Americans Continue To Name Inflation As Top Financial Problem: Gallup

By Jeffrey Jones at Gallup

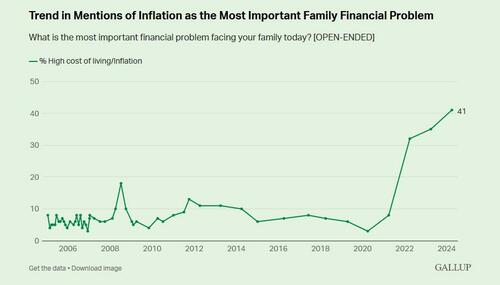

For the third year in a row, the percentage of Americans naming inflation or the high cost of living as the most important financial problem facing their family has reached a new high.

The 41% naming the issue this year is up slightly from 35% a year ago and 32% in 2022. Before 2022, the highest percentage mentioning inflation was 18% in 2008. Inflation has been named by less than 10% in most other readings since the question was first asked in 2005.

The latest results are from Gallup’s annual Economy and Personal Finance poll, conducted April 1-22.

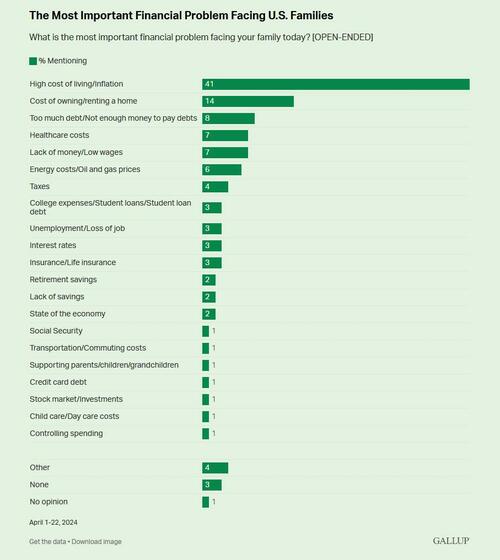

Gallup has asked Americans at least annually since 2005 to name, without prompting, the top financial problem facing their family. Inflation has topped the list for the past three years. The cost of owning or renting a home ranks second this year at 14%, a new high for that issue.

Other significant problems Americans identify include having too much debt (8%), healthcare costs (7%), lack of money or low wages (7%), and energy costs or gas prices (6%).

Over the past 19 years, healthcare costs and lack of money or low wages have frequently ranked near the top of the list, while the cost of energy or gas has done so at times of elevated gas prices, as in 2005, 2006 and 2008.

Inflation Named Most Often by All Subgroups

Inflation is named the most important financial problem by all key societal subgroups but garners higher mentions from certain age, income and political groups.

- 46% of older Americans (those aged 50 and older) mention inflation, in contrast with 36% of younger Americans (those under 50).

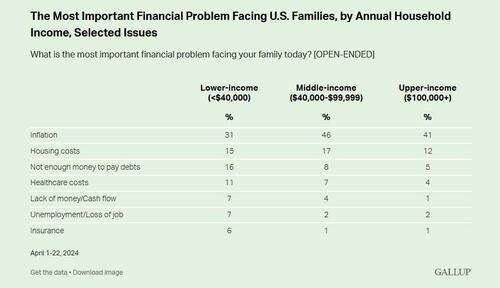

- Inflation is a more top-of-mind concern for middle-income (46%) and upper-income Americans (41% of those with an annual household income of $100,000 or more) than for lower-income Americans (31% of those with a household income of less than $40,000).

- 56% of Republicans, compared with 39% of independents and 26% of Democrats, name the issue as the most important financial problem facing their family.

Younger and lower-income Americans may be less likely to name inflation than their counterparts because other immediate financial concerns are more pressing for them. For example, 21% of adults under age 50 say housing or rental costs are their top concern, compared with 8% of those aged 50 and older.

Lower-income Americans are more inclined than upper-income and middle-income Americans to say personal debt, healthcare costs, lack of money and job loss are the top concerns facing their family.

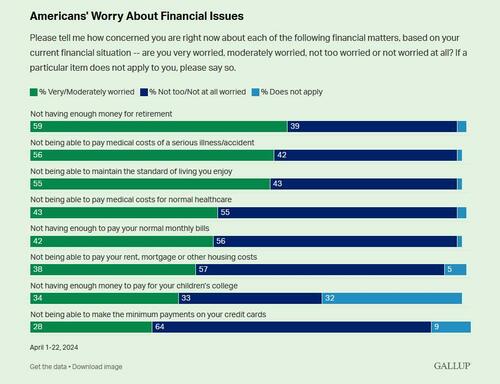

Retirement, Medical Emergencies Also Worrisome

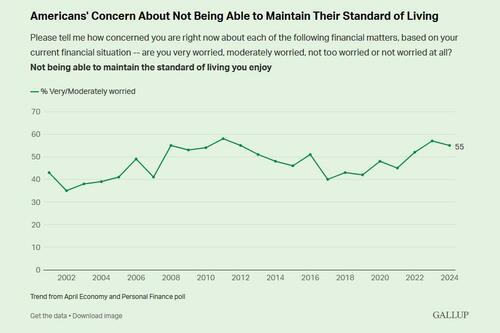

A separate question in the survey asks Americans to say how much they worry about each of eight specific personal financial matters. Inflation is not one of those issues, but its influence is apparent in the heightened percentage who worry about not being able to maintain their standard of living. Fifty-five percent are very or moderately worried about maintaining their living standards, the third straight year a majority has done so after being below that level from 2017 through 2021.

Since the question was first asked in 2001, an average of 47% of U.S. adults, including a high of 58% in 2011, have worried about being able to maintain their standard of living.

Maintaining one’s standard of living ranks as one of the three economic matters Americans worry most about, along with not having enough for retirement and being unable to pay medical bills in the event of a serious illness or accident. The latter two issues have consistently ranked first or second each year in Gallup polling dating back to 2001.

Less than half of U.S. adults worry about the five other financial matters, including normal medical costs, normal monthly bills, housing costs, paying for their children’s college and making minimum payments on credit cards.

Compared with last year, there have been slight declines in the percentages worried about medical costs for a serious illness or accident (from 60% to 56%) and not having enough money for retirement (from 66% to 59%). Both issues are now closer to their historical averages after being slightly above them last year. For the other six financial matters, the percentages worried about them are essentially unchanged from a year ago.

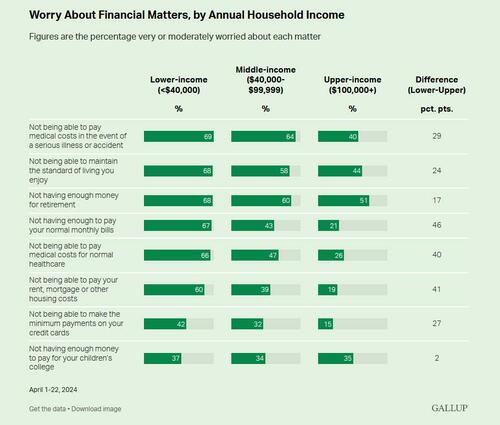

As would be expected, those with a lower household income worry more than those with greater resources about nearly all of these financial matters. The one exception is affording college for a child, which shows no meaningful differences by income. Across the eight financial matters, an average of 60% of lower-income Americans express worry, compared with 47% of middle-income and 31% of upper-income Americans.

Majorities of lower-income adults worry about six of the eight financial matters, compared with three issues for middle-income adults and only one for those in upper-income households.

The greatest disparity in worry on any single issue between income groups is being able to pay one’s normal monthly bills, which concerns 67% of lower-income adults but only 21% of upper-income adults.

Ratings of Personal Finances Remain Subdued

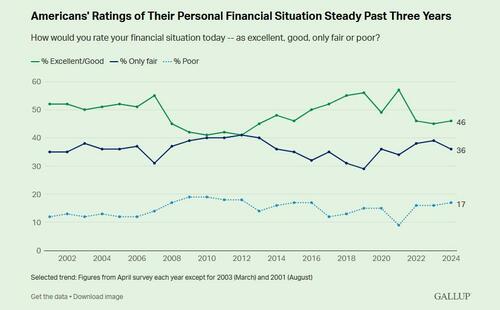

Forty-six percent of Americans rate their personal finances as excellent or good, similar to what Gallup has measured the past two years but a worse evaluation than in 2017 through 2021. Meanwhile, 36% describe their finances as “only fair,” while 17% rate them as “poor.”

Americans’ ratings of their personal financial situation were worse than now between 2009 and 2012, as the U.S. was coming out of the Great Recession and unemployment was high. During those years, an average of 42% of Americans rated their personal finances positively.

All income groups remain less positive about their financial situation now compared with 2021. Currently, 72% of upper-income, 42% of middle-income and 25% of lower-income Americans rate their situation as excellent or good.

Another question in the survey finds 62% of Americans saying they have enough money to live comfortably, similar to the 64% recorded last year but down from 2022 (67%) and 2021 (72%). Gallup has only had one lower reading on this question since 2002 — 60% in 2012. The high point was 75% in 2002, the first year the question was asked.

Eighty-three percent of upper-income, 62% of middle-income and 37% of lower-income adults say they have enough to live comfortably, with similar declines in each group since 2021.

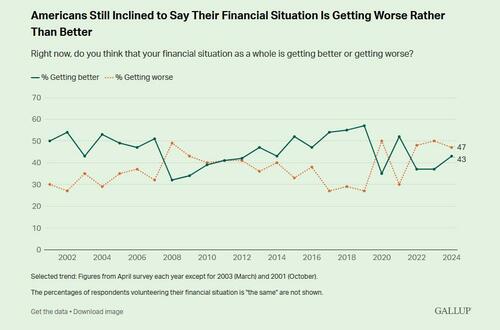

Americans Slightly More Optimistic Their Financial Situation Is Improving

There has been a slight increase in the percentage of Americans who say their financial situation is getting better — 43% say this, up from 37% in both 2022 and 2023. The current figure is still significantly below the 52% measured in 2021.

At the same time, 47% say their financial situation is getting worse, up by 17 percentage points since 2021.

A slim majority of upper-income Americans, 52%, believe their financial situation is improving, as do 43% of middle-income and 34% of lower-income Americans.

Bottom Line

Inflation continues to be an issue for Americans and is likely why less than half are positive about their financial situation. In addition to being named the most important financial problem facing their family, inflation also ranks as one of the domestic problems Americans worry most about. The issue trails only immigration, the government and the economy in general when Americans are asked to name the most important problem facing the country.

The U.S. inflation rate has declined significantly since its peak in 2022, but that has done little to alter Americans’ perceptions of their finances. This could reflect the cumulative effect of higher prices for the past few years and the fact that inflation has remained above the lower rates in the U.S. between 2012 and 2020. The latest government reports suggest inflation may be increasing again. That news persuaded the Federal Reserve to delay interest rate cuts it was expected to make this year.

The issue also stands to be a key election issue, and renewed inflation would hamper President Joe Biden’s chances of reelection.

Tyler Durden

Fri, 05/03/2024 – 17:00

via ZeroHedge News https://ift.tt/mdNAKWV Tyler Durden