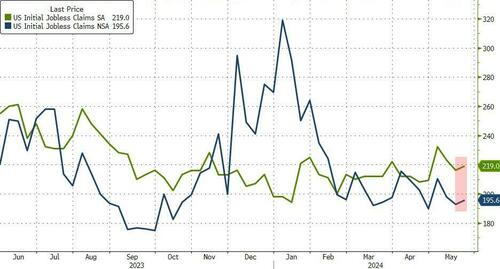

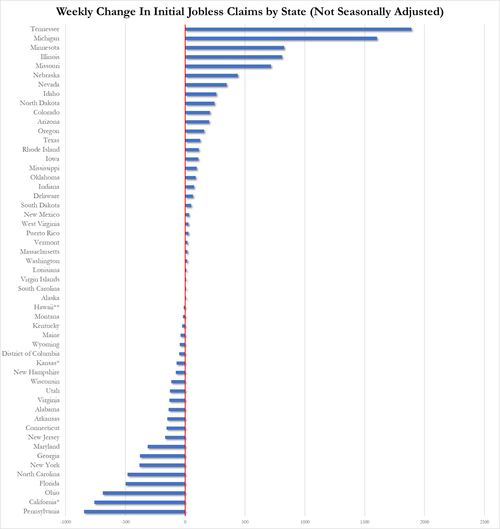

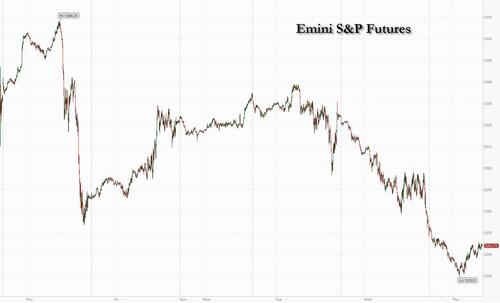

US equity futures are weaker despite lower bond yields, breaking away from this week’s narrative of Equity/Yields negative correlation, after Salesforce plunged 15% due to disappointing guidance. Small-caps are poised to outperform but have failed to hold gains this week. As of 7:45am, S&P futures are down 0.4%, pointing to a second day of declines but off the session’s worst levels as Nasdaq futures drop 0.3% while Europe’s Stoxx 600 benchmark was led higher by telecom and banking stocks. Premarket, the Mag7 names are mostly lower, ex-AAPL, while NVDA is -0.8%, weighing on Semis, dragged lower by the read through from Salesforce. 10Y yields are down 2 basis points after jumping about 15 bps in the past two days. The US dollar is seeing its weakest start to the day for this week; commodities and bitcoin are weaker, too. Today’s macro data focus will be on Jobless Claims, Retail Inventories, Pending Home Sales, and revisions to the 24Q1 GDP print including the GDP Price Index and Core PCE Price Index. Tomorrow we receive the monthly PCE data which should be more market moving.

In premarket trading, Salesforce shares crashed 16% after the software maker said sales growth in the current quarter will stall to its slowest in history. The miss sparked concerns about the sector more broadly, and hit other software names: Oracle (ORCL) -2%, ServiceNow (NOW) -3%, MongoDB (MDB) -1%. Here are some of the biggest US movers before the opening bell:

- Agilent tumbles 13% after the life-sciences company cut its profit and sales forecast for the full year.

- American Eagle drops 7% after the apparel retailer’s first-quarter net revenue narrowly missed consensus estimates. Morgan Stanley flagged the underperformance of the firm’s Aerie brand as a major negative.

- Birkenstock jumps 8% after the sandal maker’s revenue forecast for the year came ahead of analyst expectations.

- C3.ai climbs 10% after the software company forecast 2025 revenue well above the average analyst estimate, supported by demand for artificial intelligence features.

- Foot Locker gains 13% after posting earnings that surpassed expectations as the sneaker retailer tries to get back on pace with its turnaround plan.

- HP Inc. rises 5% after the company reported net revenue for the second quarter that beat estimates.

- Moderna advances 2% after the Financial Times reported that the US government is nearing an agreement to bankroll a late-stage trial of the biotech firm’s mRNA pandemic bird flu vaccine.

- Nutanix drops 12% after the infrastructure software company gave a fourth-quarter revenue forecast that trailed analyst estimates.

- Okta climbs 4% after the security software company raised its full-year forecast.

- Pure Storage gains 9% after the cloud storage provider’s results beat estimates and its second-quarter revenue forecast topped expectations, spurring a round of price target hikes.

Global equities are headed for their worst week since mid-April as US rate-cut expectations dwindle and tepid US auctions stir worries about funding the US deficit. The S&P 500 has advanced for 23 of the last 30 weeks, marking a joint record since 1989, but yesterday it fell -0.74%, and futures this morning are down again so it’s clear that the momentum is now more negative.

As DB’s Henry Allen writes, “markets have had another rough 24 hours, with no sign of the negative momentum letting up overnight. The latest selloff has been driven by a range of factors, but bonds took a particular hit after a weak US Treasury auction yesterday, along with mounting concern about inflationary pressures, which sent European yields up to their highest levels in months.”

BlackRock is sticking to the front end and the belly of the US Treasuries curve as optimism over US easing fades, according to Karim Chedid, the firm’s investment strategy head for EMEA.

“We see that as the area where you’re still getting the most bang for buck in terms of income for stability,” he said in an interview with Bloomberg Television. While the scorching rally in tech companies is underpinned by fundamentals and remains one of BlackRock’s “key sector overweights,” Chedid says he’s seeing growing inflows into European and Japanese equities.

The prospect of a rate cut from the European Central Bank at its June meeting is helping, as is “a bottoming out in the macro data in Europe, which investors are liking,” Chedid said. “Earnings have seen a significant upgrade in Europe over the past 12 months.”

And speaking of the coming ECB rate cut, European stocks are in the green after two days of losses, with telecommunication and bank shares leading gains. Major markets are all higher with Spain the notable outperformer. While some inflation prints have disappointed, the ECB remains on track to launch its easing cycle next week. Regional bonds are seeing a relief rally with Gilts curve the largest mover, seeing bull steepening. Banks among the biggest beneficiaries in EU while UK is seeing add’l support from Cyclicals. Here are the biggest movers Thursday:

- Auto Trader rises as much as 14%, hitting a record high, after the online car marketplace posted FY revenue and profit that beat expectations and said the new financial year has started well

- European renewables stocks are lifted by a renewed focus on M&A after Brookfield announced it is in exclusive talks to acquire a majority stake in French renewable energy developer Neoen

- BW LPG gains as much as 12% and to a fresh record high after the Norwegian LPG shipper reported a “solid” first-quarter beat and provided “positive” second-quarter guidance, DNB says

- Dr Martens rises as much as 11% after the bootmaker reported full-year results. While revenue and Ebitda for the period missed estimates, the company announced a cost savings plan

- YIT rises as much as 12%, hitting the highest since April 2023, as Danske Bank double-upgrades the Finnish construction services firm, giving the stock its sole buy rating

- De La Rue shares climb as much as 9.2% after the banknote maker said it’s in talks with potential buyers for some of its business divisions, but also said there is no certainty of a deal

- Telecom Italia shares fall as much as 9.2% as the telecom operator reported results that showed still challenging trends in Italy as pace of its mobile and broadband subscriber loss quickened

- NKT falls as much as 4.5%, the most since April 22, after Carnegie cut its recommendation for the Danish power cable manufacturer to hold from buy, awaiting “the next leg in the case to unfold”

- Pirelli shares fell as much as 5.8% in Milan trading after shareholder China’s state-backed Silk Road Fund Co. disposed of its stake in the Italian tiremaker

- European software stocks drop after US peer Salesforce gave a weak outlook, spurring worries over a slowdown in the sector more broadly and the firm’s relevance amid the advancement of AI

- South Africa’s main stock index falls 1.8%, the most in more than six weeks, as initial projections of results in Wednesday’s election show a marked decline in support for the ruling ANC party

Asian stocks extended declines into a third session, led by drops in Japanese and Korean equities, as higher US Treasury yields sapped the appeal of riskier assets. The MSCI Asia Pacific Index fell as much as 1.2% to touch its lowest level in three weeks, with TSMC, Samsung and Toyota among the biggest drags. The regional tumble comes after another weak sale of Treasuries reinforced concerns about the impact of higher yields. Japan’s key benchmarks retreated as the country’s long-term yields continued to rise. The yen briefly fell through a level that prompted the latest round of suspected action by Japan to prop up the currency. The Kospi dropped, dragged by losses in Samsung after the firm’s labor union said Wednesday it plans to carry out its first strike ever.

“Asian markets are clearly taking a cue from the US session marked by higher correlation and volatility,” said Homin Lee, a senior macro strategist at Lombard Odier. “We see signs that investors are still nervous about major policy innovations in Japan and China where the recent attempts to tackle the respective macro challenges – real estate in China and currency weakness in Japan – seem to have underwhelmed the markets and need to be ramped up even further,” Lee said.

In rates, treasuries pare some of their recent decline. US 10-year yields are down 2bps at 4.59%, having risen almost 15bps in the prior two sessions; they remain near the highest levels this year as optimism over US rate cuts fades. Gains were led by gilts as European bonds also recoup some of Wednesday’s losses. 2s10s and 5s30s curves remain notably steeper on the week.

In FX, the dollar erased earlier gains to fall modestly, paring Wednesday’s 0.5% advance; the Japanese yen rebounds after falling through a level that prompted the latest round of intervention by authorities. USD/JPY is down 0.5% near 156.88 after hitting a four-week high late Wednesday at 157.71. The Swiss franc is the strongest in G-10 FX, rising 0.7% against the greenback after SNB President Jordan warned a weaker currency is currently the most likely source of higher inflation and could be offset with FX sales. The rand extended losses and banking stocks fell as South Africa’s election vote count gathers pace. The ruling party looks set to fall well short of obtaining a parliamentary majority for the first time since it came to power.

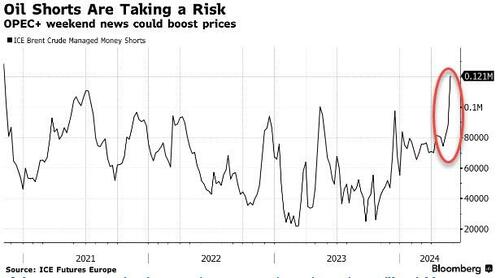

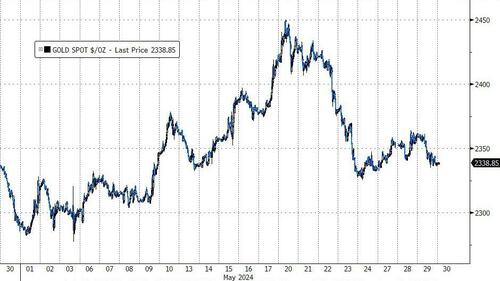

In commodities, crude slipped as traders look to US stockpile data and an OPEC+ meeting on the weekend for more clarity on the supply and demand outlook. WTI traded near $79.10 while Brent was at $83.50. Spot gold falls $3 to around $2,335/oz.

Bitcoin is modestly firmer and holds around $68k, while Ethereum continues to lose ground.

Looking to the day ahead now, US economic data includes second estimate of 1Q GDP, initial jobless claims, April wholesale inventories, advance goods trade balance (8:30am) and pending home sales (10am). Fed officials’ scheduled speeches include Williams (12:05pm) and Logan (5pm)

Market Snapshot

- S&P 500 futures down 0.5% to 5,260.00

- STOXX Europe 600 up 0.2% to 514.64

- MXAP down 1.0% to 176.44

- MXAPJ down 1.2% to 550.15

- Nikkei down 1.3% to 38,054.13

- Topix down 0.6% to 2,726.20

- Hang Seng Index down 1.3% to 18,230.19

- Shanghai Composite down 0.6% to 3,091.68

- Sensex down 0.6% to 74,021.56

- Australia S&P/ASX 200 down 0.5% to 7,628.20

- Kospi down 1.6% to 2,635.44

- German 10Y yield little changed at 2.66%

- Euro little changed at $1.0809

- Brent Futures down 0.3% to $83.36/bbl

- Gold spot down 0.2% to $2,333.60

- US Dollar Index down 0.11% to 105.01

Top Overnight News

- Market pressure is growing on the PBOC to allow the renminbi to weaken, as traders bet that the yawning gap with US borrowing costs will lead more investors to sell out of the Chinese currency. China’s central bank has maintained a strong yuan policy so far this year, keeping its daily fixing — or reference rate around which the currency is allowed to trade — within an unusually narrow range of 7.09 to 7.11 against the US dollar. FT

- China is poised to impose a record fine on PwC of at least 1 billion yuan ($138 million) and suspend some of its local operations over its role in the alleged fraud at Evergrande, people familiar said. BBG

- Global sovereign bond markets are facing the biggest month of supply so far this year in June ($340B worth of net paper needs to be absorbed from the US, EU, and UK next month). RTRS

- Spain’s EU harmonized CPI for May came in at +3.8%, a 40bp acceleration vs. +3.4% in Apr and higher than the Street’s +3.7% forecast (the rise was driven by an electricity tax increase). RTRS

- Washington is concerned about Ukrainian strikes against Russian radar systems used by Moscow to detect nuclear weapons attacks (the Pentagon is worried this could upset the strategic balance between the US and Russia). WaPo

- UBS appointed investment bank head Rob Karofsky to run its US business and jointly oversee the wealth unit with Iqbal Khan, in a management shakeup that may make them prime contenders vying to succeed CEO Sergio Ermotti. BBG

- The Fed’s Raphael Bostic said many inflation measures are moving back to their target range. He said if prices and the labor market move to a more “stable-growth stance,” officials may be prepared to cut rates in the fourth quarter. BBG

- US crude inventories fell by 6.5 million barrels last week, the API is said to have reported. That would be the largest drop since January, if confirmed by the EIA today. BBG

- AMZN has added the Grubhub food delivery service directly to its app and website, deepening an existing partnership between the two companies (Amazon Prime members already have a free Grubhub+ membership). RTRS

- Fed’s Bostic (voter) said the inflation path will be bumpy but the general trend is down and the path to 2% inflation is not assured, while he added that the Fed is vigilant and the job market is tight but not as tight. Furthermore, he said the breadth of price gains is still pretty significant and less inflation breadth would add to confidence for a cut.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were on the back foot amid spillover selling from Wall St owing to the further upside in yields. ASX 200 was pressured with underperformance in miners after recent declines in underlying commodity prices. Nikkei 225 slumped at the open and briefly fell beneath the 38,000 level but is well off worse levels. Hang Seng and Shanghai Comp conformed to the uninspiring mood in which the Hong Kong benchmark gradually weakened with notable losses in mining and property stocks, while the mainland was rangebound following another substantial liquidity injection by the PBoC and after the central bank also vowed several support efforts including promoting trade and investment facilitation.

Top Asian News

- PBoC Deputy Governor Tao Ling said they will coordinate the relationship between short-term tasks and long-term goals, stable growth and risk prevention, and internal and external balances, as well as accelerate implementation and effectiveness of a relending facility for science and technology innovation. Tao said they will promote trade and investment facilitation, support the development of the offshore yuan market and support small- and medium-sized tech firms’ first-time loans and equipment upgrades in key areas with big efforts.

- Chinese President Xi said at the China-Arab States Cooperation Forum that China is willing to build China-Arab relations as a benchmark for maintaining world peace and stability, while China is ready to work with the Arab side to explore ways to resolve hotspot issues conducive to upholding fairness, justice and achieving long-term peace and stability. Furthermore, he said China will accelerate the building of a China-Arab community of a shared future, as well as build a larger-scale investment and finance landscape with the Arab side.

- US officials reportedly escalated a crackdown on the controversial customs exemption that Temu, Shein and other e-commerce firms use to send cheap items from overseas to American shoppers without paying tariffs, according to The Information.

- RBA chief economist Hunter said they agree with the Treasury forecast on inflation and noted that CPI confirmed there was strength in some price sectors. Hunter added the Board is focused on inflation staying out of the band and there is strength in the inflation.

- PBoC says it is playing close attention to current bond market changes and potential risks; will sell low risk bonds including govt bonds when necessary.

- Some of China’s regional authorities reportedly are guiding firms to slow purchases of foreign currencies in a sign the nation is taking further measures to discourage capital outflows amid yuan weakness, according to Bloomberg.

European bourses, Stoxx 600 (+0.2%) began the session on a mostly softer footing, continuing the price action seen in APAC trade overnight; however, sentiment improved as the morning progressed, with indices climbing modestly into the green. European sectors hold a positive bias; Tech is the clear laggard, with sentiment in the sector hit following weak guidance from Salesforce (-16% pre-market), which has weighed on peers such as SAP. Basic Resources is hampered by broader weakness in metals prices. US Equity Futures (ES -0.4%, NQ -0.4%, RTY +0.1%) are mixed, though have been edging higher in recent trade, in tandem with the broader pick-up in European stocks.

Top European News

- UK PM Sunak promises interest rate cuts if he wins the election, according to The Times. PM Sunak said the economy was ‘heading in the right direction’ and that a vote for the Tories is a vote for cuts to interest rates as he set out a vision for a “more prosperous, more secure, more united country” if he wins the election.

- British Chambers of Commerce business lobby group said the next UK government must forge better trade relations with Europe and warned that companies face ever higher costs stemming from Brexit, according to FT.

- ECB is to impose the first-ever fines on banks for climate failures.

FX

- DXY is lower and sitting just beneath the 105 mark after popping above its 50DMA at 105.09 and advancing to a 105.18 peak. US yields have been viewed as one of the main drivers for the USD’s rise this week, as attention turns to the second reading of US Q1 GDP, PCE and Initial Jobless Claims later today.

- EUR/USD has moved back onto a 1.08 handle and in close proximity to its 100 DMA (1.0807) after slipping as low as 1.0789; which is just above the 200DMA at 1.0786.

- Cable is currently hugging the 1.27 mark, whilst EUR/GBP has moved back onto an 0.85 handle. Newsflow for the UK remains light aside from noise surrounding the general election.

- JPY is the best performer across the majors with some pinning the move on the recent bout of risk-aversion. USD/JPY continues to pullback from yesterday’s 157.71 peak which was the highest since May 1st.

- Antipodeans are both muted vs. the USD. AUD/USD has been oscillating around the 0.66 mark in quiet trade with focus in part on fluctuations around the CNY (see below); today’s 0.6591 was the lowest print since 14th May.

- USD/CNY is moving ever closer to the 7.25 mark with increasing speculation over how long the PBoC will keep the USD/CNY fix steady.

- ZAR has lost ground vs the Dollar as models predict that the ruling ANC party could lose its outright parliamentary majority. Further reports that suggest ANC is likely to get around 45% (prev. reports of 42.3%) helped to spark some modest upside for the ZAR; SARB Policy Announcement is also due today.

- PBoC set USD/CNY mid-point at 7.1111 vs exp. 7.2623 (prev. 7.1106).

- SNB’s Jordan said there is a small upward risk to the SNB’s inflation forecast and reasons to believe the natural rate of interest has increased or might rise, while he added that a weak CHF is the most likely source of inflation.

- South African Election Commission: Governing African National Congress (ANC) is on 42.3% of the vote with 10% of polling stations reported; thereafter, South Africa’s ruling ANC party could win 41.5% of votes, according to Bloomberg citing a model.

- Most recently, South African Broadcaster ENCA says ANC is likely to get around 45% of the national vote and will fall short of a majority

Fixed Income

- USTs have bounced modestly following Wednesday’s soft 7yr auction, in part thanks to a robust JGB auction. USTs are near highs of 108-09+ vs Wednesday’s 107-31 post-auction WTD base.

- Bunds are following USTs/JGBs but with magnitudes slightly more contained; Spanish harmonised inflation metrics Y/Y ticked up slightly, though was unable to spark any material move. Bunds up to a 129.23 peak.

- Gilt price action is following peers, going as high as 95.81 but someway to go before a retest of 96.43, 97.09 and 97.32 highs from earlier in the week.

- Italy to sell EUR 7.5bln vs exp. EUR 6-7.5bln 3.35% 2029, 3.85% 2029, 3.85% 2034 BTP and EUR 2bln vs exp. EUR 1.5-2bln 2029, 2032 CCTeu

Commodities

- Subdued trade for the crude complex as prices continue to trim the gains seen earlier this week and as attention turns to the OPEC+ confab on Sunday; Brent Aug sits between a 82.94-83.58/bbl range.

- Another downbeat session for precious metals despite the softer Dollar amid an intraday pullback in yields. Spot gold sees its losses more cushioned vs silver and palladium after the yellow metal found support near its 50 DMA; XAU trades within a USD 2,322.66-2,339.95/oz parameter.

- A devastating session for base metals thus far following the recent rise in yields and the Dollar, whilst the downbeat mood across Chinese markets overnight only added the pessimism in the complex.

- US Private Energy Inventory Data: Crude -6.5mln (exp. -2mln), Cushing -1.7mln, Distillates +2mln (exp. -0.2mln), Gasoline -0.5mln (exp. -0.5mln).

Geopolitics

- Israel’s army said Hamas is in Rafah and is holding Israeli hostages, so they are launching military operations there and will not stop fighting in Rafah until the hostages are freed.

- US official said the US is to boycott UN tribute to Iran’s late President Raisi on Thursday, according to Reuters.

- “Hearing from sources that American resistance to the E3 censure resolution (on Iran) is fading; recognising the reality that E3 are pushing ahead”, according to WSJ’s Norman

- Russian Foreign Minister Lavrov said China could arrange a peace conference in which Russia and Ukraine would participate, while he added that Russia regards planned supplies of F-16 fighters to Ukraine as a “signal action” by NATO in a nuclear area, according to RIA.

- North Korea fired what was suspected to be a ballistic missile which fell shortly after the launch announcement and appeared to have landed outside of Japan’s exclusive economic zone, according to the Japanese Coast Guard and press. It was later reported that South Korea said North Korea fired what appeared to be multiple short missiles that flew about 350km.

- China’s Defence Ministry says the recent Taiwan drills “reached expected goals”

US Event Calendar

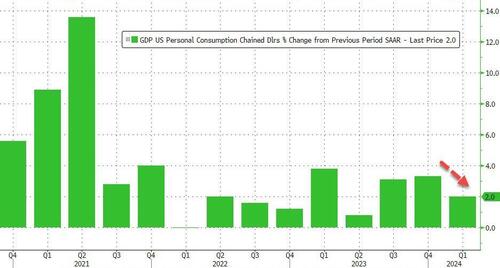

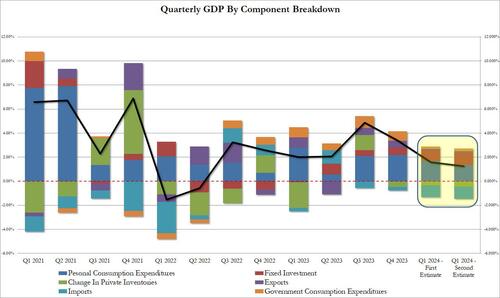

- 08:30: 1Q GDP Annualized QoQ, est. 1.3%, prior 1.6%

- 1Q Personal Consumption, est. 2.2%, prior 2.5%

- 1Q Core PCE Price Index QoQ, est. 3.7%, prior 3.7%

- 1Q GDP Price Index, est. 3.1%, prior 3.1%

- 08:30: May Initial Jobless Claims, est. 217,000, prior 215,000

- May Continuing Claims, est. 1.8m, prior 1.79m

- 08:30: April Wholesale Inventories MoM, est. 0.1%, prior -0.4%

- April Retail Inventories MoM, est. 0.3%, prior 0.3%

- April Advance Goods Trade Balance, est. -$92.3b, prior -$91.8b

- 10:00: April Pending Home Sales (MoM), est. -1.0%, prior 3.4%

- April Pending Home Sales YoY, est. -2.0%, prior -4.5%

Central Bank speakers

- 12:05: Fed’s Williams Speaks at Economic Club of New York

- 17:00: Fed’s Logan Speaks in Moderated Q&A

DB’s Jim Reid concludes the overnight wrap

Markets have had another rough 24 hours, with no sign of the negative momentum letting up overnight. The latest selloff has been driven by a range of factors, but bonds took a particular hit after a weak US Treasury auction yesterday, along with mounting concern about inflationary pressures, which sent European yields up to their highest levels in months. That followed on from a hawkish set of headlines the previous day, where stronger-than-expected data led investors to price in that rates would stay higher for longer. So it was a tough backdrop for markets across several asset classes, and there had already been a relentless run of gains in recent weeks that was always going to be tough to maintain. Indeed, the S&P 500 has advanced for 23 of the last 30 weeks, marking a joint record since 1989, but yesterday it fell -0.74%, and futures this morning are down -0.56%. So it’s clear that the momentum is now more negative, and Asian markets are also falling across the board as we go to press this morning.

This negative tone was set from the outset yesterday after the Australian CPI report was higher than expected. But that was compounded by the German flash CPI print for May, which was also a bit above consensus. So that helped to deepen the selloff, adding to concerns that rates were set to remain at higher levels for longer than anticipated. In terms of the details, German inflation came in at +2.8% on the EU-harmonised measure, which was a tenth above expectations, and an increase from the +2.4% print in April. That was partly down to base effects, but the main significance of the release was that it cast doubt on how aggressively the ECB would cut rates over the coming months. Indeed, the amount of ECB rate cuts priced by April 2025 came down by -8.0bps to 75bps, so markets are now pricing in a shallower easing cycle after the release. We’ll get more European inflation data over the next couple of days, including from Spain today, before we get the Euro Area-wide release tomorrow.

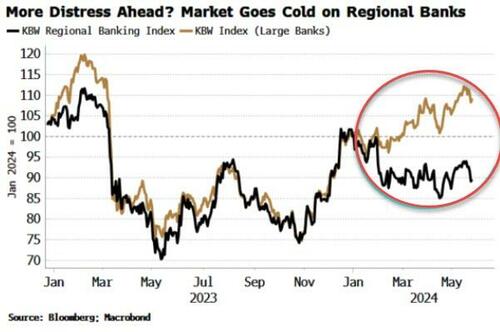

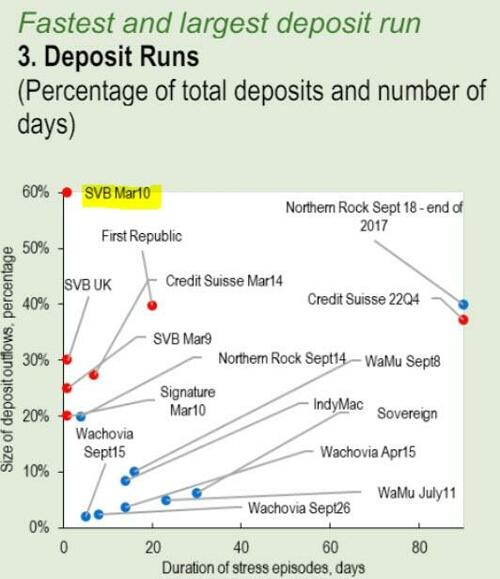

The stronger inflation prints affected sovereign bonds across the world, but the impact was particularly noticeable in Europe ahead of the ECB’s decision next week. For instance, the 10yr bund yield was up +9.8bps to a 6-month high of 2.69%. But that wasn’t just confined to Germany, as the 10yr yield in France (+10.2bps) was also up to a 6-month high of 3.17%, and the UK 10yr gilt yield (+11.9bps) hit a 6-month high of 4.40%. Meanwhile at the front-end of the curve, the German 2yr yield (+4.3bps) hit a 7-month high of 3.10%, moving closer to its March 2023 peak (just before the SVB turmoil) at 3.33%.

That pattern was repeated in other regions, and the 1 0yr Treasury yield ended the day up +6.2bps at 4.61%. In fact, over the last two weeks, the 10yr yield is now up +27.3bps, so there’s been a big turnaround since the rally that followed the US CPI print. At the same time, the 2yr yield (-0.4bps) closed at 4.97%, just below the 5% mark again, whilst the 2yr real yield moved as high as 2.70% intraday before ending up +1.7bps at 2.68%. This came as there was weak demand for US Treasuries for a second straight day. The US sold $44bn of 7-yr notes at 4.65%, which was higher than the pre-auction level of 4.637%, as concerns over funding the US deficit in a higher rate world continued to percolate. Additionally, Fed pricing suggested that higher rates were set to persist, and this morning futures are putting a 48.5% probability on a rate cut by the September meeting. There was also a modest support from the Richmond Fed’s manufacturing index, which rose to 0 in May (vs. -7 expected), which is the strongest it’s been in 7 months.

This rise in longer-dated yields proved bad news for global risk assets. For equities, it meant the S&P 500 fell -0.74%, which currently puts the index on track to end a run of 5 consecutive weekly gains. Moreover, that decline was cushioned by a stronger performance for the Magnificent 7 (-0.08%), which only fell modestly from its all-time high the previous sessio n. So if you look at the equal-weighted S&P 500 instead, that actually fell by a larger -1.17%. So this continues the theme from last year where the equity rally is a very narrow one, as the overall S&P 500 is up +10.42% year-to-date, but the equal-weighted version is only up +2.96%. Every industry group in the index was lower by the close, with energy stocks (-1.76%) as the main underperformer after oil prices fell back (Brent Crude -0.74%). Meanwhile in Europe, the losses were even larger, and the STOXX 600 fell -1.08%, alongside declines for the DAX (-1.10%), the CAC 40 (-1.52%) and the FTSE 100 (-0.86%).

Overnight in Asia, this weakness for risk assets has continued, with losses for the KOSPI (-1.41%), the Nikkei (-1.37%), the Hang Seng (-1.22%), the CSI 300 (-0.16%) and the Shanghai Comp (-0.12%). Futures are also pointing to losses in other regions, with those on the DAX down -0.38%, and those on the S&P 500 down -0.56%.

To the day ahead now, and data releases include the Euro Area unemployment rate for April, and in the US we’ll get the second estimate of Q1 GDP, along with the weekly initial jobless claims, the advance goods trade balance for April, and pending home sales for April. From central banks, we’ll hear from the Fed’s Williams and Logan, along with the ECB’s Makhlouf.