The Next (Screwed) Generation Deserves An Apology

Authored by Matthew Piepenburg via VonGreyerz.gold,

I spend a lot of time tracking the ripple effects of embarrassing and unsustainable debt levels on our credit markets, rate markets, equity bubbles, inflation metrics and, of course, the daily-debasement of our currency’s inherent purchasing power.

Inevitably, I round that all up with the role precious metals play in insuring against the same.

But there’s more to debt than gold and other financial conversations.

We All Cherish Our Children’s Future

Global and national debt forces have a ripple effect on far more than portfolio returns; they affect our kids.

For anyone blessed to parent a child, there is no greater love, no greater joy nor any greater vulnerability and source for endless concern.

This is intuitive, axiomatic and universal. As John Kennedy said just (hauntingly) weeks before his own death in 1963:

“For, in the final analysis, our most basic link is that we all inhabit this small planet. We all breath the same air. We all cherish our children’s future. And we are all mortal.”

But what does cherishing our children’s future have to do with the current state of the global and financial markets?

Invisible and Visible Forces

Love for family, friends and partners of all stripes (despite its painful lessons, mistakes and contradictions) is the most important yet invisible wealth. As Saint-Exupery’s Little Prince reminds, “the essential is invisible.”

But there are other invisible forces, from politics to inflation, which have a direct bearing on our collective well-being from one generation to the next.

And if we were pause to reflect on the hard math of unprecedented debt, openly (criminally?) failed monetary policies and a US-lead global economy falling to its knees in deficits and the concomitant currency destruction which always follows, it would seem, at least at an “economic” level, that we and our leadership do not hold a very high regard for, well—our children…

Below, we soberly consider the evidence that the prior generations (including my own) seem to be collectively thinking more of themselves and less of the next generation.

Really?

Passing the Buck and the Bill

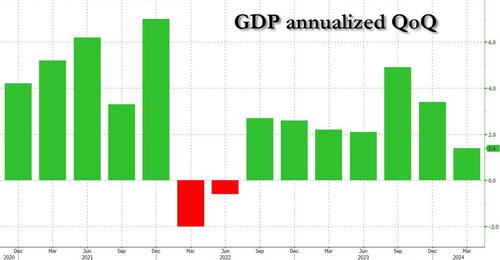

When a once-great nation like the U.S. reaches a debt-to-GDP ratio of 120%+, when its national balance sheet has trillions more in unfunded liabilities (210T) than it does assets, and when its own Congressional Budget Office confesses that its social security and Medicare budget will be tapped out by 2030 unless we print more money, we should be concerned about the reckoning—i.e., the bills to pay.

And when the holder of the world reserve currency runs an annual twin (budget and trade) deficit of $3T and counting, or mis-reports actual inflation to achieve a carefully hidden negative real return on its IOUs to inflate its way out of debt on the backs of the working poor, we should not only be concerned about the bills to pay (and who pays them), but also consider the neutered profile of the “bucks” used to pay them.

But perhaps such concerns feel less immediate to the Baby Boomer et al generation who, knowingly or unknowingly, can (via the help of an increasingly geriatric leadership) simply pass this embarrassing tab on to the next generation?

The Club Baller…

If I, for example, wanted to flaunt my status at the nearest “Popinjay Club” by arriving in the latest fashions and fastest car while indulging in the most elaborate and consistent dinner tabs, polo fees and trendiest wine selections, I suppose I’d have the right to spend as I please and flaunt my “success.”

After all, I am a capitalist, and like all capitalists, who doesn’t prefer first-class over economy seats?

But what if I lived this life for years, smiling through every chucker, wine bottle and sports car only to leave this world in my sleep at ripe ol’ age while leaving the entire invoice to my kids?

That is, what if I enjoyed it all, but then made them pay for it? What if I thrived so that they could suffer?

Seems insane, no? Diabolical? Selfish beyond belief? Absolutely grotesque at the micro level.

But here’s the rub: At the macro level, that is precisely what the older generation of American financial “leadership” is now doing to the younger generation.

The Past Thrives, The Future Suffers

As a nation, my generation has thrived–mostly on debt, extend-and-pretend monetary policies, grotesquely (debt-driven) inflated market bubbles, feudalistic rather than capitalistic wealth transfers, and entirely myopic politicos—so that our collective children will be stuck with the bill.

This is not fable but fact, this is not sensational, it’s merely historical.

And as every sober economist or thinker from David Hume, von Mises or even Reinhart and Rogoff to Mark Twain or Ernest Hemingway already knew: A nation which lives on debt for decades of joy leaves the next generation with decades of pain–all in the form unsustainable expenses paid for with debased paper money.

Any who understand the fantasy of MMT, the open crimes of the US Fed and its various (direct and indirect) forms of “liquidity” (from QE and Operation Twist to the Reverse Repo Markets, Supplementary Leverage Ratios and the Treasury General Account) already knows: We are expanding our debt while weakening our dollar.

And that, folks, is a double whammy for our children and grandchildren.

Enjoying the Punch Bowl, Transferring the Hangover

How we got here is simple.

For generations, we as a nation have been getting drunk (and re-elected) on debt at levels far beyond our national income (as measured by tax receipts or GDP).

In short, prior generations enjoyed the Fed martinis (and even a Bernanke [ig]Noble Prize) while the next are left with the hangover and the tab.

And what does this “drunk phase” look like?

Well, drunk is fun, and it makes a nation appear all warm and happy and seemingly care-free. It also makes us a bit greedy, as we keep putting the drinks (fake liquidity) on a credit card whose pains and costs are less noticed so long as the punch bowl is constantly re-filled and the bill ignored.

To help this sink in, let’s add some data to the drama.

Data Point 1: Greed

As for greed, America in particular has had it in spades.

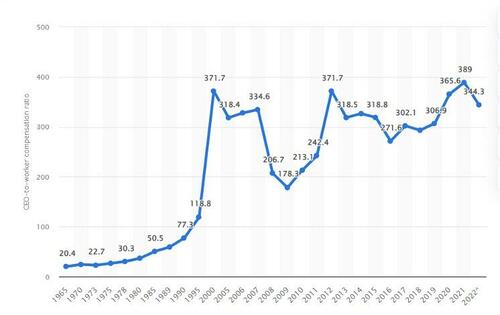

When my grandfather was an executive at Ford long before my birth, the aggregated CEO-to-worker compensation ratio for the largest publicly traded companies was 20-to-1.

Today (Statista data below) that ratio has leapt to 340-to-1.

And in the case of those oh-so essential (Main-Street-destroying/Sherman and Clayton Act violating) executives at Amazon, the ratio is a staggering 6,474-to-1.

Again, I’m a capitalist, but such wealth inequality and c-suite greed are not the products of a fair playing field and an equal access to credit or genuine, capitalistic competition.

Instead, it’s an open symptom not only of individual psychopathy but of insider advantages based on credit and legal mechanizations that far more resembles a case of modern feudalism than traditional capitalism.

Scott Galloway described it as a generation focused on “increasing compensation while reducing accountability,” as the $34M annual salary of BOEING’s CEO, for example, makes comically apparent.

Data Point 2: Stock Markets

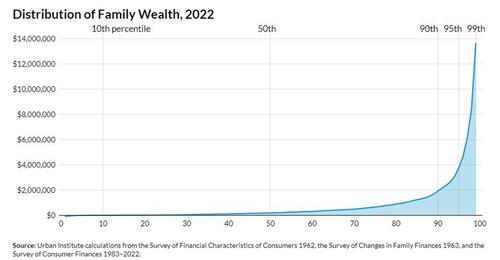

But let’s not forget the oh-so rigged playing field of the US stock market, of which 90% of its actual wealth belongs to the top 10% of the population, most of whom came of age in the aforementioned “greed” generation.

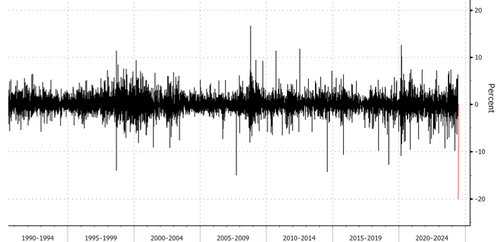

This wealth effect is largely due to a generation of Fed chairs who never let a market dip suffer too long before reflating the same with money literally created out of thin air.

I came of age when Greenspan sold his PhD to the highest bidders on Wall Street, sending rates to the floor and building a credit-driven tech bubble 1.0 which allowed my generation of young dragon-slayers the chance to buy Amazon, Apple and Netflix at single digit share prices.

By contrast, today’s market-tracking youth (the very few who can even afford to speculate after tech sirens) are chasing blow-off tops in a meme-familiar NVIDIA comedy.

Yesterday’s policies, from bank bailouts (Wall Street socialism) to the current (oxymoronic) narrative of “debt-based growth” ($35T and ticking), have led to the greatest wealth inequality and poorest “next gen” population in US history, yet Powell openly denies that the Fed has anything to with this.

Hmmm.

Data Point 3: The Cost of the American Dream

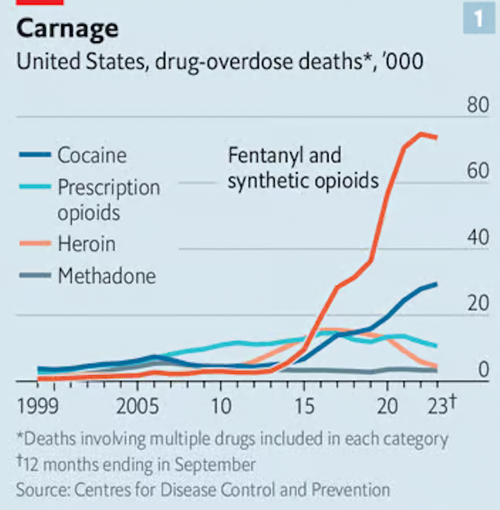

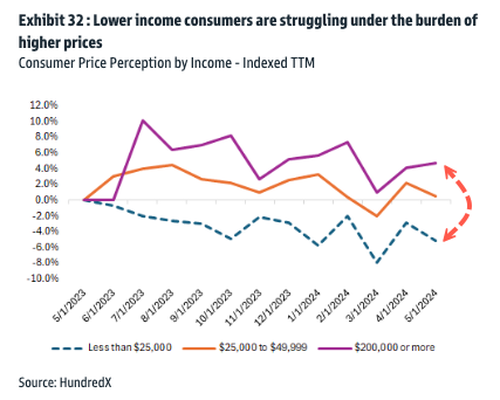

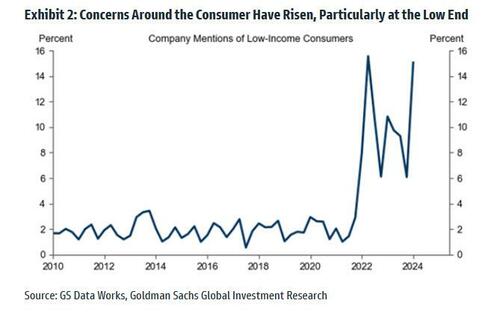

Unfortunately, our kids already feel what Powell’s demographic often ignores.

The last two U.S. generations, for example, are making less money on an inflation adjusted basis, while their cost of living, on everything from unaffordable housing to grotesquely rigged (debt enslaved) tuition goes higher.

My generation saw public university as an option, with an average admission rate of 27% and student debt at 31% of first-year incomes.

Today, however, those public education admission rates have sunk to 6% yet the debt percentage of first-year salaries has skyrocketed to 53%.

This objectively means that less and less young people can access and afford a real education, which Thomas Jefferson understood as the foundation to our nation’s future.

Sadly, most current 20-somethings can’t afford that future and have lost both hope and faith.

In my day, the average house price to first-year income was 4.4x, today it’s 8.5x.

For the first time in American history, 30-year-olds are not doing as well as their parents were at 30, which suggests that the social contract from one generation to the next is now officially broken.

But as Galloway also observes, the results of this broken contract are far more than economic.

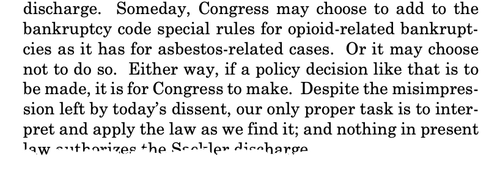

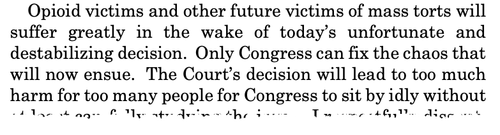

He argues that the inequities (or national bar tab) passed to this generation are “incendiary,” creating a collective sense of undeserved “rage and shame” that finds its current, splintered and identity-obsessed expression in everything from MeToo, BLM and LBGTQ to the highest self-harm (especially among women), overdose, teen depression, gun death and suicide rates in our history.

The young are even having statistically more problems finding someone to sleep with, which stems more from depression, tech-induced isolationism and growing tribalism (self-censorship) than from natural biology…

In short, economics do impact society, and when those economics are characterized by the highest debt levels ever recorded in history, the consequences are not theoretical but appallingly real.

Data Point 4: Political Zombies

As for politics, it should be obvious that our so-called leadership is hardly representative of the coming generation, but an openly embarrassing (and power-holding) representation of their own generation (interests).

Galloway, who observed that “DC has become a crossroads between the land of the dead and the golden girls,” calls our top leadership options the “walking (or in Biden’s case, stumbling) dead,” as the following images remind (average age: 80.5)

This is not “agism” but power-ism, and though it is nice to see that senior poverty is down from 17% in the 70’s to less than 8% today, the fact that child poverty has risen to 19% in the same era should make even my generation pause.

But let’s not blame everything on the old faces…

The New “Success” Icons?

The few new faces of the latest generation to make “success headlines” and motivate today’s youth have more than just a little bit of a problem with being financial or social role models…

The damage that “success stories” like Adam Neuman or a socially-troubled Mark Zuckerberg have done to the coming generation are not to be missed.

That censoring and profoundly toxic “compare me” site otherwise known as Facebook, for example is, in my opinion, one of the worst things to infect our country since the 1916 Influenza.

The Wealth Transfer is a Debt Transfer

The foregoing and highly complex financial, political, social and generational concerns all stem from something as otherwise “academic” and straightforward as debt.

Prior generations have been gorging on it, and coming generations will be paying for it—not just in absolute or nominal terms, but far more invisibly yet insidiously in real, inflation-adjusted returns.

This is because central bankers will continue to steadily devalue the inherent purchasing power of their national currency with inevitably rising levels of mouse-clicked, fiat “money,” the ultimate (but largely invisible) insult to our children’s and grandchildren’s generation.

Since 1989, the 70+ group has expanded its share of national Household wealth by 58%, whereas the share of wealth held by those under 40 has fallen by 42% in the same period.

This is not by accident, but policy design. And it’s not because American’s don’t love their children, but because those making financial policy decisions just love themselves even more.

My kids often tell me they aren’t keeping up with dad when I was their age.

But unlike their dad, their generation was born with a politically-culpable debt canon ball chained to their ankles which was unlike anything my generation knew in our 20’s or 30’s.

Most of my children’s generation are working harder for less, and yet they somehow think it’s their fault.

It’s not.

The new generation inherited a $93T (public, household & corporate) debt nightmare and we gave it to them…

Tyler Durden

Thu, 06/27/2024 – 12:25

via ZeroHedge News https://ift.tt/sEyFxeh Tyler Durden