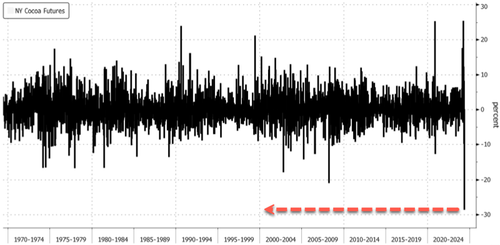

This Week’s Cocoa Price Crash Marks Largest Ever Drop

What goes up, must come down.

Cocoa prices turned lower on Thursday, extending a weekly decline that is slated to be the largest on record due to the evaporation of liquidity from large traders.

Futures in New York plunged as much as 9.3% to the lowest level since mid-March and have tumbled 37.5% from the peak of a little more than $12,000 a ton in mid-April.

If losses are sustained through Friday, then this week’s decline of about 30% will be the largest on record.

“Price moves have also been more erratic as a liquidity crunch upended the market after it became more expensive for traders to maintain their positions,” according to Bloomberg.

Jack Scoville, vice president at Price Futures Group, said the downward swings were happening “in a rather dramatic way” because of dwindling liquidity. He noted prices could still be “mostly a correction” and bulls still could push prices to near record highs.

This week’s Hightower Report report showed that “commercial firms are delaying some of their purchases of West African cocoa until next season, which has pressured the cocoa market.”

Judy Ganes, president at J. Ganes Consulting, said bulls need a “new spark” of bad weather reports in West Africa to bottom out prices.

“Bull markets need to be constantly fed to be sustained,” and the multi-month price spike has created a “vacuum” from a lack of new buyers, Ganes said.

Despite the market turmoil this week, Oil trader Pierre Andurand still has a $20,000 price target for later this year.

G7Hedge

Thu, 05/02/2024 – 21:50

via ZeroHedge News https://ift.tt/rUkmS1v G7Hedge