“Worried About The Whole System Going Down” – Chris Martenson Fears “The Great Taking” Is Imminent

Via Greg Hunter’s USAWatchdog.com,

Dr. Chris Martenson holds a PhD in pathology from Duke University, is a futurist and an economic researcher. Dr. Martenson was one of the very few scientists who called BS on the FDA’s approval of Pfizer’s CV19 vax back in August 2021. Dr. Martenson went on the record to say, “Comirnaty CV19 Vax Approval is Actually Fraudulent.”

Now, Dr. Martenson is out warning about a new kind of fraud that could leave you broke in the next financial disaster. Dr. Martenson thinks financial trouble of Biblical proportions could be coming sooner than most people think. Dr. Martenson is not worried about a brokerage going under, such as Lehman Brothers in the 2008.

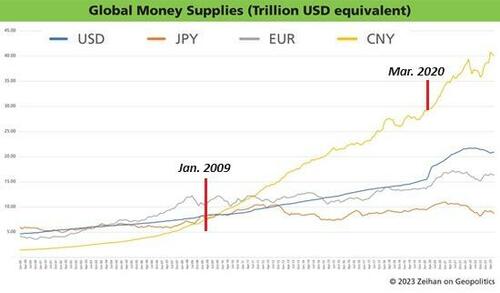

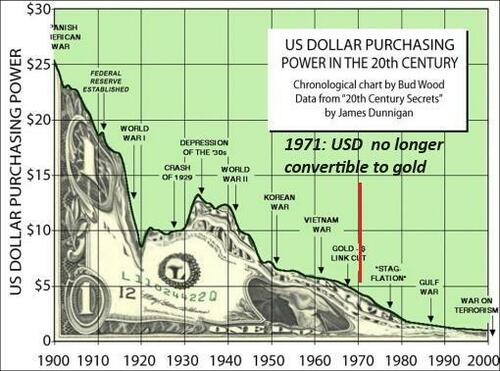

Martenson is worried about the entire system melting down and says, “When the system freezes up, they get really scared. If you are not a complete moron, you would make that system smaller because it scared you that much, but instead, they made it even bigger…”

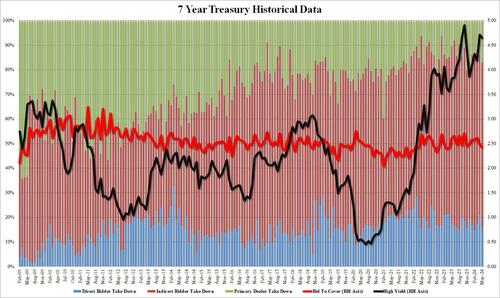

“We not only have to worry about a brokerage going down, but we now have to worry about these clearing parties…

These are the houses that are supposed to be clearing all the trades with the derivatives and the loans… The law says the brokerages have to hold your shares and bonds you have in a proportional amount. They don’t hold them. A higher company does that . . . . and you can’t peer into them.

It you want to see what Fidelity or Schwab has . . . . I found out you cannot see an audit trail.”

In a new market meltdown, Dr. Martenson sees chaos and gives a hypothetical example:

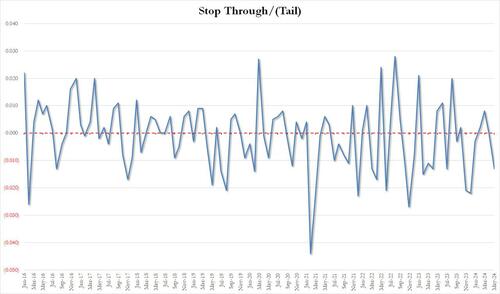

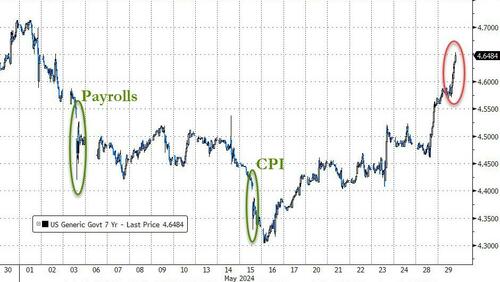

“China attacks Taiwan, and there is a 10 sigma move in the bond market. Oh no, all these derivatives have blown up. These people are supposed to be winners, and these people are supposed to be all losers. No, no, they don’t have any money for that stuff.

It’s too complicated. I don’t think anybody understands how this works anymore. I could not find anybody who could tell me the whole thing. I could find people who knew bits and pieces, but they knew their slice…

I am trying to stitch this thing all together. I get uncomfortable when I can’t answer the most basic questions, and that is how much risk is there in the system and where is it?”

In short, Dr. Martenson is worried about the whole financial system going down. Dr. Martenson says:

“Yes, I am worried about the whole system going down, and that leads to all sorts of speculation…

Imagine this, we wake up one day, and the markets are not open on Monday. Oh no, glitch. Problem. Then, it’s two days and not open, three days not open. People are getting worried. Friday, and the markets are still not open.

Monday comes, and they say it’s a super big problem, and we don’t know how to resolve it…

They offer you 100% value today in a Central Bank Digital Currency (CBDC) account or you can wait it out and hope it gets resolved, and it might take a decade.”

Dr. Martenson likes gold, silver, land and basically all (clear title) physical assets to protect you from “The Great Taking.” Martenson has an upcoming seminar with “The Great Taking” author David Webb (and others) to help you to counter the theft that will surely come in the next financial meltdown.

In closing, Dr. Martenson says,

“This has been a series of large amplitude blunders that keep getting bigger and bigger. ‘The Great Taking’ is the framework built, that just in case all this colossal blundering blows up, Congress and Wall Street flips a coin and you get heads we win and tails you lose. This is the oldest story in the book.”

There is much more in the 38-minute interview.

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with the founder of PeakProsperity.com, Dr. Chris Martenson for 5.28.24.

* * *

To Donate to USAWatchdog.com Click Here

There is lots of totally free information and analysis on PeakProsperity.com. If you want to see the “How to Protect Your Wealth From The Great Taking” seminar on June 15th, click here.

Tyler Durden

Wed, 05/29/2024 – 15:25

via ZeroHedge News https://ift.tt/IFjSwR6 Tyler Durden