Bond Traders’ Angst Around Election Time Higher Than For Stocks

Authored by Garfield Reynolds via Bloomberg,

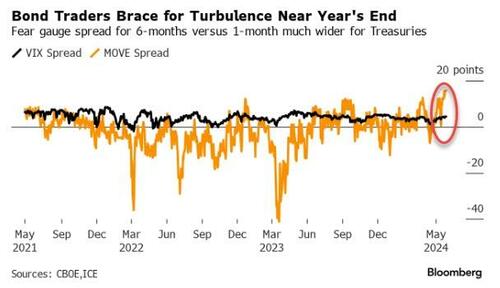

Even in an environment where implied volatility readings are grinding lower, there’s some noticeable angst appearing around the November US elections.

Bond traders look much more uncertain about the outlook for six months ahead than they do for the coming month, which underscores the potential for turmoil with both presidential candidates leaning toward increased spending.

There’s also speculation that Donald Trump would follow through after his comments earlier this year that he wouldn’t reappoint Jerome Powell as Fed Chair if he wins the US election.

The so-called fear gauges for Treasuries are showing the widest gap since 2014 between expectations for yields swings six months from now and the expectations for a month ahead. That’s similar to the picture for a range of currencies – the yuan’s 6 month-1 month volatility gap is the widest since 2016.

Equities look far less concerned, with the similar spread for the VIX only around the highest this year.

Bonds, and currencies for that matter, also have more than just the election on their plate when they look ahead toward the concluding weeks of 2024. Traders are seeing the November-December period as crucial for the Fed’s easing cycle, if it does indeed turn up this year.

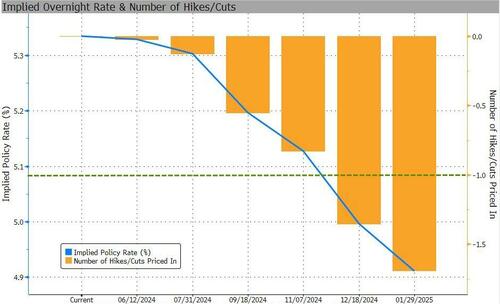

OIS contracts show one reduction this year as the most likely outcome – with November or December the focus of bets for when the rate cut comes.

As of the end of last week swaps priced in an 80% chance for a cut by the end of the November FOMC meeting, and signaled they were certain there would be at least one reduction for 2024 once the December meeting concludes.

They even seem to envisage a scenario where the Fed carries out back-to-back easings in the final two meetings of the year.

The end of this year is seen as being at least as exciting on the economic front as it could be on the political side of things.

Bond traders will be hoping they face a Happy New Year indeed after what they expect to be a relatively tumultuous run into Christmas.

Tyler Durden

Tue, 05/28/2024 – 15:00

via ZeroHedge News https://ift.tt/hxD4TeC Tyler Durden