Top Medical Journal Slaps Down Scientific American’s Laura Helmuth For Unscientific Trans Activism

Authored by Paul Thacker via The Disinformation Chronicle,

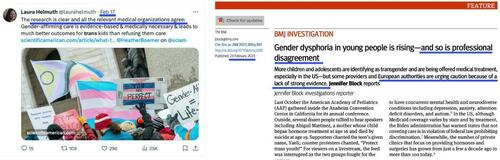

In a shot across the bow against Scientific American’s continued descent into unscientific twaddle, a BMJ investigation documented over a dozen social media posts by editor-in-chief Laura Helmuth promoting transgender care for children, despite scientific evidence showing such treatment has had “devastating consequences” for minors.

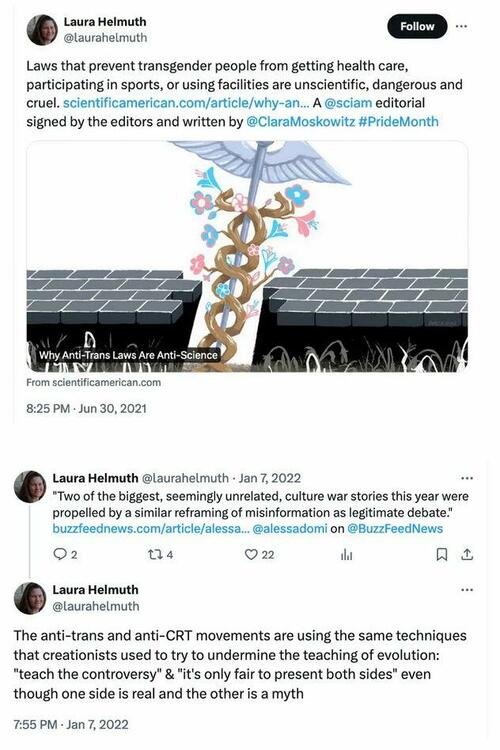

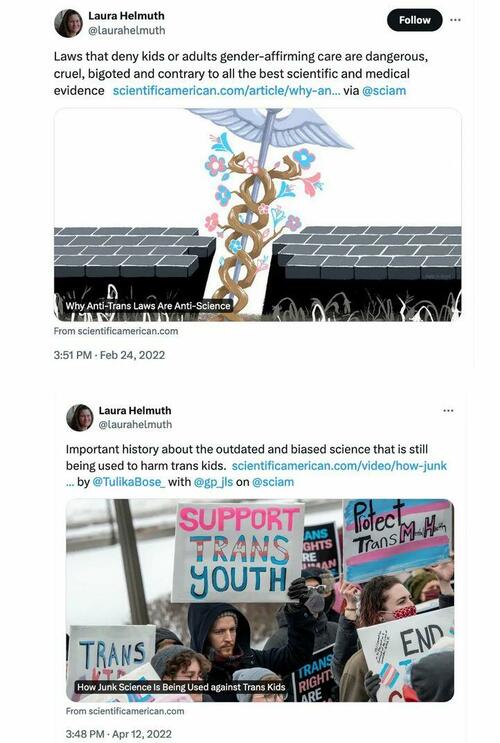

“Laws preventing trans kids from getting gender-affirming treatment are dangerous and abusive, as well as against all medical evidence,” Helmuth posted on X in late 2022, one of many examples that The BMJ sent to Scientific American and its publisher Springer Nature, asking them to explain Helmuth’s trans advocacy which runs contrary to medical evidence.

In other social media posts, Helmuth has labeled critics of dangerous trans gender medicine for children “biased,” “bigoted,” “antiscience,” “misinformation,” “cruel,” and compared them to Nazis.

Last year, Helmut promoted false news in Scientific American that argued, “The research is clear and all the relevant medical organizations agree: Gender-affirming care is evidence-based & medically necessary & leads to much better outcomes for trans kids than refusing them care.”

Six days later, The BMJ released an investigation of new research finding that the evidence for trans gender care for children lacked evidence and that medical authorities were urging caution.

England, Scotland, Wales, and Sweden have all ceased prescribing puberty blockers for children, except for research studies, and the Finnish psychiatrist who first founded the field of transgender care for children now calls it “dangerous.” Many countries’ medical authorities have concluded that studies promoting trans treatment for children were either biased or of low quality.

The BMJ’s targeting of Laura Helmuth was a warning, of sorts—an admonition that Helmuth should focus on science, cease the advocacy, and stop saying stupid things. But if you continue to read Scientific American, expect Helmuth to continue saying stupid things.

Last month, Harvard’s Steven Pinker labeled Helmuth a “woke fanatic” on X and promoted an article discussing Scientific American’s descent into progressive ideology. “Another noble American institution run into the ground when clueless trustees handed over the keys to a woke fanatic,” Pinker posted.

The article Pinker promoted appeared in City Journal (“Unscientific American”) and carefully documented the magazine’s decline into a political rag since Helmuth took the reins in early 2020. Other outlets have also cast a disapproving eye on Helmuth’s political crusades.

The Wall Street Journal noted that Helmuth tweeted last year that “sparrows have four different chromosomally distinct sexes,” forcing the community notes on X to correct Helmuth’s error.

“It’s just incredible how far @sciam — a periodical I admired — has fallen from its mission to provide accurate, clear, and vivid coverage of science,” Yale professor and physician Nicholas Christakis, posted on X.

“EXCLUSIVE: unScientific American! Popular magazine is slammed by experts over ‘woke’ article titled ‘Why Human Sex is Not Binary’,” reported The Daily Mail, a few months prior to Christakis’ criticism of Helmuth. Dr Carole Hooven, an evolutionary biologist at Harvard University, told The Daily Mail that Scientific American’s unscientific claims could put women in danger.

“On average, men are bigger and stronger than women, and commit the overwhelming majority of rapes and murders. Most men could kill most women with their bare hands,” Hooven explained. “These facts have informed the establishment of laws and social policies that protect female spaces, particularly those where women are in vulnerable positions such as where they sleep or shower (prison cells and locker rooms, for example).”

Chicago University emeritus professor of ecology and evolution, Jerry Coyne, has written several times about Helmuth promoting factually inaccurate claims in Scientific American, which he labeled “Scientific Pravda.”

Somebody called my attention to three new articles and op-eds in Scientific American that have no science in them, but are pure ideology of the “progressive” sort. I agree with some of the sentiments expressed in them, as in the first one. But my point is, as usual, to show how everything in science, including its most widely-read “popular” magazine, is being taken over by ideology. Not only that, but it’s ideology of only one stripe: Leftist “progressive” (or “woke,” if you will) ideology, so that the “opinion” section is not a panoply of divergent views, but gives only one view, like a Scientific Pravda. Remember that the editor refused when I offered to write an op-ed expressing different (but of course not right-wing) views.

In a previous City Journal article in 2022, science writer Nicholas Wade called Scientific American’s shift away from science a “new Lysenkoism” referring to the Soviet doctrine that forced biologists to ignore evolution and the genetics of plants to conform to political ideology.

And in an investigation I conducted for the BMJ(“The covid-19 lab leak hypothesis: did the media fall victim to a misinformation campaign?”) I noted that Helmuth harassed CDC Director Robert Redfield for telling CNN he thought the COVID virus may have come from a Wuhan lab:

The growing tendency to treat the lab leak scenario as worthy of serious investigation has put some reporters on the defensive. After Robert Redfield, former director of the Centers for Disease Control and Prevention, appeared on CNN in March, Scientific American’s editor in chief, Laura Helmuth, tweeted, “On CNN, former CDC director Robert Redfield shared the conspiracy theory that the virus came from the Wuhan lab.” The following day, Scientific American ran an essay calling the lab leak theory “evidence free.”

In short, Helmuth is a political fanatic who doesn’t care much for science, unless it’s science that fits her personal politics.

The BMJ’s investigation highlighted the Cass Review which found little evidence to support Helmuth’s claims that the puberty blockers or other trans therapy for children are safe, including surgery. Dr. Hilary Cass is a British physician and former president of the Royal College of Paediatrics and Child Health, who spent three years examining the evidence for treating gender questioning young people.

In a recent interview with the New York Times, Dr. Cass said that doctors in the United States are “out of date” with understanding trans care for children. “But what some organizations are doing is doubling down on saying the evidence is good,” Dr. Cass told the New York Times. “And I think that’s where you’re misleading the public.”

And in podcast for the BMJ, Dr. Cass noted that of the 100 studies for puberty blockers and hormone treatment, only two were of passable quality. She also dismissed claims by activists such as Helmuth that trans care lowers risk of suicide in children.

“There, unfortunately, is not evidence that gender affirming treatment in its broadest sense reduces the suicide risk,” Dr. Cass said, during The BMJ podcast.

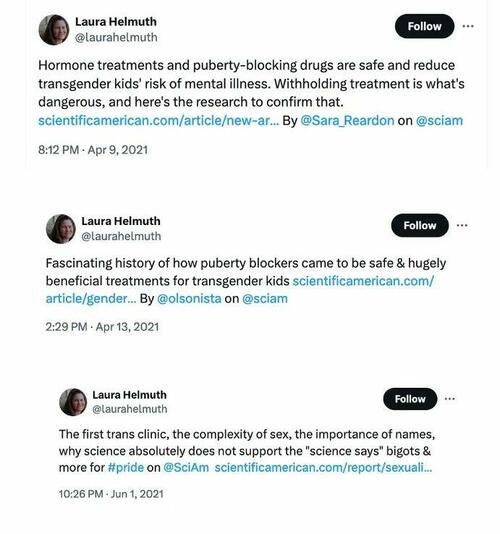

Below are several social media posts by Laura Helmuth crusading for trans care for kids—many of them dangerous messages for children, all lacking quality medical evidence.

To find the latest quality medical evidence on trans care for children, please read The Cass Review, which NHS England commissioned to improve NHS gender identity services, and ensure that children and young people who are questioning their gender identity or experiencing gender dysphoria receive a high standard of care, that meets their needs, is safe, holistic and effective.

Tyler Durden

Wed, 05/29/2024 – 12:50

via ZeroHedge News https://ift.tt/93RbEZq Tyler Durden