Aluminum Prices Hit Two-Year High On Smelter Output Limits In China

Aluminum prices in London reached their highest in two years as the industrial metals rebound theme continued, driven by a combination of supply constraints and the prospect of increased demand in China and the US.

The latest driver for the silvery-white, lightweight metal, used in everything from vehicles to aircraft to window frames to soda cans, comes as China, the world’s top producer, signaled overnight aggressive emission-cutting targets for smelters, in return, tighter metal capacity.

In a further boost for the bulls, China’s State Council pledged to strengthen capacity limits in industries from steel to alumina in a work plan for energy conservation and carbon reduction in 2024-25. The move to constrain additional supply comes at a time when the transition to greener energy is boosting demand for copper and aluminum.

The country will strictly control new capacity for copper smelters and alumina output, and take a reasonable approach in allocating fresh capacity for silicon, lithium and magnesium, the government said late Wednesday.

The government also reiterated strict implementation of the “aluminum swap scheme,” or the requirement for any new smelter to be matched by closure of an existing one. New capacity for aluminum, alumina, polysilicon and lithium batteries must meet advanced levels of energy efficiency, it added. –Bloomberg

With the US economy chugging along with the US government spending $1 trillion every 100 days, i.e., stealth stimulus, demand for metals and other commodities has increased. Easing in China has also boosted the prospect of demand increases for industrial metals. However, Chaos Ternary Research Institute wrote in a note that a near-term pullback in aluminum prices is quite possibly because of inventories in China and deliveries to the London Metal Exchange, which remain elevated.

In markets, aluminum prices on the LME rose 1.4% to $2,734 a ton.

The historic squeeze in New York copper futures fizzled this week, trading below the record high.

Industrial metals tracked by Bloomberg have soared to a 1.5-year high.

As tracked by Bloomberg, spot commodity prices have risen this year to 1.5-year highs.

In a note titled “The 5D Bull Makret,” Goldman analysts led by Daan Struyven and Samantha Dart wrote, “We remain selectively bullish commodities because 1) demand growth remains solid, 2) we see more structural upside in industrial metals and gold, and 3) oil’s geopolitical risk premium has shrunk. We expect commodity total returns to rise from 13% YTD to 18% by year-end.”

The analysts provided more insight into the 5D trends:

- Disinvestment: low investment in commodities induces select tightness

- Decarbonization & climate change: require higher prices to attract green capex

- De-risking (hedging): geopolitical de-risking and strategic restocking support demand for gold and critical commodities

- Datacenters & AI: support demand via power and via higher incomes

- Defense spending: support demand for metals and distillate fuels

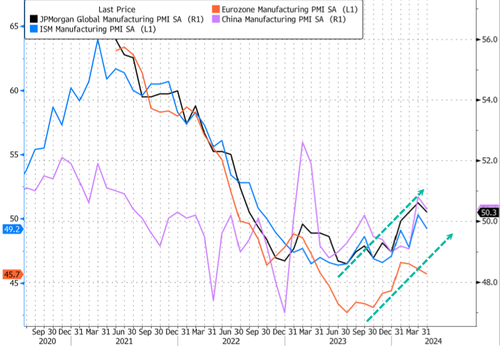

This comes as global Purchasing Managers’ Index data has turned up.

To sum up, rising commodity prices are yet more troubling signs for Jerome Powell & the gang in their attempt to slay the wicked inflation monster.

Tyler Durden

Thu, 05/30/2024 – 15:05

via ZeroHedge News https://ift.tt/Y3fbgrk Tyler Durden