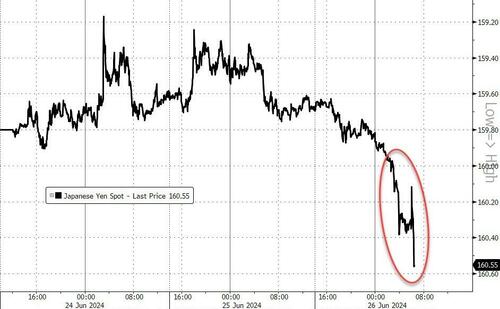

Yen Tumbles To 1986 Lows After Japanese ‘Currency Chief’ Comments; Gold, Oil, & Bonds Dump

The market is testing Japanese officials… and so far it’s winning…

Reaffirming its constant stance of jawboning over actual intervention, Vice Finance Minister Masato Kanda said late Wednesday that the government is watching the yen with a high level of urgency as he described the currency’s latest moves as “rapid” and “one sided.”

“I have serious concern about the recent rapid weakening of the yen and are closely monitoring market trends with a high sense of urgency,” Kanda told reporters late Wednesday.

“We will take necessary actions against any excessive movements,” he said.

Kanda refrained from commenting if the yen’s latest move was excessive.

This ‘status quo’ sent the yen lower against the dollar…

Source: Bloomberg

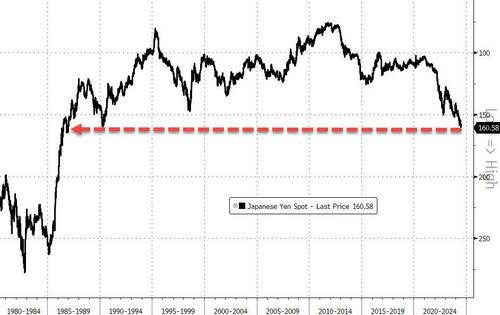

…breaking down to its weakest since 1986…

Source: Bloomberg

Earlier this week, Kanda said authorities were ready to intervene in currency markets at any time around the clock if needed.

Finance Minister Shunichi Suzuki said they are closely monitoring developments in the market and will take all possible measures as needed.

“If the moves start to get disorderly north of 160, they may come in to smooth the move,” said Win Thin, global head of markets strategy at Brown Brothers Harriman & Co in New York.

“Buy until the BOJ tilts more hawkish, upside for USD/JPY is the path of least resistance.”

Well, it’s starting to look ‘disorderly’.

“Given quarter-end dollar demand and the fact that the volatility environment remains contained, Japanese authorities might wait a bit more before intervening once again,” said Roberto Cobo Garcia, head of G-10 FX strategy at Banco Bilbao Vizcaya Argentaria SA in Madrid.

“Volatility needs to rise more if they are to step in again.”

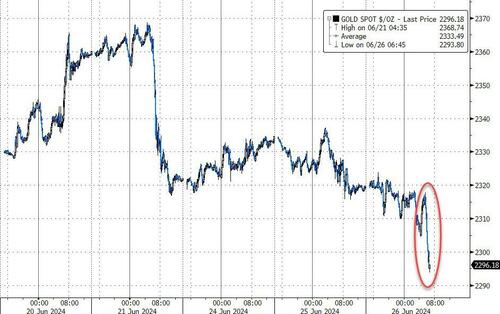

The yen weakness sent the dollar higher and triggered selling in Gold…

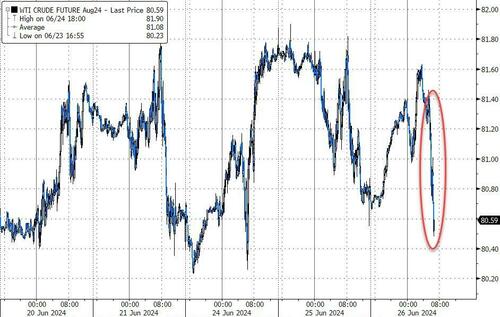

…and oil…

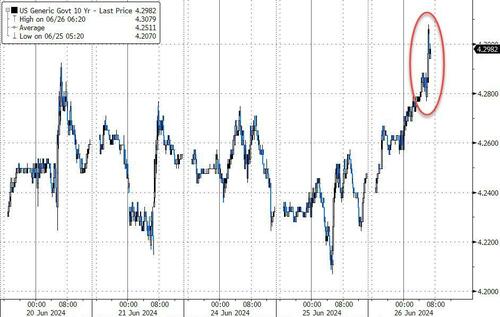

…and Treasuries…

Japan has acknowledged it spent ¥9.8 trillion ($61.3 billion) intervening in currency markets between April 26 and May 29.

Although specific dates weren’t disclosed, trading patterns suggest major interventions occurred on April 29 and May 1.

Data on foreign reserves suggest Japan sold Treasuries to fund these actions.

Previous action by Japan to support its currency market has raise eyebrows overseas, with the US Treasury Department last week adding the nation to its “monitoring list” for foreign-exchange practices.

Tyler Durden

Wed, 06/26/2024 – 09:52

via ZeroHedge News https://ift.tt/gSkEr6v Tyler Durden