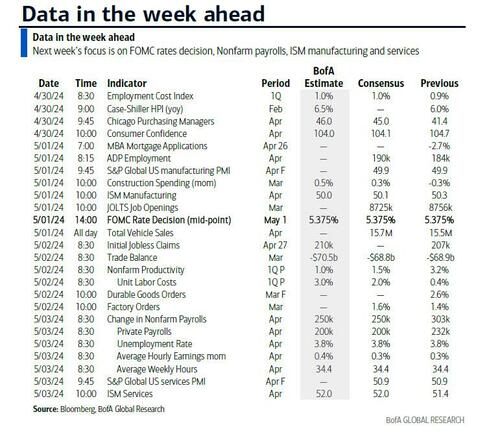

Ahead of Wednesday’s Quarterly Refunding Announcement by the Treasury and the latest FOMC announcement, as well as today’s Treasury Borrowing Estimate report, a firely but nerdy clash – with potentially huge consequences – has broken out within the rates market between those who expect the Treasury to surprise to the downside with its upcoming Sources and Uses forecast (like us, for example, as discussed in “How Janet Yellen Will Unleash Another Market Meltup Next Monday“), and a splinter group which expects far greater borrowing estimates to be unveiled by Janet Yellen 6 months before the election (and in doing so sending yields soaring, stocks tanking, and generally tanking the Biden admin at the worst possible moment).

We won’t go over the specifics of the former, since we already did that in great detail last Friday; we will instead focus on the recent view that today’s Borrowing Estimate statement (due at 3pm ET) may come as a shock surprise to the upside according to some, who expect a Q3 borrowing estimate as high as $1.2 trillion.

For that, we give the mic to Nomura’s Charlie McElligott who writes that number of client conversations over the past week or so had highlighted the magnitude of the US government tax receipts collected into / around Tax day, “which rationally on account of rising wages and enormous capital gains –tied inflows, and have powered the TGA to its highest levels in two years at the current $941B, nearly ~ +$190B over the Treasury’s targeted EOQ balance of $750B”, as we first noted first two weeks ago.

Here McElligott recaps what we said last week and explains that “the potential was that this “slack” in the TGA from the high tax receipts could then allow the Treasury to announcement a REDUCED FINANCING ESTIMATE TODAY for the new quarter to be announced with the extra funds already in the Treasury kitty, which could then act as a “dovish surprise” in a world where the entirety of the investment universe has been fixated on the exponential fiscal deficit spending trajectory which sits at the core of the enormous ongoing funding requirements and UST issuance “structural bear case” alongside the Fed cut repricing on “sticky inflation” being behind the recent selloff…so a smaller financing estimate, in-turn, could then act as a potentially bullish UST catalyst on locally lower issuance.”

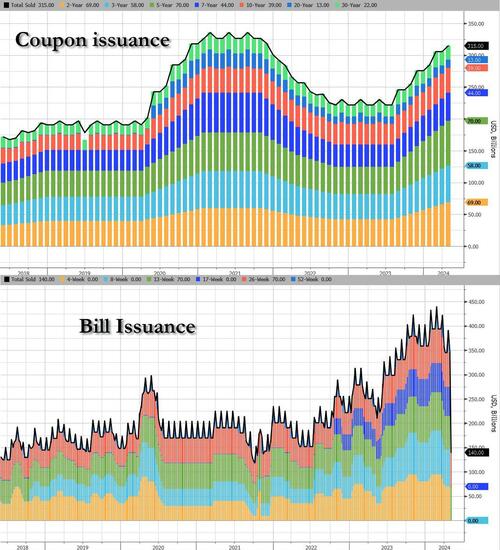

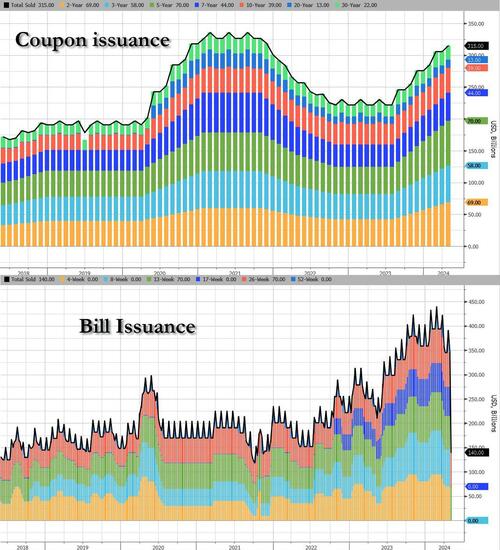

So with the extra tax monies pushing the TGA balances to two year high levels, and reducing the immediate borrowing needs of the Treasury, this potential for UST “reduced supply relief” when the latest borrowing estimates are announced today, was also layering in conjunction with Treasury’s prior guidance on the “mix” of the issuance, which explicitly stated their expectations that the just concluded prior Feb-Apr period would be the final quarter of increased Coupon issuance (and it most likely “will” be… at least until after the elections, but more on that later).

Now as readers may recall from the Oct / Nov ’23 QRA shocker, it was the Yellen’s “issuance twist” (discussed here) which dramatically reduced Coupon issuance versus prior expectations, and instead concentrated the issuance mix into Bills and blowing-out prior TBAC convention (going to Bills as a whopping 60% of the issuance mix, from prior 15-20%), taking advantage of the insatiable demand from MMF in the current “Cash as an yield asset” world we are living-in, which, in-turn, McElligott reminds us also marked the end of the Fall ’23 term-premium shock, and helped ALL assets rally in furious fashion thereafter (in conjunction with the softening inflation data at the time too, of course!), as it kicked-off such a massive “impulse easing” in financial conditions

So fast-forwarding to today when contrary to our expectations for a lower than expected print, a theory has emerged according to which the Treasury will unveil a far greater than expected funding shortfall. McElligott explains:

John Comiskey—the super-bright and well-followed Mortgage Tech engineer who meticulously follows and models the money flows of the US government / Treasury / Federal Reserve on the side (effectively as a “forensic accountant”) — yesterday on his public Substack released his projected Treasury borrowing estimates for the quarter ahead…and he sees an extremely different path ahead for the QRA than the hypothetical one I’d noted above, instead with large projected UPWARD REVISIONS to Treasury borrowing estimates in the quarters ahead.

Comiskey’s predictions for today’s financing estimates are rather jarring, versus the recent trend in Street expectations having potentially moderated on the tax receipts / TGA logic:

Versus the prior est of ~ $200B borrowing this new Q2 which some saw the potential scope to shift meaningfully lower for the upcoming quarter (i.e. ~$125B-$150B), Comiskey’s model is predicting an UPWARD REVISION of +$75-$100B to the refunding need, totalling a borrowing est this upcoming Q btwn $275B and $300B

Why? Because his modeled flows show that either the Treasury overestimated tax receipts or underestimated their spending…which, either way, will be reflected in today’s expected LARGER BORROWING estimate

More jarring is his Q3 estimate at an optically shocking ~ $1.2T, which is largely a function of calendar anomalies on maturing debt and first of month expenditures…but would catch the Street wildly flat-footed on the potential headline of a simply enormous number and the UST supply implications going-forward

CRITICALLY, however, he is taking the previously mentioned prior guidance from the Treasury at face value, and expects that they will NOT announce further increases in Coupon issuance…so the the mix will remain massively concentrated in Bills

Needless to say, if the estimate is accurate, this could be a “potentially massive swing” in expectations versus where both McElligott – and our own – views converge, and where a lot of Street chatter, had been moving (as a reference, McElligott cautions that Comiskey “incorrectly” predicted larger TGA end of qtr level increases in his last two QRA projections).

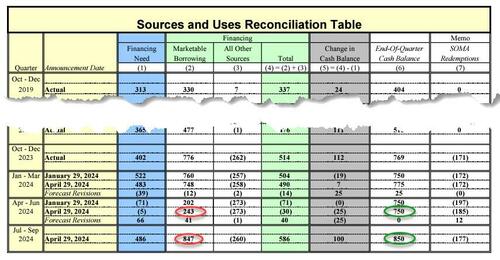

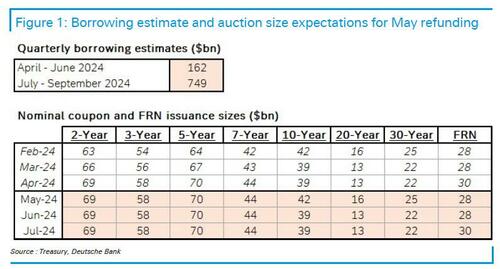

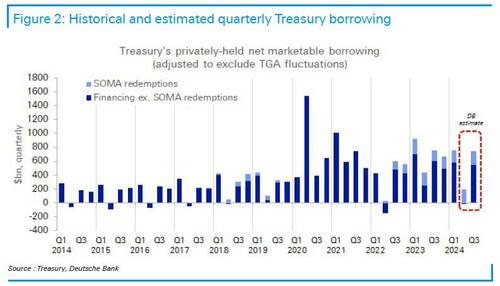

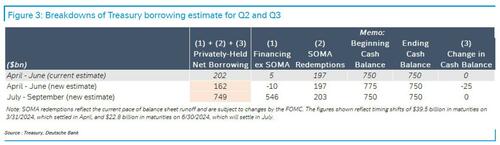

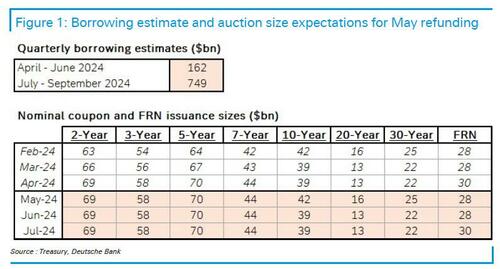

So with that out of the way – which is just that, an upside bogey which some may be looking toward as a worst case, hawkish outcome – a far more realistic forecast, and one which has traditionally been spot in historically, comes from Deutsche Bank’s Steven Zeng (full note “Treasury refunding preview: Buybacks ready for prime time” available to pro subscribers) in which we find that the DB strategist expects the debt funding need numbers to show a large increase from Q2 to Q3 ($162bn and $749bn, respectively). The increase from Q2 to Q3 is widely expected and priced in; what is missing is the abovementioned hyperoblic upward revision to Q2, and certainly no gigantic $1.2 trillion debt funding need for Q3.

Cutting to the chase, and why one can ignore hyperbolic forecasts for soaring Q3 borrowing needs, with the Treasury having stated at the last refunding that it anticipates no further auction size increases after this month, there should be minimal cause for surprise. As a result, DB expects steady nominal and FRN auction sizes for the May-July period, with near-term fluctuations in government fiscal flows being addressed through bill issuance.

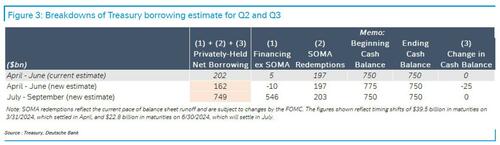

Taking a closer look, DB expects the Treasury to revise its April – June borrowing estimate to just $162bn, or $40bn lower than announced in January, and also expects the Treasury to announce July – September borrowing of $749bn, keeping the end-of-September cash balance unchanged at $750bn.

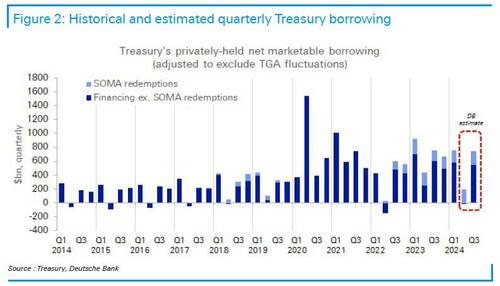

As DB explains, net fiscal flows in recent quarters have remained on (somewhat) solid footing, owing to higher wage income and a strong labor market. The Treasury’s cash balance at the end of March was $25bn higher than projected, while its actual January – March borrowing was $12bn less than announced. These factors lead DB to expect a modest improvement for the April – June quarter relative to the January announcement.

And while the July – September estimate is expected to show a large increase from the prior quarter, the number is less worrisome than it appears. The increase is first and foremost driven by the resumption of a more normal seasonal pattern in fiscal flows in Q3. Additionally, the Treasury is unlikely to assume a slowing of the Fed’s balance sheet runoff before an official FOMC announcement (even if that announcement could happen as soon as Wednesday). This leads to a larger estimate than if the Fed were to slow QT before Q3 as is widely expected.

One other factor to consider is a calendar quirk with June 30th falling on the weekend this year, which causes an estimated $95bn of June coupon settlement to be shifted into Q3, which further inflates the Q3 borrowing amount.

Finally, on the topic of QT, DB’s baseline expectation is that a taper would start in June, thus further easing funding needs, and resulting in fewer T-bills being issued during Q3 than the Treasury borrowing estimate suggests.

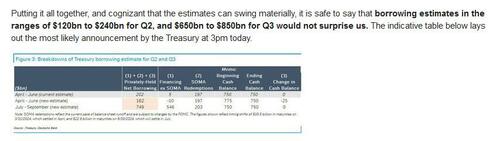

Putting it all together, and cognizant that the estimates can swing materially, it is safe to say that borrowing estimates in the ranges of $120bn to $240bn for Q2, and $650bn to $850bn for Q3 would not surprise us. The indicative table below lays out the most likely announcement by the Treasury at 3pm today.

One final point: the new borrowing estimates could begin to include the estimated buybacks for the quarter. The initial purchase sizes are small, and as such, they should not impact the Treasury’s coupon issuance. As the program matures and purchase sizes grow larger, they could eventually be factored into the Treasury’s overall issuance strategy.

* * *

Of course, all of the above refers only to the immediate future, which is as much financially-driven as it is politically: after all, what servile Treasury would pull the rug from below its own president 6 months before the election, sending yields surging (let’s be real: if borrowing needs come in higher, the Treasury can just revise them after the fact instead of guiding higher and sparking a bond selloff) and forcing the Fed to sound even more hawkish on Wednesday. But with that in mind, and considering Trump’s arrival in the White House at the end of the year will spark total market chaos, keep in mind that the long term trajectory US debt issuance is very ugly…

… and getting uglier by the day, and that while yields may drop today and even in the next few days/weeks as the Treasury “manages expectations” like the best corporation, the endgame is all too clear.

More in the full DB note available to pro subs.