Japan Confirms It Spent A Record $62 Billion In Failed Attempt To Prop Up Yen

Confirming what everyone knew, this morning Japan’s finance ministry confirmed that it spent a record ¥9.8 trillion ($62.2 billion) over the past month, but really on two occasions, in a failed attempt to prop up the yen after it fell to a 34-year low against the dollar, surpassing the total amount it used during the last intervention in 2022 to defend the currency, which also failed to prop up the doomed currency.

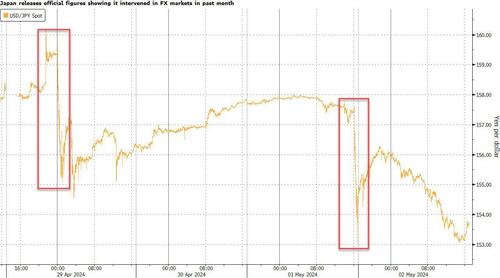

According to Bloomberg, the amount – which covered the period from April 26 to May 29 but really involves the two interventions observed on April 29 and May 1 – exceeded earlier estimates of ¥9.4 trillion based on a comparison of the Bank of Japan’s accounts and money broker forecasts.

The record spending on intervention shows what according to Bloomberg is “the commitment of Japan’s government” to push back against speculators betting against the yen. The huge amount also underscores the scale of action required to have even a short-lived impact on the market and the gradually diminishing power of its salvos to defend the currency.

In keeping with the cartoon nature of the BOJ, Locals had similar cartoonish observations of their central bank blowing tens of billions for literally nothing: “The amount feels a touch on the large side, but it’s largely in the expected range,” said Hirofumi Suzuki, FX strategist at Sumitomo Mitsui. “It didn’t top ¥10 trillion so it doesn’t feel too big and the dollar-yen pair isn’t actually reacting much.”

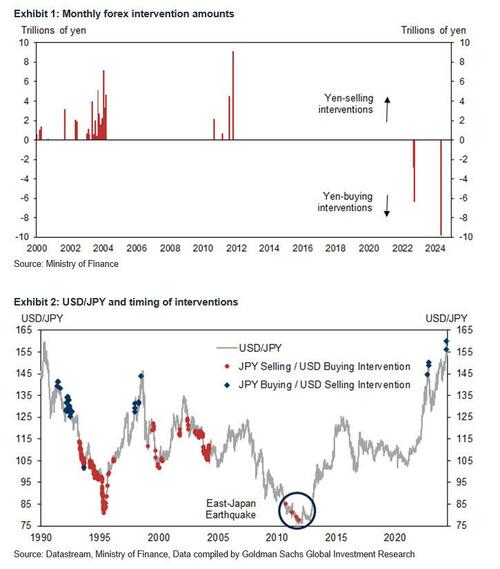

The previous round of MOF intervention was conducted over three occasions in September-October 2022, with a total intervention amount of ¥9.2 tn (September 22: ¥2.8 tn, October 21: ¥5.6 tn, October 24: ¥730 bn). The intervention this time was yet another large-scale operation, surpassing the previous size in JPY terms. The 2022 and the latest interventions were equivalent measured in USD at around $62bn. Prior to this, Japan’s last monthly intervention record of ¥9.1 trillion was set in very different circumstances when authorities were trying to weaken the yen in autumn 2011 following the repatriation flood in the aftermath of the Fukushima explosion.

At the time of interventions, the USDJPY was around ¥160/US$ on April 29 and ¥157.6 on May 2, and while it dropped as low as 153 in the immediate aftermath, the yen is now back to where it was at the time of the second intervention, trading around 157. And while Japan has failed to arrest the collapse of the currency, it has at least managed to reduce the volatility (read explosive momentum collapse) for now. One thing is certain: speculators will push the yen even lower to test just how much more dry powder the BOJ has left after this latest failed intervention, and whether they will spend another $62 billion for nothing. Since the answer is almost certainly no, and since Japan now clearly wants a weaker yen, expect the yen collapse to accelerate in coming weeks.

Currency officials in Japan are aware that their efforts simply buy time rather than reverse dynamics. From that perspective the interventions have been relatively successful. While the yen has given up a large portion of the gains from a month ago, it still hasn’t returned to the 160 mark against the dollar.

“You can’t really say how much impact you’ll get from spending a certain amount of money, since markets are like living creatures,” said Hideo Kumano, executive economist at Dai-Ichi Life Research Institute and a former central bank official. “But without the intervention, the yen would have weakened even more, so I believe that the roughly 10 trillion yen operation was effective.”

We wonder what Hideo will say when the USDJPY is at 200 in a few months time.

Tyler Durden

Fri, 05/31/2024 – 11:20

via ZeroHedge News https://ift.tt/9oMI5vZ Tyler Durden