US index futures are down but well off session lows as Treasury yields stay at a two week high high this morning ahead of a flurry of economic data over the next two days which will help set the path for Fed policy. At 8:00am ET, S&P futures were down 0.1% as ugly earnings from Walgreens confirmed the consumer weakness is spreading, while Nasdaq futures dropped 0.2% after Micron’s disappointing sales forecast weighed on tech giants. Semis are mostly lower post MU’s earning as hedge funds continue to dump TMT/semi names to retail investors: NVDA -1.1%, AMD -47bp, QCOM -40bp. MU is down -5.4% pre-market, partially recovered from the initial 7% loss. Bond yields are flat while the USD is modestly lower. Commodities are mostly higher led by oil complex, ags and precious metals. Today, the key macro catalysts are Jobless Claims, Durable/Cap Goods Orders and the first presidential debate tonight, while tomorrow we get the closely watched core PCE figures. The figures come after Fed Governor Michelle Bowman yesterday tempered market expectations for interest rate cuts. We also receive WBA and NKE earnings.

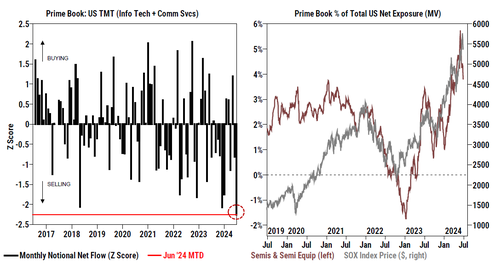

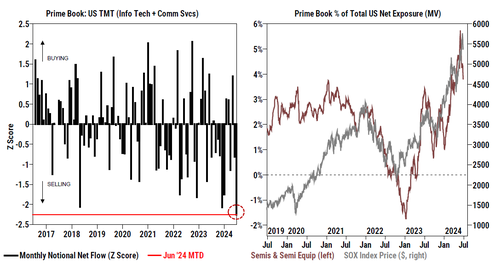

In premarket trading, Micron slipped 5% after the largest US maker of computer memory chips provided a forecast that disappointed investors seeking a bigger payoff from artificial intelligence mania. Micron’s underwhelming outlook highlighted the risks of relying on artificial intelligence chip makers to fuel the stock rally. The shares slumped as much as 8% in premarket trading, dragging down a number of megacap tech peers including Nvidia (-1.1%), AMD (-47bp) and QCOM (-40bp). Walgreens Boots Alliance fell 12% after the drugstore chain cut its profit forecast for the full year, citing a “worse-than-expected” consumer environment. Here are some other notable premarket movers:

- BlackBerry (BB) advances 9% after the security software company reported first-quarter revenue that came ahead of estimates.

- International Paper (IP) shares plunged 14% after Suzano SA ended its pursuit of the US paper and packaging company. That clears the way for International Paper to acquire UK rival DS Smith Plc, whose shares soared in London.

- Levi Strauss (LEVI) drops 15% after the company reported sales in its latest quarter that slightly missed expectations, underscoring Wall Street’s high expectations for the company.

Reports on economic growth and weekly unemployment claims are on traders’ radar Thursday before tomorrow’s key inflation figures, after Fed Governor Michelle Bowman tempered market expectations for interest rate cuts. Treasury yields held yesterday’s rise and a gauge of the dollar hovered near an eight-month high.

“It’s all about the Fed — higher for longer is keeping the front end of rates very high, drawing money into the US and keeping the dollar strong,” said Andrew Brenner, head of international fixed income at NatAlliance Securities LLC.

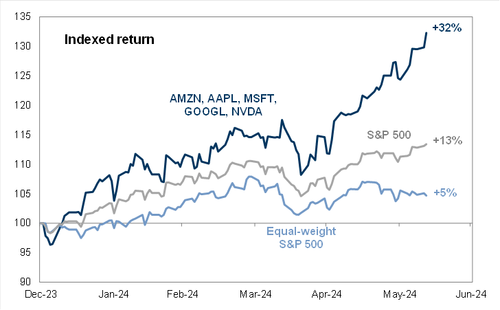

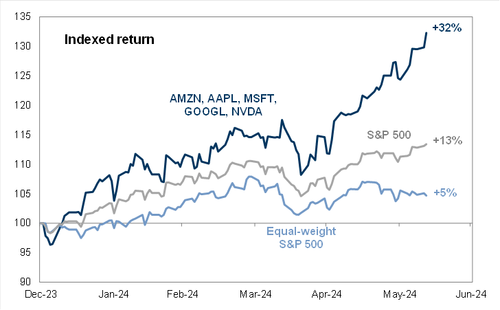

June has been a volatile month for Big Tech stocks after the meteoric rise of Nvidia, Microsoft, Amazon, Meta and Apple accounted for well over half of the 15% advance in the S&P 500 this year.

Micron is among the companies that have gotten a lift from the mania for AI-related stocks, with its shares more than doubling in the year prior to its Wednesday report. But even with an outlook roughly in line with the average of analyst estimates, it was punished for not outperforming elevated expectations.

In another sign of investor concern about market concentration, we first reported that hedge funds “aggressively” sold tech stocks in June – the month in which Nvidia briefly became the world’s largest company – to retail investors. Semiconductor and semiconductor equipment stocks were the ones offloaded the most, according an analysis by Goldman Sachs Group Inc.

Europe’s stock benchmark dropped for a third day, with traders in holding mode ahead of Sunday’s French elections. The Stoxx Europe 600 index extended its decline after ECB Governing Council member Martins Kazaks said strong wage growth was standing in the way of faster rate reductions. Data earlier showed money supply in the euro region rose faster than expected in May, fueled by credit growth. Retailers are the worst performers on the Stoxx 600 as H&M tumbled 14% after it reported a slump in sales and said meeting a key profitability target had become tougher. GSK fell after US health officials delivered a fresh regulatory blow to its blockbuster RSV vaccine. Gucci owner Kering gained after a double-upgrade from Bank of America Corp. Here are all the notable European movers:

- Chip-equipment stocks are broadly higher in early trading after US memory chipmaker Micron forecast a material increase in capital spending for its fiscal year 2025.

- Serco shares gain as much as 5.9% after the UK outsourcing solutions company upped its guidance for full-year operating profit, based on solid performance in the first half.

- Kering shares rise as much as 4.8%, in sixth straight day of gains, after BofA double-upgrades to buy from underperform based on signs of better brand heat for the luxury group’s key Gucci label.

- DS Smith shares climb as much as 7.4% after Brazil’s Suzano ended its pursuit of International Paper, removing a complication to the US company’s plan to acquire its UK peer.

- Safran shares advance as much as 2.2% following an upgrade to buy at Citi, which says the aircraft supplier’s medium-term outlook continues to be “exceptionally strong.”

- Bunzl shares rise as much as 2.1% after analysts welcome the British distribution company’s increased full-year guidance as the benefits of acquisitions take effect.

- Watches of Switzerland shares surge as much as 8.4% after the luxury watch retailer’s earnings beat expectations and the company reiterated its outlook, which reassured investors.

- OVH shares jump the most since the cloud-services company’s 2021 IPO after announcing third-quarter results which were “better then feared,” according to Morgan Stanley.

- H&M shares slump as much as 15%, the steepest intraday decline since December 2017, after the clothing retailer’s second-quarter operating profit missed consensus estimates.

- GSK shares drop as much as 7.2% to the lowest since Jan. 2 after US health officials recommended restricting vaccination with its RSV shot to people who are older and more at risk.

- Salmar shares fall as much as 3.9%, hitting its lowest this year, as Nordea sets a Street-low target and says the Norwegian salmon farmer’s valuation is “on the rich side.”

- Currys shares slide as much as 7.2%, its steepest drop since March, after the UK electronics retailer reported FY24 results.

Earlier, Asian stocks dropped for the first time in three days, as sentiment in China soured with a major benchmark teetering on technical correction. Tech shares also dragged following declines in US peers. The MSCI Asia Pacific Index fell as much as 0.7%. Along with Chinese megacaps, chip stocks were some of the biggest drags after Micron Technology’s underwhelming outlook. Benchmarks in Hong Kong posted the biggest contractions in the region, while the markets in Japan, mainland China and South Korea also fell. A key Chinese stock gauge is poised for a technical correction — after falling on Thursday and taking declines from a May 20 high to about 10% intraday — as investors struggled to find catalysts ahead of a meeting of the nation’s top leaders next month. Beijing’s new measures to ease homebuying requirements did little to lift concerns about the nation’s tepid economic recovery.

In FX, the yen is up 0.2% against the greenback, taking USD/JPY down to ~160.50 after another warning from the Japanese Finance Minister. The yen pared some of the declines seen Wednesday after tumbling to 160.87 per dollar, the weakest level since 1986. The Swedish krona is the weakest of the G-10 currencies, falling 0.2% against the dollar, after the Riksbank signaled it may cut interest rates as many as three more times this year.

In rates, treasuries are little changed on the day, with overnight price action within a narrow range leaving yields within one basis point of Wednesday’s close. Core European rates underperform slightly vs. Treasuries. US 10-year yields trade around 4.33%, near Wednesday’s closing levels, with bunds and gilts lagging by additional 1.5bp and 2.5bp in the sector. Treasury spreads are steady, largely holding Wednesday’s steepening move. The focus for the US session includes a heavy data slate headed by GDP and durable goods orders alongside weekly jobless claims, while this week’s coupon auctions conclude with $44b 7-year notes. Treasury coupon issuance concludes with a $44b 7-year note sale at 1pm New York time following decent results from both 2- and 5-year auctions so far this week. The WI 7-year — at roughly 4.32% — is 33bp richer than May’s stop-out, which tailed the WI by 1.3bp

In commodities, oil prices advance, with WTI rising 0.9% to trade near $81.60 a barrel. Spot gold rises $15 to around $2,313/oz.

Bitcoin is flat and holds around USD 61k while Ethereum is incrementally softer and sits just below USD 3.4k.

Looking at today’s calendar, the US economic data slate includes 1Q final GDP release, May’s advanced goods trade balance, wholesale inventories, durable goods orders, initial jobless claims (8:30am), May pending home sales (10am) and June Kansas City Fed manufacturing activity (11am). No Fed speakers are scheduled for the session; Barkin, Bowman and Daly are due Friday

Market Snapshot

- S&P 500 futures down 0.2% to 5,530.50

- STOXX Europe 600 little changed at 514.53

- MXAP down 0.5% to 179.73

- MXAPJ down 0.5% to 564.62

- Nikkei down 0.8% to 39,341.54

- Topix down 0.3% to 2,793.70

- Hang Seng Index down 2.1% to 17,716.47

- Shanghai Composite down 0.9% to 2,945.85

- Sensex up 0.4% to 79,015.40

- Australia S&P/ASX 200 down 0.3% to 7,759.60

- Kospi down 0.3% to 2,784.06

- German 10Y yield +2bps at 2.47%

- Euro little changed at $1.0685

- Brent Futures up 0.5% to $85.67/bbl

- Gold spot up 0.2% to $2,303.70

- US Dollar Index little changed at 106.01

Top Overnight News

- Trump opens a large lead in the latest NYT poll (up 4 points among likely and 6 points among registered voters) while Quinnipiac has him up 4 points (and up 6 points when 3rd parties are included) and the Washington Post notes he’s ahead in 5 of the 7 important battleground states. NYT / WAPO

- MU -8% pre mkt as co beat on EPS/revenue, but free cash flow came in light and the guidance was only inline while the F25 capex outlook is very high. RTRS

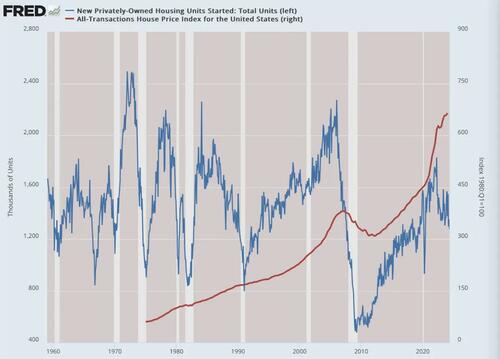

- Beijing became the last major Chinese city to trim mortgage rates and down-payment requirements for home buyers, part of growing efforts across the country to resolve a long-running property crisis. Authorities in China’s capital said late Wednesday that they will reduce minimum down-payment ratios for first-time buyers to 20% from 30% and for second homes to 30% and 35% from 40% and 50%, respectively, depending on location. They also lowered the commercial mortgage rate by up to 55 basis points. WSJ

- The era of big paychecks for Chinese financiers is fast coming to an end as some of the industry’s biggest companies impose strict new limits to comply with President Xi Jinping’s “common prosperity” campaign. The nation’s largest financial conglomerates have asked senior staff to forgo deferred bonuses and in some cases return pay from previous years to comply with a pre-tax cap of 2.9 million yuan ($400,000). BBG

- Japanese authorities will take necessary actions on currencies, Finance Minister Shunichi Suzuki said on Thursday, signaling readiness to intervene in the exchange-rate market after the yen’s slide to a fresh 38-year low against the dollar. “It’s desirable for exchange rates to move stably. Rapid, one-sided moves are undesirable. In particular, we’re deeply concerned about the effect on the economy,” Suzuki told reporters. RTRS

- NATO will offer Ukraine a new headquarters to manage its military assistance at its upcoming 75th anniversary summit in Washington, officials said, an assurance of the alliance’s long-term commitment to the country’s security that has been heralded as a “bridge” to Kyiv’s eventual membership. NYT

- Evidence is growing that Russia is building a ghost fleet to ship LNG around the world, as it did for oil, transferring ownership of at least eight vessels to little-known companies in Dubai. The ships may help Moscow bypass curbs and fund its war machine. BBG

- An attempted coup in Bolivia was subdued after just three hours and former General Juan Jose Zuniga, who led rebel troops in storming the presidential palace, was arrested. BBG

- UBS will create a new unit in its global wealth management arm, to be headed by former Credit Suisse banker Yves-Alain Sommerhalder. JPMorgan veteran Michael Camacho will head wealth management in the US as part of the push. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were negative amid this week’s choppy tech performance with headwinds from higher yields. ASX 200 was pressured with real estate leading the declines amid higher yields and firmer inflation expectations. Nikkei 225 failed to benefit from stronger-than-expected retail sales with the mood dampened amid rate hike bets for the BoJ’s July meeting. Hang Seng and Shanghai Comp. traded lower with underperformance in Hong Kong amid pressure in tech and consumer stocks, while the mainland was also pressured as China’s financial industry elites face USD 400k pay caps and bonus clawbacks under President Xi’s “common prosperity” campaign.

Top Asian News

- Some bond market participants who met with the BoJ this month, called on the bank to trim bond purchases in several stages to enhance market liquidity, according to minutes of the meeting cited by Reuters.

- BoJ Deputy Governor Uchida said weak JPY is upward factor for prices, closely monitoring in conducting monpol.

- Japanese Government says economy in moderate recovery although it appears to be pausing recently, maintaining the same view for 5 months; warns on risks of elevated interest rates in the West affecting the weak Yen.

- China’s financial elite reportedly face USD 400k pay caps and bonus clawbacks as some of the industry’s biggest companies impose strict new limits to comply with President Xi’s “common prosperity” campaign, according to Bloomberg.

- Japanese Finance Minister Suzuki said won’t comment on FX levels and that FX stability is desirable, while he is watching FX moves with a high sense of urgency and is deeply concerned about the FX impact on the economy. Furthermore, Suzuki said they will take necessary actions on FX, as well as noted that rapid and one-sided moves are undesirable.

- Japanese Chief Cabinet Secretary Hayashi won’t comment on forex levels and potential FX intervention but said they will take appropriate steps on excessive FX moves and it is important for currencies to move in a stable manner reflecting fundamentals, while he added that rapid FX moves are undesirable.

- S&P China rating affirmed at A+/A-1; outlook stable; says ratings on China reflect country’s policy settings that will likely maintain robust economic growth and strong external metrics

European bourses, Stoxx 600 (U/C), are mixed in what has been a lacklustre and rangebound session thus far. European sectors are mixed, with Energy taking the top spot, benefiting from broader strength within the underlying crude complex. To the downside, Retail slumped after H&M (-11%) reported a miss across its results. US Equity Futures (ES -0.2%, NQ -0.3%, RTY -0.2%) are modestly softer across the board, with sentiment slightly more subdued than peers in Europe.

Top European News

- ECB’s Kazimir says “I expect a quiet summer on ECB rates”; can expect one more rate cut this year.

- UK Labour Party secured a fresh letter of support from business leaders backing plans to overhaul the “apprenticeship levy” if the party wins next week’s UK general election, according to FT.

- BoE Financial Stability Report (June): Risks to the UK financial system are broadly unchanged since Q1. But some asset prices have continued to rise and the risk of a sharp correction persists.

- Riksbank maintains its Rate at 3.75% as expected; if inflation prospects remain the same, the policy rate can be cut two or three times during H2’24.

FX

- DXY is steady around the 106 mark ahead of today’s US data points, which could ignite some price action for the USD; though, much of the focus will be on US PCE on Friday.

- EUR/USD is stuck on a 1.06 handle after making a new monthly low on Wednesday at 1.0666, it can be noted there is a lot of option activity for the pair due to roll off at the NY fix.

- GBP is a touch firmer vs. USD and EUR. UK-specific newsflow remains light ahead of next week’s general election. Cable remains around recent lows with technicians noting that the 50 and 100DMAs at 1.2639 and 1.2640 have now flipped to resistance.

- JPY is marginally firmer vs. the USD but price action is limited compared to yesterday’s moves which sent the pair to a 38 year high of 160.87; currently sitting around 160.50.

- Antipodeans are both modestly outperforming vs the Dollar, with the Aussie slightly more in a contamination of the post-CPI strength. AUD/USD has risen to a 0.6672 peak with yesterday’s high at 0.6688.

- SEK is softer vs. peers after a dovish tweak to forward guidance from the Riksbank alongside their decision to stand pat on rates.

- PBoC set USD/CNY mid-point at 7.1270 vs exp. 7.2765 (prev. 7.1248).

Fixed Income

- USTs are down to a 109-28 base with the benchmark on a gradual downward path once the fleeting upside from Wednesday’s strong 5yr sale dissipated; 7yr tap this evening. Overnight, Treasuries came under pressure alongside a move lower in JGBs as the latter extended below 143.00 to a 142.58 base.

- An incrementally softer start with Bunds losing the 132.00 handle between the close & open, seemingly following JGBs & USTs at the time, and have since slipped slightly further to a 131.68 WTD base.

- Gilts are the modest underperformer, having opened near the prior day’s worst, before extending lower to a 97.93 base; As for the election, the final TV debate added little with polls cementing on a convincing Labour victory.

- Italy sells EUR 7.0bln vs exp. 6.0-7.0bln 3.35% 2029 & 3.85% 2034 BTP and EUR 1.75bln vs exp. EUR 1.25-1.75bln 2032 CCTeu

Commodities

- Crude benchmarks have bounced in the European morning after a contained APAC session but remain within the confines of Wednesday’s relatively choppy trade. Brent Aug currently just shy of USD 86/bbl.

- Precious metals are slightly firmer given the tepid tone and softer dollar. However, the yellow metal is stuck at the USD 2300/oz mark after losing the figure on Wednesday and slipping to a USD 2293/oz base.

- Base metals are modestly in the red in-fitting with the broader risk tone. Specifics have been relatively sparse with overall macro developments somewhat light thus far.

- Ilsky Refinery in Russia works in normal mode, via Interfax.

Geopolitics: Middle East

- Israeli Cabinet member Dichter says “We are preparing for all possibilities in the north and we will go to war when the time comes”, via AJA Breaking

- Israeli Defence Minister Gallant said after meeting with US National Security Adviser Sullivan that significant progress has been made on the issue of the equipping and armaments that Israel needs.

- Israeli Defence Minister Gallant said Israel does not want a war in Lebanon and prefers a diplomatic solution, but cannot accept Hezbollah ‘military formations’ on its border, while he warned that Israel’s military is capable of taking Lebanon ‘back to the Stone Age’ but added that they don’t want to do that. Furthermore, Gallant reaffirmed Israel’s commitment to a ceasefire-hostages deal laid out by US President Biden and discussed with US officials ‘Day After’ proposals for post-war Gaza.

- Israel and the US are concerned that Iran will try to develop its nuclear technology including weapons efforts in the weeks leading up to the US presidential election, according to officials cited by Axios.

- Israeli warplane fired 2 air-to-surface missiles at a two-story building which caused the building to collapse and damaged surrounding structures, while at least 5 civilians were injured by the Israeli airstrikes on the building in Lebanon’s Nabatieh, according to Xinhua.

- Syrian state TV reported explosions from an Israeli airstrike on the capital of Damascus.

Geopolitics: Other

- North Korea said it successfully conducted an important test in advancing missile technology with the test aimed at developing a multiple warhead missile, according to KCNA. However, it was later reported that the South Korean military said North Korea’s claim of a successful missile test on Wednesday is a deception and exaggeration.

- Russian Deputy Foreign Minister says western politicians will not be able to shelter in bunkers if it comes to a nuclear conflict, via Tass. Russia could amend the nuclear doctrine in the future, accounting for Ukraine experiences. Already taking measures in response to the US involvement in strikes on Sevastopol.

US Event Calendar

- 08:30: 1Q GDP Annualized QoQ, est. 1.4%, prior 1.3%

- 1Q GDP Price Index, est. 3.0%, prior 3.0%

- 1Q Personal Consumption, est. 2.0%, prior 2.0%

- 1Q Core PCE Price Index QoQ, est. 3.6%, prior 3.6%

- 08:30: May Durable Goods Orders, est. -0.5%, prior 0.6%

- May Durables-Less Transportation, est. 0.2%, prior 0.4%

- May Cap Goods Ship Nondef Ex Air, est. 0.2%, prior 0.4%

- May Cap Goods Orders Nondef Ex Air, est. 0.1%, prior 0.2%

- 08:30: May Retail Inventories MoM, est. 0.3%, prior 0.7%

- May Wholesale Inventories MoM, est. 0.1%, prior 0.1%

- 08:30: May Advance Goods Trade Balance, est. -$96b, prior -$99.4b, revised -$98b

- 08:30: June Initial Jobless Claims, est. 235,000, prior 238,000

- June Continuing Claims, est. 1.83m, prior 1.83m

- 10:00: May Pending Home Sales YoY, est. -4.6%, prior -0.8%

- 10:00: May Pending Home Sales (MoM), est. 0.5%, prior -7.7%

- 11:00: June Kansas City Fed Manf. Activity, est. -5, prior -2

DB’s Jim Reid concludes the overnight wrap

Markets have struggled over the last 24 hours, with sovereign bonds selling off and equities losing ground for the most part. To be fair, it wasn’t all bad news, and a renewed tech advance did see the Magnificent 7 (+1.60%) reach a new all-time high. But otherwise, a cautious tone was set from the outset, as the upside surprise in Australia’s CPI on Wednesday morning meant investors started to dial back the chance of rate cuts over the coming months. Other economic data also surprised on the downside, and after the US close, Micron fell by around -8% in after-hours trading as investors were disappointed by its forecasts, and futures on the S&P 500 are down -0.33% this morning. Alongside that, markets are still attuned to several political events, including the first round of the French legislative election on Sunday. So there’s multiple risks that investors are thinking about right now, which is making it difficult for markets to gain momentum.

We’ll start with the sovereign bond selloff, since that’s been the clearest move over the last 24 hours, and came as investors became increasingly conscious about inflationary risks. Indeed, this week has already seen upside inflation surprises from Canada and Australia, and we’ve still got the US PCE numbers tomorrow, as well as some of the flash CPI prints for June from Euro Area members. In turn, that’s seen investors price out the chance of rate cuts, and the amount priced in by the Fed’s December meeting fell by -3.3bps on the day to 43bps. The effects were particularly evident in pricing for the Reserve Bank of Australia, where the chance of a hike at the next meeting in August surged to 34% after the CPI release there, having been priced at just 1% on the previous day’s close.

With investors pricing in a more hawkish stance of policy, that meant yields rose on both sides of the Atlantic. Significantly, it meant that French 10yr yields (+6.5bps) were up to 3.23%, which is their highest closing level since November, and the Franco-German spread also widened again to 78bps (having stayed in the 75-80bps range for nearly two weeks now). Elsewhere in Europe, there was also a rise in yields, with those on 10yr bunds (+4.3bps), BTPs (+6.9bps) and gilts (+5.3bps) all moving higher as well. Meanwhile in the US, the 10yr Treasury yield (+8.1bps) rose to 4.33%, its highest level in two weeks. Treasury yields did see some stabilisation after a decent 5yr auction but still ended the day around the session highs. And with higher yields and the mostly risk-off tone, the broad dollar index rose +0.42% to its highest level since the end of April.

When it came to equities, the S&P 500 advanced +0.16%, leaving it within 0.2% of last week’s all-time high. But in reality it was another divergent performance between megacaps and the small caps. The Magnificent 7 (+1.58%) hit another all-time high, with Amazon closing above a $2tn market cap for the first time. But at the other end, the small-cap Russell 2000 (-0.21%) lost ground for a second day running. So even as the S&P 500 saw little change, the equal-weighted version of the index underperformed once again with a -0.36% decline, with energy (-0.86%) and financials (-0.47%) leading on the downside. That weakness was evident in Europe as well, where the STOXX 600 (-0.56%), the CAC 40 (-0.69%) and the DAX (-0.12%) all lost ground.

Overnight in Asia, the main story has been the weakness in the Japanese Yen, which closed beneath the 160 mark yesterday at 160.81 per US dollar. That is its weakest closing level since 1986 and means it’s now weaker than its levels earlier in the year that saw the authorities intervene. Yesterday saw Finance Minister Kanda say that “I have serious concern about the recent rapid weakening of the yen and we are closely monitoring market trends with a high sense of urgency”. He also said that “We will take necessary actions against any excessive movements”. This morning trading, the yen has slightly strengthened again to 160.39 per US dollar as we go to print.

Otherwise in Asia, the main story has been of further losses overnight, with declines for the Nikkei (-1.08%), the Hang Seng (-2.04%), the Shanghai Comp (-0.51%), the CSI 30 (-0.41%) and the KOSPI (-0.49%). In terms of data overnight, Japanese retail sales were up +1.7% in May (vs. +0.8% expected), and in China, industrial profits were up +0.7% in May on a year-on-year basis.

Looking forward, there’s plenty happening in the political sphere today, and tonight will see the first presidential debate of the US election, as Joe Biden and Donald Trump meet tonight at 9pm Eastern Time. Over in Europe, there’s also an EU leaders summit taking place today, at which they are expected to sign off on some of the EU’s most senior positions following the parliamentary election. And in France, there’s just three days until the first round of the legislative election on Sunday, and an Ifop poll found that Marine Le Pen’s National Rally remained ahead on 36%, with the left-wing alliance behind them on 28.5%, and President Macron’s centrist group on 21%.

Finally, there wasn’t much economic data yesterday, although US new home sales fell to an annualised rate of 619k in May (vs. 633k expected), which is their lowest level in 6 months. In Germany, the GfK consumer confidence unexpectedly declined to -21.8 (vs -19.5 expected) having risen for the four previous months.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, preliminary durable goods orders for May, pending home sales for May, and the third estimate of Q2 GDP. Meanwhile in Europe, there’s the Euro Area M3 money supply for May. From central banks, we’ll hear from the ECB’s Muller and Kazimir, and the Bank of England will release their Financial Stability Report. Finally in the political sphere, EU leaders will be meet in Brussels for a summit, and a US election debate will take place between Joe Biden and Donald Trump.