Ugly 5Y Auction Sends Yields To 2 Week High

It wasn’t quite as ugly the dismal 2Y auction earlier today but it was still ugly.

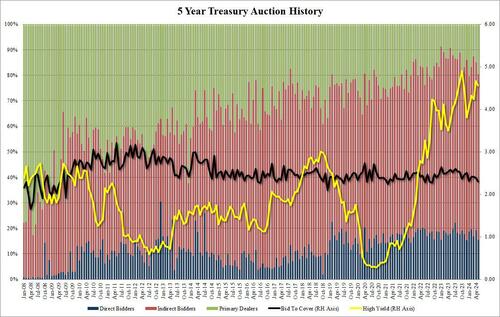

Moments ago the US Treasury sold $70BN in 5Yr paper, tying the record for biggest auction for this maturity set last month, in what was another subpar sale.

The high yield of 4.553% was below last month’s 4.659% but it still tailed the When Issue 4.540% by 1.3bps, the biggest tail since January.

Just like in the day’s previous coupon auction, the bid to cover slumped, dropping from 2.39 to 2.30, the lowest since September 2022, and well below the six auction average of 2.41.

The internals were not quite so bad, with Indirects taking down 65.0%, down from 65.7%, and just below the 66.1% recent average. And with Directs awarded 15.4%, down from 19.2% in April, Dealers were left holding 19.%, up from 15.0% last month and the highest since January.

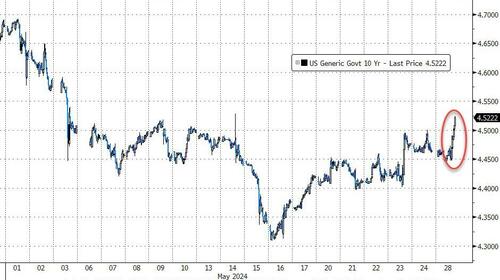

Overall, this was the day’s second disappointing auction, and while not nearly as ugly as the 2Y 90 minutes ago which sent yields to session highs around 4.50%, the 5Y was ugly enough to push yields even higher, up to 4.524%, a fresh 2 week high, as surely concern about the trajectory of soaring US yields are again starting to mount.

Tyler Durden

Tue, 05/28/2024 – 13:20

via ZeroHedge News https://ift.tt/Eef1VYw Tyler Durden