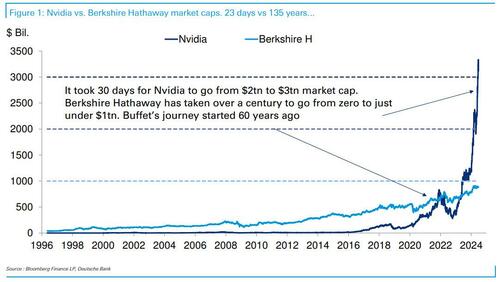

It Took Nvidia 23 Days To Add $1 Trillion In Market Cap; Berkshire Hathaway Hasn’t Managed That In 60 Years

This morning, Deutsche Bank’s Jim Reid published his latest chart book titled “Charts to make you go WOW” (available here to pro subs), which will prompt a few surprised exclamations even from the hardened cynics.

And while there is an extensive selection to pick from – and we will go over the charts in more details shortly – it’s hard to pick a more “wow” chart example than the recent developments involving Nvidia (there’s lots more beside in the pack from AI and industrial revolutions to debt, deficits, demographics, migration and housing).

The chart below shows that it’s taken 60 years for the most famous and arguably successful investor in the world, Warren Buffet, to build Berkshire Hathaway up to just shy of a trillion-dollar company ($883bn at Friday’s close). Indeed the company’s origins began in the 19th century so the full journey has taken well over a century and it’s yet to hit a trillion dollars.

Contrast that with Nvidia, which went from just below $2tn market cap for the last time on April 24th, to over $3tn just 30 trading days later. Even more impressively, at its record close last Tuesday, where it became the largest company in the world, the last trillion of market cap was added in only 23 trading days.

Then again, the higher they rise… Nvidia opened on Thursday after the holiday another 3% higher, melting up on virtually no volume (and a brutal gamma squeeze). But since that intraday peak it has tumbled 13% in just three days, and slipped back to 3rd in the S&P 500 rankings. The move came as portfolio managers rebalanced portfolios at the end of the quarter, with JPM calculating some $50 billion in selling pressure from pension funds, to account for the surge in tech shares; the start of the buyback blackout period last week didn’t help either.

So, as Jim Reid asks rhetorically, is this a pause for breath or signs the air is being let out of the balloon? He responds that while his chart book hints that he does believe in AI, there have been signs of over exuberance in the US market over the last month. Penny stock trading has soared and net call options on Mega Cap Growth and Tech has exploded in June.

This, alongside positioning and the move into the buyback blackout period, has led DB strategist to suggest a “breather” is likely.

More in the full DB Monthly Chartbook “Charts to make you go WOW” available to pro subs.

Tyler Durden

Mon, 06/24/2024 – 18:40

via ZeroHedge News https://ift.tt/y65hqxK Tyler Durden