Futures Dip On Disappointing Tech Results As Markets Brush Off Trump Verdict

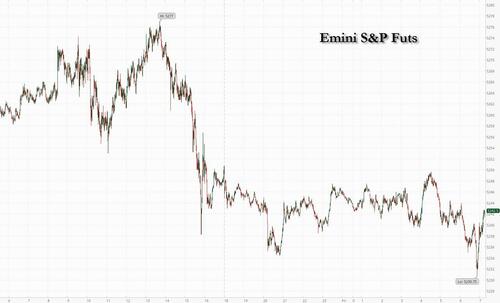

Futs are slightly lower as bond yields rise after European inflation prints came in stronger than expected and PCE looms. As of 7:30am S&P futures are down -0.2%, off the worst levels of the session; Nasdaq futures slumped 0.5% as last night’s latest round of tech earnings disappointed: DELL plunged -14% as it failed to meet the high expectations on AI demand; MDB cratered 24% and is now down 55% below YTD highs. Indeed, most AI names (ex-NVDA) are mostly lower: AMD -1.0%, MU -78bp. Bond yields are 1-2bp higher in sympathy with the move wider in Bunds where the latest data showed European consumer prices rose more than expected; the Bloomberg dollar index dipped and commodities, energy and ags are mostly lower. Today’s macro data focus will be March PCE release; the street expects a headline and core PCE print of +0.3% MoM; on YoY basis, Core PCE is expected to rise 2.8%. Over the weekend, NVDA will host the CEO live keynote ahead of the Computex 2024 event on Sunday June 2 at 7am ET.

In premarket trading, megacap tech was mixed: NVDA +58bp, MSFT +25bp, AAPL -22bp, TSLA -53bp. Dell shares sink 15% as the personal computer maker’s strong AI server sales fail to impress investors. Analysts note that the first revenue increase since 2022 came at the cost of weaker profit margins. Here are some other notable premarket movers:

- Asana shares rise 13% as RBC says the application software company’s first-quarter results show signs of demand stabilization.

- Gap shares soar 23% after the apparel retailer reported first-quarter total comparable sales that topped Wall Street expectations, and upgraded its sales and margin projections for the full year.

- Marvell Technology shares fall 4.8% after reporting net revenue for the first quarter and July guidance in-line with average analyst estimates. Despite the match, the chipmaker’s “high share price leaves little room for error,” Morgan Stanley analysts write in a note.

- MongoDB shares plummet 25% after the database software company cut its full-year forecast, the latest in a series of disappointing software company results. DataDog -2.8%

- Nordstrom shares slide 7.4% after the apparel retailer’s first-quarter adjusted Ebitda missed estimates.

- PagerDuty shares rise 11% after the wireless applications company boosted its adjusted earnings per share forecast for the full year.

- SentinelOne shares slump 14% after the security software company cut its FY25 revenue guidance and annual recurring revenue missed the average analyst estimate. Barclays analysts trimmed their net new ARR FY25 estimates as a reflection of macro headwinds and leadership changes at the firm.

- Trump Media shares fall 6.5% after a jury found Donald Trump guilty of multiple felonies.

- Ulta shares jump 7.0% after the beauty retailer reported first-quarter earnings per share that came in ahead of estimates. The company also lowered its full-year outlook, though analysts said it was now more achievable than before.

- Zscaler shares surge 17% after the security software firm’s results beat estimates and it raised its full-year forecast as demand for its platform grows. Analysts noted that Zscaler is defying a broader slowdown in the industry, and increased their price targets on the stock.

Prior to the recent swoon in tech, and especially software names, stock gains this month were fueled by the rally in tech as well as Jerome Powell’s dovish posture on rates at the start of May. That optimism has faded over the course of the month, and Friday’s data could revive hopes for easing if there are signs inflation is returning to target.

Indeed, investor attention now turns to the Federal Reserve’s preferred price-growth measure, the core PCE deflator, due at 8:30am and which likely moderated in April to the slowest monthly pace yet this year. As previewed earlier, headline PCE prices are seen rising +0.3% M/M in April (prev. +0.3%), with the annual rate expected to be unchanged at 2.7%. The core measure is seen rising +0.2% M/M (prev. +0.3%), while the core rate of annual PCE is seen unchanged at 2.8% Y/Y, although even a modest dip in the annual print would lead to the lowest annual increase in three years, since April 2021.

Elsewhere, a jury found Donald Trump guilty on all 34 counts of falsifying business records at his hush-money trial, making him the first former US president to be convicted of crimes. With Trump to due to face sentencing on July 11, the conviction creates a challenging legal and political path as he faces Biden in November as the presumptive Republican nominee. Trump Media & Technology Group traded down 12% in extended trading Thursday.

“Expectations for a guilty verdict were somewhat priced into markets,” Paresh Upadhyaya, director of fixed income and currency strategy at Amundi Asset Management in Boston. “The bigger impact to markets could be if this guilty verdict begins to turn the momentum away from Trump to Biden.”

European stocks are little changed with losses in technology shares capping any upside in the Stoxx 600. Here are the biggest movers Friday:

- Neoen share rise as much as 21% to €37.98 following news that Brookfield is in exclusive talks to acquire a majority stake at a price of €39.85 per share

- Centrica rises as much as 4.6% as analysts at RBC Capital Markets raised the British energy company to outperform, expecting further scope amid market tailwinds

- Nel gains as much as 9.5% after its Cavendish Hydrogen fueling division applied for its shares to be admitted to trading on the Oslo Stock Exchange

- Lalique Group shares climb as much as 32% to CHF 39.60 as its majority shareholder Silvio Denz intend to delist the company’s shares from the Swiss stock exchange

- Capgemini shares slide as much as 6.9% to the lowest since November after JPMorgan and Jefferies both downgraded their buy ratings on Friday

- Flutter Entertainment shares fall as much as 18% in London after the CFO announced his departure; today is also the first day Flutter’s primary listing is in the US

- JD Sports drop as much as 13%, the most in almost five months, after full-year adjusted pretax profit and sales from the sports apparel retailer missed estimates

- Pharming shares tumble as much as 12% to the lowest since June 2022 after the Dutch biopharmaceutical company noted a delay to the European regulatory review

- AB Foods fall as much as 3.8%, the most in a month, after Wittington Investments announced a sale of up to 10.3m shares at a discount of 4.1% versus Thursday’s close

Earlier, Asian stocks failed to hold initial gains to head for their second straight weekly decline, dragged by a selloff in equities in Hong Kong while contraction in factory activity weighed on Chinese shares. The MSCI Asia Pacific Index rose as much as 0.7% before trading little changed as TSMC, Tencent and Alibaba were among the biggest drags. Japan and New Zealand were among the key gainers, while a rebound in Samsung helped Korean shares higher. Shares fell about 1.5% on the week. Despite the recent decline, the Asian benchmark is still on track for a monthly gain of about 1.5% on an easing dollar and renewed expectations for help from the Fed, in addition to China’s support measures for its beleaguered property market.

In FX, the Bloomberg Dollar Spot Index is up less than 0.1% and is set to end the month 1% lower in May, after rising in the previous four months. The Swiss franc and Japanese yen are the weakest of the G-10 currencies. Euro rises 0.1% against the dollar to 1.0845 after earlier falling to 1.0811. The yen slips 0.3% to 157.27 per dollar, having risen 0.2% earlier due to a pickup in Tokyo CPI in May. In emerging markets, South Africa’s rand led declines after falling more than 3% over three days. Investors are awaiting the final results of the nation’s elections amid concern over the different permutations a coalition may take, and whether a market-friendly government will emerge.

In rates, US Treasuries slip, sending 10-year yields 1-2bps higher to 4.56%. German bund yields advanced five basis points to 2.70%, the highest since November, after the latest data showed European consumer prices rose 2.6% from a year ago in May, up from +2.4% in Apr and ahead of the Street’s +2.5% forecast. Core CPI came in +2.9%, up from +2.7% in Apr and ahead of the Street’s +2.7% forecast. Still, traders maintained bet for a cut at the ECB meeting next week, but reduced bets on easing after that. US Treasuries were also slightly cheaper across the curve with losses led by front-end, following a more aggressive selloff across bunds. Focal points of US session include PCE deflator data at 8:30am New York time. Treasuries may subsequently garner support from month-end buying flows, with a larger-than-average extension estimated for June.

In commodities, oil prices declined, with WTI falling 0.3% to trade near $77.70. Spot gold is steady near $2,343/oz.

Bitcoin has reversed earlier losses and trades just above $68k, while Ethereum has staged a rally and is trading just above $3,800.

US economic data includes April personal income and spending, including PCE deflators (8:30am) and May Chicago PMI (9:45am, 3 minutes earlier to subscribers). Fed officials’ scheduled speeches include Bostic at 6:15pm.

Market Snapshot

- S&P 500 futures little changed at 5,247.75

- STOXX Europe 600 little changed at 516.97

- MXAP up 0.1% to 176.88

- MXAPJ down 0.4% to 547.97

- Nikkei up 1.1% to 38,487.90

- Topix up 1.7% to 2,772.49

- Hang Seng Index down 0.8% to 18,079.61

- Shanghai Composite down 0.2% to 3,086.81

- Sensex up 0.6% to 74,304.07

- Australia S&P/ASX 200 up 1.0% to 7,701.74

- Kospi little changed at 2,636.52

- German 10Y yield little changed at 2.67%

- Euro little changed at $1.0834

- Brent Futures down 0.2% to $81.72/bbl

- Gold spot down 0.1% to $2,341.85

- US Dollar Index little changed at 104.78

Top Overnight News

- Former US President Trump was found guilty by a jury verdict on all 34 counts he faced at the hush money trial and will be sentenced on July 11th. Following the verdict, Trump said this was a disgrace and the real verdict will be on November 5th (US election), while he added that he is innocent and this was a rigged decision. There were also comments from House Speaker Johnson who said this was a shameful day in American history and that “President Trump will rightfully appeal this absurd verdict—and he will win”: WSJ

- China’s NBS PMIs for May fall short of expectations, coming in at 49.5 for manufacturing (vs. the Street 50.5 and down from 50.4 in Apr) and 51.1 for services (vs. the Street 51.5 and down from 51.2 in Apr). RTRS

- Japan’s Tokyo CPI for May is inline on a headline basis at +2.2% (up from +1.8% in Apr and vs. the Street +2.2%) and a tiny but cooler on core (ex-energy/food) at +1.7% (down from +1.8% in Apr and vs. the Street +1.8%). RTRS

- Japan spent a record ¥9.8 trillion ($62.2 billion) in the past month to prop up the yen, surpassing the amount it used in 2022 to defend the currency. BBG

- Eurozone CPI for May runs hot, with core coming in +2.9% (up from +2.7% in Apr and ahead of the Street’s +2.7% forecast) and headline +2.6% (up from +2.4% in Apr and ahead of the Street’s +2.5% forecast). France’s CPI for May also runs a bit hot, coming in at +2.7% Y/Y on an EU harmonized basis, up from +2.4% in Apr and ahead of the Street’s +2.6% forecast. BBG

- France is seeking to assemble a coalition of European countries willing to send military trainers to Ukraine as western allies look for ways to speed up Kyiv’s recruitment efforts in the face of Russia’s renewed offensive. FT

- Trump was found guilty Thursday by a New York jury on all 34 counts in his hush-money case, concluding the first-ever criminal trial of a former president. Now voters will render their own judgment, as Trump, the presumptive GOP presidential nominee, barrels ahead to the Nov. 5 election, using the trial and other prosecutions he faces as a rallying cry for his supporters. WSJ

- Bill Ackman is planning to take his investment firm public as soon as next year, the boldest move yet by the hedge-fund manager to capitalize on his social-media fame. As a precursor to a public listing, Ackman is selling a stake in the firm, Pershing Square, to investors in a funding round expected to value the firm at about $10.5 billion, people familiar with the matter said. That deal is expected to close in the coming days. WSJ

- The Fed’s favored inflation gauge may bring some cheer to markets, with the core PCE deflator forecast to have moderated to 0.2% in April, the slowest monthly pace this year. Personal spending and income also probably cooled. But this alone won’t make the case for rate cuts, Bloomberg Economics said. BBG

- Deutsche Bank CFO James von Moltke said fixed-income trading revenue is set to drop in the second quarter. RTRS

- Fed’s Logan (non-voter) said there are good reasons to think we are still on the path to 2% inflation but it is bumpy, while she added it is too soon to think about rate cuts and policy may not be as restrictive as we might think. Furthermore, she said there are good reasons to believe the neutral rate is higher now than before the pandemic and if the neutral rate is higher than before, it suggests rates won’t go back down to pre-pandemic levels.

- Tesla is recalling 125,227 US vehicles as a seat belt warning system fails to alert occupants of an unbelted seat belt.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly in the green and shrugged off the weak lead from the US but with gains capped amid a deluge of data releases at month-end including disappointing official Chinese PMIs. ASX 200 traded higher with outperformance seen in gold mining stocks and the defensive sectors. Nikkei 225 advanced with the index ultimately unfazed by the mixed data mixed data from Japan including mostly in-line Tokyo CPI, a surprise contraction in Industrial Production and better-than-expected Retail Sales. Hang Seng and Shanghai Comp conformed to the positive tone albeit with gains capped in the mainland after disappointing Chinese PMI data in which Manufacturing PMI unexpectedly slipped into contraction territory

Top Asian News

- Japan’s MOF says it spent JPY 9.788tln on currency intervention between 26th April and 29th May

- Chinese state media said China has richer and more powerful countermeasures if the US continues to violate and endanger China’s sovereignty and security interests on core issues, or squeeze the development space of Chinese firms and individuals. Furthermore, it warned that in the future, whether the US will suffer greater backlash and losses depends on its sincerity and actual actions.

- Japan is to shift USD 640bln in public pension money into active investment, according to Nikkei.

- US Defence Secretary Austin says the meeting with his Chinese counterpart went well, via CNN/Pentagon Spokesperson.

- Tencent Holdings (0700 HK) has reportedly been asked by Chinese regulators to recude the mobile payment market shae of WeChat, via Nikkei citing sources; aimed at the market share of in-person payments rather than online shopping.

- Japan Business Lobby Keidanren Deputy Head Takashima says stable currency is important no matter what levels they may be at.

- Japan Business Lobby Keidanren Deputy Head Yoshida says economic strength and interest-rate differentials are among factors behind the weak Yen, so much boost investment to address this issue.

- Japan Business Lobby Keidanren Deputy Head Nagasawa says current DX levels at the mid-150 Yen range are excessively weak.

European bourses, Stoxx 600 (+0.1%) are mixed, and generally trading near the unchanged mark as focus turn to the upcoming US PCE report. Equities saw very modest pressure on the back of the hotter-than-expected EZ HICP figures. European sectors are mixed and with the breadth of the market fairly narrow; Telecoms takes the top spot, continuing to build on the prior day’s outperformance. Tech is among the worst performers, joined by Travel & Leisure. US Equity Futures (ES -0.2%, NQ -0.4%, RTY -0.3%) are entirely but modestly in the red, continuing the negative sentiment seen in the prior session; however, the price action is relatively contained given the focus around the upcoming US PCE at 13:30 BST / 08:30 EDT.

Top European News

- ECB’s Panetta says policy will remain restrictive even after several rate cuts; Monetary easing will be expected over the coming months if our forecasts are confirmed by data. Must avoid monetary policy becoming too restrictive, which could push inflation below the ECB’s symmetrical target. Euro zone inflation is expected to continue to ease in the next few quarters. Salary rises can also be expected to slow as workers recover purchasing power, firms can be expected to absorb recent salary hikes without raising prices. ECB will take account Federal Reserve’s moves, but not be bound by them. ECB’s balance sheet reduction mustn’t interfere with the monetary policy stance or create a lack of liquidity in the financial system. Larger Italian banks lag behind European peers in IT investments, must step up spending. Says the latest EZ inflation rate of 2.6% is in line with forecasts and as such is “neither good or bad”

FX

- USD is flat and trading within the middle of its weekly 104.33-105.18 range; PCE will likely determine the fate of the USD today with analysts at ING suggesting that a 0.2% M/M print could trigger a run of bond bullishness (USD weakness).

- EUR is a touch firmer vs. the USD in wake of firmer-than-expected headline and core inflation metrics from the Eurozone. Next upside target would come via the high from Wednesday at 1.0861.

- GBP is slightly softer vs. the USD in quiet trade with tier 2 data releases from the UK unable to have much sway on the pair. For now, Cable is caged within yesterday’s 1.2688-1.2747 range.

- JPY is giving back some of yesterday’s gains which saw USD/JPY dragged lower from 157.61 to 156.36. The pair has since moved back onto a 157 handle following mixed data overnight.

- Antipodeans are both a touch firmer vs. the USD. AUD/USD has made further progress on a 0.66 handle but is yet to test yesterday’s 0.6647 as the pair remains in close proximity to its 10DMA.

- South Africa’s ANC vote share drops below 42% based on results from 55.63% of polling stations; FT writes that South African President Ramaphosa’s future is in doubt after disappointing South African election, figure within the ANC notes that if the vote remains close to 40% “people will suggest he leaves”.

Fixed Income

- USTs are slightly softer as Thursday’s bounce runs out of steam and hot Tokyo headline CPI, but with price action fairly contained ahead of the key US PCE figure later today. USTs are at lows of 108-12 having dipped from Thursday’s 108-19+ peak but currently remain comfortably above the WTD base at 107-31.

- Bunds were pressured alongside USTs into Final EZ HICP, prior to this some modest two-way action was seen on German Retail Sales & Import Prices. Thereafter, hotter-than-expected prints on the three headline Y/Y metrics sent Bunds down from circa. 128.90 to a 128.74 base (matching Wednesday’s low); EGBs now back towards pre-release levels.

- Gilts are essentially unchanged with specifics light into EZ HICP, which resulted in some very modest pressure for Gilts to an incremental new session low; Gilts in a narrow 95.62-95.94 bound which itself is entirely within Thursday’s 95.54-95.99 range.

Commodities

- Crude is softer and towards session lows, continuing the overnight pressure seen following the disappointing Chinese PMI data, which saw the Manufacturing component dip into contractionary territory.

- Precious metals are flat/mixed in the run-up to US PCE and unreactive to the hotter-than-expected EZ Flash CPI figures; XAU trades in a USD 2,337-2,347.81/oz range.

- Base metals are mixed and consolidating after yesterday’s slump despite the lack of a clear driver, but amid cautiousness as yields remain elevated and US PCE nears.

- OPEC+ could extend production cuts at the June meeting, via CNBC citing sources; “demand concerns persisted until only recently”. Delegate cited notes that the US SPR release is unlikely to have an impact beyond price relief during the summer period. Three delegates cited said the 2.2mln BPD supply reduction will likely be extended, which is regarded as anticipated by the market; one noted there will probably be market tightness in H2 but added that demand concerns persisted until only recently. Gaza Strip situation is adding a little pressure to prices, but the market has absorbed the majority of this.

- Russia’s Lukoil reportedly plans to restart CDU-6 and catalytic cracker units at Norsi oil refinery (340k BPD) in June, according to Reuters sources

- Chevron (CVX) Australia has confirmed full LNG production has resumed at Gorgon gas facility, according to a spokesperson.

- Ukrainian Navy hit an oil depot in the Krasnodar region of Russia with Neptune missiles.

- Oman Crude OSP calculated at USD 83.89/bbl for July (prev. USD 89.3/bbl M/M, – USD 5.41)

Geopolitics: Middle East

- Senior Israeli Security Official says there will be no truce or any halt in fighting in Gaza which is not part-and-parcel of a hostage release deal

- US military said American and British forces conducted strikes against 13 Houthi targets in Yemen, while Houthi Al Masirah TV said one person was killed in the US-British strikes on Yemen’s Hodeidah.

- Deputy Chairman of Russia’s Security Council says the use of long-range weapons against Russia could become a reason to go to war with NATO.

- “Ukrainian media: The first attacks on the territory of the Russian Federation using US weapons may begin within hours or days”, according to Sky News Arabia

- China has told other governments it will not join the Swiss peace conference on Ukraine and said the peace conference does not meet its conditions since Russia is not attending, according to Reuters sources.

- North Korean leader Kim guided a demonstration of large-scale multiple rocket launchers, according to KCNA.

US Event Calendar

- 08:30: April PCE Deflator MoM, est. 0.3%, prior 0.3%

- April PCE Deflator YoY, est. 2.7%, prior 2.7%

- April PCE Core Deflator YoY, est. 2.8%, prior 2.8%

- April PCE Core Deflator MoM, est. 0.2%, prior 0.3%

- 08:30: April Personal Income, est. 0.3%, prior 0.5%

- April Personal Spending, est. 0.3%, prior 0.8%

- April Real Personal Spending, est. 0.1%, prior 0.5%

- 09:45: May MNI Chicago PMI, est. 41.5, prior 37.9

Central Bank Speakers

- 18:15: Fed’s Bostic Gives Commencement Speech

DB’s Jim Reid concludes the overnight wrap

I arrived back from NY yesterday to unexpectedly find a half-term sleepover with several noisy and excitable 8-year old girls. I ran back to the taxi to try to return to the airport but alas the driver had gone.

While I was away, the last few days have been the first for some time where good economic data (Tuesday) was a reason for markets to sell-off, and then weaker economic data (yesterday) was also seen as a reason for markets to sell-off. In recent times, both good and bad data have managed to build a bullish narrative, as bad data has been seen to raise the likelihood of rate cuts. Having said that, the sell-off this week remains pretty mild and the S&P 500 is only -1.6% beneath its record from last week, so it’s hard to get too excited about a new trend emerging.

On the plus side, sovereign bonds recovered yesterday as investors dialled up the likelihood of rate cuts this year. But on the more negative side, the S&P 500 (-0.60%) still fell back for a second day, as the data included negative revisions to consumer spending. So it encouraged the idea that the US economy had lost some momentum at the start of the year, and it means the S&P 500 has now posted its worst two-day performance (-1.33%) in four weeks.

In terms of the details of that US data, the main headline was that Q1 growth was revised down to an annualised pace of just +1.3%, having been at 1.6% in the first estimate. That included downward revisions on the consumer spending side, with personal consumption expenditures revised down to half a point to +2.0%, whilst final sales to private domestic purchasers was also revised down three-tenths to +2.8%. That final measure was something Chair Powell had cited in his May press conference, as it was argued that underlying demand was strong despite the slowdown in headline growth. So it’s noticeable that’s been revised lower.

The better news came on the inflation side, with headline PCE inflation for Q1 revised down a tenth to 3.3%, whilst core PCE inflation was also revised down a tenth to 3.6%. So that leant slightly against the Q1 inflation spike, although there’s no doubt that it was still well above target. Bear in mind as well that we’ll get some more info on inflation today, as the monthly PCE inflation print for April is out later. That still gets a lot of attention because it’s what the Fed officially targets, even though it comes out after the CPI print a couple of weeks earlier.

This data backdrop proved supportive for sovereign bonds, and US Treasuries saw a clear rally after the release came out, taking the 10yr yield (-6.6bps) to 4.55%. That also came as investors became marginally more confident about rate cuts, with the likelihood of a cut by November up to 83% by the close, having been at 75% the previous day. Yesterday also saw mixed Fedspeak with Federal Reserve Bank of New York President Williams saying, “ I expect inflation to resume moderating in the second half of this year.” Federal Reserve Bank of Atlanta President Bostic added that he did not expect a Fed cut in July but was open to it if the data moved accordingly, and that another hike was not necessary at this time. But on the other hand, Federal Reserve Bank of Dallas President Logan was more hawkish, saying that policy may not be “as restrictive as we think it is” and that all policy options are on the table.

Remember as well that today is the last day before the Fed’s blackout period begins at the weekend, so we now won’t hear from Fed speakers until Chair Powell’s press conference in June.

That dovish trend carried over to Europe, with expectations mounting further that the ECB is going to cut rates next Thursday. Indeed, the likelihood of a cut is now priced as a 97.8% probability by overnight index swaps. In turn, sovereign bond yields fell back across the continent, having closed at their highest level in months on Wednesday. For instance, yields on 10yr bunds (-3.8bps), OATs (-3.7bps) and BTPs (-6.2bps) all fell. And that came in spite of strong labour market data, with the Euro Area unemployment rate down to 6.4% in April (vs. 6.5% expected), which is its lowest rate since the formation of the singe currency.

For equities, there was a more divergent performance on either side of the Atlantic. In the US, the S&P 500 (-0.60%) lost ground, but that was mainly down to sharp losses from tech stocks, with the Magnificent 7 down -1.73% and the Nasdaq -1.08%. In fact, 72% of the S&P was actually higher on the day, and the equal-weighted S&P 500 was up +0.44%, so it wasn’t all bad. For example, the small-cap Russell 2000 saw an even larger gain of +1.00%. Meanwhile in Europe, there was also a decent performance, with the STOXX 600 (+0.59%), the DAX (+0.13%) and the CAC 40 (+0.55%) all recovering after two days of losses.

Overnight in Asia, we’ve seen a more optimistic tone in markets, with a recovery across the major equity indices. That’s come despite weaker-than-expected data from the China PMIs, with the manufacturing PMI falling back to 49.5 (vs. 50.5 expected), whilst the non-manufacturing PMI fell to 51.1 (vs. 51.5 expected). The data out of Japan has also been mixed overnight, with industrial production down -0.1% in April (vs. +1.5% expected), although retail sales did see growth of +1.2% (vs. +0.6% expected). Nevertheless, the weaker data has been seen as raising the likelihood there might be more stimulus, and there’ve been gains for the Nikkei (+0.94%), the Hang Seng (+0.94%), the KOSPI (+0.39%), the Shanghai Comp (+0.27%) and the CSI 300 (+0.20%). Looking forward, however, US equities are still struggling for momentum, and futures on the S&P 500 (-0.19%) currently point towards a third day of losses.

Looking at yesterday’s other data, the US weekly initial jobless claims were at 219k (vs. 217k expected) in the week ending May 25. Continuing claims were also broadly in line with expectations at 1.791m (vs. 1.796m expected). Otherwise, pending home sales were down -7.7% in April (vs. -1.0% expected), taking the index down to its lowest level since April 2020 at the height of the pandemic.

To the day ahead now, and data releases include the US PCE inflation reading for April, alongside personal income and personal spending. Elsewhere, there’s the Euro Area CPI reading for May, UK mortgage approvals for April, German retail sales for April, Canada’s Q1 GDP, and in the US there’s also the MNI Chicago PMI for May. From central banks, we’ll hear from the ECB’s Vujcic and Panetta, and the Fed’s Bostic.

Tyler Durden

Fri, 05/31/2024 – 07:44

via ZeroHedge News https://ift.tt/D601nMu Tyler Durden