Newsom Forced To Slash California Budget, Blames Crippling Deficit On “Rain Bombs” And Tax Shortfalls

In the course of two years, California has turned a $100 billion surplus into a $73 billion deficit, forcing governor Gavin Newson (D) to propose painful (token) spending cuts on Friday while announcing his revised state budget.

When asked how the state was able to achieve such a monumental fail, Newsom – who claims the deficit is actually $27.6 billion (to which even AP called him out) – blamed a reduction in taxes from capital gains income, which surged in 2021 amid a raging stock market and plummeted in 2022. Then, in 2023, the state ‘continued to collect less tax revenue than projected’ due to capital loss carryovers. He also blamed “unexpected rain bombs” – which caused the IRS to extend the tax filing deadline for most California taxpayers in 2023 following severe winter storms. When those taxes were eventually collected, they were 22% below expectations, according to the Governor’s office.

Watch:

According to AP, Newsom will cut $6.7 billion set aside for doctors who treat Medicaid patients, cut off healthcare to 14,000 disabled migrants in their home, saving $94.7 million, and slashed $550 million that was headed towards state schools in order to build new facilities.

Republican State Senator Brian Dahle called the cuts a “hollow gesture, at best,” adding “The governor’s national ambitions have triggered a massive exodus of people and businesses creating an enormous revenue shortfall of personal and corporate income taxes.”

“You can’t have a good government without a strong private sector. Plain and simple, people are being priced out of California from bad policies and mismanagement,” Dahle continued.

In total, Newsom is proposing $32.8 billion in cuts over two years – including an 8% cut to state operations, which he says will shore things up.

Of course, we know that’s bullshit.

Refreshing your memory from early April, Mike Shedlock gave a sobering view into reality;

* * *

The City Journal founder Ed Ring comments on the Golden State Budget Fantasy

While finalizing the upcoming fiscal year’s state budget back in May 2022, California governor Gavin Newsom boasted of an extraordinary projected surplus: $97 billion. The governor immediately collaborated with an enthusiastic state legislature to spend it all. Of course, new spending on new programs and benefits tends to become permanent.

This has happened repeatedly in California. Between fiscal year 2012–13 and fiscal year 2022–23 (the year with the projected $97 billion surplus), per capita general-fund spending doubled, from just over $3,000 per resident to just under $6,000. (All figures are in 2022 inflation-adjusted dollars.)

The State Office of Legislative Analyst’s latest report projects a $73 billion dollar deficit for the next fiscal year. It won’t be easy to paper over this debt, but the state may use its opaque accounting system to hide the ball.

California’s general-fund budgets are reported on a cash basis. The state’s balance sheet, however, uses “accrual-based accounting.” Without getting too far into the weeds, this is an apples v. oranges situation. Instead of the algebraic perfection of private-sector income statements, balance sheets, and cash flows, government accounting provides no easy way to reconcile what you see on the budget.

Some watchdogs, however, have succeeded in cracking the code. John Moorlach, one of the only certified public accountants to serve in the California State Senate, just published a review of the state’s fiscal health, focusing on the balance sheet. According to Moorlach, California’s balance sheet is in trouble.

Moorlach declared in a March California Insider interview that the state “now has the largest unrestricted net deficit in the US: $222 Billion.” In plain English, Moorlach is saying that California’s state government accounts have liabilities that exceed assets by $222 billion. No matter how creative Newsom and his financial wizards may be, someday that money will have to be paid.

A remedy that California has turned to over the years and will undoubtedly turn to now is to accumulate additional long-term debt. Emulating the federal government, but lacking its dollar-printing ability, California’s state and local governments and agencies have racked up over a trillion dollars in debt, primarily in bonds and unfunded pension liabilities. These liabilities, too, must be paid. Since that’s all but impossible, the liabilities must be serviced with payments that, just as at the federal level, will eat up more and more of the operating budgets.

How Much Is California in Debt?

The above link says over a trillion. That’s being very generous to California. Click on it to discover … California State and Local Liabilities exceed $1.6 Trillion.

California’s total state and local government debt now stands at almost $1.6 trillion, or about half the state’s GDP.

That isn’t an alarming ratio when compared to the national debt, which has now soared to 128 percent of U.S. GDP with no end in sight. But Californians carry this $1.6 trillion state and local debt ($40,000 per capita) in addition to their share of the national debt (about $90,000 per capita).

That article was from February of 2022. I suspect the liabilities are now close to $2 trillion.

Cost of Running a McDonalds Jumps $250,000 in CA

On February 4, I noted the Cost of Running a McDonalds Jumps $250,000 in CA Due to Minimum Wage Hikes.

A blowback is underway.

California Restaurants Cut Jobs

On March 26, I commented California Restaurants Cut Jobs as Fast-Food Wages Set to Rise

Proposition 103 Backfires

Citing wildfire risk, State Farm will not renew policies on 30,000 homes and 42,000 business in California.

Also on March 26, I commented Proposition 103 Backfires, State Farm to Cancel 72,000 California Policies

Blame the state, not insurers.

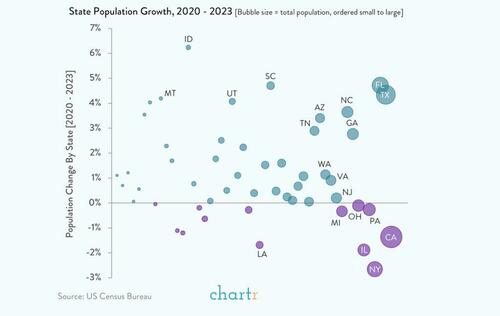

Congratulations to NY, IL, LA, and CA for Losing the Most Population

People in California, increasingly getting sick of the state’s progressive madness, are voting with their feet.

For discussion, please see Congratulations to NY, IL, LA, and CA for Losing the Most Population

Absolute Basis Losers

-

New York: -631,104

-

California: -573,019

-

Illinois: -263,780

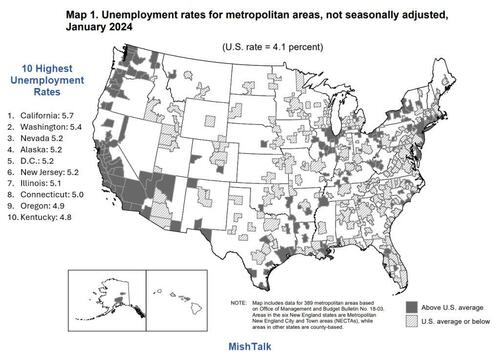

California Leads the Nation in Unemployment

The BLS metro shows unemployment rates were up in 218 of 389 metro areas. Nonfarm employment only rose in 59 areas.

On March 15, I noted Unemployment Rates Rose in 218 of the 389 Metropolitan Areas

Unsurprisingly, California has the highest unemployment rate in the nation at 5.7 percent vs. 4.1 percent nationally.

A Booming Economy?

California has massive problems although the stock market is at a record high and the economy is allegedly booming. The next recession will hit California exceptionally hard, and it’s not too far off.

Tyler Durden

Sun, 05/12/2024 – 20:00

via ZeroHedge News https://ift.tt/3QkFLGC Tyler Durden