Supply Shock: Shipping Container Costs Top $10,000 Amid Red Sea Turmoil Thinning Global Capacity

A more conventional supply shock is underway – nowhere near the nuclear-level hit by government-enforced lockdowns several years ago. The Israel-Hamas war has led to Iran-backed Houthis freezing the critical maritime chokepoint of the Bab al-Mandab Strait, attacking Western commercial vessels with missiles and drones (the latest incident on Tuesday), and forcing major shipping operators to reroute containerized freight around the Cape of Good Hope, which strains the world’s containerized capacity and has just sent shipping costs surging once again.

Bloomberg reports new data from France-based CMA CGM SA, the world’s third-largest carrier, indicating that the cost of shipping a 40-foot container from Asia to northern Europe jumped to $7k in the second half of June, up from $5k in the first half of the month. Rates ranged from $6k to $6.5k, with premium services approaching $1k.

“With capacity stretched by more than five months of attacks on vessels in the Red Sea, the container shipping industry is scrambling to meet demand that’s picking up in the US and Europe,” Bloomberg said.

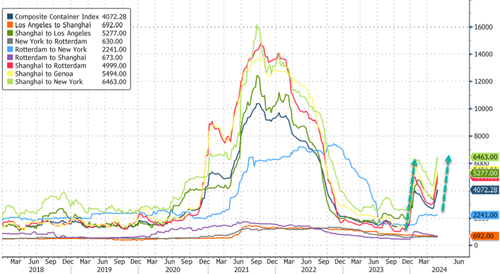

Data from Bloomberg shows that Shanghai to Los Angeles, Shanghai to Rotterdam, Shanghai to Genoa, and Shanghai to New York are some of the most critical shipping lanes experiencing a price jump.

Trine Nielsen, senior director and head of ocean EMEA at Flexport, said companies are “double-booking or increasing booking numbers to secure space” amid thinning capacity.

The chief executive of Germany-based Hapag-Lloyd AG, the world’s number five container carrier, blamed the surge in shipping rates on the continued Red Sea chaos and shrinking capacity, plus “really strong demand.”

There are no forecasts on how long the price surge will last. However, Hapag-Lloyd CEO Rolf Habben Jansen said, “It could still last for another couple of months if the Red Sea situation doesn’t improve.”

News today from Bloomberg says Israel will need at least seven more months to defeat Hamas. This suggests the fight could expand outside of Gaza to either Lebanon or Iran. If that’s the case, expect continued bombardment of ships in critical maritime chokepoints by Houthi rebels – with increasing risks of an oil supply shock that could send Brent crude over $100/bbl.

What a mess for Jerome Powell and company trying to slay the inflation monster.

Tyler Durden

Thu, 05/30/2024 – 02:45

via ZeroHedge News https://ift.tt/RhP8Xa9 Tyler Durden