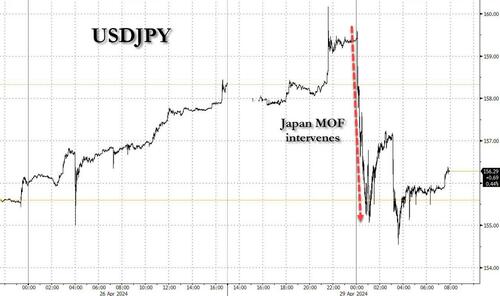

The currency’s sharp rally this morning certainly looks like an intervention — it’s not often that we get a 500-pip move seemingly out of nowhere. But thin liquidity due to a public holiday in Japan that forced algorithmic trading to take over as trailing stops were triggered could be what’s driven the market. The fact that traders aren’t sure this is an official hand supporting the yen is telling. Masato Kanda, the nation’s top currency official, said no comment when asked about the moves.

The market has been testing Japanese authorities’ patience — or determination — when it comes to yen weakness for some time now. And it will keep on doing so for as long as intervention threats are seen as a clumsily-played bluff.

The yen kept breaching through one big level after the other on Friday against the dollar and everyone’s question was whether we would finally have official yen buying before a long weekend in Japan. The answer was an emphatic no.

Did price action Friday actually give Japanese authorities the green light to intervene in the spot market?

The yen fell by the most since October on an intraday basis, for a two standard-deviation move; one-week realized volatility touched a one-month high

It was down 3.5% on a ten-day basis; Kanda said that a 4% move over two weeks doesn’t reflect fundamentals and is unusual

Over one month, the dollar was up by around seven big figures against the Japanese currency; Kanda has said that a 10-yen move over such a time period is considered rapid.

So in nominal terms, we could argue it was justified that no intervention took place, given a simple rates-check during a Japan holiday could actually do the trick. But in real terms, no one would blame Japanese authorities if they went beyond their official guidelines to step in the spot market. It’s not just about the 350-pip day range that took place. It’s the starting point that also matters. Fresh 34-year lows were hit Thursday.

Traders could see lack of official yen buying as an attempt to find excuses in order to stay pat. After all, a weaker currency in theory accelerates inflationary dynamics that will eventually support the Bank of Japan as to signal a more-aggressive-than priced in tightening bias — which could really be a game changing moment for the currency, especially if at the same time the Federal Reserve will indeed be close to easing its own policy.

And as long as credibility comes to the question, the more confident traders will be to re-add dollar longs in case the Ministry of Finance does decide to intervene. There was some speculation during the weekend that Japan is waiting for the Fed meeting and the release of the next US jobs report due this week before deciding to press the button. To me, it doesn’t matter so much if this is credible thinking, but the mere fact traders are discussing it shows the ball is moving away from officials’ court.

It’s not easy going against a central bank. In poker terms, policymakers always start the game with a pair of aces. But the flop did no favors to them and their raise on the turn looks miscalculated. Maybe the upcoming river will see traders winning this hand despite Monday’s retreat for the dollar that at the time of writing has no official confirmation it was down to spot intervention.

Tyler Durden

Mon, 04/29/2024 – 09:45

via ZeroHedge News https://ift.tt/oTDOkiZ Tyler Durden