Cryptos Soar On Ether ETF Hope As Downbeat Dimon Sends Gold To Record-er Highs

A quite macro and micro day saw stocks start off strongly but fade after JPM CEO Jamie Dimon offered his now ubiquitous downbeat view of the foreseeable future.

“I’m cautiously pessimistic. We have the most complicated geopolitical situation that most of us have seen since World War II, if you study history. We don’t really know the full effect of QT. I find it mysterious that, somehow, it had this beneficial effect, but it’s not going to have a negative effect when it goes away. I personally think inflation is a little bigger than people think and that rates may surprise people.”

Stocks were mixed as Nasdaq outperformed (with a big opening bump from Mag7 stocks) but The Dow was the big laggard. S&P fell back to unch and Small Caps ended with a small gain…

After its last second sprint to close above 40,000 on Friday, The Dow just could not hold on…

Mag7 stocks were panic-bid (safe haven?) at the open but faded…

Source: Bloomberg

The story of the day was in ‘alternatives’ though as gold and crypto soared.

The barbarous relic hit a new record high ($2450 Spot)…

Source: Bloomberg

Silver surged back above $32.00 for the first time since 2013…

Source: Bloomberg

The dollar limped modestly higher (with a JPY driven spike intraday)…

Source: Bloomberg

And then early gains in crypto accelerated after Bloomberg’s ETF guru Eric Balchunas upgraded his view of Spot Ether ETF approval to 75% (vote expected this week).

Update: @JSeyff and I are increasing our odds of spot Ether ETF approval to 75% (up from 25%), hearing chatter this afternoon that SEC could be doing a 180 on this (increasingly political issue), so now everyone scrambling (like us everyone else assumed they’d be denied). See… https://t.co/gcxgYHz3om

— Eric Balchunas (@EricBalchunas) May 20, 2024

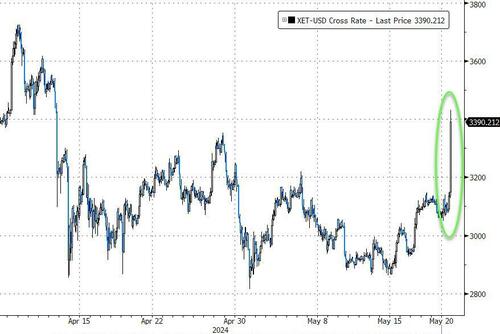

That sent Ethereum soaring back above $3400…

Source: Bloomberg

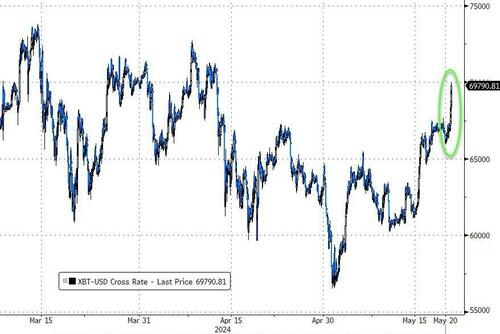

…and lifted Bitcoin even further, back with pennies of $70,000…

Source: Bloomberg

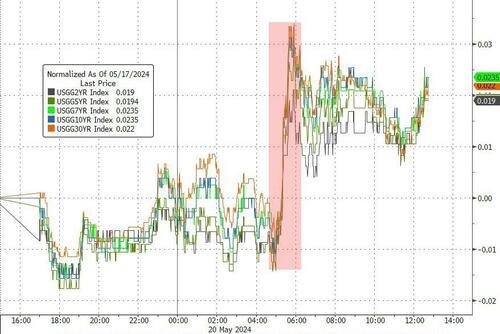

Treasury yields ended the day higher (but only marginally +1-2bps)…

Source: Bloomberg

As rate-cut expectations drifted hawkishly lower, erasing all the dovish CPI jump…

Source: Bloomberg

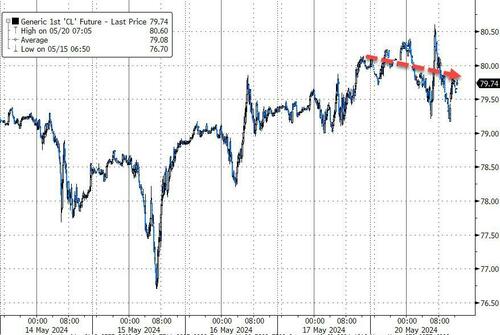

Oil prices ended lower on a choppy day…

Source: Bloomberg

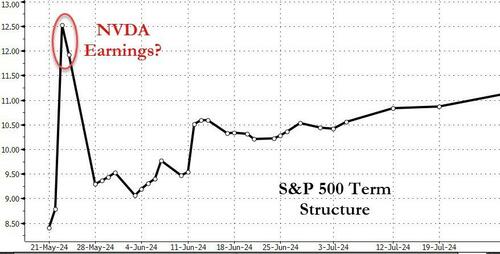

Finally, is this the week?

Source: Bloomberg

The vol market is ready for some anxiety…

Source: Bloomberg

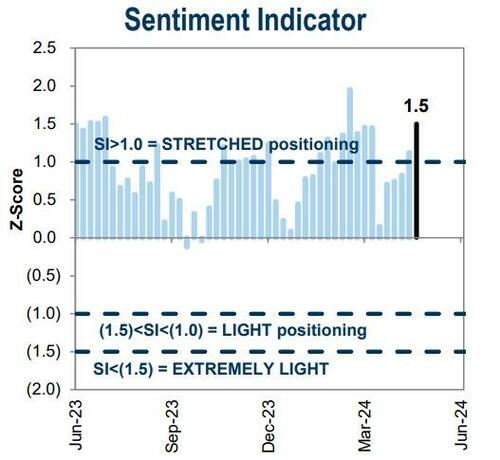

But, Goldman is a little worried…Positioning at the US index level is stretched. The Sentiment Indicator (SI) is a measure of aggregate positioning and risk sentiment in the US equity market.

The Sentiment Indicator tracks investor positioning across the more than 80% of the US equity market that is owned by institutional, retail and foreign investors. To calculate the Sentiment Indicator we run a Principal Component Analysis (PCA) on six weekly and three monthly indicators that span these three investor types. Readings of +1.0 or higher have historically signaled stretched equity positioning.

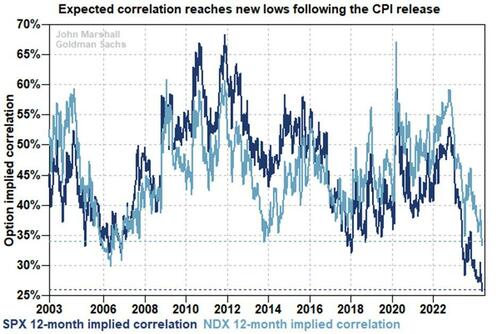

And options markets are pricing the lowest correlation expectation in history….

That’s the real ‘fear’ index and its showing absolutely none right now. Investors are fearless.

Tyler Durden

Mon, 05/20/2024 – 16:00

via ZeroHedge News https://ift.tt/XSr452A Tyler Durden