Goldbugs Waited Years For A Massive Comex Short Squeeze, And Finally Got It… Just In The Wrong Metal

For much of the past decade, gold bugs religiously tracked the physical gold inventory located in the various gold vaults that make up the Comex system, eagerly awaiting the day when there would be more deliverables (via paper shorting of gold) than physical in storage, sparking a historic, Volkswagen-like short squeeze. Well, the day of a historic Comex short squeeze finally arrived… only it wasn’t in gold but in the far less precious metal that is copper.

It all started one month ago, when we reported that in an attempt to enforce sanctions against Russia that actually worked (as opposed to the joke that is the western “oil embargo” now openly breached by absolutely everyone), the “US, UK Banned Deliveries Of Russian Copper, Nickel And Aluminum To Western Metals Exchanges.” There, in our conclusion, we wrote that “history has taught us that the market will price in some “full-sanction” risk premium which when combined with the current macro bid (reflation narrative, electrification, “copper is the first AI commodity” etc.) means we expect a complex wide rally.” Little did we know how truly historic said rally would be just one month later.

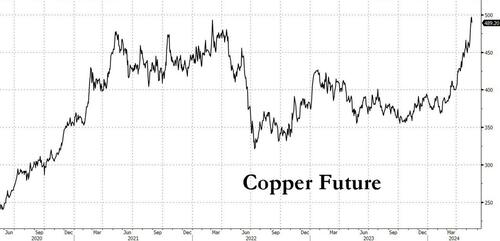

As anyone who has been following the recent moves in the price of copper – which is hitting daily record highs – knows by now, a massive dislocation between the prices for copper traded in New York and other commodity exchanges has rocked the global market for the metal and prompted a frantic dash for supplies to ship to the US.

The source of the disruption, as Bloomberg reports, is a record short squeeze that has driven up copper prices on the Comex exchange to the point where the premium for New York copper futures above the London Metal Exchange price has rocketed to an unprecedented level of over $1,200 per ton, compared with a typical differential of just a few dollars.

The blowout in that price spread has wrong-footed major players from Chinese traders to quant hedge funds, all of whom are now scrambling for metal that they can deliver against expiring futures contracts!

Adding fuel to the fire, the surge in the price is not just driven by technicals but also reflects the surge of interest from speculators after forecasts that long-term copper mine production will struggle to keep pace with demand. We have discussed the fundamental case for copper in “The Copper Supply Shortage Is Here“, and most notably in “the Next AI Trade” where we said that copper is starting to show signs of what Goldman has called “AI exposure” considering it is an essential material to produce power, and added that Goldman recently has gone full-bore pushing for copper (see the following note from Goldman S&T “Turning Copper into Gold” available to professional subs).

While less important than the LME, Comex, which is part of the CME Group, is a key playground for investors, some of whom have used the exchange to build up large bullish bets on copper in recent months

“The broader story is that there are new investment funds that are boosting their exposure to copper for a multitude of reasons, and while that’s a global trend, a huge amount of that investment has been heading to Comex,” said Matthew Heap, a portfolio manager at Orion Resource Partners, the largest metals-focused fund manager.

As shown in the charts above, while copper prices had been rising for months, this week’s spike was specific to the Comex and the most-active futures contract for July delivery. By Wednesday, the July price had soared as much as 10%, touching a record high for that contract, even as the global benchmark contract on the LME traded broadly flat. The move, Bloomberg reports citing numerous traders and brokers, was a classic short squeeze as market participants who had placed bets on the Comex contract moving back into line with prices on the LME and in Shanghai, the other global copper benchmark, were forced to buy those positions back as prices rose, creating a vicious cycle and sending the price to a record.

Indeed, as Colin Hamilton, managing director for commodities research at BMO Capital Markets, said the spread of more than $1,000 a ton between Comex and London was “something never seen previously,” adding that “there has been a squeeze on short positions into contract expiry, exacerbating the move.”

In yet another example of hedge funds and other traders being too smart for their own good (i.e. a replay of the original GameStop short squeeze), they had taken the other side of the bullish trades on Comex, betting on narrowing differentials between the contracts in New York, London and Shanghai, or between New York contracts for different delivery dates, often with massive leverage. With prices on the Shanghai Futures Exchange relatively depressed, some Chinese physical market participants had also sold on the LME and Comex, with plans to export.

Putting this all together, and on Wednesday morning, the July Comex copper contract soared to a record $5.128 a pound ($11,305 a ton), also trading at a record premium above the September Comex contract — a monster backwardation that is hallmark of a short squeeze.

While the spike was driven by short covering rather than any overall physical shortage, traders and brokers say, but it has shined a light on relatively tight supplies in the US copper market, just as we warned a month ago in “The Copper Supply Shortage Is Here. Case in point, inventories tracked by the Comex currently total 21,066 short tons, while LME inventories in the US are just 9,250 tons. For comparison, annual US copper demand is almost 2 million tons. Traders say solid demand, and shipping issues at the Panama and Suez canals, have left the market tight. Indeed, US copper imports year-to-date are down 15%, according to consultancy CRU Group.

“We continuously monitor our markets, which are operating as designed as market participants manage copper risk and uncertainty,” the CME said in a statement.

Of course, as our readers know too well, short squeezes are nothing new in commodity markets, and they often prompt a mad scramble to find supplies of raw materials that underpin paper contracts. The most recent and vivid example is the Nickel short squeeze of March 2022, when the Russian invasion of Ukraine led to a huge shortage in the market, and a staggering surge in the price which nearly bankrupted one of China’s biggest commodity traders and the LME itself.

A similar squeeze took place in 2020, when Covid locked down much of the world, and gold traders raced to ship metal to address a similar dislocation between New York and London bullion prices. And in 1988, a short squeeze in aluminum led some traders to load the metal into jumbo jets — a highly unusual and costly mode of transport for industrial raw materials — in order to get it on to the LME as soon as possible.

The current Comex copper squeeze has triggered a similar dash to send copper to the US: Chinese traders have spent the past 24 hours calling around shipping companies to try to secure transit to the US, according to people familiar with the matter.

Traders and miners in South America have also raced to boost their US shipments. According to Bloomberg, Chilean copper-mining giant Codelco is directing all of its available volumes to the market and also negotiating with customers to postpone some sales so that it can maximize deliveries.

That said, there are tentative signs that the squeeze is easing: the July copper contract edged lower on Thursday morning after coming off its highs from Wednesday, while the premium over cash copper on the LME narrowed to $573 a ton — although still a historically elevated level.

There may be further relief ahead, as investors with bullish positions via commodity indexes are set to start rolling their copper positions in early June, providing an opportunity for traders with short positions to defer delivery, potentially easing the backwardation. Still, it remains unclear if that will be enough to resolve the squeeze ahead of the expiry of the July contract, which goes into delivery at the start of that month. And any attempts to provide further metal to the US to ease the squeeze may face challenges: Chinese traders seeking to transport metal to the US have found that shipping schedules are fully booked, with the earliest available shipping slots from Shanghai to New Orleans at the beginning of July, said Gong Ming, analyst with Jinrui Futures Co.

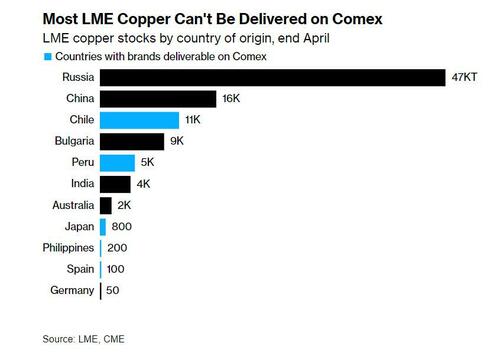

Adding to the plight of those caught out by the squeeze is the fact that much of the copper inventories outside the US is from brands that aren’t deliverable against Comex futures. For example, more than 80% of the 94,700 tons of copper on the LME at the end of April was produced in Russia, China, Bulgaria or India — countries whose copper isn’t deliverable on Comex as we reported a month ago, in a development that has eventually cascaded into today’s historic squeeze.

And while substantial inventories have built up in China in recent months, traders estimate that only about 15,000 to 20,000 tons of that could be delivered against Comex futures.

“We do not think the physical arbitrage activity will be sufficient by the July expiry to close the arb on the near month. There is not enough material and not enough time,” said Anant Jatia, chief investment officer at Greenland Investment Management, a hedge fund specializing in commodity arbitrage trading.

“However, physical traders are currently heavily incentivized to move copper into the US and over time the arb market will stabilize.”

As for gold bugs, watching with sheer shock – and outright jealousy – the epic squeeze roiling the less precious metal, all they can hope for is that one day the massive paper shorts on the comex will lead to a similar meltup in gold. All that may be needed is a pair of enterprising Hunt Brothers for the new millennium to pull it off.

Tyler Durden

Thu, 05/16/2024 – 14:45

via ZeroHedge News https://ift.tt/5wpWk9r Tyler Durden