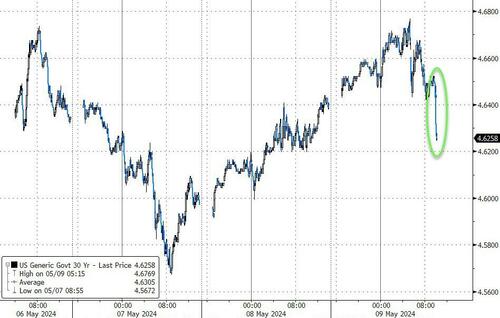

Yields Slide To Session Low After Stellar 30Y Auction

After a stellar 3Y auction and a solid, but tailing 10Y auction, moments ago the Treasury held the week’s final refunding auction when it sold $25 billion in 30Y bonds in yet another stellar auction.

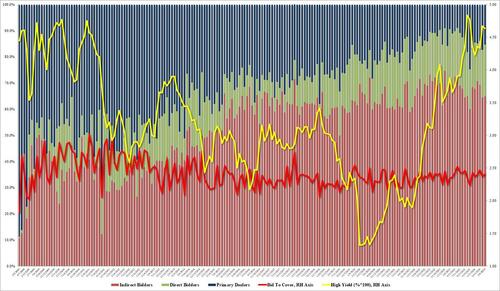

The high yield of 4.635% was fractionally below last month’s 4.671% (and well below the cycle high of 4.837%in October 2023); it also stopped through the When Issued 4.642% by 0.7bps, following last month’s modest tail, and was the 5th stopping through auction in the past 6.

The bid to cover rose to 2.409% from 2.367%, and also above the six-auction average of 2.38%.

The internals were solid with Indirects awarded 64.9%, up from 64.4% but below the recent average of 66.8%. And with Directs awarded 19.8%, Dealers were left holding 15.4% of the final auction.

Overall, this was a very strong close to refunding week, and the market clearly approved with yields sliding to session lows in kneejerk reaction to the solid demand for the ultra-long dated paper.

Tyler Durden

Thu, 05/09/2024 – 13:27

via ZeroHedge News https://ift.tt/bwEnyV1 Tyler Durden