Supreme Court Case ‘Threatens Chaos’ To Immigration System

Authored by Matthew Vadum via The Epoch Times (emphasis ours),

A complex upcoming Supreme Court case could weaken a key tool the government uses in immigration law enforcement and throw the system into chaos, legal sources say.

The case at hand deals with the doctrine of “consular nonreviewability,” which is the legal principle that a consular official’s decision to refuse a visa to a foreigner is not subject to judicial review.

Cracking down on the doctrine would harm the immigration system and cripple its ability to conduct business, supporters of the nonreviewability principle say. Opponents, such as those who favor expanded immigration, say relaxing it respects constitutional rights and the institution of marriage.

The doctrine is a judge-made exception to the Administrative Procedure Act (APA), a federal statute enacted in 1946 that governs administrative law procedures for federal executive departments and independent agencies. The late U.S. Sen. Pat McCarran (D-Nev.) said the APA was “a bill of rights for the hundreds of thousands of Americans whose affairs are controlled or regulated in one way or another by agencies of the federal government.”

Decisions about who gets to enter the United States are vested in the legislative and the executive branches, not the judicial branch.

The U.S. Constitution gives Congress exclusive authority to create policies about the admissibility of individuals to the United States. At the same time, the legislative branch delegates the power to implement those policies to the executive branch.

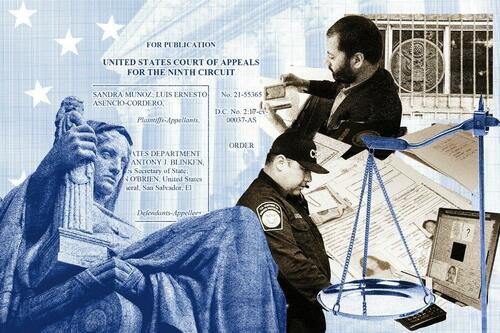

On April 23, the Supreme Court will hear Department of State v. Munoz, which concerns spousal sponsorship.

Facts of the Case

Foreign citizens have minimal rights in the immigration process, so the Supreme Court is expected to focus on whether U.S. citizens have a constitutionally protected interest in visa petitions sponsoring their spouses.

The case is about Luis Asencio-Cordero, a Salvadoran citizen with no criminal record whose U.S. immigration visa was denied because a consular officer thought his tattoos indicated gang membership. His wife, U.S. citizen Sandra Munoz, challenged the consular decision in court, arguing that her rights as a citizen were violated.

The case goes back to 2005 when Mr. Asencio-Cordero first arrived in the United States. Ms. Munoz married him in 2010 and they had a child together who is a U.S. citizen. The husband was in the country illegally.

Ms. Munoz sponsored her husband for a U.S. immigration visa. In 2015 he returned to his native El Salvador to obtain the visa. At the initial interview at the U.S. consulate in San Salvador, he was subjected to a body search.

The officials photographed his tattoos and asked why he got them. They found a tattoo of comedy and tragedy theater masks, one of a pair of dice, and one of three ace cards. Other tattoos depicted the Virgin of Guadalupe, Sigmund Freud, and a tribal design featuring a paw print.

Officials asked Mr. Asencio-Cordero about his criminal record. He said he was arrested once when he got into a fight with a friend. They were held in jail for three days and released with no charges being laid.

After a significant delay, officials ruled that Mr. Asencio-Cordero could not be issued a visa because he was viewed as criminally inadmissible to the United States.

Officials didn’t elaborate other than to cite a passage in the Immigration and Nationality Act which states “[a]ny alien who a consular officer or the Attorney General knows, or has reasonable ground to believe, seeks to enter the United States to engage solely, principally, or incidentally in … any other unlawful activity” is inadmissible.

The government argues that under federal law the visa denial cannot be challenged in court.

Ms. Munoz sued. Three years after the denial, she learned during the discovery process in federal district court that the government deemed him inadmissible to the country because he was thought to be a member of the MS-13 criminal organization.

The consular official reached this conclusion based on “the in-person interview, a criminal review of Mr. Asencio-Cordero, and a review of [his] tattoo,” U.S. Solicitor General Elizabeth Prelogar wrote in the government’s petition to the Supreme Court.

She wrote in a footnote that the government also presented to the court “for in camera review, State Department documents containing sensitive information describing the basis for the consular officer’s belief that Asencio-Cordero was a member of MS-13.”

The district court ruled in favor of the government in March 2021 and noted the consular officer’s finding that Mr. Asencio-Cordero was a member of MS-13.

Because the denial was based on “a facially legitimate and bona fide reason, the court ruled that consular nonreviewability precludes respondents’ challenges to the Department decision,” Ms. Prelogar wrote.

Court of Appeals

A divided panel of the U.S. Court of Appeals for the 9th Circuit vacated the district court’s ruling and remanded the case to the lower court for reconsideration.

The 9th Circuit did not reject consular nonreviewability but held that, on the facts of the case, the application of the doctrine violated the Due Process Clause of the U.S. Constitution.

The circuit court affirmed the district court’s holding that Ms. Munoz’s due process rights had been violated because as a U.S. citizen, she had both “a fundamental liberty interest in their marriage” and “a liberty interest in residing in their country of citizenship.” The denial harmed her due process rights because its cumulative effect was “a direct restraint on [her] liberty interests.”

The court also held that because the government had waited three years after the denial of the visa to provide the married couple with the declaration about the tattoo “and did so only when prompted by judicial proceedings,” the explanation was deemed untimely.

The court concluded that the government had forfeited its claim of consular nonreviewability by failing to hand over a timely explanation to the couple. The visa decision cannot be “shield[ed] … from judicial review” and the district court “may ‘look behind’ the government’s decision[.]”

The full 9th Circuit denied a rehearing of the case in July 2023, upholding the panel’s ruling.

Judge Patrick Bumatay dissented from the denial of the rehearing, writing that the panel was wrong to find that Ms. Munoz had a “liberty interest” in the visa denial of her husband.

And this “novel ‘timeliness’ requirement has no basis in the law,” he wrote. Throughout the 100-year existence of consular nonreviewability “no court has invented the rule that the government must act within a certain timeframe[.]”

“Congress has explicitly said that the government has no duty to give timely notice to an alien excluded on security-related grounds,” the judge wrote.

Read more here…

Tyler Durden

Mon, 04/01/2024 – 09:45

via ZeroHedge News https://ift.tt/By5cWu9 Tyler Durden