Watch Live: Fed Chair Powell Walk The ‘Asymmetric’ Tight-Rope At Today’s Presser?

As expected, no change in rates from The Fed, and a hawkish bias to the language changes in the FOMC statement.

The bigger than expected QT taper news is noteworthy and Powell will have to explain why they are ‘easing’ this policy more than expected while inflation remains ‘out of control’… and they are not ready to cut rates.

So now it’s down to Powell to avoid a faux pas (as we detailed below) over shifts in The Fed’s ‘asymmetric’ response function.

Watch Powell walk that tightrope live here (due to start at 1430ET):

* * *

As we detailed earlier, today’s Fed meeting had the market feeling (and positioned for) “HAWKISHNESS,” especially after the ECI pile-on yesterday, which didn’t simply “upside surprise,” but re-accelerated to 1.2% after ending 2023 at 0.9%, and showing that persistent wage pressures further add to the risk of keeping inflation “too elevated” for the Fed.

However, according to Nomura MD Charlie McElligott, the largest risk with the Fed today is that there will be no summary of economic projections / no dot plots…

…meaning that outside of the usual statement, it will be Powell’s press conference alone that dictates market behavior… and the backtest on that is a bit dicey, with some historic faux pas in-sample.

He’s gotta find a way to “keep it in the pocket,” where his language simply must message “balance of risks”…

…which means (as we detailed earlier) that he dangerously must “toe the line” on widening out the Fed path away from currently asymmetric “when cut?”-messaging dating back to Dec ’23…

…and instead back to a two-way distribution with both ‘cut’ and honest-to-God ‘hike’ –optionality.

Nomura’s rates guru Jonathan Cohn details just how narrow a path it is for Powell:

Powell’s FOMC presser and, in particular, his answer to the inevitable question around potential hikes represents a key risk.

Following meaningful policy path repricing since CPI and reorientation of Fedspeak, the bar for Powell to exceed market hawkishness is high.

Powell, pricing, positioning

What to expect

Statement:

Our economists expect two hawkish changes (see their preview here)

Change “inflation has eased over the past year, but remains elevated” to “inflation remains elevated”

Removal of “greater” in the Fed’s expectation that it would not ease rates “until it has greater confidence that inflation is moving sustainably toward 2%”

Presser:

- Powell’s FOMC presser will again be highly scrutinized, particularly his answer on whether hikes are in play. Bostic and Bowman flagged hikes as a risk and Williams did not rule them out, inviting a reassessment of two-way risk. Though Powell will likely maintain that policy is restrictive, he will also likely want to retain optionality amid high uncertainty around neutral. The phrasing of that optionality sentiment will be critical.

Is the market ready / priced?

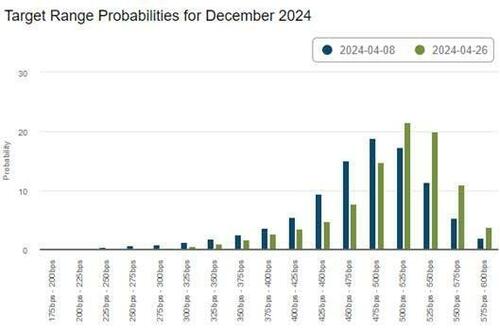

How much is priced: The market has repriced a lot, going from 63bp of cuts in 2024 pre-CPI to 28bp currently. Market-implied year-end rates for 2024 and 2025 are well above the median dots, granted the March dot plot had some ‘cuspy’ medians. The repricing owes primarily to sticky inflation arresting progress through H2 last year, though there has also clearly been a reduced ‘recession’ premium as well. In terms of hike appreciation, the market-implied probability of a hike by year-end is now around 15%, double what it was pre-CPI. Given the reorientation of Fedspeak amid this sticky inflation (i.e., less emphasis on cuts this year), there is a higher bar for Powell to exceed market hawkishness.

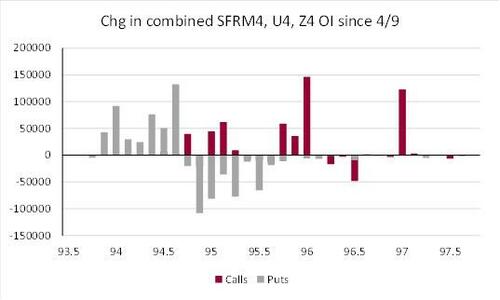

Repositioning: At the front-end, there have been a couple waves of washouts in ‘sell hike’ trades like 1×2 payer spreads in the sell-off. An examination of open interest changes coupled with insights from our futures desk suggests a good deal of positioning post-CPI was rolled into lower strikes, not simply taken off. And with the increase in put OI in 94.625 (no cut) strike largely a function of buyers, those combining with sales in lower strikes (short skew) seem prepared for something like no cut or one hike scenario. Of course, the risk is that if Powell rhetoric around potential hikes is seen as hawkish and followed by strong NFP and CPI, we move quickly toward the low strikes as the market prices in a higher probability of multiple hikes and we get another positioning flush. I do think that if the Fed feels the need to change its directional bias and hike (not just stay on hold), one has to price in a high probability of multiple hikes, not a one and done. However, I still think there’s a very high bar for the Fed to pay more than lip service to open-mindedness.

QT slowdown

- The Fed is expected to announce a reduction in the pace of QT, likely to $30bn per month for UST. I wouldn’t expect much guidance on an end date. Slowing runoff should theoretically allow for a longer period of QT and lower ultimate level of reserves (thanks to more time for an efficient redistribution of liquidity) – a level around which uncertainty bands are very large.

Putting it together suggests a ‘middle of the road’ Powell can give way to a temporary relief rally, while a blundered characterization of hike optionality could lead to another position flush out and bear-flattening of the yield curve.

Hence, McElligott warns that with all this HAWKISH mentality / sentiment / positioning, the risk is that any surprisingly dovish Fed speak or Data (e.g. NFP Friday), you COULD see potential for an outsized SHORT SQUEEZE / RALLY RISK on stops.

Tyler Durden

Wed, 05/01/2024 – 14:25

via ZeroHedge News https://ift.tt/KwRrB0d Tyler Durden