Which Countries Have The Highest Corporate Tax Rates In The G20?

In the wake of the 1999 Asian financial crisis, government representatives from the 20 largest economies in the world decided to informally gather to coordinate policy on trade. Thus began the G20.

Together the bloc accounts for more than 85% of the world economy and has been credited with unified policy action in response to world events.

However, despite this shared affiliation, this group is still made of fundamentally different economies with varied policies towards their business entities.

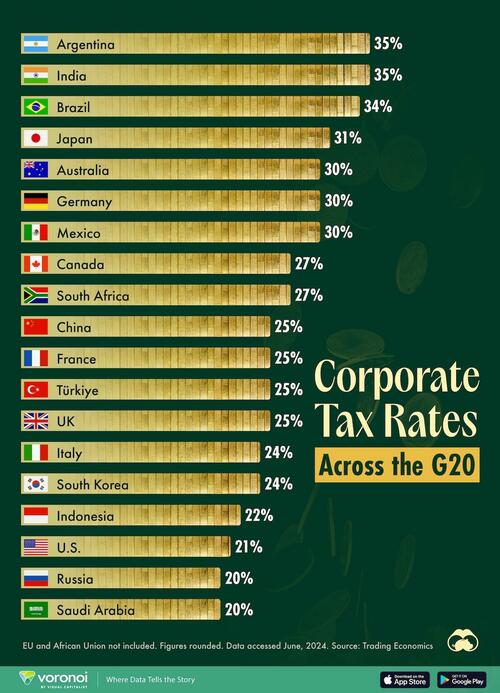

For a quick overview, Visual Capitalist’s Pallavi Rao visualizes and ranks the G20 countries by their headline corporate tax rates.

Data is sourced from Trading Economics, accessed June 2024. Data for the EU and the African Union (both G20 members) has not been included.

Ranked: G20 Members by Their Corporate Tax Rates

Argentina and India have the highest corporate income tax rates, at 35% in the G20.

However, both countries have a progressive ladder for taxation, so this headline number may only apply to a smaller subset of firms. For foreign companies with a “permanent entity” in India, the rate climbs past 40%.

Note: EU and African Union not included. Figures rounded. Data accessed June 2024.

Interestingly, BRICS countries cover the spectrum of corporate tax rates. Starting from the highest (India, Brazil) to middle of the pack (South Africa, China) to lowest (Russia).

On the other hand, most of the G7 cluster in the mid-ranges (24–30%), with Japan the highest outlier (31%) and the U.S. the lowest exception (21%).

In fact, after Saudi Arabia and Russia (20%), the U.S. has the third-lowest corporate tax rate of all G20 economies.

This wasn’t always the case.

The 2018 “Trump Tax” law was the largest overhaul of the tax code in three decades, part of which reduced the corporate tax rate from 35% to 21%.

Tyler Durden

Sat, 06/29/2024 – 08:45

via ZeroHedge News https://ift.tt/9uMeWwO Tyler Durden