DTCC, Chainlink Complete Fund Tokenization Pilot With JPMorgan, Templeton And Other Financial Giants Participating

By Tom Mitchelhill of CoinTelegraph

The world’s largest settlement system, the Depository Trust and Clearing Corporation (DTCC), and blockchain oracle Chainlink have wrapped up a pilot program with several major banking firms in the United States to increase traditional finance fund tokenization.

The Smart NAV Pilot program was conducted to standardize a method of providing net asset value (NAV) data of funds across blockchains using Chainlink’s Cross-Chain Interoperability Protocol (CCIP), according to a May 16 DTCC report.

“The pilot found that by delivering structured data on-chain and creating standard roles and processes, foundational data could be embedded into a multitude of on-chain use cases, such as tokenized funds and ‘bulk consumer’ smart contracts, which are contracts that hold data for multiple funds,” it wrote.

These capabilities could support future industry exploration, as well as powering “numerous downstream use cases” like brokerage applications, more automated data dissemination and easier access to historical data for funds, it said.

The pilot helped establish better-automated data management, limited impact on existing market practices for traditional financial institutions, enabled clients to retrieve historical data without manual record keeping and provided broader application programming interface (API) solutions for price data, the DTCC’s report noted.

The United States banking firms that participated in the pilot include American Century Investments, BNY Mellon, Edward Jones, Franklin Templeton, Invesco, JPMorgan, MFS Investment Management, Mid Atlantic Trust, State Street and U.S. Bank.

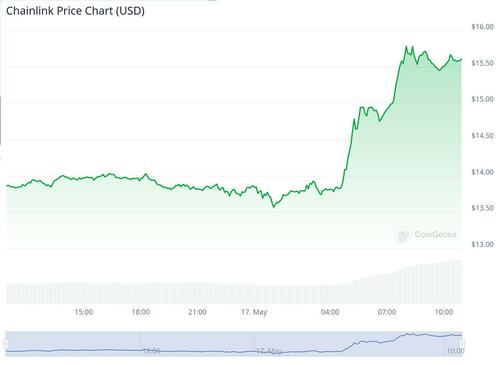

LINK has gained over 130% in the last 12 months amid a broader uptick in the crypto market.

The DTCC report comes amid wider enthusiasm for real-world asset tokenization from major traditional financial institutions.

On March 19, BlackRock launched a tokenized money market fund dubbed BUIDL on the Ethereum network, offering native U.S. dollar yields.

The fund allows investors to purchase tokens representing shares in the fund, which invests in assets like U.S. Treasury bills. The fund is referred to as the “digital liquidity fund” because it is digitized on the Ethereum blockchain and operates as an ERC-20 token called BUIDL.

Tyler Durden

Fri, 05/17/2024 – 15:40

via ZeroHedge News https://ift.tt/W24Tn65 Tyler Durden